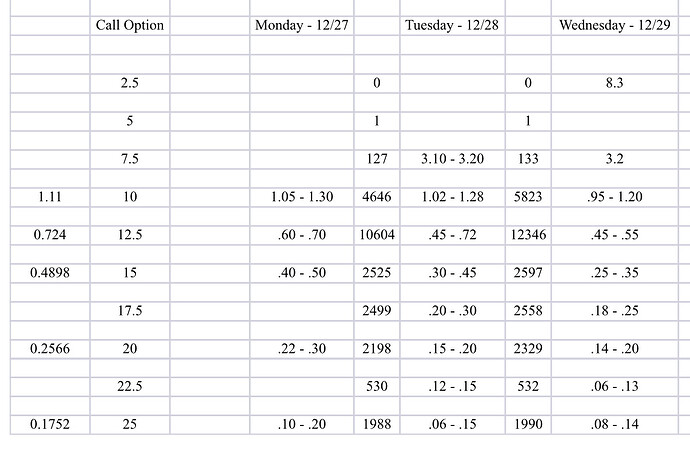

Been tracking daily spreads on calls this week, has helped me with entires all week and wanted to share as I thought some members might find this helpful.

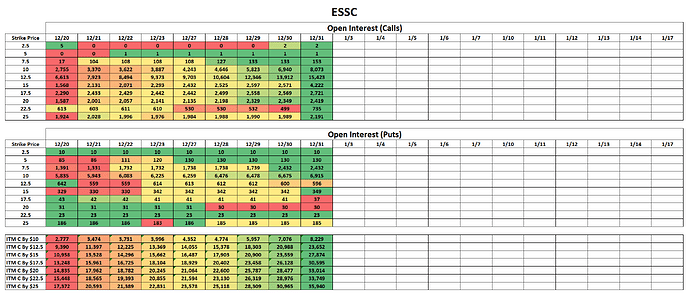

This is a fairly rapid increase in ITM OI (referring to the jump from 39% to 47% of float overnight). I’ve been keeping an eye on sentiment and it is slowly but surely starting to turn around heading into January. We’ve seen some bits of your typical “short squeeze” mumblings but I think the more compelling bit will be announcements surrounding the meeting and potential misconceptions about backstop investor’s need to buy shares at market.

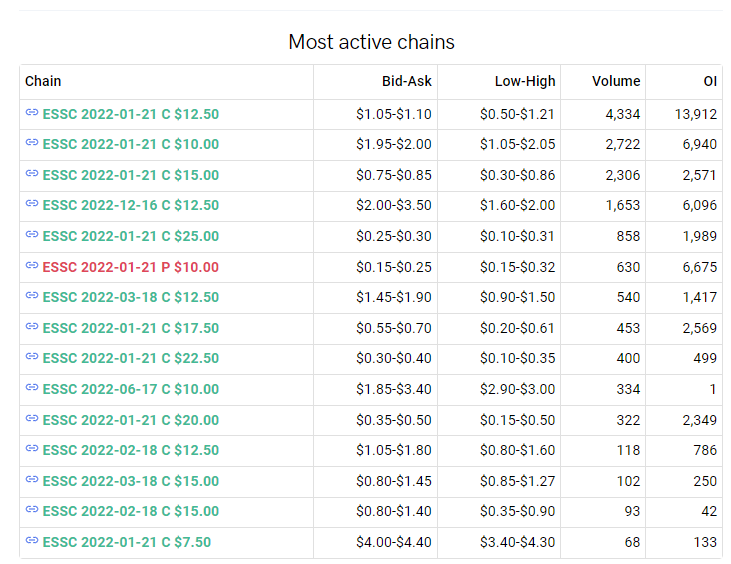

All of this is somewhat meaningless because being completely honest, the setup is doing what it needs to on it’s own. Day after day the stock creeps ever so slightly closer to breaking above $11. Should the current trend continue, we’ll be fast approaching the “flip” where market makers will forced to face the extremely high amount of undoubtedly unhedged OI on the 12.5 strike call options.

