I’m getting amazing fills for the CCV Aug 7.5cs (filling at 2.35 for a breakeven of $9.85). Thanks for the thread @Naked

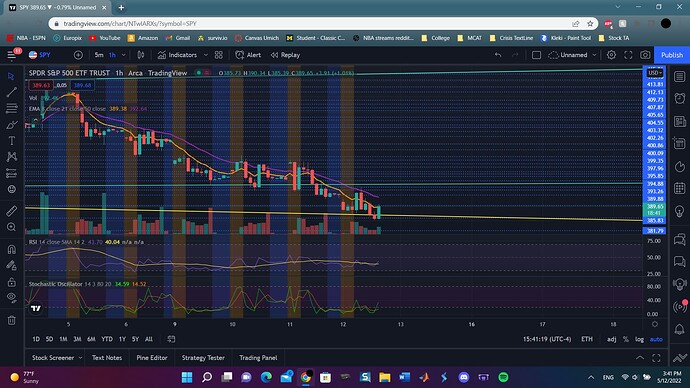

Before put holders get too emo and fear that the markets are going to be good again, SPY has failed the 8 EMA multiple times and especially the 21 EMA the entire time down. Right now, we’re not even breaking above the 8 EMA. Calm down, this might just be better times to enter puts.

8 EMA at 390ish, 21 EMA at 393 ish

Entered amzn 2100p in case consumer sentiment report is weak. Will set a tight stop

Waiting for hard rejection at 400 for spy then going to try to scalp some tesla 730p

Looking at the 750p for tesla now that the price has come down from this pump

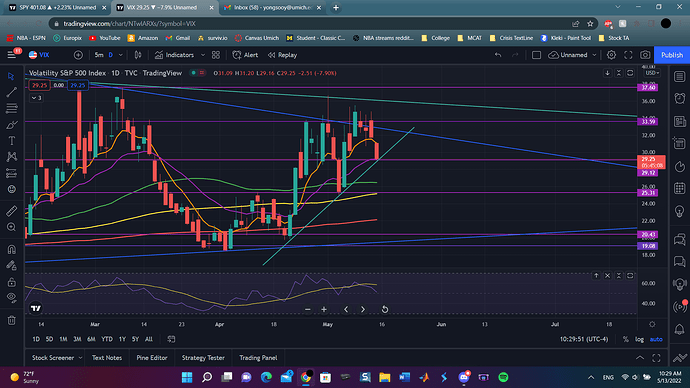

VIX at 29 and at uptrend line. VIX could bounce here and end this SPY run for a bit. SPY is also overbought on both the 1 min and 5 min so be careful with calls. I’m looking at the 8 EMA on the daily which is 402.5 for a rejection, but we’ll see.

I’m still bullish, so I’m going to re-enter calls, but I’m gonna do it when SPY isn’t so overextended.

In on a SPY 5/20 $390 Put, filled at $2.80. Let’s see how it goes into the afternoon. I’m feeling we go back below $400 today.

Sold for $3.40. Figured the morning rally would come back below $400. Nice 20% scalp. Only play for me today, though I wanted to pick up some CCL $15 calls. We’ll see if SPY drops it more and I can get a fill.

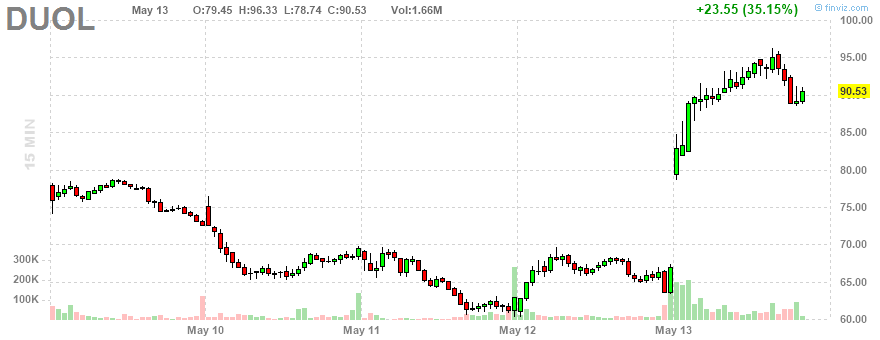

Grabbed some DUOL 5/20 75P for $1.25 ea.

DUOL has risen 35% today and is up 60% from its bottom 2 days ago.

They guided for 10% better revenue and expect to come around $380M for 2022. Current market cap is 2.8B and their net income margin is still -24%.

Something is getting lost in translation …

Betting on it retracing back at least half of the spike by the end of next week.

I averaged down on the SPY 07/15 380p that I started taking yesterday. Averaged down at 11.00 and 10.00.

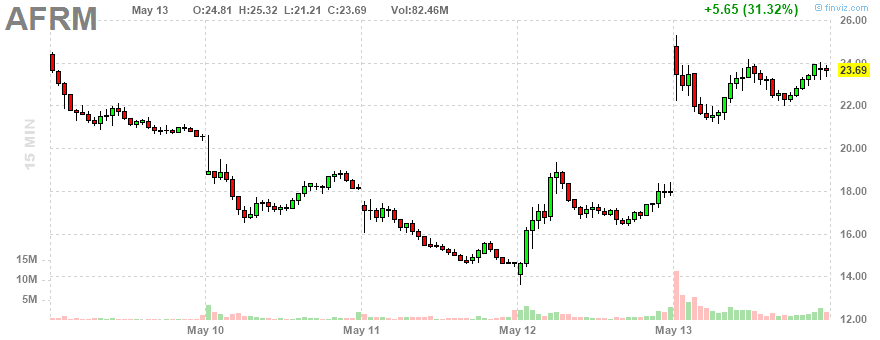

Grabbed some AFRM 5/20 20P for $0.85 ea.

AFRM is up 31% today and 85% since yesterday. Nuts. They had earnings yesterday but it’s not clear what was in there that was so rosy. It looked like a lot of accounting surgery to me.

Counting on a bit of retracement next week.

(Thanks to @Machetephil for noting this in TF!)

Btw - both this and DUOL above don’t have much DD in them, other than such rapid gains in 2 days are not “normal” and so taking bets on things returning to the previous trajectory. However, if market considers them oversold, then that may not happen.

Possible inverse h&s forming. Also bullish divergence on the RSI. Look for a confirmed breakout for calls

The hourly 8 EMA and the daily 8 EMA are both basically at 403. There should be strong support there. If not, then ig we drilling in a very unpatriotic way

Grabbed some 6/17’s 385’s #spy from @iamfrankgambino mention on TF - will dump quick @ 2%-10%

If I had the funds, I’d buy more 6/17 calls for SPY at this level. Gap has been filled.

Purchased 5 $SHEL 7/15 65 C @0.97

Still bearish on $OPEN as well. Waiting for a drop this week to below $7.