[center]ESG, CBDC’s, Commercial Banks, Central Banks and a world changing with blockchain:[/center]

Introduction (the 4th industrial revolution and web 3.0):

History never repeats but it often rhymes. I believe what we are seeing now in crypto currency is what we saw with the recovery in tech stocks post the .com bubble. 2017 ICO craze is where many “projects” wrote convincing white papers, websites and teams to make it look like a legitimate enterprise often with lofty goals. From Q1 to Q4 the ICo market grew by 100 times over. A mixture of rugpulls, cash grabs, teams with overambitious goals and under equipped skills with no path to sustainable revenue diluted a pool of a few legitimately good projects. In the dot com bubble we saw any company with a .com booming all with no real attachment to how it would lead to sustainable revenue or connect itself to the real world economy.

This bull run has had a very different feel with projects having far more confirmed real world partnerships with large corporate and government entities (see other DD’s) with the run kicking off with Chain Link and DeFi summer and real testing ground of potential future financial products and platforms. Integrations from Facebook, Amazon, Google, Microsoft, JP Morgan, Morning star, Shell and many many more. We are also starting to see the development of sustainable revenue models largely through API calls, swapping and processing fees, data hosting, registration of ownership, trade settlement layers, art sales, Music artist launching and self funding their brands the beginnings of a real marketplace beyond mass fomo of hopeful investors. I don’t believe we are at a place where crypto currency markets can sustain themselves without the mass investment at this stage but it is certainly showing progress of more organic buyers purchasing with the end goal of protocol usage over speculative investing.

With this rapidly evolving landscape filled with MIT geniuses, hacker extraordinaire, entrepreneurs, Nobel prize winners it has started to draw the attention of large institutions which has its upsides and drawbacks. On balance this is not only positive but essential for the survival and growth of the space. The anarchists dream of bitcoin crushing the banks won’t happen but it may alter them significantly in ways we are yet to see. DeFi eats into the banks offerings, NFTs can eat into music labels ownership over artist royalties and I’m sure there are many other examples. However it’s not a war, the programmers have made all of this as permissionless and decentralised as possible to equally empower all the users that includes large institutions which can use this to gain access to potentially more liquid markets, higher yields and more flexible and lower cost infrastructure.

So that’s a brief intro Now onto the meat, consume my meat.

[center]Part 1 ESG:[/center]

What is ESG (Environmental and Social Governance):

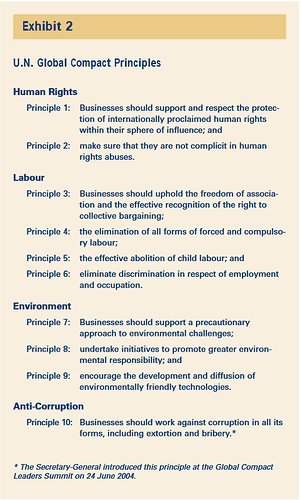

The origin of this was a letter sent to all the CEOs of worlds largest financial institutions in 2004 by the former secretary general of the UN Kofi Annan. These financial institutions, The world bank, UN and the swiss government wrote a report called “Who cares wins” https://www.unepfi.org/fileadmin/events/2004/stocks/who_cares_wins_global_compact_2004.pdf

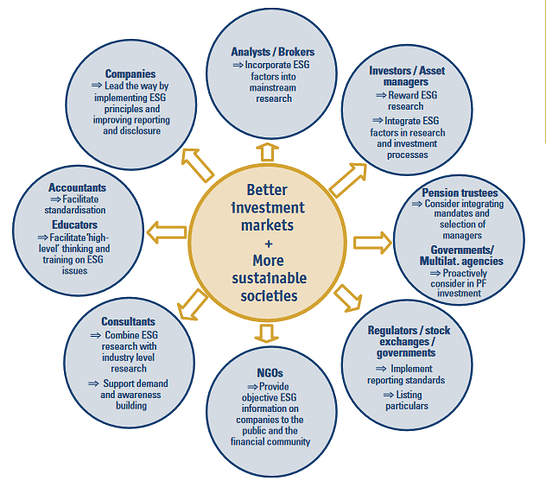

In this report analysts were expected to report on environmental impact in their reports, Financial institutions were to integrate the standard into their investment strategies top down, companies were to make steps to become more green and provide regular reports, investors/ pensions fund trustees/ consultants and financial advisors were to work towards advising on environmental impact and put more emphasis on this when selecting investments, Regulators were invited to create legal framework to enforce this, stock exchanges were to enforce listed companies to disclose environmental and governance data and NGOs were to contribute independent reporting on companies. It was far reaching and comprehensive to say the least.

