Awesome to get confirmation from someone in the know - thanks @hansolo!

Just got 1 79p april 29 filled when it touched 82. Actually forgot I had it set.

This is great confirmation on what we had suspected. Great info @hansolo

Just had a chance to read through some of this. The most interesting part to me is “ ADESA, Inc. from KAR Auction Services, Inc. for approximately $2.2 billion (the “ADESA U.S. Auction Acquisition”), to pay related fees and expenses, and they will also be used for working capital, capital expenditures and other general ” this portion screams to me the need for working capital and expenditures that they are quickly running out of cash. I also had found some info that they were buying some of their inventory from drivetime which is the company that Garcia II runs. Personally I think these guys are just padding their wallets and using CVNA to do so.

I did find this as well and thought it was interesting.

https://www.marketwatch.com/investing/stock/cvna/financials/secfilings?docid=15678819

Seems they are having their annual shareholder meeting on May 2nd according to how I am reading it. I would think that could potentially lead to sell off if the books are essential unveiled fully to current shareholders and the distress of the business comes to light. Maybe something to watch the AH moves on Monday. If this is the actual date of the meeting. I can’t find anything else on it anywhere.

That would seem like last resort if this fails the Adesa deal falls through and they blow through whatever cash they have left. Good info as always

Going to more than likely unload my one remaining put that I didn’t take profit on today had a good gap down at open like the rest of the free world so cut my others then added a few on the bounce. CVNA tends to trend some with rest of the market and I feel like there “ may be “ a rebound. Going to flip my strategy here from selling weekly’s almost daily to if it does run up some tomorrow trying to get good fill at 50p for after close date on the acquisition and let them ride to see what happens… I think if the fundraising fails and the Adesa deal falls through it could be nail in coffin to their financial situation unwillingly coming to light. Hope this plays out like it sure seems to be headed.

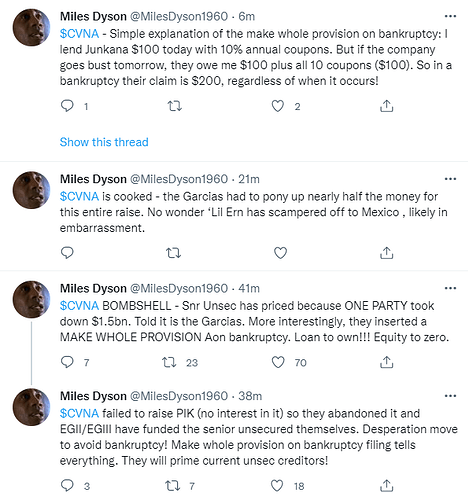

This dude posting lots of saucy stuff on how the raise is going. Not sure how true though…

Could be truth to about half of it. I wasn’t able to get my 71p may 9th sold today because of massive run up but was able to grab another at around 74 range to average down a bit. That not how it works usually for me. Genuinely wanted it to be green market day. But seems CVNA has broke off on its own a little.

Wow just looked at this Twitter thread this guy has Garcia private jet tracked and everything.

If they have raised the 4B, even if half of it is from the Garcias, this gives them enough funds to close the Adesa deal and provides them working capital for at least a few months. Hard to see how CVNA goes bankrupt now.

If anything, I’d expect them to use the close and additional PR to get prices as high as they can again, and then sell their shares, like Q4 2021. And then… sometime in H2, file for Ch11 if the market keeps going south on them.

Have sold the 60P for a tidy margin, have no more exposure to CVNA for now.

So assuming the tweet is true, it sounds like they managed to raise the $2.275bn senior unsecured notes (1.4bn self funded) in addition to the upsized $1.25bn in common equity but no takers for the PIK Preferred Equity.

So just over $3.5bn of which $2.34bn will cover the ADSEA purchase + txn fees with the balance of $1.1bn for ongoing cash burn (assuming they put off the ADSEA real estate improvements)

I am not feeling the acquisition finalizing. For a multitude of reasons. First and foremost I can’t imagine them being able to attract enough investors to raise that part of the funds. We are talking about a company that posts loss after loss. Secondly I’m starting to think Garcias don’t wholly give a shit if they acquire Adesa. Starting to seem like that was to prop the price up at their first earnings.

However it could happen. But I don’t see any ramp up in their ticker pricing anytime prior to the closing.

@The_Ni and @hansolo thanks for all your efforts on this thread. Has been a good one for us all I hope. I am still holding 1 40p for may 20th and 3 50p for same expire. Feel like worst case scenario I can exit these and still be largely in positive overall if things go backwards after exiting my 71s today

So it appears they dropped the prefs and upsized the unsecured notes

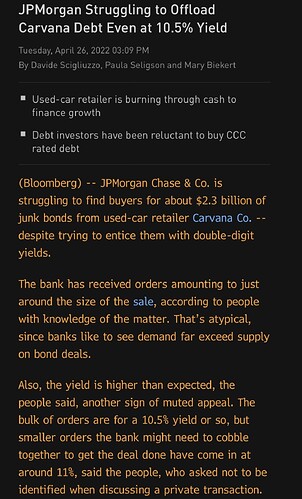

Here is the full article. None of which sounds promising. Lowered the yield as well. One fail after the next it seems.

Apollo to Purchase $1.6 Billion of Carvana Bonds – WSJ

https://www.wsj.com/articles/apollo-to-purchase-1-6-billion-of-carvana-bonds-11651084271?mod=Searchresults_pos1&page=1

Welp was mowing the grass and got price alert ![]() . Craziness. Halted now it looks like

. Craziness. Halted now it looks like

Picked up some 5/20 50P for CVNA. The downward step thing has been happening pretty reliably over the last month and five days, so this may end up being an overnight scalp.

The spike yesterday on Apollo’s 1.5B debt buy getting immediately clubbed down makes it seem like this thing will just keep going down until it flattens out, but almost impossible to think of something that will make it go up. So will try to scalp this often.

Closed out my commons short today as I was worried the market might bounce tomorrow on the back of APPL and AMZN earnings which turned out to be somewhat unfounded.

May look to enter some puts tomorrow depending on how we open. I think if the broader market weakness persists this has a chance of retesting today’s low of day and potentially broach 55 or 50 levels

Closed my may 20th 50p today at major drop this morning. They were way too green not to. Also sold the 40p that was up nearly 60 percent. I did get a may 6th 60p once it bounced back over 60 but then kept running up so I grabbed another to average down a bit. And as you said it almost inevitable tumbles every morning. I agree don’t foresee anything changing it’s direction anytime soon. So will keep trying to sell the puts on morning drops.