News of approval just dropped:

I have kinda been liking the price movement on this. With the overall market having such a green day today, I am starting to like this more than I was last week. Is anyone else still watching this?

I am watching, and have a small warrants position. The warrants seem undervalued relative to the share price considering the deal is definitely going through and they had popped to $2 back on DA.

If this performs anything like BRCC after ticker change (big “if”) then the warrants will 10x or get close to it.

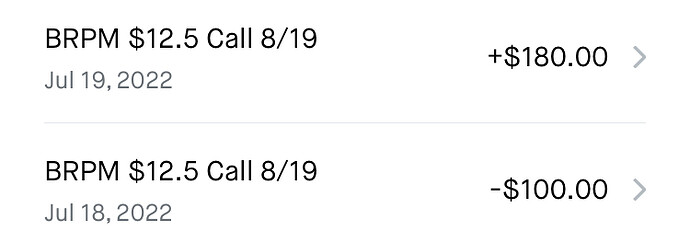

Thanks so much for the DD. Scalped yesterday/today for 80% didn’t want to hold past ticker change but I’ll be watching!

I took a small put position before close yesterday to try hedge the warrant position. With this getting hammered from $13 to $9 I am netting green, but Fidelity is not letting me close any positions today due to the ticker change.

I think warrants + puts (even as expensive as they were) was the right play.

But this is just yet another situation in which Fidelity is terrible for trading.

" Waiver of Minimum Proceeds Condition

As previously disclosed, the obligation of FaZe to consummate the Business Combination is subject to, among other things, B. Riley’s having a minimum of $218,000,000 in cash available to it at the closing of the Business Combination after giving effect to redemptions of B. Riley’s public shares and payment of transaction expenses. In connection with entering into the Term Loan (as described in Item 8.01 below), on March 10, 2022, FaZe waived the Minimum Acquiror Closing Cash Amount (as defined in the Merger Agreement) under the Merger Agreement."

https://esportsinsider.com/2022/07/faze-spac-merger-likely-to-succeed-after-key-barrier-removed/

“According to B. Riley, the SPAC sponsor, the minimum amount of cash FaZe needed on hand to complete the deal has been waived.”

“SPAC merger votes are typically two-part votes. In essence, shareholders can vote to merge and still recoup their cash investment in the SPAC. However, even if shareholders vote to approve, typically the cash in the SPAC after redemptions must meet a minimum cash requirement.”

“In this case, the cash requirement has been waived, vastly increasing the odds the vote will succeed.”

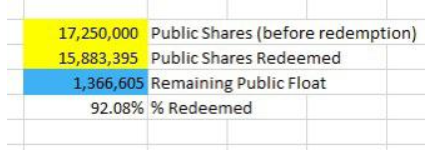

They were expecting so many redemptions that they thought that FaZe wouldn’t have the minimum cash needed post-redemptions, so they had to waive the minimum cash requirement? Am I interpreting this correctly? If they had to waive it for it to go through, then shouldn’t we expect the redemption number to be really high and the free float to be really low?

I’m not familiar, is having this requirement be waived a common thing?

I checked the stock a couple times today and the bid-ask was pretty wide, so I was assuming the float was pretty low anyways. I couldn’t find any redemption or free float numbers so I’m just assuming they’re not out yet. But if the SPAC waived the requirement ahead of time they must’ve been expecting really high redemptions, moreso than the average merger. And if there were really high redemptions, that would leave us with a really small free float.

Thoughts?

Am I right in thinking waiving the 218m cash requirement just means the float is under 21.8m shares? It’s been moving a lot more than other low floats like ESSC and THCA we’ve seen on less volume but I don’t think that confirms anything.

If you’re looking for a low float gamma squeeze it’s not really got anything resembling a ramp so far. Looks like there’s some sentiment there but I’d 100% wait for confirmed redemption numbers because if the float is anything over 2m it’ll tank immediately. There was a recent low float that had NAV floor removed (EVEX 1.9m float) that basically never developed a ramp, I think it might go the way of that.

If the float turns out to be low and it still dumps and theres not really a ramp for a GS, theres a potential play in watching for a random volume spike in stock/options because it’ll be a prime target for pumpers, thats what happened with EVEX.

Although I agree this was swinging in an ESSC-like low float fashion (it only took a couple hundred thousand shares to go from $13 down to $9), we should be careful making conclusions on float size based on the movements and spread on the day before or day of ticker change.

A lot of SPACs seem to move like micro floats during the days surrounding redemption and ticker change because X number of shares are briefly “offline” from trading. I can’t say for sure what the cause is, but if you look back at other tickers you’ll see a similar pattern, with big bid/ask spreads near redemption that quickly become a lot more liquid after a few days.

This has become a pattern on some of the NAV-protected hopeful high redemption optionable SPACs like BREZ and ALTU. Many are lured into buying calls with the assumption that anything showing a 10 cent spread on commons must have had huge redemptions.

Interesting bit here in this Barron’s article:

To read: https://www.barrons.com/articles/faze-clan-stock-spac-merger-51658341467

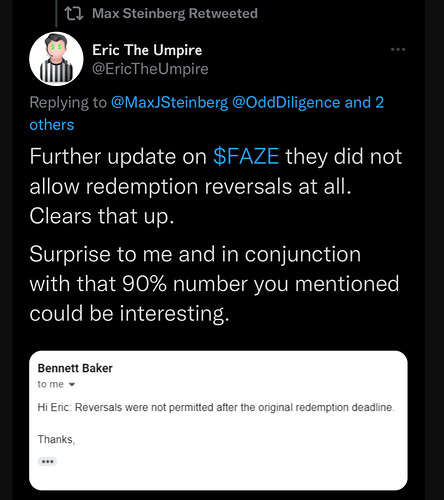

If this is correct and 90% redeemed, then the float should be under 2 million.

