Time to resurrect this thread, with CPI data coming out on Nov 10.

Cleveland Fed predicts 8.1% headline and 6.6% core. And they don’t expect a change into Nov.

A 0.1% cooldown every month is likely too slow for the Fed’s liking.

Time to resurrect this thread, with CPI data coming out on Nov 10.

Cleveland Fed predicts 8.1% headline and 6.6% core. And they don’t expect a change into Nov.

A 0.1% cooldown every month is likely too slow for the Fed’s liking.

CPI print is out PM tomorrow; sharing some data points as prep.

Consensus is 7.9%, with a 7.8%-8.1% range:

Cleveland Fed’s estimate is 8.1%:

Swaps are also indicating a change in sentiment on inflation’s trajectory:

I’ve seen relatively convincing arguments for both movement in either direction. On one hand, energy, food, rent etc. should be cooling even more. On the other hand, the sticky service inflation is ramping up. However this nets out should result in a sizeable move tomorrow.

Thx @The_Ni. So if CPI comes in above 8.0 it’s bearish, below 8.0 is bullish.

Core above 6.6 bearish, core below 6.5 bullish.

Based on the table you posted in TF today, I believe the probability of 75bps for Dec is higher than last week after JPow spoke which would indicate inflation may come in high tomorrow.

Only part that I have to add is that last time it wasn’t as simple as raw percentages and that could be a thing again. Why seems to matter to some degree and I think that would probably still be the case given that the market is already bracing for a miss.

To be taken with a grain of salt because it’s JPM but let’s look back at this later.

I feel this Reddit comment

This is what the inflation swap market is pricing in now - inflation of < 3% in 8 months.

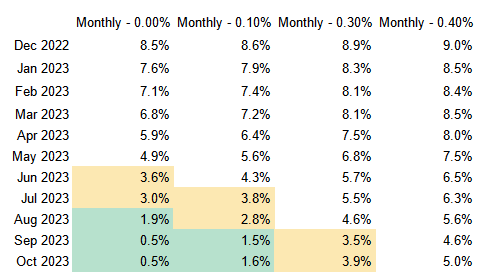

This is possible if we hit no more than 0.1% MoM inflation.

(Source - I maintain this.)

This month’s lower inflation report was made possible by a combo of lower energy prices, price of used cars and cost of medical care. The rate of increase of most other categories are also decreasing. I suppose it’s possible we end the year with sub 3% inflation, assuming there are no shocks. Main one we have to look out for is around energy; specifically crude oil. For now though, perhaps we can be cautiously optimistic.

This is interesting on the used car part. I had mentioned somewhere at one point I had noticed roughly 10 percent slide in valuation from October through November. Spent better part of a week putting inventory on the money with writedowns and adjustments.

We are currently projecting that’s the big drop and starts to level off to normal levels of depreciation. Stil actively in aqcustion mode because inventory levels aren’t near where they were previously still. But to watch the wholesale prices come down to more realistic points is a pleasant sign. December is the second strongest month of the year typically in automotive. This could pose an issue on pricing if a big volume month drys supply up some this could push pricing back up a touch. But in my opinion I feel like we are in the clear with elevated used car pricing. As demand has sufficed some. Used car rates have nearly doubled this year. And always a shock to consumers for a bit. If I had a dollar for every customer nowadays that says they aren’t paying that rate. I’d be able to retire.

This is a segment often forgot about I feel like when it comes to CPI and inflation in general. However it plays large part in consumers daily lives as the second biggest expenditure. I think the decline is a good sign for future prints.

CPI expectations for tomorrow:

These are the expectations that are priced in.

(Source)

Also note that market is expecting inflation to be back below 2% within 1 year:

And market is also feeling pretty good about the 25bps in Feb:

Finally, SG reports IV is high, but not a lot of downside being priced in:

All in, market is well aligned on life getting better. It is not well positioned to handle a surprise though.

CPI came right on the dot, for both core and headline inflation.

On cue, Fed whisperer Nick T essentially confirmed a 25bps increase in Feb.

Fresh data showing inflation eased in December are likely to keep the Fed on track to reduce the size of interest-rate increases to a quarter-percentage-point at its meeting that concludes on Feb. 1.

Which the bond market confirmed.

Should be smooth(er) sailing now. Why, then, was the market fairly meh today? That’s a discussion for a different thread.

Resurrecting this thread since it’s that time of the month again.

Earlier today, Labor Department revised Dec CPI higher:

U.S. monthly consumer prices rose in December instead of falling as previously estimated and data for the prior two months was also revised up, which some economists said raised the risk of higher inflation readings in the months ahead.

The consumer price index edged up 0.1% in December rather than dipping 0.1% as reported last month, the Labor Department’s annual revisions of CPI data showed on Friday. Data for November was also revised higher to show the CPI increasing 0.2% instead of 0.1% as previously estimated. In October, the CPI rose 0.5%, revised up from the previously reported 0.4% increase.

![]()

Whoops!!

For tomorrow… current inflation swaps are pricing in 6.24% today. Bloomberg estimates median of 6.2% and mean of 6.24%, with a std dev of 0.15%.

