Watching ACCD for 1% - 2% super quick scalps - Risky playing shares -

High Risk

Out of ACCD - 6.20 - 6.50

Just took a two option strategy on UNG.

1 x 25 C for 5/20 @ 1.95

1 x 26.5 P for 5/20 @ 2.25

Could be risky, but trying to scalp an ARKK 48.5p 5/06. Watching for a strong dip under $48 or ideally no bounce at $48 and closer to $47/opening price to sell it

Out of ARKK put, 1.60->2.20. Not doing too much else today through Wednesday except probably cutting a bunch of calls over in RH and grabbing little in and out plays like this

Looking into SPY calls today. My entry target is around 407 due to my low-quality analysis. June 17th. I’ll likely enter if I see support at that level.

420 appears to be the best profit/risk if you expect a bounce like I am.

430 is the second best. Less premium.

450 is if you don’t want to put too much on a potential reversal before FOMC.

I’m giving myself as much time as possible to play out.

Bought some AMD shares with my SPY gains today to try to average down my cost basis a bit… I hope that isn’t a mistake rather than just cutting my already red position. Up to 8 shares, $98 cost basis

Touching on this again, spy hit exactly -15% off the closing high of 477.55 which is ~405.91 today…. This level could act as a buy point for institutions… I would watch for a bounce in this range 400-405 could be a good time for some monthly calls around ~420-423 looking to sell on a bounce if they go ITM. I think we see correction territory act as resistance again (428-430) correction level is 429. Food for thought. Otherwise bearish outlook long term still. FOMC could be influential in a short term bull reversal if they announce 50bps….

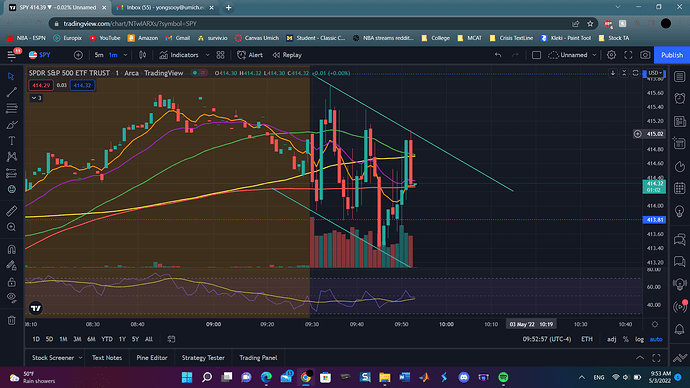

SPY rode the 8 EMA down since 425. If SPY is just returning to retest it before going down lower, we should see a rejection at the 410 area.

SPY Puts are probably easier, but I’m trying something with volatility stuff, going for a 5/06 VXX 28c scalp

Gonna cut it EoD, just thinking SPY will pull back a bit from here

Short term bull play: Seeing that bounce from that 405 level gives some confidence that institutions were willing to use that -15% area as a buy point… especially looking at the volume for the day (this is the highest volume we’ve seen since 3/8/22) next thing to watch is FOMC, if they announce 50bps I’d be willing to bet this will help fuel a short term bullish run…. Where to? I’m not sure but I think we could easily see correction levels again ~429 or close to it 428-430 was a range that recently turned resistance last week… we could see it act as resistance again or not? if I was playing this swing play I would shoot lower to be safe with 423 (end of may calls) as I said before and sell once they’re ITM, could wait with monthlies and try for a bigger profit play, around correction levels again (428-430), but better safe than sorry in this market.

Wait it out and time the bear play:

I think we all know the fundamentals of this market are bearish still, with inflation still running hot and liquidity is low so eventually the market will come back down and probably in a decisive way. That brings Another leg to this play, which is to wait until correction levels (428-430, with 429.72 being exactly -10% off ATH) to start entering longer term puts again for 400 level in July or aug (to be safe exp wise.) and if spy runs a little hotter can always average down. My thoughts for now on longer term swing plays.

SPY stuck in a downward channel. You can play the bounce in between or wait for a breakout of either direction

grabbing some SPY 416 5/6’s - looking for about 5% and I will be out -

SPY is choppy - and it could go either way very quickly - don’t risk if you can’t afford to lose it

Held it a bit longer than planned - but out of it - about 11% - @thots_and_prayers style

Was home sick yesterday… closed short para strangle 5% yesterday, kept longer ones for june sold put kept 30c. Sold gme put leg for cost $20 over whole strangle, have free otm lotto fd call still open.

In tqqq atm strangle for 5/13. A few otm far out tqqq calls (june)

A few spy calls still, closed 2 for profit today(50% and 100%) all way otm and far off atm to expensive for me atm.

Fat fingered a cps oct call(was going to sell) so will hold for a profitable exit. Holding and praying on zyme and ispo still.

Edit:my para call sold at cost, bought 2 more otm june tqqq calls(I’m bearish in general, but atm I’m bullish until next spy put plateau (430 or 440 ish?)) of course this likely means sub 400 by eow ![]()

I think this swing play is holding up well… room to go still as more retail will enter when they see more bullish movement and volume. At this point risk reward is diminishing tho. I still think 5/6 420-423 calls could be pretty profitable or monthlies for safer expirations. I would look to sell them ITM for weeklies and maybe if you have monthlies you could risk it for the biscuit and wait to see if spy will retest correction level ~429 personally I would try to sell sometime before that 427-428…. Even if spy goes higher that’s good profit.

Of course this could all fall apart if FOMC is hawkish, but I think it won’t be (prob do 50bps at most) and institutions and big money didn’t think it would be hawkish either which is why there’s been so much volume since bounce around -15% level on spy.

Regardless how you play don’t be emotional and take your profits.

Exited my AMZN AMD shares positions, VET 80x 20c Jun., all at breakeven or slight gain. still holding onto GOOGL VTI. About 50% cash going into FOMC/ERs

Bought a 420 spy call when it knifed to 416.20ish. Looking to sell today if it retouches the day’s high

Looking to get SPY strangles today, for exit tomorrow.

Premiums are already high.

I’m hoping to see it drop significantly by 2pm.

Thursday, ER plays are not looking spicy enough except for LCID.

In SPY puts as of about 5 minutes ago. I have a support point marked at around 416.2. I’m up on a 3DTE 417p and will continue to hold to see if it breaks this point or not. I have a SL set that would keep me green regardless.