I’m here to work on my trading skills. I have a pension, house, and other long term 401ks so my primary goal is inflation protection (asset preservation) with my savings (approx 75k). I will be pleased with 1% over i-bonds so 8% by Dec 31st is the target.

I came out green on ESSC, but it was not easy and I had some losses. Trading is a brutal sport, kinda like picking up women, a mind game.

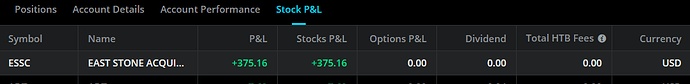

ESSC $375 gain

ESSC 2021 $974 gain

ESSC 2022 ($663) loss

2 Likes

Goals for 2022:

- Patience - I want to be more patient with my winners and let them run. I’m anxious by nature and enter ultra-short positions and close them too quickly.

- Confidence - I want to develop an improved understanding of macrotrends so I can be a better medium-term trader

- Fortitude - I want cojones to hold a stock long-term no matter what it does. Currently long MSFT and DCAing down. Looking for long-term entry points on COST, MU, NVDA, throughout the year.

- Reduce FOMOing - FOMO is the mind-killer that brings utter destruction. Remember the tooth.

I began in October 2021 and ended up green for the year, factoring in wash trades. Options are new to me. Sometimes I traded emotionally and broke my limits to have a bad red day. I need to diversify my strategy and hold different positions simultaneously.

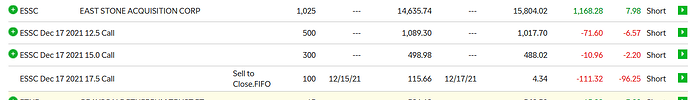

I traded TSLA options about 200x and I caught a few knives. If I trade less and control my emotions more, I’ll make more money this year.

1 Like

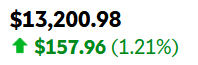

I overtraded on 1/26 and went full degen. I went red, then green, then very red (-1.1k). Reversed this through slow daily trades, patience, and discipline. I am slightly green YTD at 59.3k. Mostly trading TSLA and QQQ options with the occasional COIN put:

The most important thing is that I stop trading when I feel my ego creep in. Small daily gains are my goal over time. It means being objective, mostly spending the day watching charts and waiting. And some days barely trading at all.

I don’t perform well when the market is trading sideways. My peak effective hours are 10am - 1145am or so.

My trading technicals on TSLA did not have a long shelf life so I’ll be changing things up. Its just too volatile.

After consolidating my accounts, I’m down about 2.8% YTD, which hurts, although its certainly better than if I’d left everything in an index fund when I started in October. I’m going to work on being more patient and playing swings rather than ultra-short term bets, which are not a sustainable strategy:

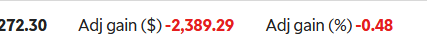

So, after a break, I ended 2022 up +0.6% overall, most of which came from I-bonds. Factoring in inflation, I’m probably -7% or so. A lot of effort for very little brogress. My 401k remains fully invested in stock and flat for the year but still can’t help but feel disappointed for my brokerage management. But hey, could’ve been worse.

Time to start trading again. I have some positions in BIL (T-bills ~3-4%) and a few bonds so far. Stocks seem more expensive than last year so I’m holding out based on the macro picture.

I’m starting to believe I’m at the turning point where I can make money consistently. I just need to keep at it. Down on the year overall (boomer challenge account is a guh but holding). I’m still down YTD about -2.3%.

This week I’m up $151.37.

I’m going to get more aggressive and turn things around. Try a mix of some 1Dtes and deep ITM puts/calls a week out.

1 Like

You all should see my Valhalla 2023 AD video if you haven’t already:

2 Likes

Well, it didn’t take long to live up to my username. I felt overconfident going into this week and quickly made one emotional trade and then another and another and lost $600. I’m nearing my ‘stop trading and fuck off for the year threshold’, which is the max tax deductible loss of 3,000.

I realize this is peanuts for some of you but overtrading makes me freak out like Doug Flutie’s kid.

So I’m going to hit the reset button. Limit myself to a $1,000 trading account. Log all trades and play very, very carefully from here until the end of year. Victory or Death!

5 Likes

Had good setups that didn’t go down and hit my stop loss twice in a row to end up -25%. Hard to believe after the first week of going 12 for 16 or so that things would nosedive so quickly. Post-FOMC volatility makes me feel like Scotty in Boogie Nights:

BACK TO PAPER TRADING. See ya’ll in a few months!

Edit: Dumped the 2023 $6,500 max into VGT in my Roth and still waiting on the next opportunity. Boomer acct: 17 VGT 156 SPYD.

2 Likes

$1,000 → $750 → $832.

Along way from becoming DonCorleone but still in the game. Had a great setup at 3:55pm yesterday but was rattled by emotion. As with any difficult endeavor, your true self becomes exposed. I was in fight/flight mode and settled early with a bad fill on what was probably the easiest money to be made the entire week.

Adjustments: (1) frustration tolerance and defining what that means to me, with daily reiteration, (2) exploring how to get better fills on my platform, and (3) avoiding things that generally fuck me: 0/1dtes and META puts.

