None of my business but asking for knowledge… why not NOT use the loss for 2021? If you end up losing still then just claim it in 2022? And if you end up making money then you only get taxed on overall profit?

I would guess the issue is that entering the position now would mean the loss can’t be used during 2021, so taxes might need to be paid on whatever loss was accounted for in 2021. Since the loss (in a wash sale) is then added to the cost basis in the new position, the taxes in 2022 would be reduced, if you did make money on it though. I guess it depends on what kind of numbers we are talking about here.

This is correct. However the issue was I entered the original play with gains prior in the year. My position in ESSC was a loss, but if I did not sell in 2021, I would have had to pay taxes on my gains, while holding a loss in ESSC.

There was no sure indication ESSC was going to move back into where it is today, I had to make a personal finance decision. Great play for the rest of you all though.

EDIT: To be clear, not exiting would have had me pay taxes on gains that no longer existed.

Yeah I can see that. It’s unfortunate that the end of the year creates that situation when normally the wash sale wouldn’t be an issue.

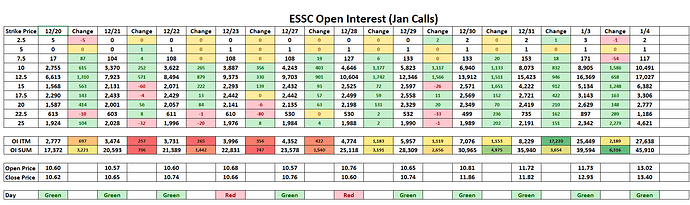

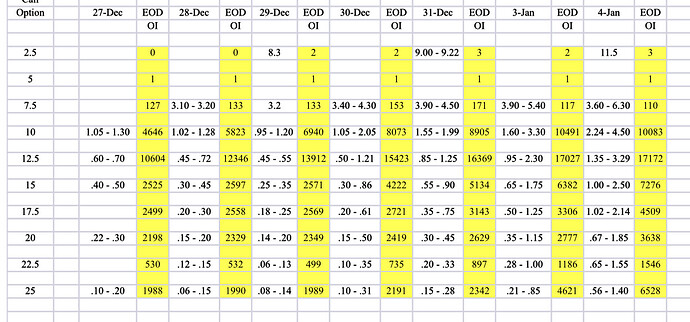

Updated my table a little bit.

Included the previous day changes into the table, also added tracking ITM and overall OI. Also just to see basic price of open/close I put that in also.

I like to see trends and this lets me see them easier. Hopefully this helps. If you think something could be better tweaked please let me know.

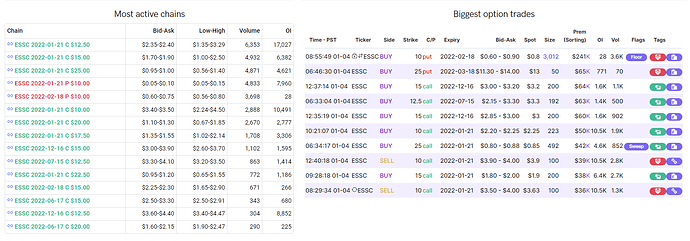

In the days after the big infamous drop from $26, ESSC options flow has been quite small, with most flow sizes being under $1K, and some flows over $1K but not really. In the last few days flows have been getting popular in the $1K to $10K range again.

Here is a summary of the most active chains today and Biggest Option Trades. Uniquely there is a large February 10p order of $241k size, which is a confirmed Buy To Open order. Not too sure what to make of that but here it is, for your information.

seems they would be expecting the price to fall post merger?

Noticed that too and posed this on the discord.

Jan and Feb $10 Puts. 3,012 contracts. Going through at the exact same time at 11:55:49AM. Was a Floor Trade. Not too sure what to make of it but it was odd seeing that type of volume on puts particularly at that strike.

Probably that they are very confident that both: a) the merger will go through before opex, and b) that the price will crater afterward.

b) will almost surely follow a), given the target. Assuming merger closes and ticker changes before opex (2/18) is probably the risky bit though - as far as I know, the date has not been announced.

One of the reasons I’ve been holding off on getting those puts. 2/18 opex leaves 6 more trading days to be on the wrong side of that put trade.

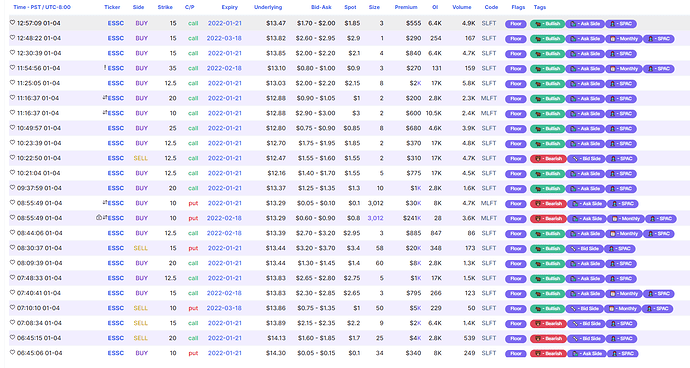

One more thing to add. It is interesting to see that similar to the December run, most Floor trades have been marked as Bullish. Below is a screenshot containing all Floor trades for the day. As noted by others, I agree the large February 10p flow could be a play on the aftermath of the run, which doesn’t necessarily mean that they are bearish on the actual squeeze (unless you think, “but why buy the puts now instead of farther up the squeeze?”), maybe because they actually understand what’s going on with the setup.

Perhaps one reason they could be buying the puts now is to benefit from an IV spike in the event that this does run.

We also haven’t seen much accumulation of OI on the december '22 strikes compared to the Jans. Adds credence to the idea that these are long positions and not hedging taking place.

