DCRC is a SPAC for Solid Power, a company working on solid state battery technology. If you don’t know why solid state batteries are a big deal Google it. Higher power density, safety, and fast charging are key factors. After listing in the summer, they had a nice run up to $13/share. Since that time the chart flattened around $9.8-$10 with a recent spike to $10.7. With TSLA news generating a lot of EV buzz I think this stock could be primed for a move up.

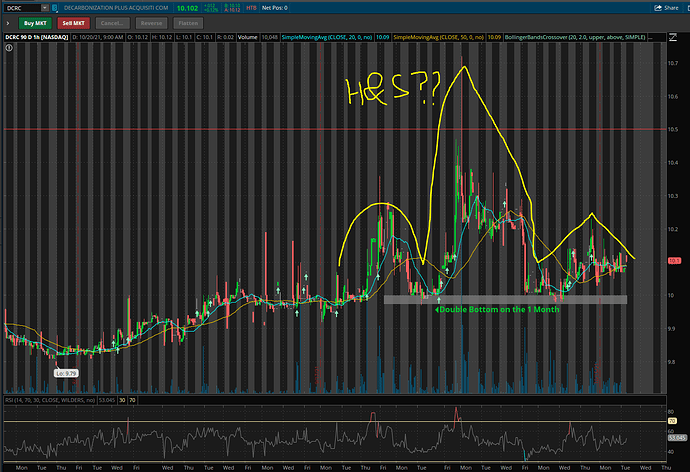

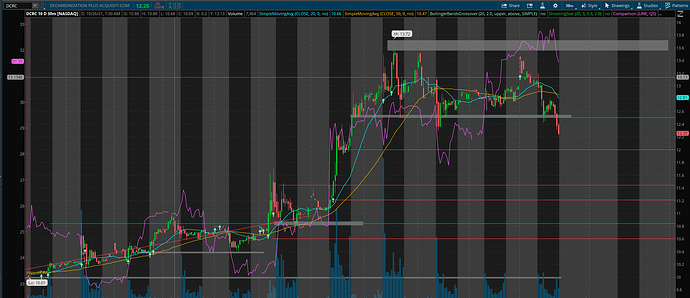

The 1 Month chart shows resistance at $10. However, there could be a head and shoulders forming.

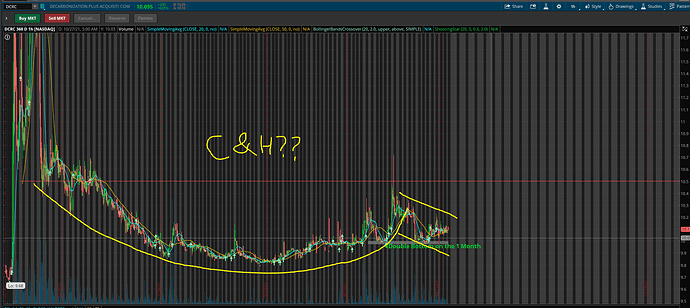

The 4 Month chart seems to show a cup and handle forming.

If we consider the top of the recent peak around 10.7 the edge of the cup, we should expect a handle retracement of 50% to hit in the $10.13-$10.20 area, which is where it currently sits.

I’m going to keep watching this one. I think with Tesla generating a lot of buzz this stock may also get some attention. They posted some test results a week ago (followed by a sharp drop on the chart) showing effective safety features of their technology. However, the fact that they use sulfides is a concern. You can read more about that here.

1st of this month (oct) they announced $12.5M in funding from the government.

70% of float is held by institutions. $441.438M. That means $132.4M is open for trading. About 13M shares.

Edit: This sentence is incorrect. See below Oct 24 update.

They plan on converting sometime Q4 2021 being listed as SLDP. When they do, I expect the price to go up based on their potential.

Solid Power is backed by Ford and BMW. They probably won’t be profitable for a long time, but they have solid funding and if they’re able to develop reliable production batteries Ford will buy a ton.

I’ll be keeping an eye on this one.

[size=4]Update Oct 21 AH[/size]

There’s been a rejection of the head and shoulders pattern. I entered yesterday with the 11/19 $10C option. I suppose it bounced off the resistance at $10 yet again. That $10 price seems rock solid as support.

[size=4]Update Oct 24[/size]

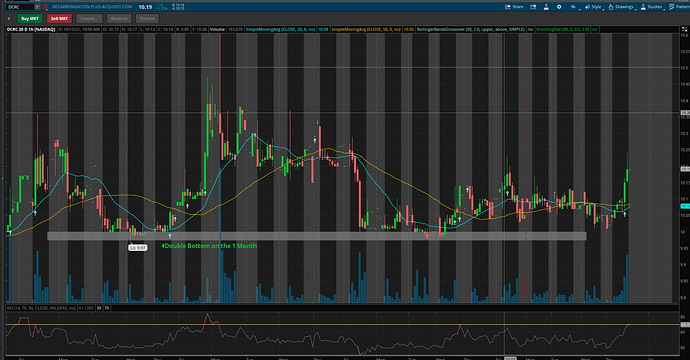

The stock fell back down to about 10.22 from the 10.85 peak. I plan on acquiring some more options or potentially shares this week.

After reading financials and tech info I’ll share some highlights.

Business Model

The strength of Solid Power’s technology is that they are not trying to spin up huge cell manufacturing lines, but rather to integrate their technology into existing lithium production lines. Don’t get me wrong. They want to spin up their own manufacturing, but they intend on licensing their tech to the automakers. This focus is a big deal because manufacturing is a huge money suck. It’s painful. It’s difficult. They’re smart to focus on R&D and licensing.

