Starting this thread as a starting conversation for playing disney. After the initial airline earnings and easing gas travel and hospitality has been up ( cruises , hotel , airline , entertainment stocks ). CPI report has shown travel inmflation is up over 10 percent which shows it still is in demand. Airlines have stated that demand has offset costs of increased energy. Yet DIS has been underperforming the entire sector. It is currently at 130 area and its lowest during war worries was 127. Earnings based on google is May 11 and is after the FOMC fiasco. Im thinking agreeing with the sentiment that consumers are shifting from goods to services and DIS will benefit from this. Also will look torwards Netflix earnings since DIS is this hybrid hospitality sector / growth and tech. Normally i would wait until right before FOMC for peak fear but i may start a position since i missed TGT before and there is sympathy play from NFLX. Im looking at this play more from it having more room to run if its earnings negates any of the negative sentiment about this stock.

I’m strongly considering to start a small position tomorrow after this dip due to NFLX earnings dragging DIS down. I do agree that Disney has been underperforming and think that we will get a run up leading to earnings.

Jesus Isaiah what did you do to scare Mickey Mouse! Looks like Netflix earnings took DIS with it. Glad I sold my DIS calls this morning!

But I smell an opportunity here and it isn’t Mickeys shit filled trousers!

I have a feeling disney+ subscriber base has grown significantly. Those NFLX users must have gone somewhere. Also a lot of families I know are going to the theme park this year regardless of cost because of pandemic keeping them away for 2 years.

Is this anecdotal, yes. But the same thing happened to SNAP when we found out all FB users migrated to SNAP before last earnings season. I see DIS offering very good guidance this earnings. I will pull some charts later.

yep I bought stock and just sold it when it bounced back. I will be buying tomorrow as well.

haha Ya I sold my Disney profits as well. Specifically because of Netflix catalyst. The next fear catalyst is JPOW , earnings and FOMC before DIS earnings.

Watching! I agree with the sentiment @Jekyll_and_Hyde and @Isaiah . I’ll be looking at calls that expire after ER, but not sure about which strikes yet.

Just to add to the convo, while it might be purely political DIS does have some legal problems / tax implications in the near future. Did my best to cite a few different news sources but you get the idea.

I am not interested in the political debate side of it - but it is one thing to keep in mind as for the earnings.

Snippet -" Unique in Florida, the Reedy Creek Improvement District in the Orlando area shields Disney from local government regulations and from local property taxes, which could be worth as much as $200 million per year, by one lawmaker’s estimate.

Legislators in both chambers predicted the legislation — which could end the 55-year-old taxing district next summer — would pass by Friday. And they acknowledged it was an effort to exact revenge on Disney for its opposition to the law DeSantis signed last month that prohibits classroom instruction around LGBTQ issues."

snippet " Things had been different between Disney and DeSantis. Politico reported that the company donated $50,000 directly to Desantis during the 2020 election cycle. Last year, the governor’s staff worked with Disney to give it an exemption from a law designed to crack down on big tech companies. DeSantis now says that was a mistake. And Disney says it has halted all political contributions in Florida."

This is a much more complicated issue than it seems. Disney does pay property tax; they pay a ton actually. They also provide their own governmental services within their boundaries. Those costs would now get pushed to Orange County.

A big part of the law originally being created was so that Disney could exist and others couldn’t come in and take advantage of their visitors. Orlando wasn’t well populated then, like it is now, so it will be curious to see how this plays out.

Wait so they trying to dissolve an improvement district? That the people that handle storm water and sewage and common access maintenance. Does the FL governor want the local taxpayers to absorb the burden of maintaining the roads and shit in Disneyland? What am I missing here?

Yes. And apparently yes.

In my line of work we see a lot of industrial parks or business parks that have their own improvement district, esp if it is on the border or outside incorporated area. I think even big (BIG) multifamilys do it.

This smells like some performative bs to me

Sorry I think I’m derailing this thread a bit. ![]()

DeSantis is taking this out of the Trump playbook, fighting with Disney for godfuckingwhateverreason. Orlando isn’t as reliant on Disney as it was for many years, but pissing Disney off doesn’t seem like a terribly great idea either. Central Florida would likely still be a shitty swampland if Disney hadn’t come there in the 60s.

Regardless, I don’t think taking away their district will even end up being legal and it’ll probably just flounder around in courts and the real winners will be the attorneys.

There are almost 1900 in Florida, this bill targets six.

The county in which Disney mainly resides is shitting a brick. Unfortunately the legislators DGAF and will make the locals figure it out, I guess.

This is a pretty interesting read, not too dated Feb 2022

Snippet “ Disney broke down the streaming service’s global subscriber count by domestic and international categories. Disney+ has 42.9 million subscribers in the U.S. and Canada and has 41.1 million internationally. It also has 45.9 million Disney+ Hotstar subscribers, which is a collaborative service offering between Disney and Star India’s existing streaming service.

The streaming service’s growth topped Wall Street’s expecations of around 7 million new subscribers. It may have also eased investor concerns about the state of the streaming industry after Netflix’s bad quarter, which delivered its lowest subscriber growth since 2015, with just 8.3 million new additions compared with the expected 8.5 million.”

Just a hunch, nothing backed by data, ignore if I sound crazy but – huge moat I suspect Disney has is that the target audience is children. And there will always be children, and parents who need to keep them entertained at all cost. <end bias>

I wouldn’t say the target audience is just children. Disney owns Lucasfilm & Marvel, they’ve been rolling out new TV series from both those properties (and of course have the huge movie selection). Though having all the disney childrens content is likely a huge plus to maintaining annual paying subscribers.

As for the adult shows, granted a lot of these are short runs and only 6-9 in a series. I can see a lot of adults simply subscribing for a month to binge watch then cancelling when there is no new matching content.

So I didn’t know about the DeSantis drama. Would a better short term play be puts based on the upcoming news, then calls after for the ER? I’ll have to think more about my entry now.

Thanks for complicating things again, politics

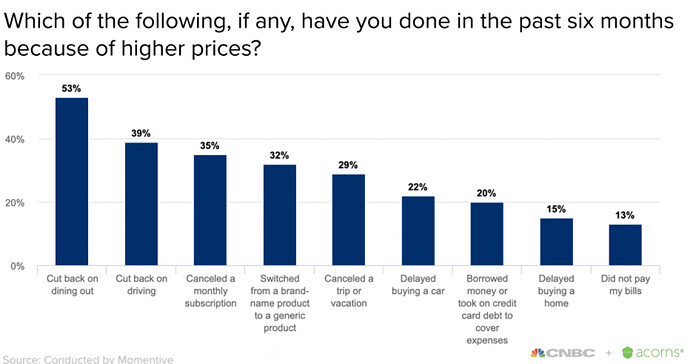

Reposting this chart in this thread as I believe it is relevant for not only streaming but theme park / cruise.

I would agree -

Over 50% of our global marketplace don’t have kids, our subscribers don’t have kids. And that is the big difference. And so now you can see that sort of, I’m sure we’ll be talking about Star, but you can see where those strategies get born, when 50% of the people in Disney Plus don’t have kids, you really have the opportunity now to think much more broadly about the nature of your content.