On the topic of things we may not expect, going back to December we know about CBOE and their announcement about the options chain.

If I recall correctly the announcement was only in regards to existing strikes specifically.

We also know that the options chain extension for December and January was unsuccesful. BUT, the february and further chain was extended.

I recall there being theories that because during the time they were waiting on the administration of the extension the price dropped, they didn’t need the extension anymore. Since the February extension was succesful, I’d say this is not a possibilty, and december and january chain was not extended due to the low available float(as per CBOE). February potentially successful due to the planned business combination timeline being before opex, expanding float.

I’m bringing this up because based in prior experiences, our thinking of a gamma squeeze is reliant on the hypothesis that MMs win big by the effects of a chain extension. I find it highly likely that we will not see an extension for January.

I encourage the community to think about this possibility even if you don’t agree with the above, just to cover all bases.

My ideas on potential outcomes with this change:

-

They just need to buy to close options

In order for people to sell to close, price needs to go up, basically not changing much, hedging then repurchase what cannot be hedged due to float. Only difference is potentially they have a losing play in ESSC -

They hedge, run the price same as before, except relying on further February chain extension. In my head this would be the more bullish version as february options are more expensive, a further OTM strike is needed in order for retail to pile into.

Thoughts?

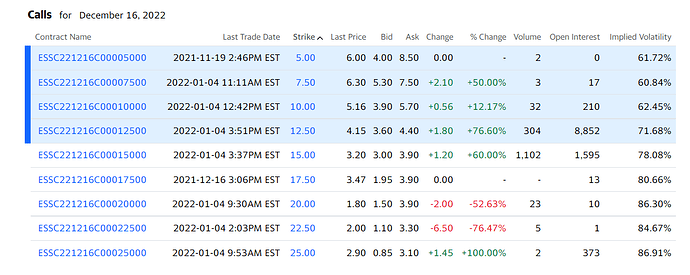

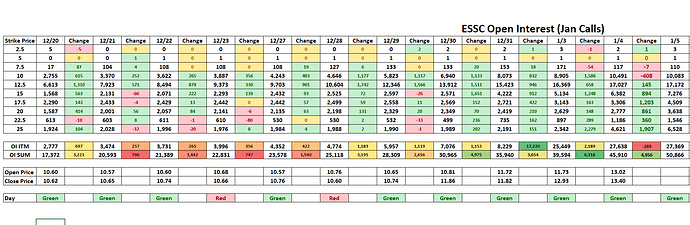

| Strike | OI | Change | %Change |

|---|---|---|---|

| 10c | 10083 | -408 | -3.9% |

| 12.5c | 17172 | +145 | +0.9% |

| 15c | 7276 | +894 | +14% |

| 17.5c | 4509 | +1203 | +36.4% |

| 20c | 3638 | +861 | +31% |

| 22.5c | 1546 | +360 | +30.4% |

| 25c | 6528 | +1907 | +41.3% |

ITM OI is at 182.5% of float (down from 184.3%), the $15 bring it to 231% of float (up from 226.8%) and the whole chain is up to 339.1% (up from 306.1%)

Using 1.5M for the float.

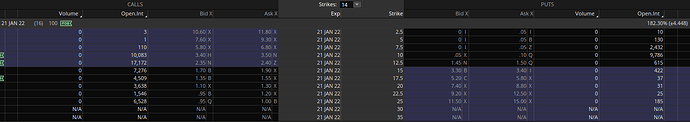

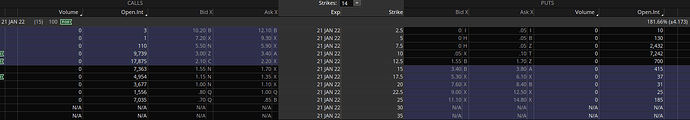

| Strike | OI | Change | %Change |

|---|---|---|---|

| 10c | 9739 | -344 | -3.4% |

| 12.5c | 17875 | +703 | +4.1% |

| 15c | 7363 | +87 | +1.2% |

| 17.5c | 4954 | +445 | +9.9% |

| 20c | 3677 | +39 | +1.1% |

| 22.5c | 1556 | +10 | +0.6% |

| 25c | 7035 | +507 | +7.8% |

ITM OI is at 184.9% of float (up from 182.5%), the $15 bring it to 233.9% of float (up from 231%) and the whole chain is up to 348.8% (up from 339.1%)

Using 1.5M for the float.

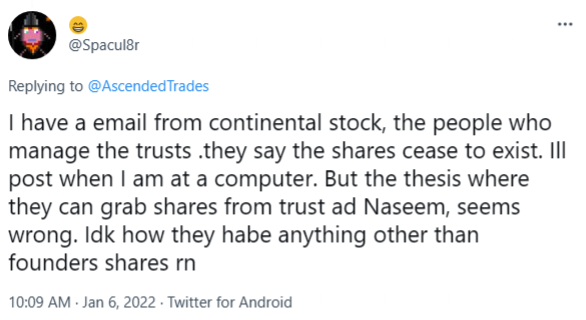

In regards to the below tweet:

If this is true, it means that SeaOtter could possibly have to reacquire ~900,000 shares at market before OpEx shrinking the float to 340,000K again. This isn’t vetted so take it with a grain of salt, and overall it’s only more fuel to the fire since this is already primed, but if it’s true it would mean that the chain on ESSC is 3X more loaded than IRNT right now, this far out of OpEx.

I can see this info on the twitter page but thought to post here too.

IF this is true, then when SeaOtter requires those 900k shares if we use the 340k float figure the OI numbers would look like this:

ITM OI would be at 815.5% of float, the $15 would bring it to 1032.1% of float and the whole chain would bring it up to 1538.6%.