As you can see this Has a lot of influential members and is looking to change a substantial amount of criteria that dictates the success of a company outside of profitability.

You get the idea. There’s even sections where they draw the groundwork for scoring companies on the above and produce ratings. At this point it was a nothing burger the letters went out to CEOs of big companies and investment firms and it was more or less ignored this will change.

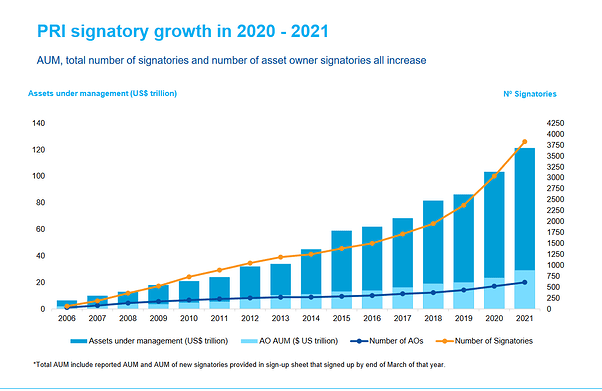

In 2006 the same group founded a coalition called the principles for responsible investment https://www.unpri.org/. Any signituries that sign up to this are expected to adhere with the report and there are over 4000 signitarties at this time 75% are asset managers and the amount is growing.

And this thing is a big deal producing quarterly reports for members on the coalition progress on guidance for its members. https://www.unpri.org/download?ac=14962

There are also rating companies that assess investments and implement ratings based on that (and have since evolved) from the original report.

You do not want to be put on their naughty list as a company as all those signitaries up their would probably DOOMP EET. No gos include Alchocol, Tobacco, Gambling, Adult entertainment, Weapons, Fossil fuels and Nuclear power???. Last one is a bit weird if you ask me. Now obviously these sectors have access to investors but it does narrow the range.

Until January 2020 ESG was a joke with a mixture of conflicting ratings and ESG rated companies having to jump through hoops to avoid fossil fuels and hire diversity quotas over just hiring on merit among other things put them at a substantial disadvantage which largely meant it went ignored. The Larry Fink Blackrock CEO wrote a letter in January 2020 https://www.blackrock.com/corporate/investor-relations/larry-fink-ceo-letter . Now blackrock control a rather silly amount of money over $7 trilly. He basically told anyone he was invested in to get in line and set a standard of how to do so with the assistance of the big 4 (KPMG, PWC, EY and Deloitte) and the international business council headed by Brian Moynihan the bank of america CEO. Now Bank of america recently did a crypto report https://rsch.baml.com/access?q=vHFr886ohGg and one of the things they focus on is ESG. This basically has caused companies and asset managers to take it a lot more seriously.

The world economic forums forth industrial revolution and their concept of stake holder capitalism (this is more or less where we are going next and proof of stake blockchain hosting the economy is perfect for this) written by klaus schwab (WEF Founder). Who are stakeholders according to Klaus the WEF was designed for stakeholders to meet at Davos…

Also Kevin O’Leary has been talking about how its warping investment and capital application and states its “crushing the energy sector”. He even stated ESG caused the May crypto Dump and tesla to back peddle on Accepting BTC payments. https://www.youtube.com/watch?v=N-TwVLIK7UM

The main focus of ESG on crypto is starting to shift from Environmental concerns to that of governance. With companies using more renewables, blockchains getting more computationally and hence energy efficient, new DERs (distributed energy resources, see my EWC DD) and a move to proof of stake its getting greener. On the governance front miners leaving China (for those that remember Chinas “crackdown” and BTC ban in May this year i believe it was to make them look strong rather than the truth that the miners were leaving for their own reasons and potentially ESG concerns) this also assists to ease the governance concerns (China once had over 50% of BTC hash power). Now it’s moved to europe and North america ESG is far easier to be compliant with. The last problem is electronic waste from miners like ASICs going to landfill. There is now protocols specialised to reusing the “e-waste”. However all of this is coming on leaps and bounds and running some miners and nodes is surely cheaper than our existing legacy banking system and all its physical infrastructure requirements. ESG also is targeting the lack of awareness of the average crypto investor so your rugpulls and puppers i mean pumpers probably wont be around in 10 years. Non-returnable transactions have also been flagged as a concern i would imagine eventually front end user interfaces will probably not interact with the blockchain and the banks will be the only ones to interact on chain for the average joe.

