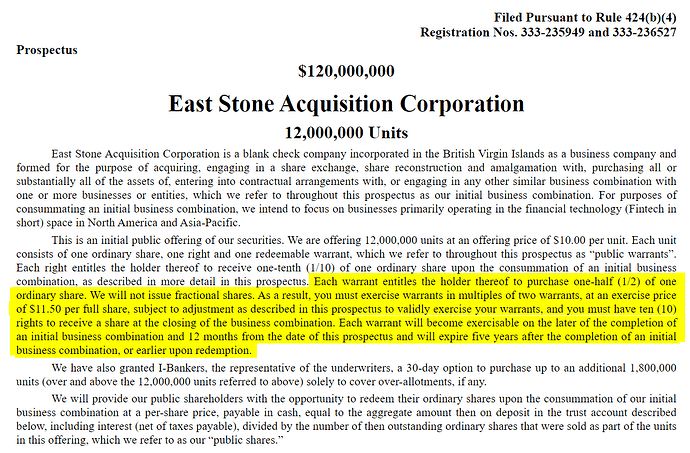

I’m going to add in the warrant info. It doesn’t seem to be any hedging opportunity for them based on the last sentence of the highlighted information.

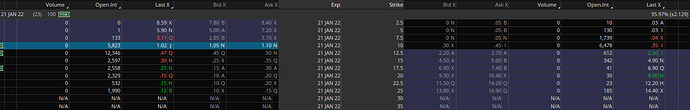

Updated OI numbers for 12/29 up to the 20c.

| Strike | OI | Change | %Change |

|---|---|---|---|

| 10c | 5823 | +1177 | +22.5% |

| 12.5c | 12346 | +1742 | +15.2% |

| 15c | 2597 | +72 | +2.8% |

| 17.5c | 2558 | +59 | +2.3% |

| 20c | 2329 | +131 | +5.8% |

To update the OI percentages last laid out by @Conqueror for yesterday:

ITM OI is at 39% of float (up from 31%), the $12.50 bring it to 122% (up from 102%) and the whole chain is up to 188% (up from 162%)

Their price right now is totally out of sync with the value of the stock. It’s probably being mentioned somewhere as a cheaper alternative to shares so people have been piling in without a full understanding of the underlying.

During runs with like DWAC and other despacs that would have massive retail sentiment, warrants would follow movement of the stock, and in fact change value at a greater percent so it was an easy way to make more than with shares if you couldn’t do options. But this doesn’t seem to be the case with ESSC.

Building up to the first run, the warrants were moving at a greater percentage and were an opportunity to make a little side money. However once the run was happening, I noticed that their momentum kind of died off and in fact the shares were moving at a greater percentage while the warrants kind of tapered off.

I ended up bag holding a lot of warrants at a price higher than I would have liked, but was very happy to offload them yesterday.

My two cents… Stay away from warrants for ESSC, double especially at this price.

During the first run I managed to buy the warrants early, but was disappointed in their movement in relation to the stock. I did, however, manage to sell them for 30% profit before the big run.

I agree, wouldn’t buy them here. My average during the first run was 0.2 and sold around .27-.28.

for the exchanges that showed chain extension for Dec OPEX and didn’t extend, do we know why the chain extension didn’t occur? for CBOE delist (hope you’re doing well, Maria!), it was the float/value. seems like OI is building up more for January than December. it’s still more than 3 weeks away but would a chain extension be taken as a good indication MMs are attempting/planning to hedge?

there won’t be a chain extension without price action

The intrinsic value for warrants would be around ([stock_price]-11.50)/2. As discussed above, warrants can only be traded in (two warrants per share, at $11.50 exercise price) after the business combination is successful. The thing about other warrants that is different with ESSCW, is that the no one (as far as I know) expects ESSC to be above 11.50 after the business combination, whereas something like DWAC might still maintain some value afterwards.