We’re nearing a place where we’d be willing to call a coming squeeze. Speaking candidly it’s times like this that always made wonder what the hell the rest of the Reddit “analyst” community is doing. Drawing a comparison, when we came across IRNT, we were blown away that the same people who championed it initially (pennyether, repos39 and others) weren’t losing their minds over the setup that existed after the first AH run. I was even more surprised when they came out claiming that it “was over” as pennyether did in our first IRNT thread. Here’s a self-proclaimed “gamma expert” looking at a completely loaded chain with evidence of massive unwinding saying “nah, that’s not one”.

ESSC is probably one of the most primed squeezes in the market at the moment and Reddit is almost completely unaware that it exists. Almost a full year after GME and retail is not any better at this than they were then. Now, there is a chance that this pulls an AGC and nothing comes of it, but I would say that chance is objectively shrinking by the day.

Where I’m at with this play is that we’re seeing evidence of bullish positions that are potentially institutional in nature. OI accumulation has been picking up over the period of the last couple days and the underlying is trading more bullish. While we’re absolutely missing the match, the fuel is all there.

More soon.

Just for clarification, are these percentages using the “Chad” float, the “full” float, or the in between?

We’re using a float of 1.5M which is slightly higher than what the real float is believed to be factoring all current SEC filings.

Awesome, thanks Conq

moon* soon?

Some ESSC discussion on r/maxjustrisk: Reddit - Dive into anything

Exited today on the run up. Wish I could stay, but good luck boys.

Last time I exited this, it ran up to $28. May my undoing be in all of your favors.

Yesterday’s volume on the 15c was only 320. Today it’s 2,306. Expecting a large increase in OI for the 15c. This is also an important contributor to the gamma squeeze as we want the snowball effect of OTM strikes becoming ITM as the stock price goes up – Ideally the 15c buyers are not also rolling out of their ITM strikes. We’ll see tomorrow.

While the floor for the open market may be 10.26, for the backstop investors it is actually 10.41…

We have announced that we have entered into three Forward Share Purchase Agreements — one with Sea Otter Securities (“Sea Otter”) (the “Sea Otter Purchase Agreement”), one with Stichting Juridisch Eigendom Mint Tower Arbitrage Fund (“Mint Tower”) (the “Mint Tower Purchase Agreement”), and one with Glazer Special Opportunity Fund I, LP (“Glazer”) and Meteora Capital Partners, LP (“Meteora”, and together with Glazer, the “Principal Investors”), with Meteora on behalf of itself and its affiliated investment funds (which together with the Principal Investors are referred to as the “Glazer Investors” and, together with Sea Otter and Mint Tower, the “Backstop Investors”) (the “Glazer Purchase Agreement”) — which would provide that each of the Backstop Investors will not redeem shares that they each hold in connection with the Extension and the Business Combination and instead would each either hold such shares for a period of time following the consummation of the Business Combination, at which time they will each have the right to sell such shares to the Company at $10.41 per share, or will sell such shares on the open market during such time period at a market price of at least $10.26 per share.

https://www.sec.gov/Archives/edgar/data/1760683/000121390021058879/defr14a1121_eaststone.htm

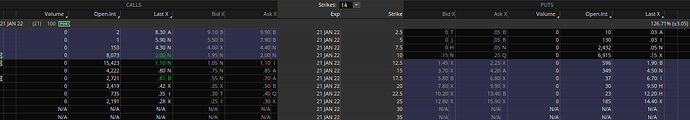

| Strike | OI | Change | %Change |

|---|---|---|---|

| 10c | 8073 | +1133 | +16.3% |

| 12.5c | 15423 | +1511 | +10.9% |

| 15c | 4222 | +1651 | +64.2% |

| 17.5c | 2569 | +152 | +5.9% |

| 20c | 2419 | +70 | +3% |

ITM OI is at 54.9% of float (up from 47%), the $12.50 bring it to 157.7% (up from 140%) and the whole chain is up to 239.6% (up from 190%)

Edit: Using 1.5M for the float.

ITM OI is up to 69% of the float, and adding OTM OI that is up to 301.8% of the float using the 1.191M figure

Wait there’s a $25 strike now?

Has always been there afaik but have just been posting up to 20c for the table that tracks changes.

The statements about total % of float have used the entire chain up to 25c.

Been there for the January expiration since like 12/10 iirc.

We’re watching OI accumulation continue to accelerate rapidly while the underlying continues its upward trajectory but holding the $11.50 support level. This is an organic movement which is pushing the stock towards a breaking point.