That’s some solid detective work, I don’t think that changes the conditions of the actual stock though? He probably is a filthy P&D guy, just be vigilant and make sure you’re on the P side and not the D side.

Damn dude, that’s some serious digging! I agree that although his positions could be sus, and even if it was initially a PnD, it has gotten to be much more than that with where the OI has grown to.

I also want to say, I prefer to be on the P side and not the D side. And not just with trading.

I think it’s an obvious PnD. However, looking at IRNT, it pumped and dumped. Many people earned their month’s paycheck or more. Reddit was a volume train for new passengers to ride that IRNT coaster which hopefully happens with ESSC (ITM options). I even found this group from Conq’s reddit post on WSB. Still bullish on this one, just need to be mindful of when to exit the ride.

This DD author on reddit for ESSC has still yet to screenshot his positions but this play seems valid so far.

LMAO I can’t believe you figured that out (assuming it’s true)

I mean people lie on the internet all the time, especially about the money. I understand where you’re coming from with that being shady but I believe Conqueror confirmed the float to be what the DD claims.

It is a good bet most Reddit DDs are pump and dumps. Wahoowa is correct Conquerer gave the play a green light, but as a disclaimer you should know by now, any play could drop off. Looks like the play has already been profitable for some of us, I hope it keeps making us all money! Know your risk tolerance and always take profits. I’m in until next week.

This is just what market making is, buying and selling the spread.

I’m always wary of stuff I see on reddit or anywhere really. I like to be skeptical and always fact check.

Especially in certain reddits there are plenty of folks who PnD. So its just merely looking into post history, if you look at the dude’s post history, prior to his ESSC, he doesn’t have that many other posts. I think the oldest post I saw was 8 or 9 months ago.

He suddenly got to be super active within the last 2 weeks and he has been mega active on spreading the word on ESSC.

I’ll reiterate that I don’t disagree with the current setup and how it could be another gamma squeeze. I looked in the SEC filings through 8-Ks and others to verify the lockups, redeemed, ipo amount, etc… It is just that the reddit dude seems to try to instill “confidence” in the play by over-hyping his position.

I’m personally in the play myself but I always look for counter points to see if I can poke holes in my own confidence for the stock. Never good to be in an echo chamber.

Agreed, we try and avoid the hive mind at all costs but after all the research if you’re still in, then it’s a solid play. I took enough profits to cover my current position, which I’m holding. Once those 15c’s are in the money… LOOKOUT

Option chain expanded to 22.5. Seem like they want retail to leg up on otm calls to die this down. Uneducated assumption.

Was about to post this, thanks. January expiration up to 25s

I don’t see those yet, but it’s only one extra strike so far?

You sure? It’s $22.5s for 12/17 and up to $25 for Jans… happy not to see much volume on those as of this moment though!

There is only one strike added to the 12/17s, a $22.50.

With these plays there is always an origination point where someone is pointing to something with potential but without fuel. This isn’t necessarily nefarious, but the following step is absolutely fuel, which means generating sentiment (you add fuel by pumping it of course). But after that, you are left with a legitimate play.

Our thing is that we only take part in things that have potential and are already fueled. IRNT was amazing because the setup already existed, we were just along for the ride.

Appreciate the digging. We definitely don’t take anything from Reddit at face value, which is why I personally go through SEC filings to sort out what is and isn’t true.

Ah not showing up for me yet on ToS, probably need to restart.

Offering a brief update ahead of close. We’re still bullish on this and I personally will be holding my position through the weekend. The OI is still stacking and we’re seeing what we’d want to see in a stock that is prepping to run most likely in the early part of next week.

Don’t get overleveraged. This is still a watch, not an active squeeze.

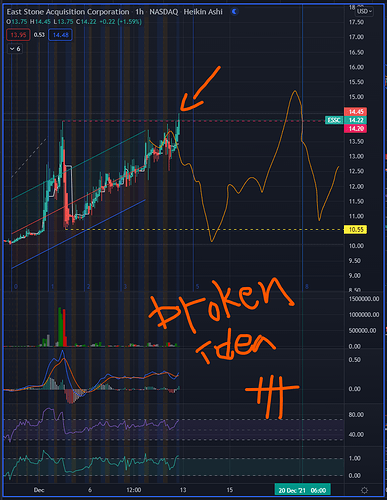

OK, here’s the update to my 1st idea above…

As you can see, it miraculously tracked well yesterday and earlier this morning–I wasn’t counting on that.

You’ll note how it’s now poking above the pink resistance line, and that makes me happy.

When I was posting to the threads that night I was fighting the shivers and was not calm.

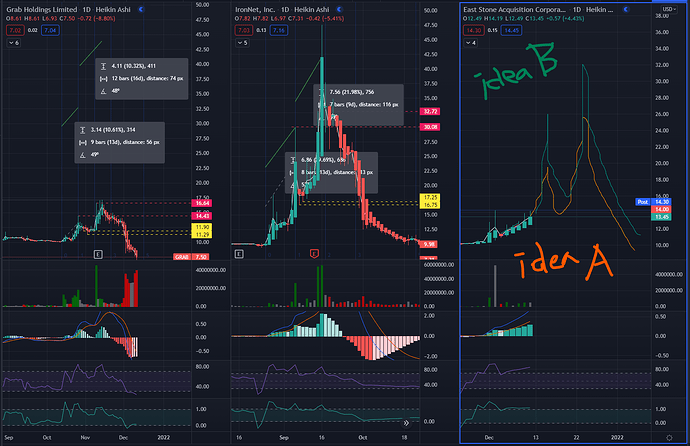

I forgot to post the 2nd idea.

Here it is…

AGC to the left, little sentiment and bad news about GRAB during those weeks.

IRNT, good sentiment and good news around IronNet during that time.

ESSC at the right, developing sentiment, no bad news.

- PT? I can’t give any, for various mathematical reasons. None of which I know how to solve. kek

- Do notice ESSC moves slow intraday and spikes in PreM–keep that in mind with your chosen strategy.

- Personally, near / at peak, I will be selling my Contracts first, then slowly cut my shares.

I have added a couple of layers to my way of reading the charts and I get to understand things faster.

If it pops as high as expected, the call to end the play will be easy.

If it pops a different way, I can help point out the support as possible re-entry for a possible continuation.

It’s a progress and I’ve been testing it out on a lot of tickers everyday. It’s good. For me it’s good.

Why are you comparing ESSC to AGC?

Besides the fact that they’re both SPACs, AGC had nothing comparative to ESSC as far as a gamma play goes.

Market watch is showing the SI on this at 85k. Anyone confirm ths on Ortex?