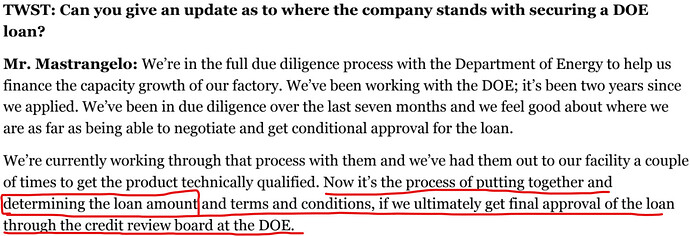

I don’t see this as a flag that the DOE loan won’t happen based on the section I pulled below under “COMMITMENT INCREASE AGREEMENT”. I actually see this as bullish based on their needs to expand their Pennsylvania facilities…

Form 8-K Eos Energy Enterprises, For: Dec 07

Item 1.01. Entry into a Material Definitive Agreement.

As previously disclosed, on July 29, 2022 (the “Closing Date”), Eos Energy Enterprises, Inc., a Delaware corporation (the “Company”), entered into a Senior Secured Term Loan Credit Agreement (the “Credit Agreement”) with ACP Post Oak Credit I LLC, as lender, administrative agent and collateral agent (“Atlas”), and the lenders from time to time party thereto (collectively with Atlas, the “Lenders”). The Credit Agreement provides for an $85.1 million term loan (the “Term Loan”), the entirety of which was funded on the Closing Date. The Credit Agreement also permits the Company to request additional commitments of up to an aggregate of $14.9 million, with the funding of such commitments in the sole discretion of the Lenders, under certain circumstances and under the same terms as the Term Loan. As previously disclosed, on August 4, 2022, the Company requested, and the Lenders agreed to fund, an additional commitment of $9.6 million under the Credit Agreement.

On December 7, 2022, the Company entered into a Commitment Increase Agreement (the “Commitment Increase Agreement”) by and among the Company, each subsidiary of the Company, as guarantors, and the Lenders. Pursuant to the Commitment Increase Agreement, the Company requested, and the Lenders agreed to fund, an additional commitment of $5.3 million under the Credit Agreement. The terms of the additional commitment are consistent with the Term Loan.

As previously disclosed, pursuant to the Credit Agreement, the Company may not permit Liquidity (as defined in the Credit Agreement) as of the last day of each fiscal quarter to be less than the Interest Escrow Required Amount (as defined in the Credit Agreement), which is calculated as the aggregate amount of the four immediately following interest payments on loans under the Credit Agreement. Following receipt of the additional commitment proceeds, the Interest Escrow Required Amount would increase to $12.3 million.

The information set forth in Item 1.01 of the Company’s Current Report on Form 8-K filed on August 1, 2022, which provides a description of the Credit Agreement and other material terms of the additional commitment, is incorporated by reference herein.

The foregoing is a summary description of certain terms of the Commitment Increase Agreement. For a full description of all terms, please refer to the copy of the Commitment Increase Agreement, that is filed herewith as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information set forth under Item 1.01 of this Current Report on Form 8-K related to the Commitment Increase Agreement is incorporated by reference herein.

Item 9.01 Financial Statement and Exhibits.

(d) Exhibits

COMMITMENT INCREASE AGREEMENT

(b)The Borrower agrees that the proceeds of the Incremental Loans shall be used (i) to fund the Interest Escrow Account in an amount equal to the additional Interest Escrow Required Amount required based upon the principal amount of the Incremental Loan, (ii) to fund growth investments and for general corporate purposes in accordance with this Agreement, including corporate-level R&D investments, (iii) expansion of the Excluded Subsidiary’s manufacturing facility in the Turtle Creek, Pittsburgh area in Pennsylvania, and (iv) to pay the Transaction Costs, in each case in accordance with the funds flow memorandum delivered in connection with this Agreement.