The Next stage is legislation which obviously institutions are keen on. Including attaching all wallets to a KYC ID. no more anonymous wallets (sad face).

ESG Critics:

Tariq Fancy former Blackrock CIO of sustainable investing https://www.youtube.com/watch?v=3qGLLA8HNP8

SEC commissions Hester Peirce

Chamath (the mammoth) Palihapitaya

ESG and Energy:

There are connection to ESG, the pressure to energy markets and surging energy costs. This is coupled with an argument that the now limited energy (that ESG has contributed to) that using the limited energy is wasteful to use on blockchain. However most of the mining is done in North America and Europe using the cheapest energy (which is renewables).

Blackrock is investing heavily in BTC mining companies and ESG rating companies are compiling lists of all the most influential developers. Proof of work also functions off of majority token holders so buy 51% and you are in control. So this anarchists economic dream yeah NOT GONNA HAPPEN. But what we can do is buy what they want before they know they want it and demand a premium. That’s $100,000.00 per LINK thank you. DRNS (did not read never selling). Well really its more wait for market buy pressure to push up price and sell when in profit but allow me the delusion of control.

[center]PART 2 CBC’s and the banks (caution if you are a freedom loving American this may cause the following symptoms: heightened temperature, tachycardia, increased blood pressure, sweating, musculo skeletal tension, involuntary vocal emissions such as “FREEDOM!” and “THEY WILL NEVER TAKE MY CONSTITUTIONAL RIGHTS!!” if you suffer any of these symptoms please take a break and consult with your doctor if you have any heart conditions):[/center]

80% of central banks are developing CBDC’s some of which have already been rolled out. CBDC’s are just digital fiat currencies controlled by a central bank.

Currently fiat currencies do not operate on instantaneous transactions. Although it will show up on your account immediately, the actual transaction has to go through various administrative levels before it’s updated on the base money layer. There are layers of money supply and as money isn’t backed by anything (other than its enforcement of use to pay tax aka use this or i will throw you in a concrete box, yes it’s still a world governed by the biggest stick) the money you and I use is not the “real money”. Currently banks operate on fractional reserve banking this means that they can lend out more money than they have on their account with the central bank (the federal reserve, bank of england etc). This is effectively leverage. As long as the amount going out from the bank does not exceed what comes in and the base money remains stable or growing they can lend out as much as they want. (it used to be 10:1 in the US however there now no limit Federal Reserve Board - Reserve Requirements ) So banks can effectively leverage as much as they want however it is somewhat limited to what their counterparts are doing and the risk of a “run on the banks” feel free to look into the mentally insane fiat system but I don’t want to go too far down that rabbit hole here. The main point I’m trying to make is that under the existing system the central bank is seeding a lot of autonomy and flexibility to the commercial banking sector in terms of the supply of cash.

Under this system there are reports on commercial bank holdings sent to the central banks for regulatory reasons and oversight (the central banks role was created to keep the currency stable essential to any healthy economy, although I would argue they have significantly overstepped this role). However this framework is open to misreporting and human error where a blockchain based Fiat would not as this would exist on a automated unalterable database (without the green light from miners, majority stakers etc) so mistakes or hiding certain data points would be at least far more difficult and at most impossible. At present all the banks store the data on their account on their own databases then intermittently report to the central bank. UNder CBDC’s this would all be on one central blockchain database accessible by the central bank at any time.

CBDC’s seem similar on the surface to stable coins but they’re not. For a start there will be full KYC and all your transactions will be logged by a centrally controlled authority that can edit the parameters of the currency as they see fit with no permission required from its users (I guess it has some similarity to tether lol). They will also be able to freeze transactions, remove money or move money in your account, remove or block you from using the currency etc (terrifying) and it makes all this central control far easier and more centralised for the central banks than the existing model. Like stable coins they are pegged to whatever value the central bank feels is required.