Financials

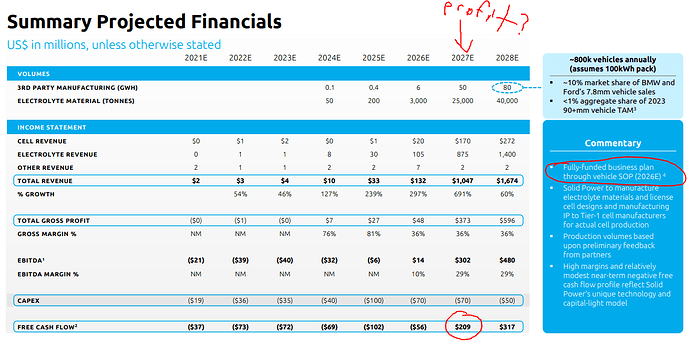

After closing the most recent round of funding, they claim to have enough money to last them until 2026, which is when they predict full-scale production manufacturing. Here’s a slide from their investor presentation where they claim to be set on cash:

Investor Commitment

Ford and BMW aren’t just throwing money. They intend to use this technology. SP’s IP was developed in partnership with these companies. If SP were to fail, one of these companies or a competitor would likely snap up all the infrastructure and IP at a premium.

Differentiation

Solid Power’s biggest competitors are either not fully stolid-state, use a different technology, or don’t have the full portfolio of solutions. They’re also manufacturing plays. This gives SP a big advantage imo. SP also has produced working prototypes with demonstrated superior performance. Much further along than most of their competitors.

Risk

The largest risks to the business, imo, are the following:

- A technology superior to solid sulfide electrolytes will emerge before 2026+ profitability, rendering the technology obsolete. The solid state battery technology landscape is bursting with possibility, startups, etc. It’s the step-change level of performance that ensures the future is electric. If something comes out between now and 2028ish their stuff will be obsolete. the way their stuff will make Li-ion obsolete.

- EV adoption globally may experience friction due to factors such as supply chain constraints, lithium under-production, manufacturer scalability, unfavorable public policy, or other factors. This reduces the total market available for SP’s products. Much of their estimations are based on an assumption that the EV market will reach a certain size globally by 2028.

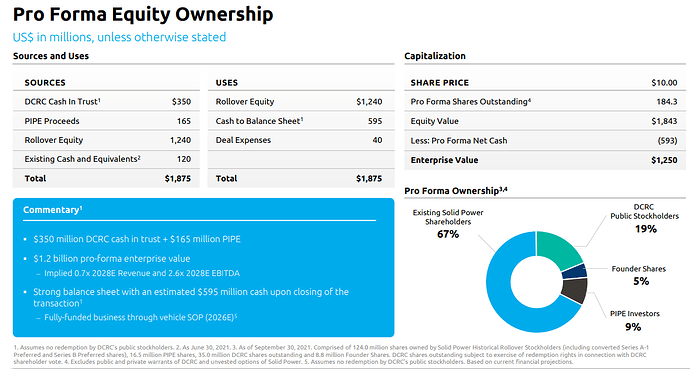

Another update on financials. I seem to have misrepresented the value earlier. Here’s a slide from a recent investor analyst presentation:

I’m still learning financials, but it appears that DCRC’s valuation is only a portion of their 1.2B self-valuation, assuming $10/share of DCRC. This is likely why DCRC is continually pumped up above $10/share. So when I said the float was $132M above, I was incorrect. The entire value of DCRC is considered the float.

Having said all that, I’m sure you’re wondering, why should I be interested in this company? I want to make money now, not in 2028!

Great point. SLDP will list this fall/winter at whatever DCRC is. What will happen to existing share ownership? I predict that a lot of high tech etfs, especially the overpriced EV tech etfs, will snap these up like hotcakes. This will rocket the share price, at least initially. With 70% held by the likes of Ford, BMW, Volta, and others who have a long term vested interest in the project’s success, that float will remain locked away in their vaults.

I’m buying a few shares and playing 12.5-15 calls through december 2021. I don’t think DCRC is going to fall below 10/share throughout, so I plan on buying calls when/if it drops to 10 and selling when it has little runups.

[size=4]Oct 28 PM:[/size]

Last night Solid Power announced a partnership with SK Innovation along with a $30M investment from SK. SK, who already makes lithium ion cells, will work on manufacturing using Solid Power’s technology. SP will focus on their tech and licensing. A great move for SP. Stock is up from 10.61 close to a high of 11.63 in PM.

[size=4]Oct 29 AH:[/size]

It’s been a good day. A consistent run up to 12.4 from an $11.08 open was phenomenal. My 11/19 12.5C were up well over 100%. There is a big buyer at the $12 mark that kept it up the rest of the day, finishing at 12.2. Huge volume at that price point. I’m hoping for a pullback so I can buy some more, but if not, I’ll ride these bad boys into next week and roll into decembers.

Nov 1 AH update

Another green day. The price action showed a crack today for the first time since the SK partnership announcement. I think the momentum from that news may run out of gas this week, leading to consolidation and then some selling. I would like to see a move back below 12 for a good entry. But they may announce the reverse merge any day now. That is the catalyst I expect will lead to a run. I’m buying Dec calls this week because I don’t like the theta on the Nov 19s anymore.

Nov 4 late hours:

I’ve decided to put DCRC up against QS stock performance. You can see that they sort of match a little. To me, this indicates that there’s some hype around this technology and people are diversifying. I was looking at QS earlier today and thought that it looked pretty overvalued. I was super close to buying puts on QS. Too bad I didn’t. I’m going to keep an eye on this correlation to see if they stay somewhat in sync.

Having said that, DCRC is headed down today and I am hoping for that $12 pullback I’ve been talking about for a really nice entry.