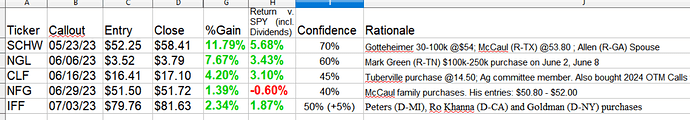

After today’s pump, I’m pleased with the portfolio’s performance. Its time to move this out of the thesis phase. Dividends were added for a total return basis comparison.

DD with methodology is forthcoming. I will be adding to all positions on dips.

Gottenheimer bought in on SCHW on June 12 and 16th @ $54.00. SCHW closed above $58 today.

1 Like

Correction: Gottenheimer (D-NJ) added in two blocks totaling between 2-30k, not 100k, as part of his very diversified (and I suspect professionally managed) portfolio.

Adjustments: only update when I’ve had >5 hours of sleep.

1 Like

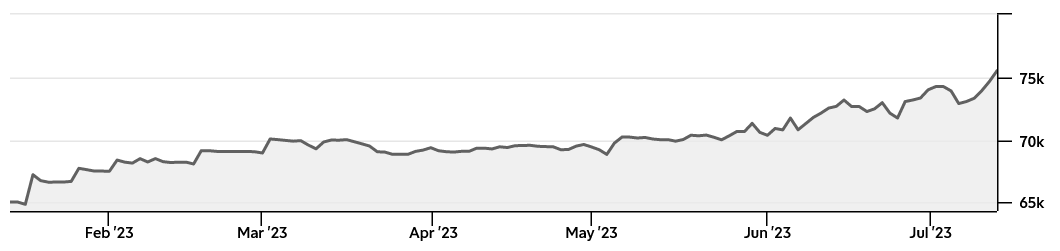

Broke green and erased all losses on the year yesterday. I took profits around the 4525 SPX level as a tactical move, we’ll see how the rest of the month plays out for a re-entry. All I had to do was stop playing stupid shit!

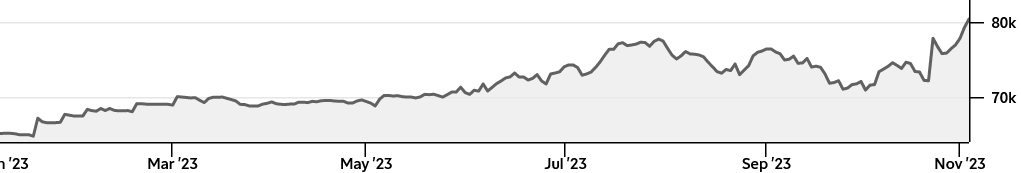

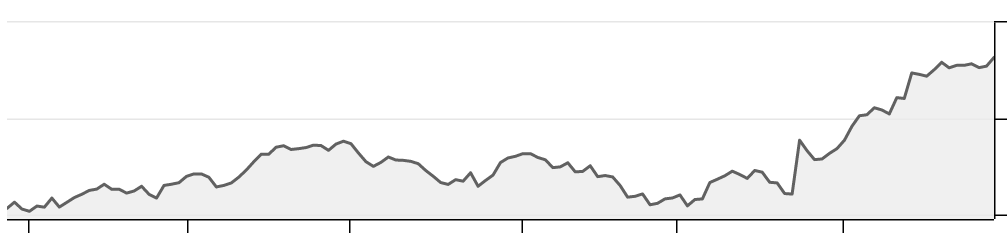

The below chart does not reflect the whole port, since I had some home upgrades in January, sold i-bonds, and have been redepositing monthly with more cash:

1 Like

Taking a break. Baby girl on the way and am distracted. Combined with seasonal weakness, I’m starting to miss the angles. My hit rate has dropped back to 50/50 this past week. Better to nip it in the bud than try to ‘win it back.’

Long 255 VTI, 64 VT, and 16 VGT. Sitting on EIS (the Jews), EWZ (the_Ni), IFF (the corrupt) and some biopharma stuff.

I’ll continue to monitor for Corruption Port plays and let you all know if anything really stands out. See you Monday!

