This thread is for general discussion and analysis of the listed commodity.

Article I read last night giving a macro view on commodity prices and how volatile they have been this year.

One ETF I’m going to start watching is IEZ it is an Oil Equipment & Services ETF. Going to see how it’s movement and option pricing compares to SLB, BKR, and HAL directly. Just watching at this point, no reason to dive in yet.

Looks like crude dropped today based on the API numbers. Also OI on Brent and WTI dropped to the lowest level since 2015 as it appears Europe isn’t going to join the Russian oil embargo. Could see a further drop in prices.

Where do you go to check the OI on commodoties?

Aren’t May Brent futures up right now though?

Yeah. I just realized they started a new day and the are up as of now.

A quick search turned this up.

https://www.cmegroup.com/tools-information/quikstrike/options-open-interest-profile-energy.html

Light crude opened up DOD, but its still down from this weeks high. However I am still a perma bull. Maintain 150/barrel in April outlook. Projection consensus 185 EOY likely but 200+ is also very possible.

I wanted to add this link for US Biofuel Stocks. Despite the rise in grain prices one of the largest cost associated with food production is fuel usage. It may sound counterintuitive but an increase in biofuel refining may offer some relief overall. Anyways, I’m going to start watching these companies.

The rise of oil might have to do with lower levels of oil inventory at Cushing:

- Storage levels at America’s largest oil storage hub have fallen to extremely low levels.

- Crude oil inventories at Cushing have shed some 13 million barrels since the start of the year, to stand at 24 million barrels as of last week.

- The risk of a short squeeze is the highest around contract expiry dates near the end of the month.

(Source)

From Commodore1648:

Update on the Iranian nuclear deal and its implications for oil production:

I came across a WSJ article this morning stating a nuclear deal may be coming within the next few days. Iran has released British prisoners detained in Iran since 2015-2016. The WSJ states that " The prisoner issue isn’t formally a part of the nuclear negotiations in Vienna, but the release in 2016 of four U.S. prisoners in Iran was secured through similar talks that happened in parallel to the nuclear talks. White House envoy for Iran Robert Malley has said a nuclear deal is unlikely as long as Iran holds U.S. “hostages.”

" Their departure from Iran will fuel hope in the U.S. that four American citizens held in Iran will also be released soon."

U.S. intelligence also released to the public today that Iran has conducted a clandestine finance system that has circumvented a lot of the sanctions. I am speculating that this news was released as leverage over Iran for a final bargaining chip in the deal.

What it means for oil:

If a nuclear deal is met with Iran it is likely that Iran will increase its production of oil causing a surge in supply. This may bring the price of oil per barrel back down although I’m not sure how much. The US delegation may have a sense of urgency to reach this deal sooner rather than later with the price of oil increasing in the US due to sanction on Russian oil imports.

Caveat: “within the next few days” is hardly an accurate forecast of the reaching of a deal. It could be this week, it could be next–the deal could still fall through in the last minute. The next step to watch is the release of the American prisoners detained in Iran. I believe this would signal a good faith move by Iran and the US would then proceed to finish the negotiations.

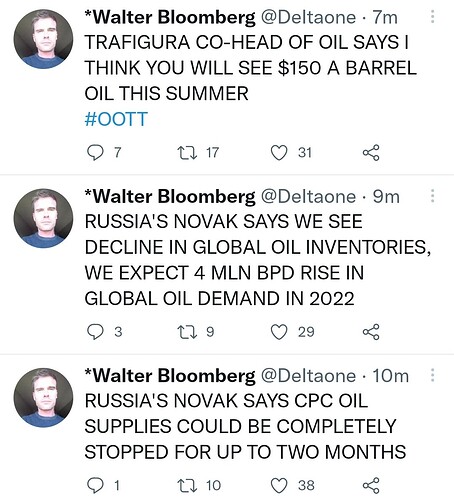

More news out of Russia, a few green candles on BNO as a result.

For those of you who aren’t familiar, Peter Zeihan is a geopolitical analyst and speaker—and he’s published a number of books on geopolitical topics (I’ve read and recommend two: The Accidental Superpower and The Absent Superpower). He regularly publishes a newsletter, and occasionally publishes video clips pertaining to geopolitical issues.

As you might imagine, he’s been extremely active during the war, and has had several bits focused primarily on the current and eventual impact of this war on the global oil supply. He doesn’t directly relate it to economics (and definitely doesn’t give investing advice), but I think it’s super useful information and has helped to shape some of my recent trades.

Anyhow, here are some of the more recent clips:

-

March 23: Russian Refineries’ Reduced Runs

- TLDW; There are signs emerging now Russia’s 4+ million daily barrels of crude are going to disappear in the very near term (weeks), regardless of what happens with the war now.

-

March 22: Russian Oil’s Vanishing Act

- TLDW; China isn’t going to benefit from this situation (in terms of oil) and can’t take in more Russian oil even if they want to due to infrastructure/logistics problems. Furthermore, Russia does not have the ability to operate their infrastructure for any length of time—all of the expertise (Exxon,Schlumberger, Haliburton, etc) has already pulled out, and China is even worse at this level of “oil tech” than Russia.

-

March 17: Deal With the Devil(s)

- TLDW; Venezuela, Saudia Arabia, and Iran aren’t going to make up the deficit in oil production that this war will result in. It is possible that Biden’s administration could cancel all exports of crude from the U.S. resulting in a large break in oil prices between the U.S. and the rest of the world; e.g. $70/barrel ceiling in the U.S., $150/barrel floor in the rest of the world.

-

March 8: China, Oil, and the Ukraine War

- TLDW; Mostly old news by now.

There are many other viewpoints he’s shared recently, but this is most of it as far as oil is concerned.

Could someone more informed explain what this means for the talks overall?

I believe the Iran Nuclear Deal requires Russia to sign off on it for it to come in effect and for the US to start getting oil from Iran. But it’s been delayed for about a week now and now looks like Russia rejected it to essentially hijack the deal and not allow for the US to get oil from Iran.

it’s a reversal from what Russia said 5 days ago in terms of signing off on the Iran Deal:

Following is a little rambly.

Brent-WTI Spread is at 3 year high.

BWTIS tells a story about global geopolitical conditions and their effect on crude.

OPEC+ meeting next Friday. In the past this has crushed the spread.

Iran deal in 2015 narrowed the spread. Brent is more likely to be impacted by changes in volatility because is global benchmark. WTI delivers in OK=Landlocked so cost to carry/deliver is higher. Less desirable. This could also crush the spread.

2 upcoming catalysts to short BWTIS, but I would imagine one would need fairly substantial margin to play it. For that reason, I will not be entering (unless microfutures but idk shit about that one famdog)

Something to pay attention to is how there seems to be significant divergence of oil prices (going up) and the current oil futures contract prices (going down). Not sure what is causing it, but I’d be extremely careful playing this commodity right now. Only one of them will be right in the end…