Grabbed 2 15c and 2 10p on AFRM, both for next week. My plan is to sell one of each tomorrow for whatever IV gain I can get and hold one and one through earnings if the profit isn’t too much to hold through.

Sold my spy puts for 25% and 45% gain respectively

Got stopped out @ 7.50 decent return can’t complain

bought an AAPL 150c May13 as a gamble ![]()

Gonna scalp a CVNA put here, 5/20 27p

I entered SPY 05/13 390p at 2.77 off the 5 EMA retest on the 15m, plus ~395 intraday and yesterday support now becoming resistance. Risky though as SPY already fell down quite a bit.

May cut if downtrend breaks, or may swing through PPI release tomorrow.

AAPL was also a pillar for bulls and it’s getting crushed today with everything else.

Took one dis 90p 5/20

Playing #crge for scalps - will be out @ .05 a share

out of this one, a nickel is a nickel

I averaged down to a cost basis of 2.34 on these…

Current mentality is I will swing through PPI because I expect bearish outcome, but I don’t want to encourage anyone else to do that. I may trim some before EOD ideally green.

finally pulled trigger on CVNA 20p jun

Derisking some here at 2.80 (up from 2.34)

Scaled again at 3.00 (up from 2.34 cost basis).

Holding 1/3 size through PPI numbers tomorrow unless SPY commits seppuku in the next 20 minutes.

All out of the 390p here at 3.4

Looking at Joby puts for today. They report AH and looking at the OI, it seems heavily skewed towards puts. The 2.5p 5/20 are fairly cheap, closed at .08 yesterday so I might grab some at open or when there’s a random pump in the market.

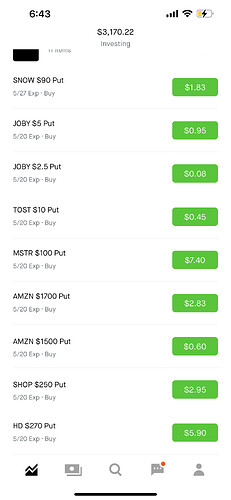

Just gonna post which options I have on my watchlist for today :

Some of these have earnings today and some next week, I’ll be looking to start positions throughout the day.

Also want to add that this is just a watchlist so I may not add all of these (there’s still ppi to consider) but I’ll call out the ones I do here ![]()

grabbed some #spy 6/3 383’s

Got 2 10p TOST puts, 1 Amazon 1700p, 10 2.5p joby, And one snow 90p

Also averaged down on my Disney 90p from yesterday

Sold both of my affirm calls for a loss, and one of the puts for 28%