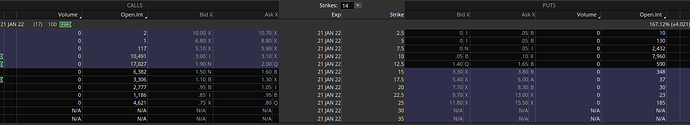

Volume is up across the chain, play is still looking good.

| Strike | OI | Change | %Change |

|---|---|---|---|

| 10c | 10491 | +1586 | +17.8% |

| 12.5c | 17027 | +658 | +4% |

| 15c | 6382 | +1248 | +24.3% |

| 17.5c | 3306 | +163 | +5.2% |

| 20c | 2777 | +148 | +5.6% |

| 22.5c | 1186 | +289 | +32.2% |

| 25c | 4621 | +2279 | +97.3% |

ITM OI is at 184.3% of float (up from 60.5%), the $15 bring it to 226.8% and the whole chain is up to 306.1% (up from 264%)

Using 1.5M for the float.

Omg this is an even bigger tome now.

13-14, I expect to see bigger candles here. 300k volume on the 15min or something like that.

16 is now a major resistance.

19 and 22 are after that.

Chasing after 19 is the riskiest.

Volume might catch you off-guard.

Expect bagholders to dump from time to time.

Thanks, can we also expect 26.25 to be a resistance as it was the ATH?

Psychologically, sure. This is where a large position sold off after all. Though I think this time around anyone with a large position is going to try and avoid making those sell offs occur, hopefully.

There’s going to be resistance all the way up I’m sure, but if it does break through the ATH, it could see that as support to shoot higher. It’s going to be volatile as usual, so impossible to know what will happen.

So then are we thinking MM’s will hedge sooner to prevent this from getting worse?

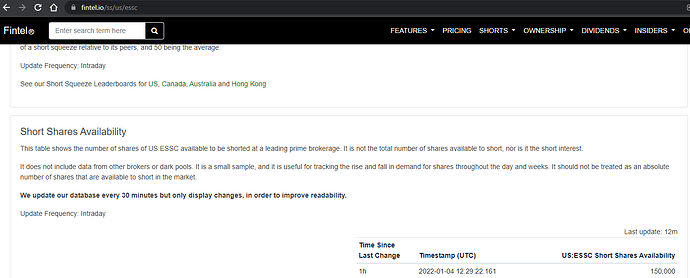

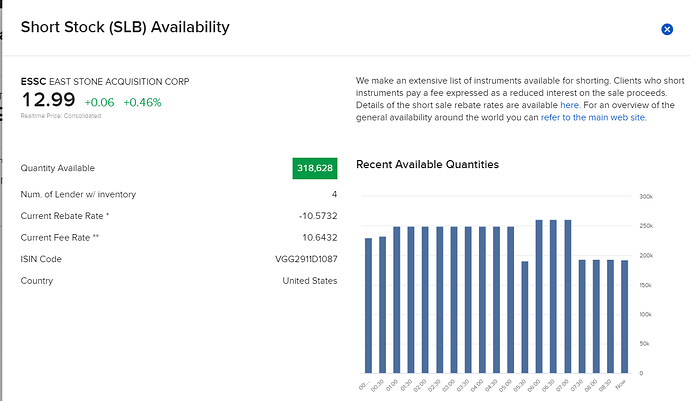

Would shorts available be able to impact the run this time? as far as I remember there were no shorts available at the time of the december run.