The Bahamas already have a CBDC and China’s digital Yuan is much more advanced than any other major power (for a country so anti crypto I hope the above helps you understand why a pseudo communist authoritarian regime hates decentralised crypto but loves CBDC’s). China has already outfitted merchants to accept the CBDC’s and want it to be used by all merchants for the 2022 winter olympics. Although China’s digital Yuan is not on a blockchain allegedly, it’s still equally horrible. Turkey has also been pursuing a CBDC due to runaway inflation and its population using crypto to transact which it banned (yet another authoritarian regime rushing to CBDCs). Ukraine also is developing a CBDC’s in partnership with stellar lumens which did cause a spike when it was announced however they will not be using the stellar network just building with their help. Ukraine also had the highest proportional growth of crypto adoption in 2020. They have also stated the CBDC will be on a par with cash when it is released. South Korea is also seeking assistance on testing its CBDC however they are not rushing this Klatyn an eth enterprise focused fork looks to be the front runner for this with its partnership with consenSys to test the CBDC. Klaytn is built by a south korean giant Kakao. Israel has began researching a digital currency since 2017 and is using ethereum for its settlement layer. They have a 5 year time frame before using it primarily for cross border payments. The EU is also exploring CBDC’s however they are relatively late to the party and are testing on ethereum and are releasing a wallet within 12 months. One thing they all have in common is that they do not like the idea of a non central bank issued stable coin as that would make them kind of redundant so how long tether, dai, rai etc have to live i don’t know. Algorand looks a front runner for the USA’s CBDC’s as the fed is partnering with MIT and if you read my Algo DD you’ll see that Algo is basically MIT’s Blockchain. Although Sam Bankman Fried is ex MIT so solana could be a candidate however he does not have the direct ties to the university like ALGO. The space of international currencies is a war. There a reason america will use it military force to back it securing oil and enforcing pricing of oil in dollars, having the world reserve (and strongest) currency is absolutely key to a countries ability to protect its interests (I AM NOT ASCRIBING A POLITICAL OPINION TO AMERICAN OR ANY OTHER COUNTRIES FOREIGN POLICY PLEASE DO NOT TAKE OFFENCE).

So a recent development is a report from the Bank of International Settlements in partnership with: Bank of Canada, Bank of England, Bank of Japan, European central bank, Federal Reserve, Sveriges Riksbank and the Swiss national Bank and the G7 and they have been setting out a new standard for CBDC’s. https://www.bis.org/publ/othp42.pdf

So for a start there will be 2 types of CBDC’s a retail one for us peasants and a wholesale CBDC for those in power.

[center]Here’s some comforting snippets from the report:[/center]

- “Central banks might consider measures to influence or control CBDC adoption or use. This could include measures such as access criteria for permitted users” You are a bad citizen.

- “Central banks would be the only entities entitled to issue and redeem a CBDC and would bear the ultimate responsibility for the design of the CBDC system and the operation/oversight of the core ledger” No you have what I say you have, you will own nothing and you will be happy.

- “If the central bank were to play too operational or dominant role in th ecosystem private intermediary participation could be curtailed” (Horay some hope they will give out some autonomy to the private sector, oh wait this next bit seems to crush that)…”However, a broad range of intermediaries may also lead to unclear responsibilities, a higher likelihood of failures (operational or financial) and user disruption. Approval processes for new intermediaries of certain services and strong oversight could help mitigate this (although the cost of oversight would increase with the number and diversity of intermediaries)”

- “Full anonymity is not plausible, as central banks would design CBDC systems to meet all anti money laundering and combating the financing of terrorism requirements” You will have no privacy and you will be happy

- “The central bank would have no commercial interest in end-user data and may be better placed than a commercial entity to commit to minimal use of such data” It’s safer with us trust me bro, i have your best interests at heart.

- “The so-called travel rule (FATF (2021)) requires participants transaction data to be collected and shared along a payment chain (hence “travel”). Outside these requirements, collecting and processing personal data is also subject to a country specific data protection regulations.” More on FATF later.

- “A CBDC could also be introduced with an explicit policy goal to catalyse a migration of national standards to (eg) an internationally promoted standard.”