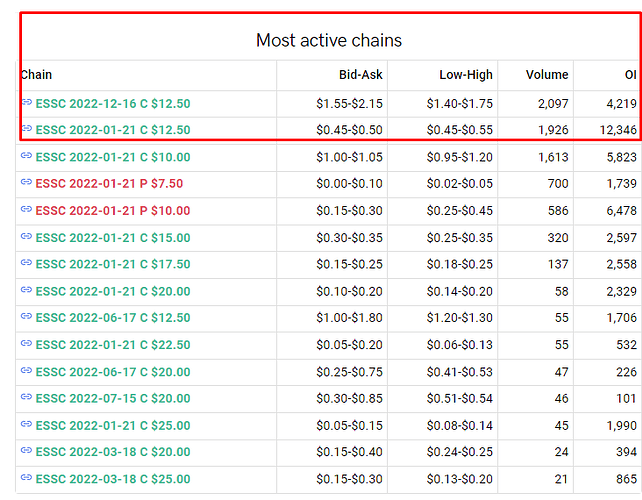

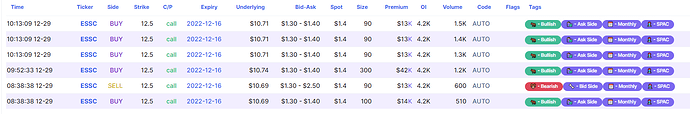

Posting some unusual action that we discussed in trading-floor today.

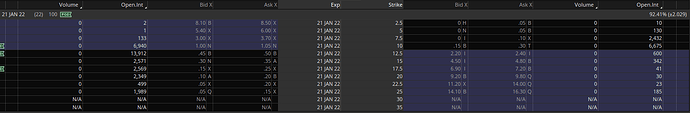

For the last few days I’ve been observing a notable influx of calls being bought for 2022/12/16 12.5c. Today the volume on it is actually the greatest and exceeds the January options.

The largest flows lately have also been dominantly for this option. See example from today so far:

ESSCW has also been running lately and is higher than during the last run.

Could the same party buying the leaps be the same buying the ESSCW? The volume of exactly 1,500 and the timing of the buys leads me to think the options buyer is probably one or few parties.

What do we think is the intent behind these moves?

Is there a reason why Sea Otter was able to dump their shares? As per the filings, I thought backstop investors were required to maintain a net long position to maintain a certain $ amount in the trust – are backstop investors just able to amend their current positions?

Isn’t there a way of hedging that involves buying/selling LEAPs? I can’t remember but I feel like I saw something to that effect on wsb ages ago

thanks @wolfwoodx for clearing up the misunderstanding. Misinterpreted the filing – Sea Otter is still required their net long positions for periods before the Special Meeting and 3 days prior to closing the business combination.

Yes, if you are negative delta (e.g., from selling calls), then buying calls, selling puts, or buying shares would bring you back to neutral.

At 1.40 they should not have any theta decay until february, IV increase should have a good effect on them, and have a good upside in general since they are OTM. Essentially they are similar to january 7.5Cs, but cheaper and more upside potential, and even more safety net since even if it doesnt move before january opex, you still have most, if not all of the value

Observing that the 12.5c on every expiry has around 1,500 OI, except for the February chain which has about 800. I find this curious because intuitively I would’ve thought that the February chain should be the 2nd most jacked chain out of all of them because the merger deadline is in February, but the February chain is actually the weakest.

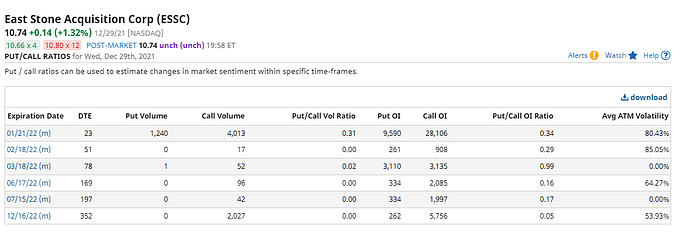

Here’s a pic of the put/call ratios on every chain consolidated, from barchart:

Wish I could hold this, but I need to harvest losses for tax purposes.

Expect this to run as soon as I sell this week

Your sacrifice is appreciated.

| Strike | OI | Change | %Change |

|---|---|---|---|

| 10c | 6940 | +1117 | +19.1% |

| 12.5c | 13912 | +1566 | +12.7% |

| 15c | 2571 | -26 | -1.1% |

| 17.5c | 2569 | +11 | +.4% |

| 20c | 2349 | +20 | +.8% |

ITM OI is at 47.2% of float (up from 39%), the $12.50 bring it to 139.9% (up from 122%) and the whole chain is up to 189.9% (up from 188%)