[center]The True value Proposition of Blockchain and Cryptocurrencies: A fourth industrial revolution, A new Accounting standard and a new form of truth for transacting value on a global scale[/center]

Introduction:

Warning this is going to be a big fat wall of text essay style but effort and work has gone into this and I think you can get some value out of it if you stay the course and push through. I will be talking about some things which will appear to be off topic but I have included them as I believe it both frames and forms a basis for the end thesis of why this holds so much value for the future and can change society far more than people realise.

In this DD (is that the right word for this?I’m not sure) I will attempt to strip away all the noise, hype and confusion and get to the true heart of what value and improvements this technological platform can offer humanity. I will be looking at this at the most primal layer possible so we can identify where all this value generation is coming from and why. Having a better understanding of this will assist us in identifying true value creating projects which can give large returns over the long term with the main basis of asset price growth coming from fundamental revenue growth instead of short term investor speculation.

Before going any further we need to cast from our minds anything related to price especially in terms of fiat as this can distort what value we place on certain facts and realities and what really matters in the grand scheme of things. As Warren Buffet said in the short term the Markets are a casino in the long term they are a weighing machine. We need to weigh the value and Fiat pricing and thinking is brilliant at preventing us from adopting this long term mindset as it teaches you to value things on what you can buy with it now as fiat will always devalue in the long term.

This document will also show you why I’m crap at hype and momentum plays and why it’s been a huge learning opportunity to see things from the perspective of excellent day/swing traders like JB, Conqueror, Kryptek, Tedro, Deadbread, NoSauceNoGains, Rexxxar, Raiben the list goes. You’ve really opened my mind to this particular method of investing and I can’t thank you enough for your time and effort in building this community. You’re bringing opportunity and knowledge to people such as myself who in my normal social circles would be relatively inaccessible.

[center]What is Blockchain and why does it have fundamental value outside speculation?[/center]

[center]A brief history of the evolution of trade and exchange:[/center]

Hunter gatherer:

Before money most people are led to believe humans operated on a system of gifting and bartering. This was the case with pre agricultural nomadic society. As human interaction would have been brief and transitory a simple exchange of what they had to hand was all that could be facilitated. This could have been an exchange of knowledge in tool creation, hunting grounds, fresh water, shelter building or anything else. Although a very simple act, this ability for a species to exchange knowledge gained through experience to other in species individuals is the basis of human dominance on the planet and our capabilities to develop technology outside the knowledge of a single generation let alone a single individual (to quote Isaac Newton “if i have seen further it is by standing on the shoulders of Giants”) . A small detail leading to monumental reshaping of a planet.

Agrarian civilization and the classical era:

Once humans were able to harness the power of agriculture in 10,000 BC in an area of the fertile crescent (the birthplace of civilization) an area stretching though modern Egypt, Jordan, Lebanon, Palestine, Israel, Syria, Turkey, Iran, Iraq and Cyprus. So called due to its crescent shape.

Due to the proliferation of freshwater rivers and brackish wetlands there was a large supply of wild edible plant species that could be cultivated (the first grains and cereals still to this day forming the mainstay of human caloric consumption). This allowed a transition from a mobile nomadic society to a sedentary agricultural one. This had MASSIVE implications for trade, value exchange and as a result cultural, technological and economic growth like never seen before. The world’s first great empires were founded here as a result, ancient Egypt, the Hittites, Babylonia, Persia and all formed one small change that meant humans didn’t need to move with the seasons and could live in higher density populations again changing the face of the earth. This enabled the formation of a social based credit economy (I’ll build you this house because you are known in this community and you’ll owe me one) this meant exchange and trade could flow more freely than ever before allowing humans in localised communities to be specialists instead of generalists. Previously humans would need to be able to hunt, gather, cook, make shelter, clothing as a result all was done at a more basic level. Now carpentry, masonry, bronze work, farming, textiles and even the first paper papyrus would allow knowledge to evolve from the passage of stories to the accurate written word. More complex economies could develop and more economic growth to a new agrarian economy.

