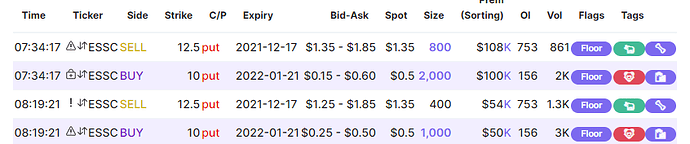

Some discussion and speculation regarding these trades today:

Those are bullish moves, aren’t they? If price goes up, they get to keep the premium on the $12.5P. Would need to see the delta on the 12.5’s at the time, but whoever bought them might delta hedge by buying shares, probably more than required to be sold to hedge the 10P (unless these were intended to be delta neutral positions).

I’m confused by the Jan 10p. What are they trying to achieve with that?

The $10 floor is intact until February, so this is unlikely a bet that the stock goes much below 10…

IV farm maybe? No idea.

The most likely scenario is that it’s exactly what it looks like, someone betting on a jump in the short term followed by a return to NAV in the longer term. Theoretically, buying the puts before the IV spike could net profit considering IV may still be elevated while it’s on the way down, providing profit both ways.

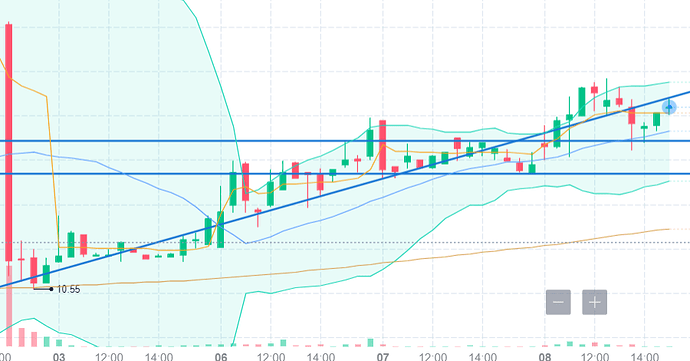

Providing some thoughts on today’s current movement: ESSC is fast approaching a gamma squeeze. It’s moving in line with what we know about these movements and I believe that it will close above the $12.50 strike either today or tomorrow and clear the $15.00 strike not too soon after.

I take this moment to remind everyone of CRVS so you can be aware that these plays do not always pan out how we think.

I feel safe declaring at this point that we’re watching an imminent gamma squeeze unfold. We do not offer PTs anymore. Take profit when you’re happy.

Be warned, this play is incredible risky, if you choose to partake only do so with money you can afford to lose.

with ESSC, another data point I was looking at is volume relative to previous jump - the day before the big spike as 1M in total volume, the day of the spike was 5M in total volume. Previous to the runup it was only 25k, so a 40x increase then 5x increase there. ESSC traded at 123K volume yesterday, I think we’re pacing towards 500K in total volume today but it may ramp up near the end of the day. Keep an eye out for volume later today and tomorrow.

Is it possible for someone to explain to me, or refer me to a source to understand what exactly happens when a ticker closes above a certain strike price and how those calls being ITM can lead to gamma/price increase?

The term for the process is “delta hedging”:

This is an extremely important thing to look for.

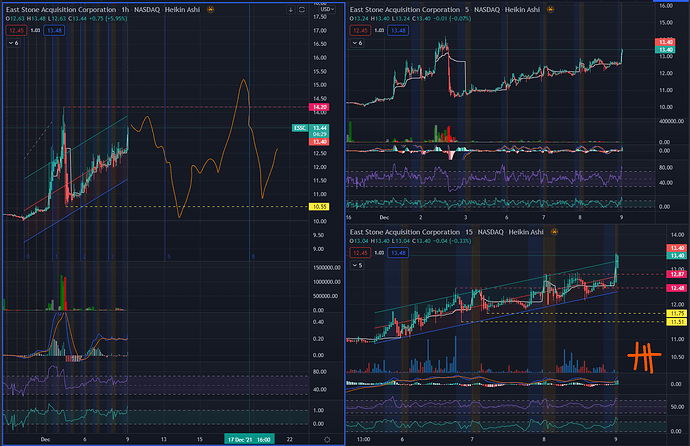

ESSC idea on the 1hour and 15min charts…

If it gets rejected before or at 14, I’ll exit today and possibly re-enter next week.

