[center]Crypto Currency 101 - The Beginners Guide to Crypto Principles and Trading[/center]

[center]A collaborative effort by hibitternes & DoseMe42[/center]

This was written back in 2020 but has been edited for today’s time (11-10-21). There is a Glossary at the end.

Basic Blockchain

by hibitterness

So let’s start at the very beginning, with how most cryptocurrencies work. They operate on a system known as blockchain, which is a way to record and store data via a system of “blocks” that are “chained” together. There’s a set amount of data that constitutes a block; after that threshold is met, a new block is generated and chained to the previous one. This is done via a cryptographic hash, which is a mathematical function that compresses data, and the process is chronological and inalterable. This means that the data is not only perfectly ordered by time, but can also never be changed. The data that can be stored on a blockchain varies greatly, but because it organizes data chronologically it lends itself best to data that is “transactional” - that is, information that is created at a certain time. You could store your business contacts in the blockchain, but it would be kind of pointless because chances are you aren’t really interested in when you added the contacts; you just want the contact information. However, the transactional nature of blockchain makes it great for information that you would have in a ledger - such as, for example, logging exchanges of an asset.

Blockchain technology is fascinating and has a lot of potential; some would argue that it, rather than cryptocurrency itself, is the true gift of Statoshi Nakamoto to the world. You can read more about the “practical” applications of the technology on your own time. However, it was first debuted in the form of cryptocurrency (specifically Bitcoin), and that’s our main concern here. What blockchain demonstrated was that a decentralized method of recording and verifying data was possible, and what better way to demonstrate it by making money?

You see, normally money’s value and authenticity is guaranteed by a third party; in the United States, this would be the Federal Reserve. As the only institution legally allowed to make money, the Federal Reserve effectively dictates the value of the dollar by controlling how much money is in circulation, and simultaneously guarantees its authenticity. Now you may not think that’s a problem, but it kinda is. Just take a look at Weimar Germany in the 1930s as an example; in order to pay off the nation’s debt, their central bank just started printing more money. The result? The value of their currency became worthless, and everybody who trusted the system and saved their money ended up having the same monetary value as a beggar. It sounds a bit tinfoil-y to say this, but the problem with having a third party verify the value and authenticity of your money is that you are reliant on that third party to keep your best interests in mind, which by and large they likely don’t. Central banks have a whole lot of other stuff they have to do, and between your retirement account and the nation’s lumber supply being too cheap, you’re out of luck. But you also can’t just make your own currency in order to protect yourself, because otherwise everyone else will lose trust and the system will collapse. So basically, you can’t trust the banks to decide value, but you are compelled to because otherwise you can’t do anything.

However, the blockchain provided a framework where authenticity and value are determined in a decentralized manner. Bitcoin provided the most basic version of how such a system would work along the following lines:

- Somebody enters a transaction

- The transaction is sent to a bunch of different computers

- The computers analyze the transaction according to a bunch of rules that constitute the “protocol” of the blockchain (which is basically how to determine whether a transaction is legitimate)

- If the majority of them agree that the transaction is legitimate, it gets entered into the current “block” of the blockchain.

- At this point, the transaction is over

- When the current block gets filled, it is cryptographically encoded and then gets added into the new block

- As a reward for verifying the transaction, the owners of the computers receive a set amount of coin (as dictated by the protocol) as well as a portion of the transaction (a “fee”)

A heavily simplified version of this is as follows:

- I attempt to place an apple into a community storehouse for apples

- My apple is given to a group of people to analyze

- Each person in that group examines my apple to make sure it is a real apple based on a set of rules about what makes an apple and apple

- If the majority of them agree that my apple is a real apple, it will get added into the community storehouse

- At this point, my apple deposit is done

- Eventually the storehouse gets full and we build a new one. A sign with the address of the previous storehouse is placed outside of it and then we repeat the process

- As a reward for verifying the authenticity of my apple, the people who did so get a slice of an apple that appears out of the list of apple rules (metaphor broke down here)

Let’s actually take a moment to backtrack here, because there’s a few things in these examples that I haven’t exactly discussed yet, and you’re probably scratching your head about them.