3 Likes

Gotta hand it to McCaul and his multimillion dollar VTI dump on July 27 (in his child’s account). Brilliant tactical top at SPX 4600. I’ve been surprised by the severity of this correction but my guess is

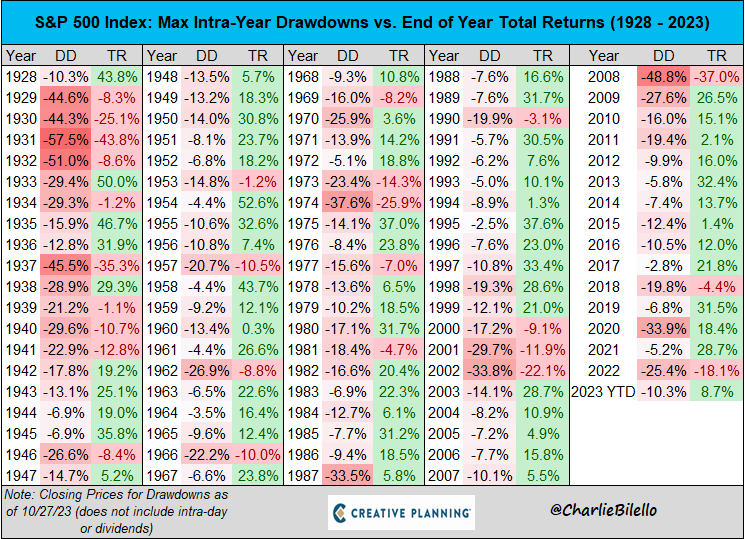

we are now at or near the tactical lows. Seasonality has been wild to trade this year:

Bagged at -10.1% YTD, my worst performance since 2008! We’re almost back to pre-AI hype tech levels, essentially a statement that this was all speculation. Currently ~80% of the port is in VTI & VGT, with the remainder being high-yield corporate bonds (SPHY) and 2yr treasuries. While earnings keep rising (MSFT, NVDA) and today’s 4.9% GDP growth, I find myself scrambling for explanations.

A lot going on with China’s breakdown and Middle East hostilities. In a multipolar world, Iran’s ability to choke the Hormuz can lead to a breakdown in global security, trade, and giant spike in energy costs. I don’t believe the Iranian regime wants a showdown. Its much more in their strategic interest to act through proxies and saber-rattle to rile up their base. Even after the Solemani assassination, they deliberately directed their missiles to miss. I expect that to continue.

China, on the other hand, is getting weirder and weirder. Reports of youth unemployment being so high that the party has stopped reporting figures. Reports of desperation following the pull out of international companies.

Now if there is in fact some seismic, strategic shift that I’m missing, then the bears were right and we’d expect to see this rather ridiculous flight to safety trade (I say ridiculous because giving up the unlimited upside of equities for a 4.8% fixed return is silly on a long term basis). However, if the attack on Israel is a harbinger of a global reordering of sorts, then we’re in trouble.

1 Like

My to-read list is expanding following how I missed the plot this year. Just finished Zeihan’s The End of the World is the Beginning, a geopolitically-based forecast of the coming decades. Best horror book I’ve read in a long time. Anywhoo, he identifies many headwinds unraveling our standard of living, among them:

-

A supply-chain breakdown and regionalization following a global re-ordering where the US can no longer guarantee global trade security. Essentially if the US retreats to its hemisphere, thug regimes and proxy-privateers abound, component costs go way up: think years between new iphone models. Food-insecure countries and regimes become vulnerable: something we’re already seeing in the Sahel. And oil becomes a great deal below $150.

-

Climate change: Humid areas like the midwest actually gain from longer farming periods; dryer areas like Australia, Middle East fucked. Greentech would only shave off ~10% of petrochemical demand; insufficient to curtail warming. Chance to prevent the coming cataclysms was 8 elections ago (yikes).

-

Demographics, Agriculture, and Trade Locale: China, India, Middle East are fucked. China mega-fucked (in part due to demographics, part hyperfinancialization) But he’s bullish North America, Colombia, Mexico Indonesia long. The 2040s look like the new expected golden era since that’s about how long historically its taken for a new order to manifest efficiently. Oh, and in the mid-2020s when the boomers retire en masse, they will pull money into safer assets. But the US looks good long-term due to the Millennials and their kids.

