So I’ve been following this stock for some time now. It was involved in some pump scheme 1 year ago and left a lot of retail bagholding in that mouvment. However, in the end of 2021, James Doris who has been the Chief Executive Officer of Viking Energy since December 2014 ( The company CEI has stakes in an plan on merging via the 10K) made son restructuration of the paper work and the company and in general and plans on being in the forefront of carbon-capture tech.

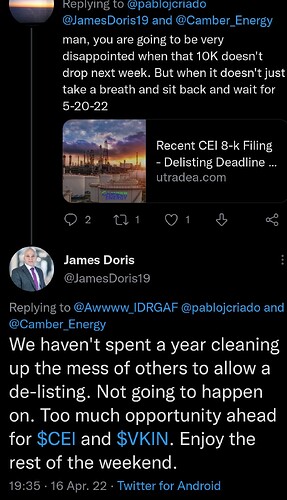

The bummer about this play in the near future is that the old administration of Camber Energy let the company in non compliance with some SEC paperwork obligations. They have until may 20th to provide the requested paperwork needed or else, delisting procedures will be triggered by the SEC staff.

To be honest, I think the risk of delisting is low even if it must be considered. The price action been on a long down trend for the last 3 weeks prior to the most recent run 1 month ago. Betweem this time, James Doris did gave update with retails about the fillings and the paper work being filled out for April 15th to April 22nd. The current run we are seeing at the moment could indicate that insiders know that the 10K is about to be released, witch would mean that CEI is in compliance with the SEC to continue business and go as planned with its merger with Viking Energy.

I know it looks like a dank play. It probably is. So be aware of the risk. but it could provide good reward aswell. So take a reasonable position if yall wanna tip in this play.

Regards

1 Like

CEI has a strong start Premarket today. I’m expecting a big run and the possibility for me to take profit depending of the situation.

2 Likes

Great reversal on CEI at the moment. Covering all the down trend of this morning who was probably gap filling. Everything is still bullish and the 10K PR is expected at any moment now. Overall great.

4 Likes

Here are some new VKIN fillings

2 Likes

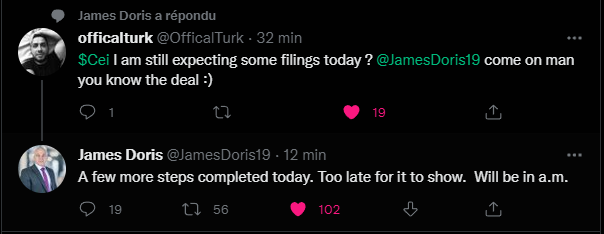

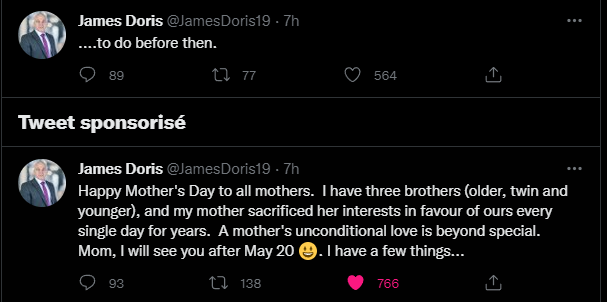

A lot of fillings been released this morning between VKIN and CEI. It created a good buying pressure early in the PM hours that seemed to got eaten down by shorts at market open. Now we wait. The last filling required to really put CEI into a new business phase, creating the departure with the old administration, is the 10K. I think it’s the waiting game being played at the moment. James Doris said it would be released before the end of April 22th, so this Friday. If he’s not able to respect his own words, I believe a sell off my occur monday the 25th and short probably planning on exiting their position at that moment.

However, if we get the final 10K before the 22th as Mr. Doris said he would deliver, I think we might see a big run this week. That’s for the short term setting.

For the long term setting, you all probably heard that a global Russian Oil embargo is planned on Russia by EU next week. This will have a huge impact on the oil price as JP Morgan stated. CEI might run aswell with the high pricing of oil, as we saw in the begining of the Ukraine/Russia war where CEI reached the high $1.90.

So for the time being, CEI is still bullish and there’s a lot of catalyst that might make it run in the current and future weeks.

To end, I dont remember specifing my position. I curently old 75 2c contacts for April 22th. I plan on taking an additional position at 2c for May 6th.

3 Likes

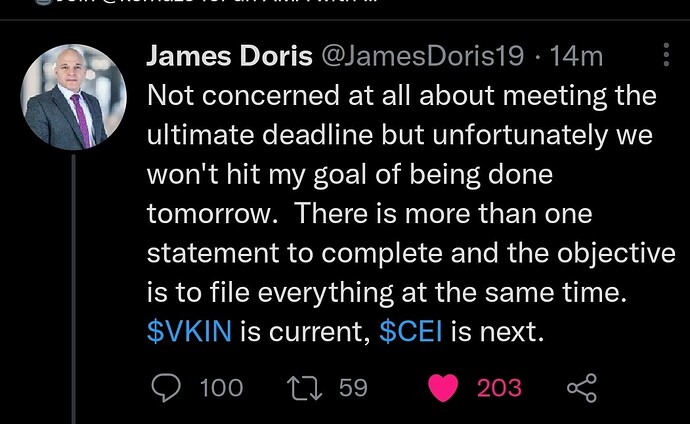

Message from The Ceo. Seems like all the fillings wont be ready for tomorrow. This is being displayd on the price action right now.

However, I love the transparancy. I still plan on taking a new position tomorrow. The play is still bullish and the fillings might be completed next week.

That’s a bummer for this week, but I still think the play is bullish for the weeks to come!

I’ve been reading through this all week and I’m curious what you’ll do with your April 22nd calls. I assume they’ll be down with the current movement

1 Like

I’m cooked well done for these unfortunately. Didn’t bet a lot so I’m fine with the loss I will be subjected to.

However, I will push further in time the calls I will take for tomorrow.

Just glancing at OI, I see most April22, 29, May 20, Jul15, and Oct21. I’d be curious to see if this plays out come late May.

Wow. Investors seems to be reacting really well this opening. After hour from yesterday and this morning Premarket is being eaten up quite nicely. Looking great. Took new position. 70 contracts at 2c for May 6th.

Ya’ll have a nice friday friends.

1 Like

Goodevening everybody. Good mouvement AH. Really bullish. Maybe incomings news ?

1 Like

Isn’t it related to EU and Russia rising tensions ?

Yeah it might, was talking globaly ( 10K or Russian oil embargo

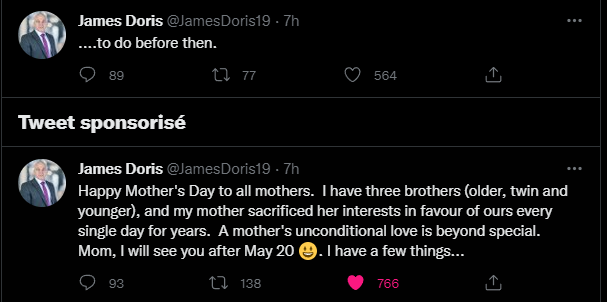

Here is an update from the CEO himself! Video was posted today. Bullish!

1 Like

Bullish! Great week ahead!

I think we might see fireworks this week! Hopefully market condition turns around and doesn’t fuck up a potential run! Bullish mouvement ahead!

Regards.