Idk what’s going on with BYND but sold my put for 80%, gonna keep an eye on it to see what’s up and maybe re enter again

took a shop 250p here

guess I just average down here ? ![]()

Sold my Tesla put for 80% fuck this gay ass market

Watching #ride Lordstown Motors for a scalp - could have already peaked -

as @TheMadBeaker pointed out - Huge Cash infusion due to the FoxConn deal

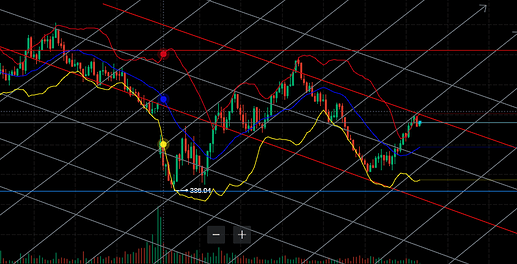

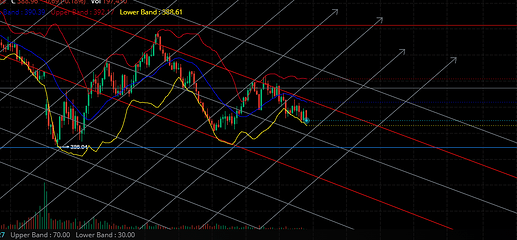

SPY put position from 394 isn’t bad. SPY is overextended on indicators right now and esp on the 1 min. I’m looking for a rejection off 394.88, but 394 was also a strong resistance so it’s not a bad starting level. I would look to sell at like 392-391.5 for a scalp and if you’re confident in puts, just hold but I wouldn’t personally.

Started SPY 07/15 380p at 13.74

Just a reminder that all these ARKK stocks that are up 20% today are still DOWN 30% compared to last week.

Make sure you’re looking at the big picture and not today’s move in a vacuum

Anyone who did this should consider cutting at either 394, 393.26 or 392.5

Got a Tesla put and averaged down on Amazon one more time

Got my Disney put average down to .38 from 1.16 ![]()

added 10 VET dec 20c leaps at 3.50

Bought spy puts here, looking at a bounce off this resistance trend line

Sold some BYND 17 Jun 25/30c credit spreads at 2.25. Decent risk/reward with some time to play out I reckon

Took some LFLY June 7.5ps at $.55 . Only reason this hasn’t cratered is because it’s a low float.

Took profits on 1/2 of this spy position here. +30%

Cut another 1/4 of spy puts position here. +56%

Going to let the rest run down to 387 and see if we break through.

These sold off based on my limits while I was at lunch - for 10.50 little under 10% return

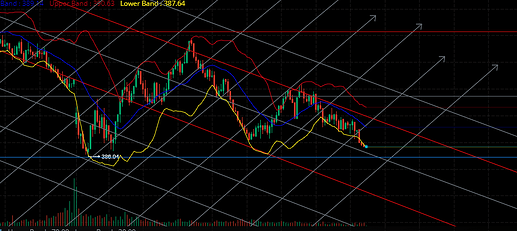

Will be looking to enter SPY strangles again tomorrow. Probably around 10:15am.

Volatility is crazy. Vix is holding 32 over.

I plan to keep entering strangles, 2weeks out, to possibly catch any sudden flush or quick rally unforeseen.

These next few weeks might be key.

so just so i understand this strategy, your buying a put and a call same exp date, different strike price, waiting for a time when stock and IV go up and sell the call and waiting for a time the stock goes down and IV goes up and sell put?