If we are in-fact already seeing a breakdown of US power, then we’d expect to see evidence of that in the Israeli-Palestine crisis. Recently: Sec of State Blinken was snubbed, Biden dismissed, Turkey is riling up their anti-Israeli base, and there are still 600 Americans in Gaza trying to escape to Egypt, who does not give a shit. Egypt, an over-populated dictatorial semi-shithole, declined a deal! Yikes! From Nader’s blog:

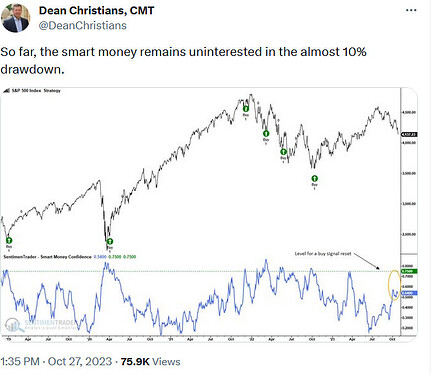

So maybe that’s why the smart money is sitting out (still):

I think the China stuff is worthy of exploration. I’ve noticed some activity in long-FXI puts (2025 and 2026). Keyu Jin’s The New China Playbook is next.

1 Like

Not seeing any major events, so my guess is the drop was just a standard drawdown, par-for-the-course in a bullish year:

Books:

- Jin’s The New China Playbook was pro-CCP mouthpiece. So bad I couldn’t finish it. On to Beijing Rules by Bethany Allen

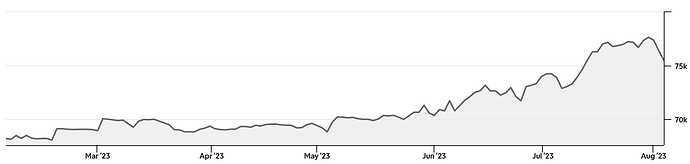

About -5.4% after that week. Slowly working trades back in. Some of the below are deposits from my working acct, but its the full port now:

Beijing Rules was a disturbing and great read. Not sure I want to call a big short on China anytime soon though. Most likely it will experience a deleveraging. But who can say when? And will it translate to resistance to the CCP outside of western-oriented cities like Shanghai? Too complex of a problem.

Next up is Freidman’s The Storm Before the Calm. I don’t agree with everything but it is well researched.

About -4.1% after yesterday’s monster run:

Notes from The Storm Before the Calm

Author was the head of Stratfor and Zeihan’s boss. The main thesis is that America goes through two cycles: institutional and socioeconomic, each lasting about 80 and 50 years respectively. What’s different about the mid-2020s is that for the first time, both cycles are occurring simultaneously. For example, capital became too difficult to obtain in the 1970s, Regan ended the FDR New Deal from the prior cycle, and in the 80s capital was able to move more freely again. Today we have the opposite problem as wealth is too concentrated.

Interestingly, during each cycle throughout our history, Americans felt the US will collapse and the world is ending but in reality the US was forged out of conflict and at the end of each cycle has emerged more robust than ever before.

Predictions:

-

He correctly predicted tech job crunch and tech maturation by the mid-2020s but was wrong that low inflation would continue.

-

He called the rent and asset squeezes we’re seeing.

-

Predicts a crisis in higher education. Particularly Ivy league universities who reward the top slots in the society to beneficiaries of elites but leave the post-industrial class behind. Essentially, this class is rewarding itself rather than the poor smart kid who has to work during high school and has no time to study. He sees disenfranchised groups unifying and equity initiatives putting pressure on universities.

-

Sees the party of the technocrats, i.e. the specialized classes who benefit from globalization, as insisting their way of doing things is best until the very last moment (sound familiar?). They’ll fail to recognize times have already changed and the pain will amplify going into the 2028 election when the new president will act accordingly, culminating in the new institutional 80 yr cycle. The 2024 elected president will take the blame and that party will suffer.

-

Golden era occurs 20-30 years after the new socioeconomic paradigm so that places the new good times sometime after 2040/2050.