So firstly, how does the blockchain actually begin? After all, you can’t create something from nothing. And especially in the case of crypto this is critical, because it has lasting effects on the subsequent ecosystem surrounding the system. We’ll discuss different ways later, but for Bitcoin this was done by manually creating a “genesis block” that would serve as a reference point for all future transactions in the blockchain and then hard coding it into the protocol. After that, the first block was mined based on that genesis block’s transactions and coins began to come into existence.

Ok, fine, but what is this “protocol” that I keep mentioning? It’s basically the spine of any crypto; it governs how the coins work, how more of them are made, what makes a coin authentic, how rewards are distributed, the amount of transactions that comprise a block, the scalability of the currency, etc. Basically everything about the crypto’s structure is governed by a protocol. In a more real world sense, you can think of it as how the Federal Reserve makes money, verifies that it’s real, and the whole system surrounding how money can be used. The protocol is super super important to a crypto’s value and usage, because it affects stuff like inflation and supply as well as what the coins actually represent. And in Bitcoin’s case, this is super critical, because part of what makes Bitcoin so special is that it’s protocol inherently limits the amount of coins that can exist. Unlike the Federal Reserve, which can literally just make more money out of thin air if they want, creating more Bitcoin then what is allowed (21 million coins) would require altering the protocol. This restriction would require a majority agreement among miners to change, making Bitcoin all the more democratic in nature.

Jumping off of that to probably the most burning question on your mind, let’s talk about rewards, fees, and mining in general. Again, this is something that varies from crypto to crypto and has evolved over the years, but for Bitcoin it uses a basic Proof of Work (PoW) function in it’s protocol to govern the creation of new coins. Basically, what this means is that a transaction carries with it a certain degree of verification needed to authenticate it; in other words, a transaction needs to be proved to be valid. For Bitcoin, this is the solving of advanced mathematical functions (the kind of math that people spend hundreds of thousands of dollars on degrees just to understand).

This is where the miners come in! You will recall that Step 3 in the above list of steps about how the Bitcoin system works, a bunch of computers analyze the transaction to determine whether or not it’s legitimate. This is PoW at work; a bunch of people have their computers working to solve these math problems. But obviously these problems are complex, and they take time to do, which means that they’re burning power (which costs money). So to encourage people to mine, the protocol gives out a reward of coin on a per-block basis; effectively, you print your own money by mining.

However, because Bitcoins can be divided into non-whole units, the amount of transactions increases dramatically as people start using portions of coins, rather than whole coins, to transact. This increase in transactions means that the actual process of recording new transactions in the blockchain slows down; and because rewards are distributed on a per-block basis, the slowdown in block creation means that rewards start coming through less frequently. But to encourage people to keep authenticating transactions, Bitcoin also has a “fee” attached to each transaction that goes to the miners; think of it like paying a small tax to cross a bridge. Even after every single bitcoin is mined, you will still pay transaction fees on your BTC transaction; miners don’t spend their precious energy for free!

Trading Crypto

*By @_DoseMe42

Crypto currency exchanges run 24/7, 365. They do not stop. The entire world trades the same coins at all hours. This is a stark contrast to the normal stock exchanges that have strict trading hours and take off holidays. Volume can reach its peak at literally any hour of the day and be affected by anyone in any region of the world.

This makes trading crypto currency very exciting. It’s a thrill and a rush. It will raise your spirits then crush your soul if you’re not careful. If you are strong and smart enough, however, you just might live long enough to feel your hands turn to diamonds.

Fun Fact: One of the first and most notorious exchanges was Mt. Gox. It stood for Magic the Gathering Online Exchange. It was meant to sell Magic cards, not Bitcoin. It eventually got hacked and many, many Bitcoins went missing.

Nowadays there are thousands of exchanges. They range from billion dollar, private companies like Coinbase to simple decentralized coin swapping like Uniswap. The largest crypto exchange is Binance. Many exchanges have shut down, been hacked and scammed over the last decade. The #1 most important lesson in holding, trading and obtaining crypto currency is that if you do not possess the private keys to your wallet, you do not possess the coins. Some exchanges, much like banks, might even loan out your coins. Exchanges can also crash or stop functioning during high volume activity, although this happens less and less often now then in the past.

