Tl;dr:

- 0.5% monthly inflation will keep annual at same 9.0% level. Cleveland Fed forecasting 0.27%/8.82%.

- Markets puke when inflation comes hot as size and duration of rate hikes increase

- Which direction markets go may therefore depend on whether that monthly print is > or < 0.5%

One factor that will likely play a role in how markets react is, of course, the actual inflation print versus expectation. I can’t quite find the exact data, but I believe the print came higher than forecast every time. And so markets reacted negatively, because higher inflation means more rate hikes for longer from the Fed.

If we agree that that is an important factor, then let’s ask ourselves whether we think inflation will overshoot or undershoot forecasts. If someone can Blomberg estimates, that would be lovely. In the meantime, we have the Cleveland Fed with its very low 0.27% MoM estimate, suggesting a July YoY inflation of rate 8.82:

No doubt, reduced energy costs and possibly reduced food costs too, played a role.

Is this realistic?

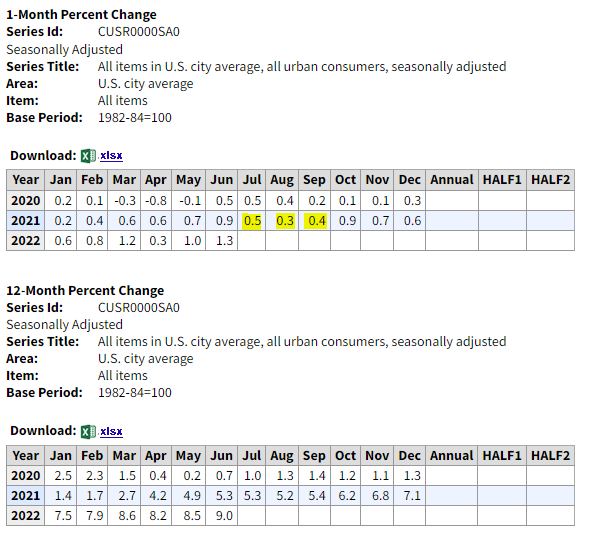

Here’s the monthly and annual inflation data from the BLS:

(Source)

For July to have the same annual print as last month, we basically have to have a monthly inflation print of 0.5%. Not just that, but to stay at this 9% annual level for the next two months, Aug monthly inflation has to be 0.3%, and Sep has to be 0.4%.

Note that the last three months were 0.6%, 0.7% and 0.9%. We were going up. And services inflation is getting entrenched now. Sure, food prices may be stabilizing and energy prices adjusting downward even, but is that enough to offset the other increases to give us a monthly print of 0.5% this month, and 0.3% and 0.4% the next 2 months?

Will have to see it to believe it.

The math is thus (my calculations, take with grain of salt):

| July MoM | July YoY |

|---|---|

| 0.0% | 8.5% |

| 0.5% | 9.0% |

| 0.9% | 9.5% |

| 1.4% | 10.0% |

| 2.3% | 11.0% |

Thus, anything over a monthly 0.5% inflation print is likely to markets nervous and likely give us a red day. This is 2x what Cleveland Fed is projecting ![]()