What is a redemption reversal?

I’m guessing there’s a waiting period once you opt to redeem your shares and they couldn’t undo that process once it ran up to $13?

The 8k has just released:

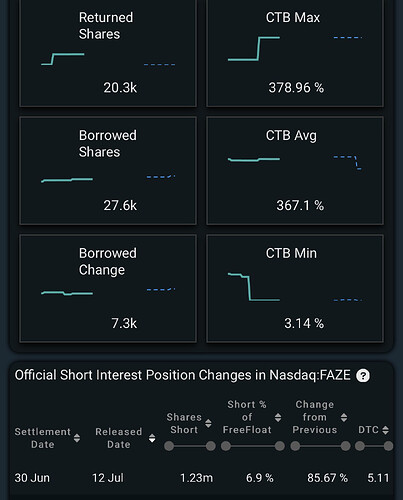

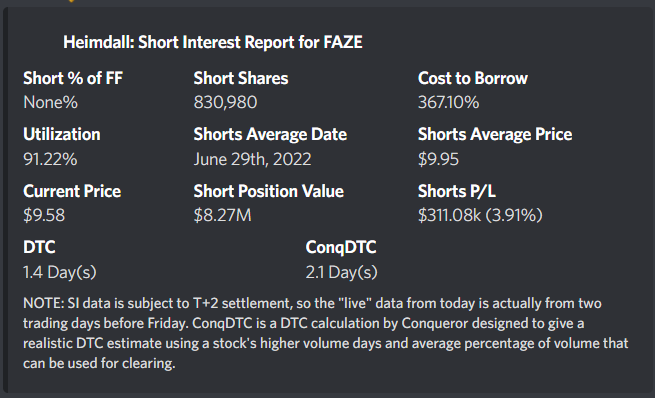

This also makes about 70% of the float shorted too which is a good magnet for retail to pump it.

Just saw this on twitter so the SI could actually be higher.

As far as I understand it is pretty much what you said. So if they redeemed their shares they can’t change their mind and undo it if the stock changes price/outlook. Which is good in the case of a pump/squeeze because the free float cannot magically increase due to reversals.

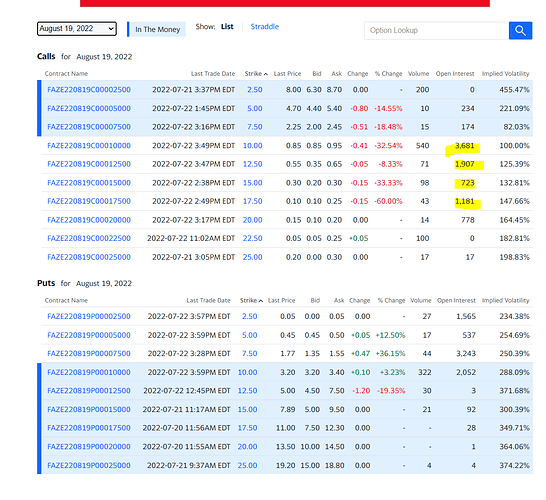

Based on the numbers provided above, if the stock price continued to trade above $12.50, existing OI that is ITM is 43.87% of the float.

Would need to see continuing accumulation of OI on the 10c and 12.5c and the price to stabilize for this to ramp I think. Will defer to others who are better at analyzing that.

There is a big question when looking at OI as an indicator of squeeze potential. Have MM’s have adjusted the way they handle OI ramps and their need to hedge since last year? Especially on retail-led tickers.

Personally I think so. I’m not an expert and am only using anecdotal evidence, but there have been plenty of SPACs that have come and gone since ESSC with high ITM OI (100%+), but for whatever reason did not squeeze.

Now at a certain point MM’s probably have to hedge regardless. But it’s not like they just sit on their ass and wait for the stock to hit their breaking point. They have methods of keeping a ticker under a key price strike. I remember on $SST and $BBAI it was theorized that MM’s would buy deep ITM calls and exercise immediately to get their hands on shares without raising the stock price. Then, they would sell them to tank the price and hit stop-losses.

If MM’s have time to understand the situation and prepare, they can certainly avoid hedging an OI ramp.

My point is basically if this hits a certain ITM OI percentage it doesn’t mean it will be a free squeeze. There are more factors than a nice OI ramp and MM’s will do absolutely anything and everything they can to not hedge a ramp.

Personally, I think short interest relative to free float size is a better indicator of squeeze than an OI ramp. Of course this also is only really a useful indicator if for whatever reason shorts are pressured to cover (positive ticker news, big short losses, etc.)

Whatever the case, this has a small free float and meme potential so it’s a good start. It has also will have much bigger retail interest than a no-name ticker which I think will help as well.

I think the way to play these now is to be out before the last week of opex, think the Tuesday of opex is when they start dumping. ESSC, THCA, RDBX all played out pretty much the same. SST had a second pump I believe on the Wednesday of opex but then dumped on the Thursday, Friday.

There’s a thread on the education section about gamma squeezes incase some people weren’t aware.