The first form of money in the form of coinage was the Mespotamian shekel nearly 5,000 years ago with the first mints in 650 to 600 BC in Asia Minor. This was the money of the elite, the kings, Queens and Emperors and maybe some rich noble families. The issue with social credit was it was endemic to a population. Any outsider by its nature would not have social credit. So in order to transport value, taking trade goods would have been very difficult on a mass scale. Coinage allowed intangible value to be transported long distances due to its portability, durability, trans portability and inherent value (often silver or copper was used). Kings and Emperors would also mint their coins with their own image and use it as a projection of power. What compelled the creation of such an innovation was war and armies. Armies required food, clothing and supplies while on the move and social credit was not an option and pillaging an area you were planning on ruling isn’t a recipe for stability so coins were used to ensure armies could pay for the supplies they needed on campaign. This allowed for expansion of empires on more stable empires. In turn more economic growth and a greater exchange of goods and services over a greater area and less barriers to trade such as raids or conflicting currencies. Different areas of the world rich in different resources could supplement each other. This is in part what allowed the formation of such long standing aforementioned empires.

Various empires rose and fell in the classical era but all had a common weakness that is that the primary source of power was that of an individual and the force they could bring to bear in terms of silver and military might. Once a leader died or was killed it would destabilize the entire power structure of a region causing political instability and war and we all know what that does to an economy. The Romans and Greeks briefly evolved semi democratic (citizenry in Rome meant serving in a legion and some other exceptions and Greece Citizens were people of power not just anyone in Athens etc) regimes however these faced collapse from external and internal pressures. Rome became a dictatorship under Caesar and Greece was conquered by rome.

Dark ages 476AD-1000AD:

This was more or less a lapse in political and administrative regimes and a loss of technological capabilities from Rome which were not sustainable without its global networks. Although very interesting, the collapse of the Roman empire is not relevant to the point here so I will skip over this.

Medieval Feudalism 1000AD-1250:

The origin of feudalism comes from latin feudalis meaning fee and foedum meaning fief. The fee was the land given (fief) as payment for regular military service. This was an advancement in administration. By having both a system in place for decentralisation of power with vassals (you manage this land and keep some profit but give me troops when i ask) and having a system in place for determining an inheritance to the throne through bloodlines and having the throne as an entity itself (I guess in a weird way it’s kind of the first corporation) it lead to multi generational stability. No one party of power wanted to tear it all down just reorganize the pyramid of power as they all had VESTED INTERESTS AS STAKEHOLDERS (i will circle back to this) Although not perfect (we had the occasional disagreement in Europe of the correct assessment of the bloodline, fuck you Lancashire! White rose of Yorkshire for life!) it did offer far more economic stability. As a result a more complex global economy. However this is an evolution of administration and establishment of institutions more than one of accountancy and currency so I don’t want to spend too long here.

Double entry bookkeeping and mercantilism 1300ish:

In 1495 in Italy Leonardo da Vinci noted in one of his books a to do list on it was “ learn multiplication from the root from Maestro Luca.” Luca Pacioli was a Renaissance man educated in commerce, conjuring, a chess master, a franciscan friar and a professor of mathematics. He is also known as the father of double entry book-keeping, however he was not its creator.

Double entry book keeping known in the day as “bookkeeping alla Veneziana” or “ in the venetian style” was being used around 2 centuries earlier around 1300. The venetians had abandoned Roman numerals in favour of Arabic ones. There is a possibility it came from Arabic nations or Indian but there is no solid evidence of this at this time that I am aware of.

Prior to this merchants were no more than travelling salesmen they had no way to keep accounts and simply checked if their purse was empty or full. Up to this point accounting was done only by the very wealthy or elite. Accounting was done annually with the Exchequer (so called because of the chequer table cloth that would be used in combination with counters for accounting) formed in England around 1179 and simply provided a snapshot of what they had in that moment. The abacus, accounting rolls and Justices in Eyre were developed however it was not a running balance of account it was still snapshots. This meant value at this time was measured in how much land you had, how many bushels of wheat you could grow, heads of cattle, men at arms, horses etc you had. And economic growth was entirely reliant on seasonal weather and obtaining more land.

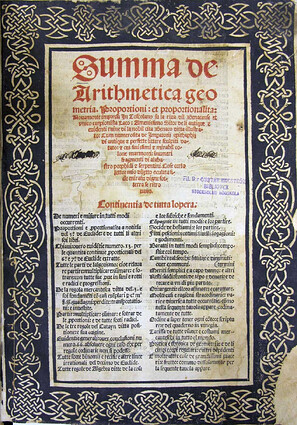

Back to our Renaissance man Luca Pacioli. In 1494 he wrote a book called “Summa de Arithmetica, Geometria, Proportioni et Proportionalita.” which was a compendium of everything that was known about mathematics in 615 pages.

