And I didn’t even get puts, pepecry

Bought a 140 FD on Facebook. I’m expecting this level to be resistance along with IV to push the premium higher.

Added 10 more VYGG 10c June17 contracts.

Maxed out to 50 now, with a total cost of $590.00, at an average of 0.12.

Grabbed some #spy 5/20 410 Puts - (I am able to average down if needed)

My reasoning - SPY broke well over JB’s support - the market is still very volatile

For me, if spy breaks 418.45, it’s back to puts all day

did you even get this posted before it did?

Back into COST 540 puts for May 20 exp at 10.15. In for the thesis + I don’t really like how the market reacted to the housing data and the big tickers crashed through their bullish supports, might be an over reaction but we will see.

Oh, also, I’m heavily bear leaning into close today as I do not believe the market is going to trust that the big earnings tonight are gonna beat.

Looking like a bear flag on spy rn. Could break below 416 soon

Out of these, I do think #spy could drop more but was @ +29% - and didn’t want to see the profits disappear.

Took a May 20th 40p on CVNA on that bounce with thoughts of failed ability to raise additional capital leading to collapse.

Decided to finally re-enter the longer out puts here at this SPY dildo with half of my intended size

SPY 06/17 410p at 11.97

Still holding vuzi and bbai (bbai holding 10 support, vuzi a steal at 5 imo) tried to get a fill to add on both today but algos keep raising bids above my ask even when I creep it up in steps. Loaded some tqqq calls (up already) probably a bad idea but far out otm so maybe iv crushed if flat after amazon’s earnings but there’s way to much fear prior to even one actual.5 raise so I am betting on a relief rally(or put puts otm rally). Amazn may tank but delta low so they’re lower risk than shorter at or near strike. added a few rdbx and stss warrants as they’re cheap and I’m low on money but still want to gamble(also both have high si/ctb/low available shares, but I have not looked up pipes on either so a gamble). I will eventually go back to day scalps but this iv is too much for my small account and I’m too busy at work for 0dte scalps

Picked up one 5/6 175c AAPL call for earnings tmrw. Not sure if I will hold or not

Throwing this in here real quick.

Amazon prime has struck a deal with One Championship to show their fights on Amazon Prime streaming.

It’s in unknown at this time if there is exclusivity in this deal.

For those unfamiliar, One Championship is the largest and most popular (by the numbers) competitive martial arts company in the world, they are centered in Asia. They had over 13 billion views last year. This is long term bullish for Amazon if there is exclusivity in this deal.

Just an update to this- I was stopped out. I made $70 off this (60%). The other one which was 110 for next week was $30 profit (110%)

Current price .328

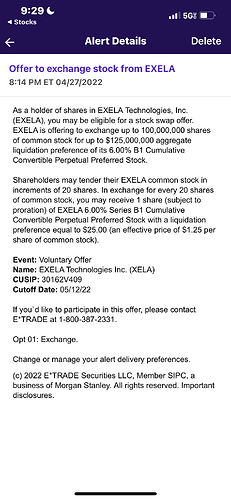

I’m either missing something or this should start running to the effective $1.25/share price.

It has not moved up after this was initially announced but now that it’s official I’m assuming tomorrow will start to go up.

Please write your thoughts along with any screenshots shared.

surely we’re missing somerhing with this. XELA has options and the 5/20 1c are going for a penny.

Watching SPY today for a possible long call entry to hold overnight.

I posted my idea (1hour candles) on TF.