Chip War by Chris Miller is next.

2 Likes

Port is up +0.5% YTD.

From Chip War:

-

We’re hopelessly dependent on semiconductors to maintain our standard of living. Apple’s chip components, for example, can only be built by one company in one building in the world: in Taiwan, by Taiwan Semiconductor (TSM). The island alone produces 37% of the world’s supply of chips, and these are of an unparalleled quality anywhere else (I note TSM is building a facility in Arizona under the Chips Act, not yet passed as of this book).

-

The world is staggeringly dependent on the supply of chips. An earthquake along Taiwan’s fault line - or even in Japan, which produces 17% of the world’s chips, will likely cause huge disruptions to the global economy.

-

Intel, although it has fallen behind, is still systemically important. Without it, there isn’t a single company outside of Taiwan or South Korea capable of producing cutting-edge processors.

-

China is highly dependent on foreign technology and has less than 1% of the software tool market. US has a dominant hold over the software market.

-

Companies like AMAT (Applied Materials), Lam Research, and KLA are part of a small oligopoly of firms that produce irreplaceable machinery.

-

Worse still are ASML’s EUV lithography machines, which have taken decades to develop and have 457,329 parts. ASML is Europe’s largest tech firm.

-

NVDA’s chips are absolutely critical for AI-driven machine learning, since they are able to perform parallel processing.

-

Establishing a cutting-edge all-domestic supply chain would take more than 10 years and over 1 trillion dollars.

-

In Pentagon Taiwan invasion wargames, China’s first step is likely to seize the adjacent Pratas island atoll to determine the scope of the US response prior to initiating a full-scale reunification. Everyone has bet on peace so far, but the consequences of the destruction of TSM’s factory would be no less than catastrophic.

I’m taking a break and back to adventure non-fiction next week with Skeletons in the Zahara. I expect a boring rangy-week until 11/27.

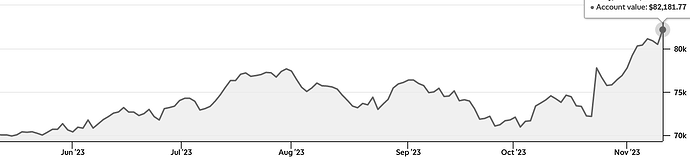

Over +3.1% YTD after today. Account is $11,000 higher from the Oct 26 low. Been giving it 100% and its starting to show. I never achieved this level of success before and this is typically where my ego begins to creep in. I just need to stay humble, like a pro, patient and consistent like Munger, and let small gains accumulate.

I’m tired. I should rest for a few days but I when I feel good at something I can’t stop until I reach my goal. No rest for the wicked

2 Likes

+5.1% YTD but flat on the week. Lost patience on a few trades and bought downside insurance on AAPL and was blown out. HOOD calls evened things out but I got rattled on some other trades and paid the price.

Oh, and I now have a tax bill coming.

+9.6% YTD. Connecticut capital gains tax is 7% and I don’t have enough in my Roth to daytrade <:kekw:923797443471081503>

Took $388 in profits today but port is down -0.4% overall. META and AMZN calls paid but not enough to recover SPWR collapse on SEC filing citing “going concern” questions. Completely shook out of my shoes on TAN, which although it was a high risk play, bounced nicely off the 50 support. I have to remind myself that making consistent money means dealing with painful fluctuations. These movements should be expected. I second guess myself too much and break exactly according to predetermined algorithm levels. I must be stoic and indifferent to personal suffering.

1 Like

Closing thoughts on a wild year. Port is up +10.6%, adding another $6,100 this month alone.

A lesson I learned during my pickup artist days (from Mark Manson, actually) was the difference between success and failure came down to one thing: speed of implementation. Meaning if something isn’t working, change it up until you find something that does. Repeat again and again until you reach your goal.

It is not enough to succeed. Algos must fail.

My only goal for 2024 is patience.

1 Like

Port down -$4,200 this week. I was overlevered going in and the Santa “rally” basically was one giant dump. I have lost confidence so ill be hunkering down for a bit to preserve my capital and live to fight another day

2 Likes