Inside this master work there were 27 pages that are widely regarded to this day as the most influential work in capitalism. It was the first detailed description of double-entry bookkeeping to be set out clearly and in detail with examples. This knowledge was expedited throughout the world through the movable type printing press which Venice at the time was the centre of. It was not adopted by all common businesses at this stage but the newly emerging rich merchant class was using it widely as well as the aristocracy and noble elite. However in light of the industrial revolution this would be THE STANDARD and essential to any business first used by Josiah Wedgewood a pottery entrepreneur who first was making fat gainz when a recession dropped demand for his ornate wears turned to the method to identify where his profits and costs were and saved his fortunes.

You need to understand prior to this all power and wealth was derived from family names, bloodlines, fiefdoms, agricultural yields and the size of the army you could muster. Average joe did not own land and simply farmed it on behalf of his liege lord. His liege lord got his power granted by the king or queen etc. the idea of a wealthy trader with power simply did not exist. Economic growth did not happen other than taking more land and robbing your neighbour (like when we English used to give the French a good old fashioned beating). Value extraction was already maximized so you had to just take more. Mercantilism powered by double entry book keeping changed the world in so many ways. Merchants became able to influence Kings, Merchants states also known as maritime republics like Venice, Genoa, pisa and Amalifi were run by the textile, shipping or whatever barrons and not Kings or Queens. They could literally buy armies of mercenaries at the drop of a hat to win wars with professional well armed soldiers vs feudal states mostly temporarily mustered troops which would be farmers and potters. Double entry bookkeeping flipped what power meant on its head and birth capitalism.

So to recap:

- The ability to trade in nomadic society lead to humans being the Apex predator

- The ability to utilise agriculture, alter their local landscape and form sedentary higher density populations enabling an endemic social credit economy and the creation of royal mints and coinage and the formation of the first civilisations and empires.

- The medieval ages new form of stakeholder economics where power was divested form the central authority of the monarch to vassals in the form of feudalism and with institutions which outlived their occupants lead to a more stable economic environment.

- An innovation in accountancy changed the entire power structure and economic landscape of the globe and gave place to modern capitalism giving all incumbents right down to the individual worker a stake with time birthing huge economic growth beyond land grabbing.

The Industrial revolutions:

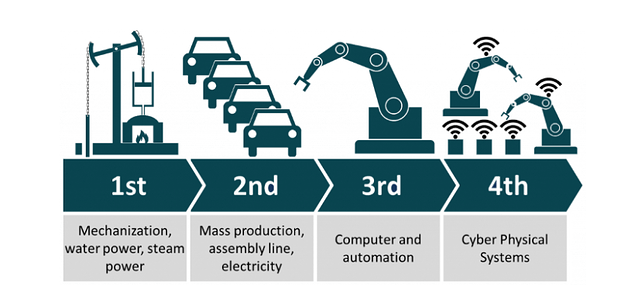

There is much debate on how many industrial revolutions there have been however I will be sticking to the theory that there have been 3 and we are living in the 4th one. This is simply a debate of categorization which is essentially a meaningless human concept to enable us to grasp the world around us so let’s not split hairs over this.

The first industrial revolution, Steam power and non standardised mechanical automation 1760-1840:

This was the process of transition from agrarian and handicraft economies to one dominated by industry and machine manufacturing. This process began in Britain in the 18th century from 1760 to 1840. So something to draw attention to is this is a technological driver of change, We have also explored other drivers such as administrative, accountancy and social (we will circle back to this later). The main components which enabled this transformation are new basic materials such as high strength iron and steel, new energy sources for fuel and motive power such as coal and the steam engine. New machines including the spinning Jenny and the power loom for mass production of textiles reducing the requirement of human labor. New organisation of work in factories. This caused huge displacement in work and many people found themselves out of work as they were replaced by machines. The luddites was a rebellion of such workers who smashed apart textile mill machines who felt their long established trade was being deceitfully destroyed by the new capitalist class.

These new machines were all custom made of non standardised components so took the original builders of them to enable them to be repaired and maintained and no part that would work one factories machine would work on another. This significantly limited growth and progress. Britain also forbid the exporting of the machines and one of the first instances was William and John Cockerill who brought the industrial revolution to Belgium with machine shops in Leige. The Russian Bourgeoisie lacked the resources and wealth to develop this however under the Soviet union they achieved what took Britain a century and a half in 5 years, France was in revolution (there’s a shocker) and Germany in spite of having massive reserves of Iron and coal lagged behind but once they got going they out paced and overtook even Britain (and caused some bother later on).