Chatter is inflation will come in hotter, which is likely what is priced in. So … it would have to come in quite a bit hotter, otherwise, :all good:.

I’ve been considering something with CPI for the past 6 months. This past June prices peaked and were 9% higher than the prior year. Each month we get the annual CPI figures and the most attention seems to go toward the annual increase. Previously, the e calculation somehow utilized the prior two year average but that is now changing to only look at the past 1 year. So as long as inflation slows down and stops accelerating at a high pace (75 basis points per month = 9%), this summer the annual CPI will come down simply because it’s relative to June’s ridiculously high figure. In other words, we could see inflation stay the same as it’s been the last 6 months and the annual CPI will look much better than it does now because prices in Jan 22 were much lower than June 22.

No wonder the Fed feels comfortable slowing rate increases, they just do the math and see a better year over year comparison on the horizon. For CPI to stay above 6%, we would need to see 0.5 every month from July 22 through June 23. Instead, we’ve seen 0.0 - 0.1 - 0.4 - 0.4 - 0.1 - 0.1 - & now 0.5 for Jan. This 7month avg is 22.9 basis points per month or 0.229. Multiplied by 12 months gets us to 2.74% by June.

While this looks great on paper, it assumes we are all fine with the absurd prices items have risen to. There seems to be no desire from the Fed to see deflation or prices going back to a level at 2% annual increases above 2021 levels.

This makes this CPI number of 0.5 for Jan troubling because if we see continued inflation at this level, translating into 6% annual increases on top of the 9% increase in 2022, we would be living with a 15% increase over a 2 or 3 year period. I suppose this doesn’t impact workers whose wages are rising along with it, but those on fixed incomes are getting hit hard.

My main point here though is that I don’t see quite as much value in the CPI year over year figures as the month over month figures and the rolling total past 6 and 12 month totals. Why is no one reporting that we are trending toward a rolling 12 month total of 2.74 or that our past 6 month total is only 1.6?

The CPI report for January 2023 is actually even worse than meets the eye and here’s why.

This was the first CPI print based on the ‘new’ methodology of calculating based on 1 year of expenditure data vs 2 years. This means that had the CPI calculation continued being based on the 2 year method from last year, the number would’ve shown up as even hotter than 6.4% YOY because CPI would’ve been compared against a lower number. Here’s the official link, and excerpt:

Starting with January 2023 data, the BLS plans to update weights annually for the Consumer Price Index based on a single calendar year of data, using consumer expenditure data from 2021. This reflects a change from prior practice of updating weights biennially using two years of expenditure data.

10 out of 13 of the items in CPI printed a positive MoM reading. Only 3 items “cooled”. However, let’s take a microscope at 2 out of 3 of them:

Used cars and trucks was the biggest “cooler”, but this directly contradicts with the Manheim Used Vehicle Value Index which is supposed to be pretty reliable, and showing an uptick in January 2023.

Fuel oil is another “cooler” in this CPI. Note the wild swings in the readings so this is not too consistent of an indicator, thus not being included in the “core” print. Nonetheless, it was a cooler print, but keep in mind a couple of major tailwinds for fuel oil, which will impact the prices of everything else, and impact the headline numbers:

So the cooks at the CPI tried their best with the new calculation method, somehow concocted a negative used car price print, and still saw +0.5% MoM which is 6% annualized and a 6.4% YOY

Shelter has also been up consistently around 0.7% MoM every single month. It’s supposed to be “lagging” around 12 months, but we are seeing zero signs of slowdown so far in the CPI readings, but given that we haven’t quite hit 12 months yet. However, instead of signs of slowdown as we approach the end of the 12 month lag, keep in mind that last month mortgage demand was ready to surge at first hopes of interest rate pauses/cuts from the fed.

Not even getting into the +3% retail sales print this morning.

Maybe this January print was a one-off, but my point is it’s much worse than it actually presents itself in this CPI report, in my opinion. Inflation is sticky hot.

Bond yields and DXY have gained higher in response to all of the above news.

Just wanted to say thank you for taking the time to breakdown the new calculation of cpi. Wanted to do it just don’t have the time to deep dove into it. The one question I had but could not find an easy answer on is that now that there are 2 ways to run the calculation do they have the ability to choose to revert or is this set in stone as this is the way going forward? Thanks man appreciate it

I’m not sure, but from the sounds of this link, the CPI calculation method has been revised many times in the past. Seems like an ever-evolving document?

Bloomberg median estimate for CPI is 5.1% tomorrow.

Inflation is expected to remain flat next month, and then slowly go down:

Good luck to us, tomorrow!

These are the forecasted details for tomorrow. Even if headline and core come in line, how the composition shifts underneath may determine market reaction.

(Source)

CPI forecasts for day after:

YoY core expected at 4.3% vs 4.7% actual for last month.

In terms of MoM, consensus is 0.6% for headline and 0.2% core, vs 0.2% and 0.2% respectively from last month.

Headline is thus expected to be higher while core is expected to cool a bit. This is what is priced in, and what markets will respond relative to.