I bought my first BTC off LocalBitcoins which required me deposit money into a stranger’s bank account and then pray he sends me BTC to my desktop wallet (he did). Luckily, you don’t have to walk both ways in the snow to get your hands on some hot, eye melting order book action.

How to use an exchange:

For this section I will use Coinbase Pro. This is just what I use. You should find similar features in most other exchanges but the look and feel of them can vary wildly.

[center]The Coinbase Pro interface, in its entirety.[/center]

[center]

Most exchanges require a certain amount of KYC (Know your customer). This means you will need to provide a social security number, bank account and other forms of ID before being able to trade. Coinbase Pro does not offer margin or futures trading but some platforms out there do. Platforms like Robinhood and CashApp allow you to purchase crypto with instant cash deposits. Many users now access coins like Doge through easy-to-use apps like these. But as we are the more savvy and sexy type of trader, we prefer something with more moving parts and flashing colors.

Below I will go over the parts of the interface of Coinbase Pro.

[center]

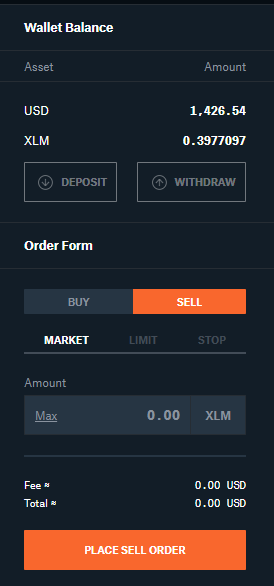

[/center][center]The buy and sell interface.[/center]

[center]

Orders - The same types orders exist in crypto trading as do stocks. Most exchanges should let you place market, limit and stop orders.

[center]This is the candle chart. I won’t write much about it. You get it.[/center]

[center]

[center]

[/center]This is the Order Book, the most exciting part of the entire experience. In the image above, you’ll see the three columns. They are split into buy and sell orders. Since crypto is 24/7, limit orders are always good ‘til cancelled. This means people will stack up limit orders and just wait for them to be met…even if it takes months or years.

Market Size is how many coins of the currently selected currency are for sale at the price in the Price column. You can see on this XLM example that 168,138 XLM are posted for sale at a price of .601796 cents. My Size is where you will see your orders that you’ve placed. You can literally watch them run to the top or bottom and get bought/sold out.

Below is a visual representation of the order book. This is what I love to watch. You can zoom in and out on both of these areas to get more granular price action. I love watching this area during high volume. The sheer amount of order volume is a sight to see.

This is the Trade History. It just shows you orders from the order book that have gone through. I don’t find this area particularly useful and generally ignore it. It can be fun to watch orders print during high volume.

[center]

[/center]Below you will see the Open Orders and Fills. You will notice in the picture that a limit order is set in open status. It is to sell 2,821 XLM at .67 cents. You can see on the right the orders that were filled in the past. Sometimes when you place an order, it might get filled in multiple smaller orders. You can also see how 5 months before this screenshot, XLM was trading at .08 cents and was sold at that price.

Markets are expressed uniquely in the crypto-sphere. There are many different ways to trade coins. As you can see here there are several categories to choose from. You can actually trade BTC (and some other coins) into Euros, GBP and other foreign currency. There are also stable coins that we will touch base on in another section. Just know that they are tokens meant to always remain very close to $1.

[center]

[/center]In the example you are seeing the BTC trading pairs. Trading a pair takes some time to wrap your head around. Almost every exchange will allow you to exchange BTC for ETH and vice versa. You have to be extra careful when trading these pairs as you are trading on the volatility of both currencies, not just one (already volatile) asset against a stable one (like BTC to USD).

Let’s take a slice of the order book and look at it. On the bottom half (buy side) you will see that there is 11.3 ETH posted for sale at the price of .03827 BTC. It’s pretty simple. Most of these markets are much lower volume then XXX-USD, so filling large orders at the same price can be difficult.