This is the FIRST TIME IN HISTORY that the standard of living of the average person was going up from one generation to the next driven by GDP per capita growing which . Throughout most of history this has been largely stagnant and entirely dependent on the agricultural yield. This changed people’s expectations, how people lived (more urbanisation and density), increased power in the merchant now capitalist class, a shift from land value in terms of agricultural value to that of industrial development and resource richness. However this began to stall out before the second revolution in 1870.

All the economic growth from this stemmed from the ability of one man today to make what 100 would have yesterday thanks to technology the heart of what drove value growth in that era.

The Second Industrial revolution standardisation 1870-1914:

This was the technological revolution which was the rapid phase of standardisation and industrialization from the 19th to the 20th century. The interchangeable parts and the Bessemer process (the first inexpensive mass steel production) allowed for a much larger scale of adoption for industrial innovations. This included the telegraph, railroad networks, gas, water supply, sewerage systems which had been for select cities. This is the first glimpse into globalisation that would be visible to more average members of the population rather than isolated pockets on industrial activity in the age prior. Obviously the onerous task of maintaining the non standard machines of old with limited steel capacity and differing areas having different non standard tech severely stifled growth and put a cap on how far it could be pushed until this second age.

All the growth from this area is part technological (telegraph, bessemer steel etc) and part administrative (the standardisation of parts).

The third industrial revolution computers, the internet and big data 1943-1989?:

This is a bit harder to define and the waters get muddy here but here’s my take on humanity’s next major economic leap forward. In 1943-1945 in Bletchley park a British intelligence task force developed a Colossus computer in order to break the enigma code of the Germans which required the day’s code from the enigma machine (captured by the Polish) and a huge number of computations (Spoilers it worked). This kick started the computer industry which eventually found its way into modern life and we all know about the impacts it has had in administrative, data processing, communications, sales, marketing as its part of our daily lives so I won’t go into much detail here but it has opened up new levels of human labor efficiency. What the factory did to the textile worker in 1760 the computer did to the office worker. More GDP per capita growth and a whole new market and environments with big data, the internet and gaming.

Recap:

- Industrialisation enabled higher density living and an increased output on a person by person basis enabling growth in standard of living that existed outside the mercies of agricultural yields for the first time in history.

- Standardisation of parts enabled more parts of the globe to benefit from this.

- Computers are good at stuff.

- Social media and online sales took off in the early 2000s i guess but its not the face melting holy shit this is changing the very structures of power and how we evaluate the value level of change that I think this is.

[center]The fourth industrial revolution, Blockchain, immutable ledgers, cryptographic truth and stakeholder capitalism:[/center]

Well done to those who have made it this far. I sound like a lunatic historian who doesn’t belong in an investing community but I’m about to get to the promised land of the value proposition and how we monetise this.

So for a start we haven’t seen an innovation in accountancy since 1300 that’s 721 years ago. We also haven’t had a proper game changer when it comes to economics since 1989 (computers and tech have advanced but it’s more tweaks and optimisation than a new paradigm that can change the way we live) so that’s 30 years. We haven’t had a shake up of the structure of how economic value is assigned really since mercantilism aka 721 years.

So now hopefully we’ve established a scene of how something can dramatically change the way we live, price things, distribute power and wealth and what can help boost per capita growth and why we have in recent years seen that slow down substantially when taking into account inflation.

So blockchain at its core is an automated double entry ledger of account that is immutable (cannot be changed), Cryptographically secure (safety maths) and often but not always Decentralised (no single actor of authority but multiple).

Bitcoin is our prime example of this, some of my other DD’s including the one on ESG and CBDC’s (this covers some current implications of how power structures are being changed today) , chainlink and Dose does a good one too links below.

Dose’s Trading intro Crypto Currency 101 - The Beginners Guide to Crypto Principles and Trading

The point is Accountancy is about to be made a ton more reliable and efficient and it’s going to enable some incredible innovations that cut out large requirements of human labor and time in a manner our generation has not yet seen.

The base problem and the base solution:

What is truth and trust and how do we use it in modern society?