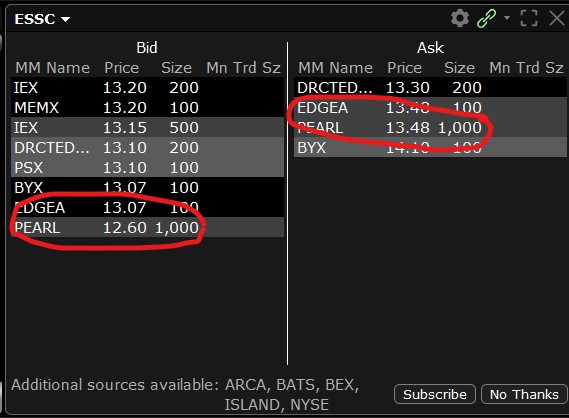

is there a reliable way to see if everyone is exiting their 10/12.5 calls like the last rug pull?

I don’t really think so - everyone kind of does their own thing based on their own risk tolerance.

You won’t know for sure until tomorrow morning. I’m sure there are ways to estimate but I’m not familiar with any of those techniques.

This is still moving how we would expect and hope for something that is building up to a squeeze. Currently no evidence of significant options rollover.

Clear skies.

Theoretically, I believe if people are selling to close for a profit that’d register in the volume for that contract, which are updated live-ish. However, OI isn’t updated live, I think just daily. I could be wrong on here but if OI is at 10k, let’s say, and volume is 5k for the day, that means at most 5k contracts were sold to close (and not counting any new contracts that may have been created, like covered calls). So if volume on a given contract is spiking, it may be an indicator of unloading. Let me know if this is inaccurate though

We can’t tell if the volume is sell or buy. But if the squeeze is happening and the volume is spiking for ITM options, it’s probably safe to assume most of the volume is probably sell volume?

That’s my thought, I’m sure maybe some people are selling CCs to take advantage of an IV spike and incoming crash/dip but again, if my reasoning is correct, then you could at least assume most is sell. Could also watch volume on OTM calls and see if those are going up to see if people are rolling out their calls.

In theory though this could still cause a gamma squeeze right? So long as the new options are close to ITM or ATM. So if people are taking profit but rolling those mostly into ATM calls, the pressure could still be on. Although if the overall ITM OI is static, then that’d probably flatten the squeeze. Just speculation here, wondering if Conq or anyone else has thoughts on that.

here’s a question, because i’ve seen these types of positions on other tickers where it’s the same amount of shares and the bid/ask is off of what the current price is trading at. can this be an indication of day trading short/long sellers?

The guy who wrote the original DD edits in an update every day. Here is today’s latest update:

Edit 5: Thursday - A big move to start - possibly shorts covering (2 x block buys at 42k shares and 33k shares roughly matched up with ORTEX returned shares at the time on the live updates. Volume still ok, OI and volume on the option chain still good. Two really promising moments today - first was when a 32k share block sell was eaten up at 13:06 with hardly a dent, and second was the end of day close - the selling pressure was intense but it held around the $13 mark and hit a milestone - closing above $12.5 for the first time. A lot of the downwards movement was not selling pressure, but lack of buying pressure. Hopefully we get more consistent volume next week. This is building up nicely. Still in with full position (bought an extra ~2k shares over the last 2 days). Overall great day.

https://www.reddit.com/r/SPACs/comments/r9q382/update_to_essc_dd_the_game_is_still_afoot/

He also made a new post: https://www.reddit.com/r/SqueezePlays/comments/rcsvgv/update_to_essc_dd_closing_in_for_the_kill/?sort=new

I’ve been digging into that guy who made the DD post and I find him a bit suspicious.

The earliest post I can find him in regards to this play is on Nov 30 at 2:45PM EST. He discloses that he apparently has “I am long 30,000 shares @ $10.4 average, and 1000 Dec 12.5c at $0.2 - total risk = 7.2% of position.”

I dug a bit into the options chain and trade data for that day.

Going into 11/30, the OI for ITM calls (price was not above 12.5 until later in the day), was only 246 which was the $10Cs.

There was 479 for the $12.5Cs. Also volume on that day for the 12.5s was 1613. So if by 2:45PM on 11/30, for him to have 1k 12.5Cs for Dec, he would’ve made a significant chunk of those 12.5Cs trades.

Looking into the following day, the OI for those 12.5s jumped 1255 from 479 up to 1734 . Meaning 358 of the total 1613 volume for that particular option being traded didn’t hold and 1255 did.

Looking furthermore into the individual trades that went through and the fact that he made a post at 2:45pm, he must have purchased if he did a majority of those calls prior to 9:40am especially at the price he claims of 0.20.

So he bought a ton of OTM calls at the time when the stock was barely moving. On top of that the share volume for the whole day was 28,778.

Not to mention he says he has 30k shares at a 10.4 average. So unless he has been buying these shares nearly at the very top prior to his post, that average cost doesn’t make sense either.

While the DD of the potential float and all that make sense, his position disclosure screams to me that he/she is not being truthful and gives me PnD vibes.