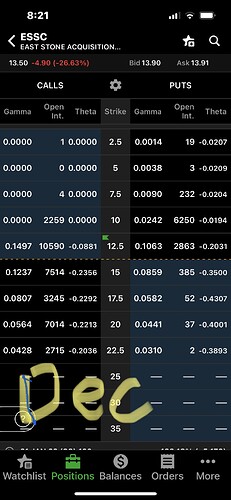

Back with another OI update comparing december (the week of opex) to where we are now 2.8 weeks out from opex… OI is seriously moving like crazy now. 10/12.5 strikes are getting bought in large amounts. Expecting this to continue as sentiment builds across the board until MMs decide to delta hedge. Godspeed gents

Here’s some VC updates Conq was relaying while discussing ESSC. had to sift through all the talk about shit and toilets sorry.

macromicrodick

![]() — Today at 2:03 PM

— Today at 2:03 PM

VC paraphrasing Conq (on ESSC trading sideways): more packed chain, more longer run. so more consolidation could be better in certain circumstances. but also in the squeezes that we looked at, time to expiration doesn’t really have a correlation. some happen days out and some happen weeks out. some don’t run right up to expiration. and most people will remember because you got to sit and watch them go worthless to expiry.

macromicrodick

![]() — Today at 2:06 PM

— Today at 2:06 PM

VC Conq: it can go anytime between now and then. if the play sits at $12.50 for the next few days, speaking just on gamma, you don’t want it to go quick. you want it to build up so it gives it enough to run. GME had several red days. IRNT had a red day. ESSC had an identical drop before it ran last time. don’t get too into your feelings about this, all this is basically meaningless. like right now the options flow is turning bullish again. we’ll either open up higher than yesterday or about even on OI.

VC Conq on ESSC update: all the flows for ESSC are coming in substantially more bullish and have been for a bit. so squeeze no squozed

VC Conq on ESSC server play: today was confirmation that what we’re doing is heading in the right direction. everyone’s entries are incredible. even with that knife today (Conq) had plenty of padding on his plays. SPAC plays near NAV are incredible. it just makes the plays feel so different. and we all had a calm day even with that run (dip)

VC Conq on server’s approach to ESSC: we just all have to work on overall being calm. when freak outs happen, everyone should do their best to remain as clam as possible instead of flooding chat. gives gods/mods a chance to respond too. so try to avoid the freaking out. we’re here to trade and that’s it. we take information as it comes and trade on it. as it gets closer to where these plays run. there are going to be more of these opportunities (SPAC plays). we’re already tracking one. and it’s imperative we get better, as a community, at playing this

VC Conq on the value of forums: today while ESSC was going, we had a ton of other plays being called out. which is phenomenal and what we want from this community. all of this is happening on the forum and we need to do better to force people there. it has all things we need to follow these plays and create a storyline for these plays. you can see developments, dumps, etc. there’s another play in Public Signals, just Conq, to start the play. overall we need to make sure everyone is using the forum. i.e. ILoveYou’s AMD play

VC Conq teasing ESSC post Feb. 16: there’s a potential for a play post-merger on ESSC. we’ll have to see. depends on what the unlocks are ![]()

VC Conq on continuation of SPAC plays (more reason not to FOMO): we have someone with experts in the field, and we are about 3 years out from any possible regulation on SPACS. so this party gonna be on for 3 more years.

VC Conq on the traditional gamma squeeze disconnect: there is a traditional thought on these things that create a confusion. the numbers always matter (delta/gamma/etc). but there are times when you just say “FUCK IT” and we’re trying to find those times when you hit FUCK IT. there are times when you are no longer hedging and can’t meet the shares you need so your only option is to run it. not “they don’t want it to hedge” but “they can’t hedge it.” these moves are purposeful. MM’s know what they’re doing and they let it run.

VC Conq on MM vulnerability: they’re not watching these things through sentiment . the chain tells them sentiment. on Reddit someone claimed “this makes MMs vulnerable”. they’re never vulnerable. MMs are making bank on these options run. they want it to run

VC question: would it not be a bad idea that while this runs, sell out OTM options but keep the ITM to keep pressure on it? Conq’s reply : my goal is to put people in the position where they NEVER need to hold. if you’re good with money/profit, take it and change your life with it. but today is an example where if you dumped at today’s candle you would have gotten the least for your options and then buy in at a higher price. the other part of the theory is that WE are not the one moving this. IRNT, for example, had DEEP ITM calls, so when it ran the first time penny/retail called it was over. so retail was out but OI remained. so who was the OI? it wasn’t retail. at the end of the day it was either BIG MONEY or INSTITUTIONS. so Conq’s not conviced the start of these isn’t institutions. so people should feel free to sell and fuck it.