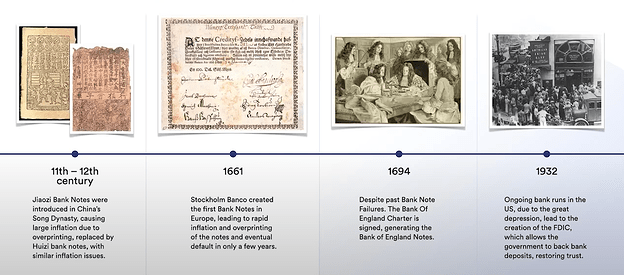

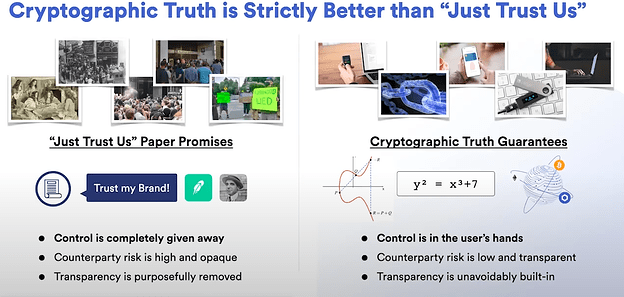

Blockchain is attempting to solve the problem of what is truth and how society functions on a basis of trust. So at the moment we have just trust us with paper promises. Banks, insurance companies and other entities all promise to fulfill various commitments with no real solid unbreakable commitment to fulfill.This is normal and up until now we did not have a choice.

The world currently operates on institutions and brands. This really is quite an old way of operating and somewhat medieval (institutions which still exist to this day were established back then and brands were family names they even had logos aka crests). It essentially rests on the concept that the institution will act on a set of principles laid out in law or policies. However there are times where short term economic incentives can outweigh long term moral, legal and financial ones.

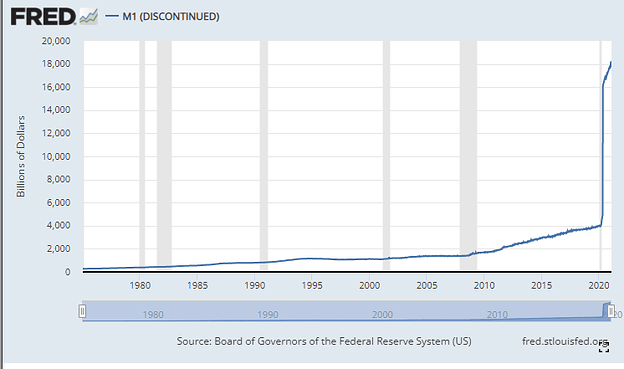

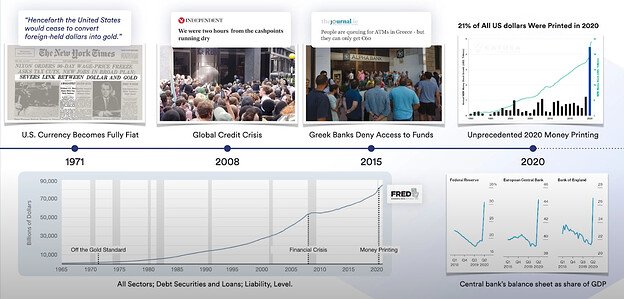

Examples of this include government scandals List of political scandals in the United Kingdom - Wikipedia , Ponzi schemes like Bernie Madoff, Corporate fraud like Enron, commercial banking fraud, removing the dollar from the Gold standard after the dollars issued exceeded the gold backing it, central governments generally in impoverished countries succumbing to corruption and money printing often having to issue new currencies after hyperinflation like Argentina, Hungary, Zimbabwe and Yugoslavia as some examples where governments and central banks abuse their ability to print their way out of a crisis (don’t look at modern fiat it’s fine honest).

On the subject of fiat its a storey told dozens of times in history before Fiat always goes to hyperinflation and blows up its the dollar doesn’t it will be the first ever, and what are the chances of that. History doesn’t repeat but it often rhymes.

https://i.redd.it/jtp4xgayah111.png this is a link to an infographic of 152 failed fiat currencies and their lifespan. And it doesn’t even go back that far relative to the earliest known inception of fiat in China.

The dollar has been fully decoupled from gold since 1953 so that’s 68 years. 68 year old fiat, Not long in the scheme of things.

This underpins solvency, credit, insurance everything and it doesn’t exactly look like a stable or reliable system. But it’s the best option we’ve had so far.

