This might explain the afternoon push up! Posting now and going to read what’s in it…

So for the last month they’ve been slowly tapping into the SEPA to help “offset a portion of the outstanding amounts owed to Yorkville pursuant to that certain promissory note for $15,000,000 issued and sold to Yorkville on March 17, 2023”.

http://archive.fast-edgar.com/20230404/AN2JT22CLM22V29Z282D22Y2Q45SZ222Z252/

This is an absolute gift you believe they will get the DOE loan. Just over the weekend the person in charge of approving said loan hinted on Twitter: “Many announcements coming to Pittsburgh and the Ohio River Valley!” - With EOS facility loan in Pittsburg it had some folks on Twitter humming…

https://twitter.com/JigarShahDC/status/1642321683880067073?s=20

Pittsburgh-area expansion expected to create more than 125 green jobs and increase total manufacturing facility to nearly 100,000 square feet

https://investors.eose.com/news-releases/news-release-details/eos-energy-enterprises-expands-manufacturing-facility

Q2 is now so literally any day we may find out the DOE loan approval (or denial…)

New $15M Convertible loan tapping into their SEPA… Implies there could be a delay in funding but with an 8/31/23 maturity this smells like “bridge loan”. I sold half my position for break even to be safe since ironically I originally got in at $2.64 back in Sept 22’… So I’m now able to preserve some cash for a dip and lowered my cost basis down to $2.08… fwiw I’ll take it for now… still very bullish on the play, we just might have more time before we know on DOE loan…

market said “F a SEPA”, this resilience is pretty impressive. Will look to grab back some shares if we get a dip below $2.50 from dilution to pay this back. This could play out another few weeks before we find anything out (or longer). I just don’t see them finding out DOE loan “any day” if they needed this bridge, something tells me that they “know” it might take a little longer than “early Q2” like they said on the earnings call… All that said while the stock price keeps pushing up this morning… crazy lol

On the recapture of $3, I have sold half of my holdings on this for just over 100% gain. The remaining 1000 shares I’m letting ride for a while as my cost basis is now completely covered.

Eos Energy Enterprises, Inc. Announces $40 Million Registered Direct Offering and Concurrent Private Placement

apparently this is “bullish” for the loan according to the twitter furu who’s been all over this stock since Feb:

Not sure what to make of it but I’m also glad I pulled out half my cost basis and I now have a very nice average at $2.08 with 900 shares

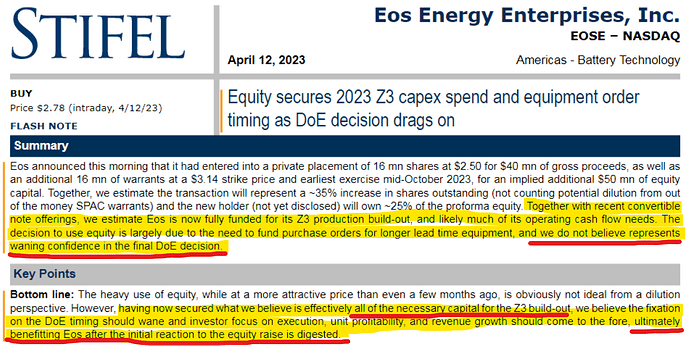

Stifel put out a flash report on $EOSE today (apparently… I don’t have paid access), overall bullish

(source: x.com)

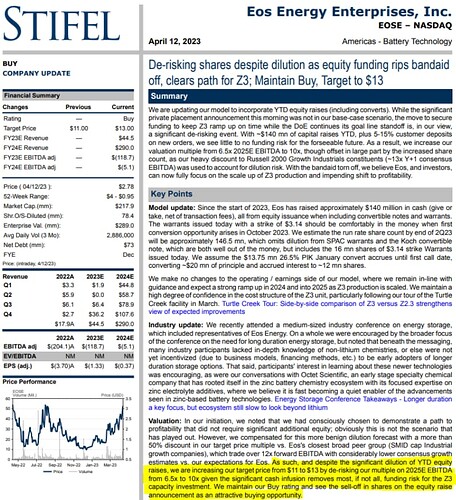

I don’t have a Stifel account but they apparently increased their PT from $11 to $13 after the dilution news today. Seems like the bigger picture is ramping up on their backlog with DOE loan probability increasing. I’m going to try to snag some shares on any selling by Yorkville off of the related SEPA, ideally under $2.50 if it happens who knows…

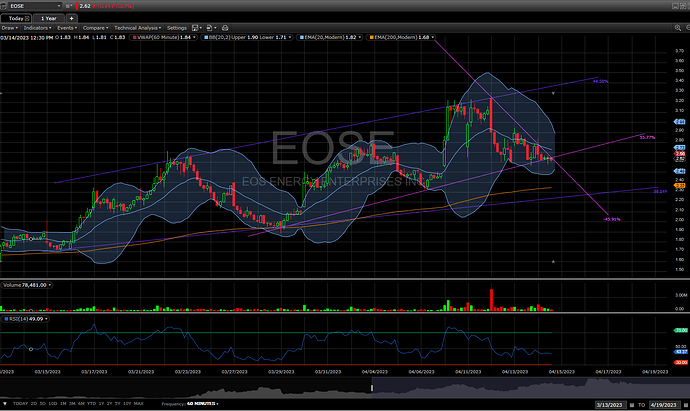

Broke out the 'ol crayons this morning and draw these purple and magenta lines (below), low and behold we closed right on the fookin magenta X, noiceee.

I see next week having a big move in either direction (towards purple) as this stock has had wild swings lately. Other than that feel free to cautiously take profit on any wild upswings lacking DOE loan news as it’s likely to settle with a 15% correction as we’ve seen over the last 3 months since volume has gradually increased. Still long and strong managing to DCA a few chunks of shares around $2.59 today. Have a great weekend!