CBDC’s will need to be interoperable with existing infrastructure as replacing the whole thing would be a logistical nightmare to say the least (so plug into ISO2022, and need a cross chain interoperability protocol that can interface with swift hhhhhhhmmmmmm i wonder what could LINK all that together).

[center]Why now?:[/center]

Well basically cryto is awesome and decentralised and kicks them out of a job and gives money back to the people. This seemed like a pipe dream but all this CBDC stuff is their way of getting back control before they lose it so as sad as it is in my mind this counter offensive from the central banks confirms our hopes could have materialised but they will kill that dead. To quote the report “For a discussion of CBDC adoption, there are two important contextual elements from the preceding report

[center]published by this group of central banks and the BIS (Group of central banks (2020)).[/center]

First, for the central banks contributing to this report, the common motivation for exploring a

general purpose CBDC is its use as a means of payment. “Use” in this report should be understood in this context. Adoption of CBDC as a means of payment would likely present the most value for public policy objectives.

Second, without continued innovation and competition to drive efficiency in a jurisdiction’s

payment system, users may adopt other, less safe instruments or currencies, potentially leading to economic and consumer harm. If user needs emerge in the future, unserved by safe payment instruments, the chance of this risk materialising arguably increases.”

Less safe for whom?

So why are they taking their time if they feel their role as the intermediary of value exchange (AKA controlling currency) is under threat?:

The report acknowledges that the private sector has been evolving the payment sector to become faster, cheaper , safer and more innovative. So if that’s the case then let it continue, but the BIS knows Best… In fact they intend to get you on board by fulfilling unmet user needs (what?), Achieving network effects (you vill use ze coin), and not requiring users to use existing tech. And the main advantages are security (blockchain has this), low cost(blockchain has this sharding, layer 2 etc), high liquidity(blockchain has this as it allows ease of access), programmability (are you for f***g real?!) and Pri… Privacy (fk me sideways).

“Consumers who receive payments in CBDC may be more likely to use CBDC. Public authorities might therefore be able to incentivise consumer use of CBDC by disbursing social benefits and transfers to individuals in CBDC and allowing employees to receive their salaries in CBDC. Allowing consumers to pay their taxes in CBDC may also provide a stable, concrete example for consumers to use CBDC.” Want your benefits? you vil use ze coin. They even suggest a tax discount for CBDC payments. It does briefly mention existing stable coins stating they are only just being developed (what?) and have a lot of work to do to satisfy legislators… They also state “Unlike central banks, issuers of stable coins are not bound by the principles to design that products that would co-exist and interoperate with other forms of money to promote ongoing innovation and efficiency” So the entire economic foundation of capitalism and competition doesn’t apply in this situation then? This is simply a lie. USDC works on dozen or more chains and even works with Visa, maker dao dai is everywhere, reflexer rais going multichain etc… On top of all this, central banks say they aren’t ready (hang on i though the private sector was too slow to innovate?!) but don’t worry regulators can slow down the private sector to help them catch up.

So the next main issue that has the commercial banks getting nervous is 2 things. 1 a run on the banks where people could panic to withdraw money from the commercial sector and rush to store money on the central banks CBDCs. They suggest issuing limits on the amount people can hold or transfer in a given time so you could get your account frozen in a crash scenario by the central banks. CBDCs would also cap the inflation of the money supply as fractional reserve banking where the commercial banks can issue currency as required would not be possible. Without the ability to leverage commercial banks ability to create assets as it needs would crush their profitability. There is currently 120 billion dollars in on-chain stable coins and this will have come from bank balance sheets one way or another (well maybe not tether but lets ignore that) and it’s growing all the time and not just by the tether printer. People want to use stable coins because its a bank account where you have full control and can move, spend, stake, gamble or do whatever you want without the bank flagging “suspected fraud” or whatever. As a Brit I have had to change banks 3 times now because of them telling me how to spend MY MONEY. If I could pay bills and tax without any bank account and just a wallet I’d do it today and I’m not the only one thinking the same.

The point is as you can see the way crypto is going does not suit the interests of the current leaders of currency institutions. They are in threat of being displaced by decentralised networks and they are starting to fight back. I have no doubt no matter how this plays out they will leave their mark in the crypto space.

[center]Part 3 the FATF:[/center]

To be continued