SBEA is now BRCC now that the merger has happened.

I would highly suggest puts now if your looking to buy em. Was not expecting it to shoot up this hard at all. I think it will drop down if we see any spy downward movement next week

What price and date are you playing?

How is this valued at 430 million?

Tait Fletcher, a former MMA fighter co-owns it.

Joe Rogan and the MMA/BJJ community shill it to no end.

IV feels high to play puts but I’m considering it due to expiration being next week.

Not valued at $430 million it’s valued at 2.7 billion at $16. Definitely buying puts trying to get the march $15 P for $2 they are significantly overvalued imo now.

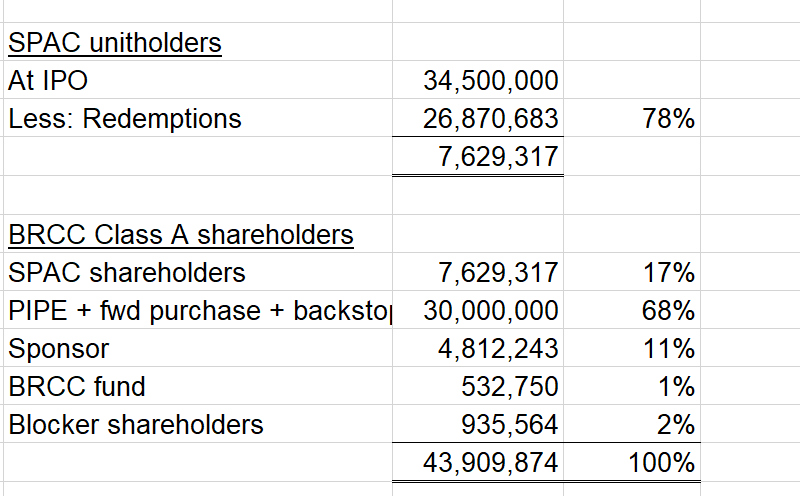

Redemption statistics and current shareholder base (excl. class B shares without economic rights and other potentially dilutive units which are convertible into class A shares from 9 Aug). 78% of SBEA unitholders filed for redemption which means the free float (which is actually not that small) will be around 7+m for the near future before the other PIPE shares get registered and lockups expire for the sponsor and other legacy holders.

https://www.sec.gov/ix?doc=/Archives/edgar/data/0001891101/000110465922019525/tm223251d1_8k.htm

Some back of the envelope calcs shows at $15 it’s probably trading around 8.5x '22 Rev and 6.1x '23 Rev

Once the share lockup period ends, this stock is going to fall off a cliff IRNT style. If it stays at these wild valuations, it could be a day of halts.

I took CCS off the pump yesterday, and i may look to add next week.

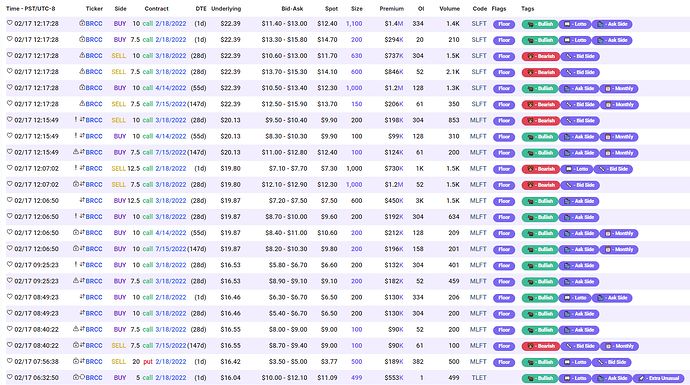

A lot of deep ITM calls today for very very large premiums for a stock like this… quite strange if you ask me. Flows from the day before are similar as well, but today was a bit more bullish and more premiums.

yesterday

First and only dark flow today for BRCC:

Am I reading the SEC filing right, share lockup ends August 9th? ~I am holding 3/18 10p that hasn’t quite been doing what I’d hoped, not really losing too too much, but not gaining much either. Getting to feel like locked capital that can be put (lol) to better use. With those new flows coming in via @Kevin , I’m thinking it probably wouldn’t be a bad idea to just cut at open and reposition accordingly…~ Nevermind, I’m (thankfully) retarded sometimes, I cut this already. Jesus just in time too ![]() I don’t trust that at all, but I’m probably not quite done with this one either. Will keep an eye on it

I don’t trust that at all, but I’m probably not quite done with this one either. Will keep an eye on it

I will be buying puts when the IV and premium aren’t BATHSHIT crazy. This stock is worth 3.4 billion at $20. That’s 33x smaller then Starbucks. Starbucks is MASSIVE they have stores, property, merch, branding etc. No way BRCC should be valued this much. Will hopefully take puts if iv chills out

With the stock continually going up this week ignoring everything else going on in the world, every day I was waiting for a pullback that just never happened, and I never felt comfortable getting in at these prices. I noticed that the premiums for Mar-18 puts were pretty tempting so I sold some Mar-18 10p’s for 1.15 just be patient and they will fill. Also less risky (but less profitable) is selling 7.5p’s for .45

Another strategy is to sell Put Credit Spreads. I just sold one on the March 10/7.5 strikes for .70 with only $250 collateral. I think that strategy could get you 4x the premium for the same collateral if you are just selling a 10P for 1.15ish.

Well-researched bearish piece on BRCC: Due Your Diligence | Strat Becker | Substack

The massive put IV compared to call IV suggests smart money has a similar view.

Btw… TA experts - what does this pattern suggest? It’s not quite my forte.

I think this and BROS are in the same boat of being over valued - not sure what it is about the market and these richly valued coffee chains which are unprofitable. But BRCC with its lower float may need further share unlocks (like the PIPE, etc) to be the catalyst towards trading closer to its fair value. We should keep an eye out for the S1 and the registration of the PIPE and other shares. Could also be the case that a BROS re-rating may trigger a revised view on BRCC…

Can someone explain to me why those comparisons are being made? I can understand $BROS and $BRCC, but TTCF? ZVIA???

Where are the comparisons to markets leaders like DNUT and SBUX?

I think Playtpus picked some broader high growth F&B tickers, some of which I’m not too familiar with. But my understanding of those which I know like OTLY, BYND is that these are the trendy high growth but low/no profitability names at the net income level.

No point comparing to SBUX cos they actually generate earnings and trade at around 25x P/E according to Yahoo Finance