CVI (Susquehanna) went long 8M shares on 4/12, 13G filed today…

Likely we also have SEPA shares dumping in addition to private placement all while DOE just released their first title 17 conditional commitment yesterday… I’m taking this as an op to DCA for “the play”… Good luck and Godspeed…

Grabbing a couple lots of 100 on this morning dip. My belief is that this is a fabricated drop based off of the recent SEPA and private placement… I consider this a gift leading up to DOE loan news (which could drop any day).

IF we break below $2.00 w/out news that would be an excellent opportunity to begin building a position for this play… At the end of the day this is still a gamble, just a calculated one…

Continuing to DCA… Grabbed some shares @ 1.97… $1.80s have been mentioned by some for support, so I’ll save some port if it happens to drop that low…

I scooped up more shares around 1.80s+/- on that daily low yesterday before the strong bounce in the afternoon.

Thesis remains unchanged… Another day, another DCA… @ $1.74

Yep you guessed it, another 100 @ $1.61… Will see how the day goes to DCA some more before the weekend as I suspect this could start climbing back up as we approach earnings on 5/9 and the call the next morning on 5/10… There will be hype that they “could” announce the DOE loan on the call but this will be an incorrect assessment to the thesis. It will be random and they don’t control the timing and honestly if they knew and withheld this material information that could get them in more trouble than what they want at this stage. In this case I will look to take profit if we do run hard without any news updates into close on 5/9…

There’s been a trend noticed by some folks tracking DOE loans… When a new poster drops, there’s been conditional approvals release soon after within that segment of said poster…

In this case, the DOE just dropped their STORAGE poster which specifically includes “Newer Battery Chemistries and Flow Batteries”… cough… That includes $EOSE… cough…

https://www.energy.gov/lpo/storage

Take is for what you want but this is at the very least nothing short of neutral and at the most very bullish for an upcoming conditional approval to be announced… For me? My bags are packed ready for Valhalla ![]()

Leaving this here if you want to join me in listening to the US DOE webinar on " Pathways to Commercial Liftoff: Long Duration Energy Storage Deep-Dive" today at 1pm EST

https://t.co/GmByOrSgGW

Earnings did not disappoint ![]()

Eos Energy Enterprises Reports First Quarter 2023 Financial Results

May 9, 2023

Revenue increased nearly 3x with unit cost down 25% compared to 1Q 2022

EDISON, N.J., May 09, 2023 (GLOBE NEWSWIRE) – Eos Energy Enterprises, Inc. (NASDAQ: EOSE) (“Eos” or the “Company”), a leading provider of safe, scalable, efficient, and sustainable zinc-based long duration energy storage systems, today announced financial results for the first quarter ended March 31, 2023.

First Quarter Financial Highlights

- $8.8 million revenue, compared to $3.3 million in 1Q 2022, a 168% increase year-over-year.

- Cost of Goods Sold of $26.9 million, a decrease of 24% compared to 1Q 2022, representing a 25% reduction in product unit cost year-over-year.

- Operating expenses of $19.4 million remained flat year-over-year.

- $16.1 million cash balance on March 31, 2023, compared to $17.1 million on December 31, 2022.

- Booked $86.3 million in orders, resulting in an order backlog of $535.1 million as of March 31, 2023, an increase of more than 2.5x versus 1Q 2022.

Recent Business Highlights

- Signed a 300 MWh Master Supply Agreement with Carson Hybrid Energy Storage (“CHES”).

- Completed final new Gen 2.3 Energy Block shipments; transitioning to Eos Z3TM battery production.

- Achieved 1 GWh of discharged energy from field installations, with 70% occurring in 2023.

- On April 14, 2023, the Company successfully completed a $40 million capital raise; planned use of proceeds includes factory automation and capacity expansion.

- Substantially completed due diligence for Department of Energy Title XVII loan application; actively negotiating the final provisions of a term sheet with the Loan Program Office.

Eos Chief Executive Officer Joe Mastrangelo said, "The Eos team delivered a solid first quarter, with continued backlog growth, strong manufacturing performance, and 1 GWh of discharged energy in the field, all while raising additional capital that enables us to scale operations and accelerate our market competitiveness.”

Mastrangelo continued, “We are positioning ourselves to transition to the Z3 Energy Cube, which combines our patented electrolyte with a new mechanical design that is easier to build at a lower cost. We are continuing to scale operations to meet the world’s future energy needs.”

Earnings Conference Call and Audio Webcast

Eos will host a conference call to discuss its first quarter 2023 financial results on May 10, 2023, at 8:30 a.m. ET. A live webcast of the call will be available on the “Investor Relations” page of the Company’s website at https://investors.eose.com. To access the call by phone, please register in advance using this link (registration link), and you will be provided with dial in details via email upon registration. To avoid delays, we encourage participants to dial into the conference call fifteen minutes ahead of the scheduled start time.

The conference call replay will be available via webcast through Eos’s investor relations website for a limited time. The webcast replay will be available from 11:30 a.m. ET May 10, 2023, and can be accessed by visiting https://investors.eose.com/events-and-presentations.

At work office all day but quick update on the investor presentation from this morning…

- Extremely bullish on the DOE loan still, $250M+

- On track to be gross margin POSITIVE by eoy or q1 ‘24… huge

- A lot more to list but all in all play is still on and looking just as good if not better (z3 cost reduction increased to another 15% on top of the 50% cost reduction from gen 2.3)

Check it out:

https://investors.eose.com/static-files/589460b5-8001-4a76-b06b-2e2880968f98

As for DOE news play… I will look to cover cost on a pop to $4 then let the rest ride and continue selling (presumably on the way up)