[center] [/center]

[/center]

Trading the pairs can be extremely profitable but it has its caveats. For better, or for worse, you are allowed to remain entirely inside the crypto environment. This means if you swap all your BTC for ETH and then BTC starts going up, you can at least count on your ETH to rise with the general market. You won’t miss the rocket ship, you’re just sitting in a different seat. If you had traded your ETH for USD before take off then you’re stuck on the ground. Of course, this can also be true for the crash. I have accumulated a decent amount of coins by trading the LTC-BTC pair. I would just take 5 LTC and swap it for BTC then place a limit order to swap it back for 6 or 7 LTC then wait for the pair to flip and do it over again.

Pro Tip: Stick to reputable exchanges with good volume and only trade the strong pairs. Don’t trade your BTC for shit coins that you can never get out of.

[center] [/center]

[/center]

CB Pro has added some ETH pairs as well as one for DAI. Some exchanges will have hundreds of pairs.

Fees are also a thing with crypto exchanges. These will be auto deducted from the amount you get in the trade. If you want to get 1.00 ETH, exactly, you’ll technically have to purchase just a little bit extra for the fee.

[center]

[/center]Taker and Maker fees are basically just market orders and limit orders. If you place a market order that gets filled right away, you’re a taker. If you set a limit order that rests on the book that a taker comes and fills, then you are a maker. I almost always use limit orders just because it’s safer but this is another good reason to do so.

Analyzing Crypto

*By @_DoseMe42 *

Fundamental Analysis

Fundamentals used to be the only thing that would move crypto. In my opinion, there is no other single commodity that has overcome as much negative media and publicity that Bitcoin and crypto in general has. It is becoming much more resilient as it has gained more mainstream acceptance. Visa and Mastercard will start letting merchants accept crypto as payment and use it as a store of value. I believe that as time moves on the scales have tipped for Fundamentals to Technicals for Bitcoin and the other main coins. News still does move it like when Tesa revealed they purchased 1 billion dollars worth of BTC and will accept it on their website to purchase their vehicles.

Technical Analysis (TA)

TA can be used as well. I personally believe it works best on the higher volume and more popular currencies. The more these coins begin to become and therefore act like normal stocks, the more effective things like Elliott Wave Theory and other technical analysis will be. I would not have taken any technical analysis on DOGE seriously 5 years ago, simply because it was an unknown meme that only a very small number of people took seriously. As of 2021, I believe technicals can be used much more accurately now that there is more price movement related data which creates support and resistance zones.

Nowadays I use technical indicators almost exclusively. Any news or event that doesn’t have global echoes probably won’t have much effect on Bitcoin anymore. Support and Resistance are king when charting crypto.

SHIB is a perfect example of how support, resistance and channels/trends can really be helpful in the crypto world.

You can see the many, near-perfect touches on the trend lines and support/resistance. I truly believe these three things are the most basic and reliable tools you can have in your TA toolkit.

Selected analysis of coins

There are thousands and thousands of cryptocurrencies in existence, and it would be a Herculean task to try to cover them all. This is just the basic gestalt of each…simply meant as a crash-course for someone who knows next-to-nothing about them.

Bitcoin (BTC)

By @_DoseMe42

The original, the OG, the grand pappy of them all. It has name recognition like no other. It has withstood negative press, flash crashes, bans, restrictions, persecution and false accusations like no other asset before it. Bitcoin is synonymous with crypto. If somebody only knows about 1 crypto currency, it is Bitcoin.

That being said Bitcoin is not the “best” crypto when it comes to usefulness. It’s old and archaic. It is actively developed but new, fresher ideas have been brought up and launched. This was all expected by Satoshi. Bitcoin’s original architecture was very simple by modern crypto standards.

Bitcoin has been and continues to be the best store of value on the market. There is no other coin that has performed better over a longer period of time. This is 80% of my portfolio almost always. I will keep the other 15%-20% in altcoins.