Currently at $867. I’ve been trying different setups off VWAP and playing fewer scalps on the 3m. My scalp setup has not been conducive to present market conditions. Some days there’s only 1 play, which I might easily miss if on a break. Ideally there are 4-5 potential plays when the market has a clear direction.

I found myself gambling with small positions (never CCIV-style full port NVDA puts, mind you), which is counterproductive. Not only am I not learning anything by a gamble play, I have a harder time convincing myself it is viable, so even when it does work I bail sooner than I should. Not helpful.

Adjustments: Going to piggyback on others’ plays for a while and find a way to manage my boredom during trading hours. Hence, I am “DonPiggyback”.

2 Likes

To $1,001 on NVDA today. BACK TO ZERO BABY. This discord kicks so much fucking ass. Thank you all!

3 Likes

And…back to $979 following a gamble SPY 0dte. Adjustment for this month is not to trade SPY.

Took profit on VGT in my Roth, then re-entered a slightly smaller position (currently 16 VGT, 162 SPYD, 2 MNMD). Liquidated my I-bond. Total port is $81.1k following some swing trades this week that were not part of the challenge account. Down 2.9% YTD overall. I’m considering when to go long but am very hesitant given current conditions. Perhaps fair value is 3950 or 4050, but the speed of the rise of tech stocks has given me some hesitation that I’ve missed the boat. So, in all probability, SPY will rocket to 5,000 from here.

I am still long equities in my 457 and have a pension, so I have a good deal of redundancy which permits me the privilege of continued retardation. Follow trades with caution and skepticism, as always. - DonDegen

Looks like the VGT I bought at 369 as a hail mary in my IRA was in fact, beautifully timed. Looking at the labor market, a yield curve that seems a very long way from reaching zero, I’m starting to believe my moderate/severe recession fears were unfounded.

Tech is in a new boom and its 1996. Going long half-port into VGT, QQQ, and probably ROBO in the coming weeks. I made a mistake in listening to bear-inclined analysts (like MacroAlf), who turned out to be wrong.

Challenge account is at $1,112 today.

To $1,174. Great week overall. Adjustments: Continuing to avoid playing SPY. Playing mostly resistance breaks and MACD crossovers on the 1m/3m. Removed RSI indicator but kept VWAP.

Still down -2.6% YTD but climbing out slowly. Dividend share (SPYD) dumped this week and that has not helped. Probably going down further.

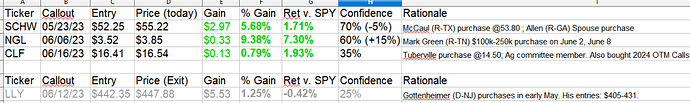

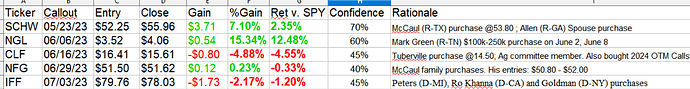

I have some ideas for corruption plays and will be putting together a DD with a test thesis. Played SCHW this week off the 52.25 break following that Michael McCaul purchase for 80%, which was nice.

1 Like

To $1,025 (from a $1,250 high). Taking a break and back to paper for a bit. Also, yoga. Adjustments: Don’t trade high profile events. Limit trades on days after big run-ups and in the first hour of the day.

I should’ve been cautious this AM. Setups were good and the probabilities favored entry but I misread the jobs report as a positive. I also removed my stop losses to be able to exit more quickly.

Anyway, its June and I’m still in the game. So I got that going for me, which is nice.

2 Likes

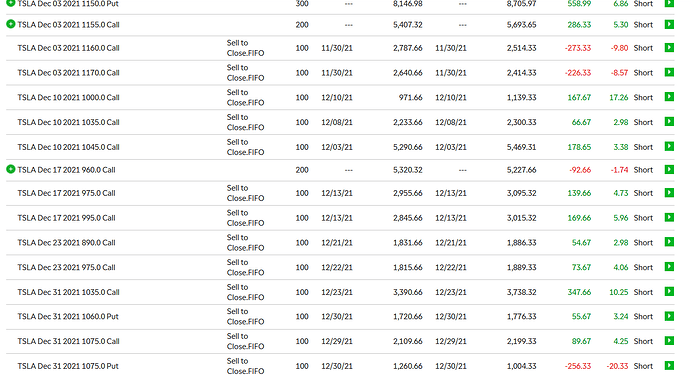

I’ve been hounding the disclosures for trades to include in the Corruption Portfolio. These are share plays. Here’s the performance at close today so far:

I’m up substantially this week but gave back some on trades I shouldn’t have made. Its time to disable options trading (for a while).

LLY was cut from the Corruption portfolio, while the NGL position was expanded. Lots of purchases in the banking sector. I suspect money managers are looking for bargains in the event a soft landing does in fact play out. The chase is on:

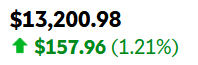

Roth not only broke even from contributions ($12,500 max for '22 and '23) but is actually looking good. No change to my positions:

1 Like

Corruption Port is up little after today’s bounce (LLY actually outperformed, but I sold as it was an untimely entry). I haven’t been trading much other than small share positions:

1 Like

Posting this on a red day, to avoid misleading y’all. Averaged down on the CLF position. Some politicians moving to cash (t-bills), but most are holding, based on the data so far.