The issue is there are often opportunities for individuals or groups within centralised organisations to exploit their power for short term economic gain at the expense of the larger economy or group. And there is no truly reliable systemic way to bring about swift economic consequences to such actions until now.

This changed in 2009 with bitcoin. This enabled the guarantee of outcomes with mathematics, physics and cryptographic security. More and more advanced versions of this have developed with smart contract platforms like ethereum and oracles like chainlink. The nature of blockchain technology will enable up to date open and accessible fully audited cryptographically secure accounting of data, collateral and documentation at all times.

Bitcoin is so different and unique as for the first time you had a private key and you had something you could control with no one stopping you that you could send a transaction that was guaranteed not to be stopped or interfered with and you could prove forever took place. That’s not something that could be guaranteed before without a middleman for the transaction. Even physical cash can be devalued from the entity that issues it which could invalidate a transaction.

Lets look at the legacy financial system vs Defi on a software level. Well when we order or buy a stock it takes days to settle and goes through a whole mess of different systems before being actually attributed to you as an investor. So you buy from Fidelity, they send it to citadel who then sends it to the DTCC for final clearing. I may have missed some steps but it doesn’t really matter there are different brokers, street level brokers all on different systems sending orders of different exchanges and servers all that have to be totted up by a central agency. That’s lots of steps which are open to error before final settlement is reached. Now the DTCC and Citadel and other such organisations I’m sure do an impressive job and I’m not here to dispute that or make out they are inherently dishonest as it’s not in their interest to act in such a way. I’m more highlighting all the various stages a simple buy or sell has to go through before it’s finally accounted for on the base system the master ledger as it were at the DTCC.

Compared to DeFi which you trade and in seconds it’s settled you can see it done. All that administrative checking and balancing is gone. It simply is a far more efficient operating layer. It also has no central authority (in Ethereum) so no one individual weak point can be compromised as it is done through automated processes. It is by no means ready to handle such volume however developments in blockchain are coming thick and fast to facilitate higher throughput at lower transactional cost.

This guarantee at the base layer that blockchain can provide is truth whereas in legacy financial systems where intermediary 3rd parties (banks etc) operate on trust which is an inferior basis to transact on. Truth > Trust.

How will the existing infrastructure be displaced and why would they choose to use it?

Quite simply the complexity and breadth of capability of smart contacts, blockchain and oracle systems the more services can be incentivised to use them. And looking at the current development path of the cryptocurrency space this is happening at an accelerated pace. That’s the how. The why is simple. It will remove counter party risk and running costs. So looking at banking and transaction and settlement of stocks etc as we have before if we remove the requirement for a trust based institution with a truth based cryptographic software we have removed the need for staff, offices, company cars, ATM machines, buildings, power and heating for the staffed building maintenance and cleaning costs. I could go on but you get the picture. Much like the spinning Jennys of the first industrial revolution displacing the needs for huge numbers of textile weavers, the blockchain will do away with a large variety of roles in the financial sector as it is gradually automated into smart contracts. Also counter party risk. As everything on chain can be verified including things such as proof of collateral and block times are generally less than 10 seconds you are going from a world of annually audited accounts by centralised companies like KPMG to 10 second audits conducted by immutable programs. It simply presents a lower counter party risk to people to deal with transactions on chain.

A very simple example would be weather insurance. If a farm requires insurance against extreme weather events or lower rainfall etc. Once they have engaged with an on chain insurance smart contract they can 1 check at any time that the appropriate collateral is in place, 2 guarantee that once the parameters are triggered to execute the insurance (an oracle reports substantially lower rainfall the smart contract is programmed to trigger below a certain threshold to insure against drought) will pay out straight away without a centralised authority like an insurance company sending out someone to assess if a payout is due which could in the case of a bad actor intentionally be misreported on.

But what if a smart contract is intentionally misprogrammed or an oracle intentionally mis reports data. Well in Proof of stake systems in blockchain in order to economically as well as cryptographically secure smart contracts nodes and oracles processing data need to stake a higher level of economic value on the node through the token than they are securing on chain. So if I lie about a transaction worth $5million I will have my economic stake slashed to a greater degree than I can physically profit from. There are systems in place and in development where other nodes in the network, if they correctly identify the bad actors, will receive a bounty from that slashing. And because it is one interconnected network you would require a consensus of the full network in order to successfully misreport which means controlling 51% of the entire network. There are even cryptographic developments which raise this threshold for control even higher. If this is the global settlement layer for global transactions I can’t imagine that would be viable.