BA at $169 looks like an attractive buy.

This is a gamble, but bought a FB Put $100 strike for next week. They 're planning to have physical stores likely to sell VR equipment which likely going to see the stock go down short term.

Picked up 2-AMC $18.50C for 5/20 expiry. RSI on 30 minute is pretty close to oversold(about 27 last I looked). This is extremely risky, so I wouldn’t mirror this on any other account. After all, it’s a meme stock, yeah?

Picked up a SPY FD 223p at that VWAP rejection. Holding till it touches support from earlier around 423.40 then cutting for scalp unless it keeps sinking.

Out of it now. Good scalp

Averaged down on my SPY 430c from earlier. Holding 2 total. Full position.

I don’t really use the 1 min other than seeing if there’s a trend within the 5 min candles, but I’ve found that the 50 MA on the 1 min acts as a insanely strong resistance. Already bounced off of it 3 times today and marked the top at 424.5. Rn it’s at 423.8 and I’m going to get puts if it rejects off the 50 MA on the 1 min again

Looking at puts if SPY rejects 423

We tapped 420 level, I sold for 48% ($330 gain)

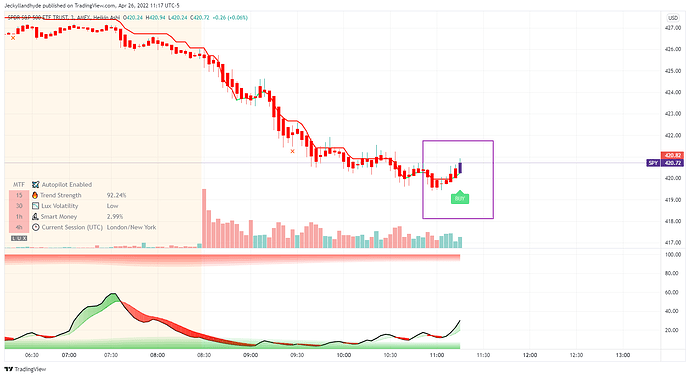

This may seem retarded, but I am thinking about entering calls around here. We are insanely oversold on the 5 min and heading lower, but the RSI isn’t going lower. We’re showing a bullish divergence on the 1 min, 5 min and 1 hour. Because of how oversold we are, I think that the risk/reward for calls here is very good. Also we are again very overextended from the moving averages so I think we should return back to the averages.

Going to take a december mkc put based on anonyman’s dd in the covid valuation thread. I agree that it’s valuation seems to high, I believe it’s only being held up by demand for defensive stocks and with my bearish outlook for the year I believe this is a good long term put play.

Out of this one, over 20% return - counting it as pure luck - sure it could be worth more later but I will never argue with huge returns

Mentioning SPY. This time and level would be the area you’d expect a reversal. Personally not getting in, but keep your eyes peeled for SPY to attempt an uptrend.

I’m looking to enter SPY call for a scalp from 421.45 to 422.5ish if spy does break above. 421.45 has been a strong level today and we rejected off multiple times. Breaking above 421.45 is also being above the 8/21 EMA (big bc we would be above the 21 EMA) and showing a follow through on the hammer candle and tweezer bottom on the 5 min

Risky Play - Grabbed some HOOD shares

the basis is a pop in spy combined with earnings on Thursday could move it up a bit - don’t plan to hold through earnings - would like to scalp for about .25 - .50 a share (stock gods willing)

If spy holds here I think it’s a double bottom, If it breaks down we’re going to 415.

Taking 1 SNOW $180 5/6 put here. I’ve had success over the last couple weeks with 1-week out SNOW puts on intraday run ups and taking profits at 10-15%, but to be clear this is more a risky trade than a “smart” trade.

Well, snow put at +10%, there’s my close signal

this one didn’t pan out looking to dump at close - might be able to squeeze a nickel a share out of it