Thanks for the transcripts, really helpful. Y’all are doing amazing work.

anytime! got to do this while i still can and life gets busy! here’s one last post on Conq in VC;

VC Conq end of day roundup: heading into the end of the day, ESSC is back up above where it was. good time to say if people haven’t taken care of their cost basis, go to a profit calculator, plug in your options, map out what would it take to cover your cost basis and know how many you have to cut to cover your cost…do it when you feel like it. but end of the day, the play is still on. right now, tapping on 14, still better than IRNT. worst case we open up with similar OI tomorrow. more likely we open with more OI. last time, people held positions they were uncomfortable with and when it ran, they sold into market (at the bid) and it created a dump (some with large positions) and when large positions dump it obliterates the chain. so when they cut the stock came down. and it was holding above 20 and then caddouche fucked it all up with his dumbass tweet. confident internally that’s not gonna happen (tagging the whales) where it shouldn’t happen. no sell-signal rules also helps. also, the play is better this time around there’s more OI and safer price points so we should have longevity. and to be clear we love our whales

So Conq re: selling into market. Doesn’t really apply to me I don’t think, but are you saying everyone should be selling through Limit Orders? I’ve been doing that anyway to practice patience on buy-ins, but if it’s better for the plays overall I’ll continue to do so all the time

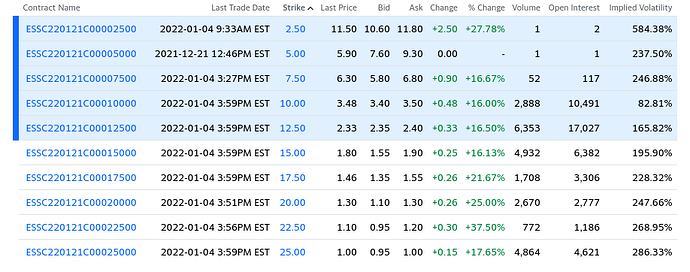

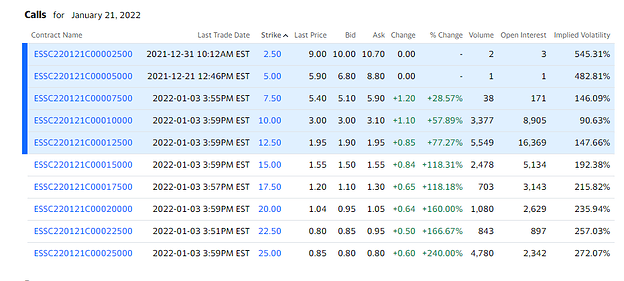

Seeing a nice increase in option volume as well as shares. As expected we are seeing the 12.5/15s accumulate a lot more volume.

Share volume has increased from previous day 982k → 1.345m.

Today’s option volume:

Previous Day:

Clearly I was holding this back. Luckily I can’t rejoin due to wash sales. Movement looks incredibly bullish, but can’t hate on people taking profits. If you entered sometime last week you’d be up nearly 1500% on some options.

Here’s the response from Hoss. Maybe need Thots to interpret:

Hoss — Today at 4:31 PM

— Today at 4:31 PM

Market orders are for when that black swan shows up at your front door with a Mossberg. Market orders in periods of low liquidity and wider spreads; you will be relieved of your face in a timely manner. Limit, walk it in if things are dire.

Why can’t you rejoin due to wash sales?

Using a market order for a couple of contracts is fine. Using market orders to buy or sell hundreds of contracts (at least for this stock) means you are going to blow out the order book and cost yourself a lot of money.

I took this loss for 2021 as you cannot carry back losses as an individual and holding it for 1/21s was too risky. I can’t re-enter a trade involving this security for 30 days or it will be a wash sale and it has more than tripled in price so the risk is too high for me.