A good analogy for Bitcon is the “Gold” of the crypto world. This is especially pertinent due to the deflationary characteristics of Bitcoin’s protocol. While this has been mentioned before, this is because the current version of Bitcoin’s protocol only allows for a set number of coins to ever exist, and the more blocks that are mined the more the rewards for mining drop (at a rate of approximately once every four years, the reward per block halves, an even called the “halving”. At the current rate and assuming there are no changes to Bitcoin’s protocol, the last coin will be mined in 2140. However, it is important to remember that while this is actually relatively soon, the true supply of Bitcoin is likely far less (due to “lost” Bitcoin). This means that it will perpetually remain a scarce and stable coin.

Litecoin (LTC)

By DoseMe42

The “silver” to Bitcoin’s gold. A copy of Bitcoin but with some tweaks. Litecoin is well… “lighter” and faster then BTC. It’s a good store of value as well and often follows the trends of it’s big brother. LTC has always been my favorite coin. It’s a safe side-car to stash some money in along with BTC and I’ve always enjoyed trading it.

Ethereum (ETH)

By @_DoseMe42

The “oil” of the crypto world. Ethereum can be used to do so many things. ETH has the real power of the crypto world in that it is the most useful. It has many many tokens laid over it in the Ethereum environment. Many decentralized applications and disruptive technologies are being developed on the Ethereum blockchain. ETH is, developmentally and technologically speaking, the most exciting crypto currency around, bar-none. It also trades very well. I always keep my eyes on the ETH/BTC pair as you can never really go wrong being in one or the other.

Glossary

This section will cover terms that have and have not been mentioned herein, but are important to understanding the crypto environment.

- Blockchain - the transactional “ledger” that forms the basis of most major cryptocurrencies

- Know Your Customer (KYC) - a policy that requires exchanges to ask for the identities of buyers and sellers of cryptocurrency, which not only are implemented to prevent money laundering activities but also to create tax records

- Coin - a unit of cryptocurrency that is intended primarily to function as actual currency. They do not have any special functions and generally cannot be staked or used within a different operation. Examples of this include Bitcoin and Monero

- Token - a unit of cryptocurrency that functions “on top of” an already existing blockchain and utilizes it to create their own transactional network. Unlike coins, tokens generally service functional purposes inside of a seperate program. While they can be used as currency, that is not their intended purpose.

- Altcoin - there are two definitions that are largely semantic in difference, but worth noting regardless:

- 1.) Any cryptocurrency that is not BTC. This is by far the most common usage of the term.

- 2.) A cryptocurrency that is not considered “mainstream”. In this usage case, you are probably trying to differentiate between coins that have higher recognition (e.g. BTC, ETH, LTC) and those that are more obscure or esoteric in function (LINK, XMR, XRP)

- Shitcoin - a term used to describe crypto that lacks intrinsic value or has serious flaws. You’ll see this term frequently used to deride many new or lesser known cryptocurrencies, with the obvious implication that they are worthless or some sort of pump and dump scheme designed to steal money

- Pairs - similar to traditional currency pairing, it refers to “pricing” one currency in relation to another. Technically speaking, USD to any crypto is a pair, but in general you will mostly see pairs being used in reference to the relationship between two different cryptos

- Proof of Work - a blockchain system that requires all nodes to work together to solve complex mathematical equations and then distributes rewards according to the “work” done by each node. While it is innovative, it is fairly slow and requires enormous energy costs in order to validate transactions, besides having vulnerabilities in node control. It also is characterized as “unfair”, since rewards have a higher chance of going to the systems that do the most work (which requires expensive equipment)

- Proof of Stake - a blockchain system that requires all nodes to work to solve complex mathematical equations. Unlike Proof of Work, however, rewards are distributed based on the number of coins staked in a particular node relative to the total number of coins in circulation. This creates a system whereby coin holders are invested in maintaining the security of the network for two reasons; first to get the rewards, second to ensure that the system is not compromised and thus potentially making the coins worthless.

- Staking - an activity by which a holder locks a portion of cryptocurrency into a network in order to maintain network consensus. Staking only applies to proof-of-stake blockchain systems, as proof-of-stake systems do not have the same mining systems as proof-of-work.

Resources

Live Market Data:

Best free live charts:

Reputable/popular Exchanges:.

https://www.kraken.com/ (supports XMR trading)