Interesting Bloomberg article that came out this morning:

Original (paywall): https://www.bloomberg.com/news/articles/2022-07-24/fed-to-inflict-more-pain-on-economy-as-it-readies-big-rate-hike

Archive (no paywall): https://archive.ph/UmuvI

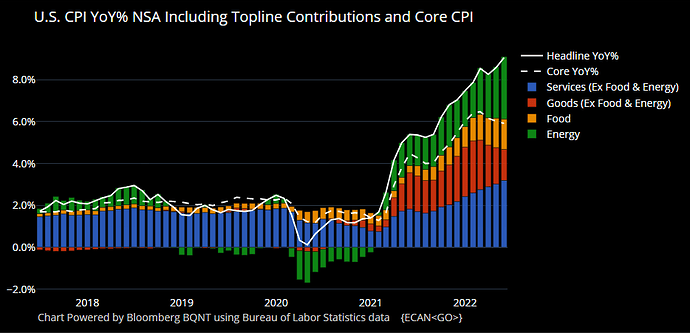

I like this chart from the article, really helps break down CPI components visually: