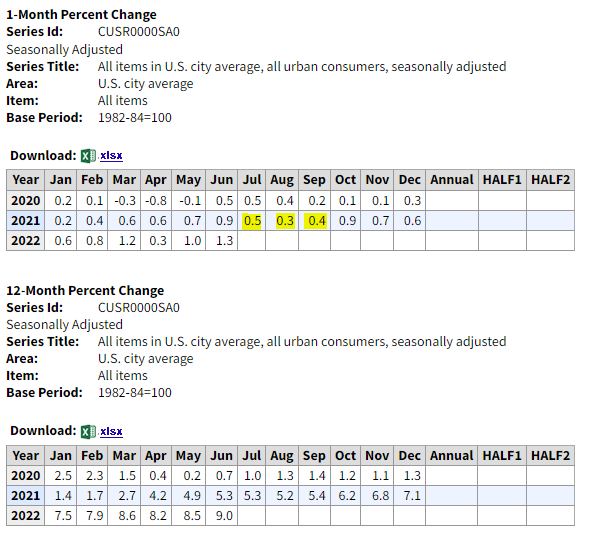

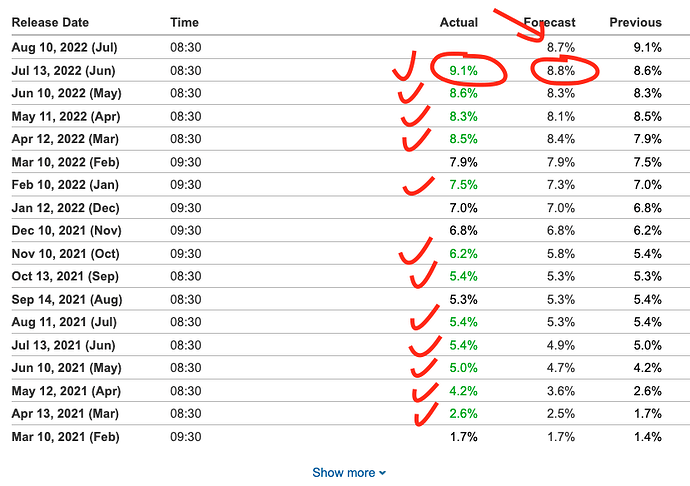

CPI numbers come out this Wednesday, August 10th.

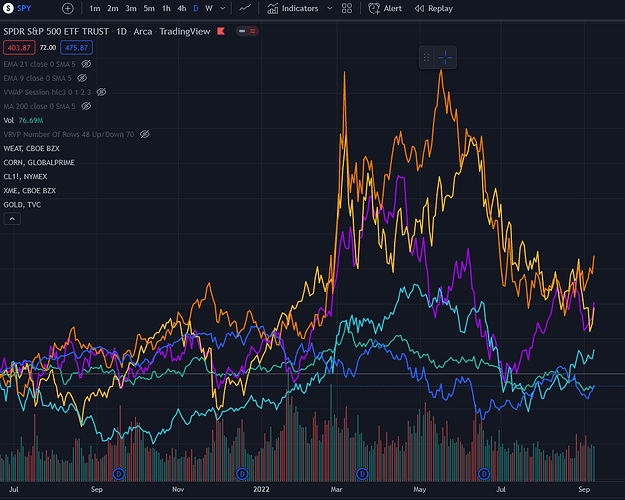

I was curious how the market reacted in the past to CPI numbers so I looked them up on the government website:

https://www.bls.gov/cpi/news.htm

Some of the previous release dates, Core / All (which are obviously for the previous month’s data), and also how the market ended that day:

July 13, 2022 - 0.7 / 1.3 / Green

June 10, 2022 - 0.6 / 1.0 / Red

May 11, 2022 - 0.6 / 0.3 / Red

April 12, 2022 - 0.3 / 1.2 / Red

March 10, 2022 - 0.5 / 0.8 / Green

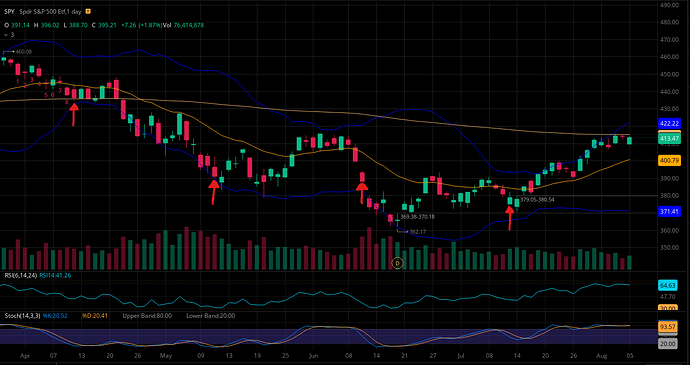

When looking at SPY on the daily, we can’t just assume CPI day will be red, or even the days after.

HOWEVER, These past 4 CPI releases, the two days before (Monday & Tuesday) have all been RED. Sometimes a little, sometimes a lot. Will history repeat itself a 5th time? Who knows… But for me it’s just one useful bit of information to keep in the back of my head that things will probably be leaning to the downside first part of this week if we are to believe algos and fears stay consistent with this sort of information in the current macro environment.

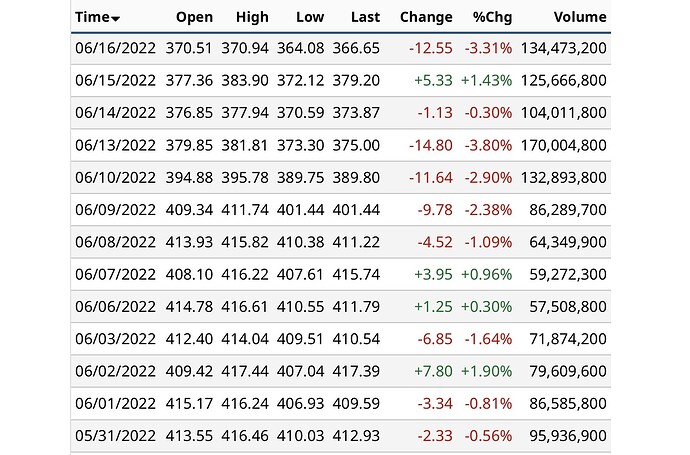

UPDATE:

The combined drop for the two days preceding CPI were as follows:

July 13, 2022 = -1.98%

June 10, 2022 = -2.97%

May 11, 2022 = -3.47%

April 12, 2022 = -2.02%

So on average we’ve seen a -2.61% drop for the combined two days before CPI. Granted it is a little skewed with the May 11th big drop likely on other news, if we exclude that then for the other 3 times we still see a -2.32% drop.

To paraphrase Ian Fleming: Once is happenstance. Twice is coincidence. Three times is actionable intelligence.