Out of SPY puts for +7%. Might fall through this point, but I’ll take a little green over any red.

In ABNB May 6th 150c @ 5.70 for earnings. We know all around travel demand is up from Mastercard & Visa earnings. From the EXPE earnings we know that the vrbo growth segment has increased. Website traffic is up and they are also expecting a negative EPS of -0.24 when they posted an .08 EPS gain last Q. There is also remote travel / work which has proven to increase throughout the last quarter.

Todays related dump is most likely attributed to EXPE, which is an aggregation of multiple businesses.

The Retail segment, which consists of the aggregation of operating segments, provides a full range of travel and advertising services to our worldwide customers through a variety of consumer brands including: Expedia.com and Hotels.com in the United States and localized Expedia and Hotels.com websites throughout the world, Vrbo, Orbitz, Travelocity, Wotif Group, ebookers, CheapTickets, Hotwire.com, CarRentals

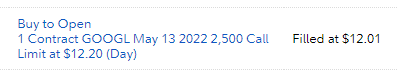

Taking 1 GOOGL call here.

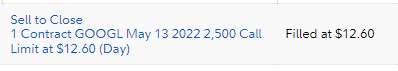

And out.

Sold 1 tqqq and 1 spy call bought with settled cash.

Bought 1 aapl put and vxx call to hedge the remaining calls. Seems like a consolidation before a rip but ports too small to be full calls and only 1 strangle unless fully scalping.

When you look at spy strangles what strikes do you look for ? Like 5 dollars each way ?

Out of Abnb at 8.20

Cut BGFV calls at a significant loss earlier when it was coming back up a bit. My challenge account is now pretty much back to where it started ![]() Hold me

Hold me

Going to keep an eye on #prts for shares scalps - it moves a bit slower looking for 1% - 2% (play at your own risk)

I should treat today like earrings, high iv sell before and have cash to buy the direction 20 minutes or so after, but I’m fully leveraged on mostly bullish positions so this will probably hurt. Anyways bought 2 more tqqq calls with what little cash I had left. I have high limit sells open on everything and I’m bent over in the “this will hurt” position praying

out of this one -

Picked up a 5/20 440 spy call

Got 5/20 SPY 425C - 0.5 rate hike and conference call almost done and didn’t hear anything that should spook the markets. Hoping for a week or so of a good run.

went on a massive buying spree for tsla & ftnt calls but bit too late to signal those lol, Will swing into TMR.

just entered NFLX May 6th 210c @ 1.50

added some more NFLX May 6th 210C @1.37

Because not a lot of option movement either but assuming they will pour in over the next few days, got these two semi-lottos for 5/6:

QQQ MAY 06, 2022 334.00 CALL

SPY MAY 06, 2022 432.00 CALL

Jumped in Ni’s play @2.18

Same, jumped on a SPY 432c after market close, but a May-09 cuz I’m a weenie.

No worries that there will be profit selling in the morning tomorrow?

Last time it ran until Friday