How long do you have to own the shares to redeem them?

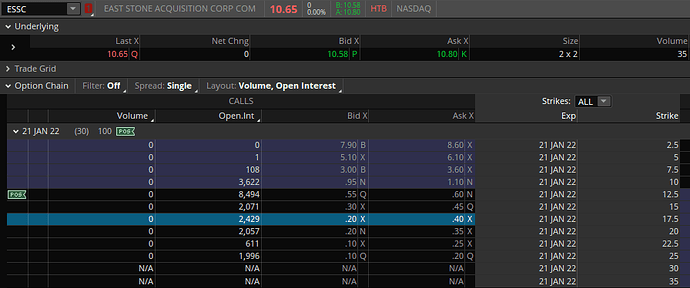

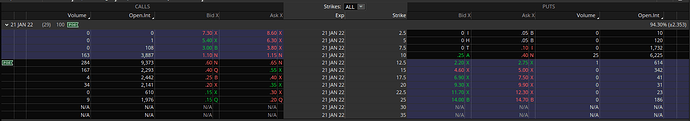

Current ITM OI is currently at 23% (up from 18%) of float with the $12.50 adding enough OI to push it up to 75% (up from 63%). The full chain is currently sitting at 137% (up from 115%) of float in total above the $25 strike.

This one is continuing to consolidate and accumulate OI on the chain. A run is far more likely today that it was yesterday and there is no indication that the accumulation would cease considering it’s piling onto the chain while the underlying is trading near it’s theoretical “NAV floor”. While it’s possible that ESSC drops below this floor, it’s not likely that it would hold under the floor for an expended period of time making buyers feel more comfortable buying this this specific area.

Continuing to watch this one. I would think some upward movement is either expected later today or tomorrow.

This is a good entry point if you’re looking to make one.

literally, just did fingers crossed.

wish i could but don’t have funds EDIT: yet

Welp scared money don’t make no money. Back in for a bunch of shares and calls. Thanks for the updates. Let’s run it back

Thinking of picking up more Jan 12.5s

In with Jan 12.5 let’s do it again.

I was considering joining back up for round 2, but I’m concerned about the wash sale rules. I really want to use that loss on my December (and a few 25c January) calls to offset other gains. Best I can tell from research is that buying January calls now MAY make it a wash. Score one for ambiguity in the tax code.

It would be a wash sale if you buy it back in 30 days after selling, so Jan 21 calls would be a wash sale.

I’ll be looking for a pushback up this week and if not I will be taking the loss.

look for entries below 1.00 on the 10s, ideally as close to .75 as you can get. I highly doubt it will dip much lower than that, but you can also park a limit order to catch it just in case. I think as ESSC gains more visibility it will become increasingly harder to snag those entries, as more and more people place orders there.

the reality is that ESSC is trading near the NAV floor, and the current value of the options pales in comparison to the expected returns the run in January will bring.

That said, even if you struggle to find an entry below 1.00 do not fret, the gains will come. Just be patient.

Hoooo boy.

Kryptek pointed out in VC this morning some glaring pricing discrepancies with ESSC puts. basically, you can sell puts on the 12.5s and even if you get assigned you would be make profits. But Kevin believes that others have already noticed another “market inefficiency” that Kryptek has recognized:

https://discord.com/channels/832633555309166633/846739018228957224/923234340106797136

Here we go again! Better mindsets moving forward here. Got a limit parked for 10’s. Might look into 12.5’s later but gotta build the chain from the bottom up. Thanks for the insights gang!

Today ITM OI is at 25% (up from 23%), the $12.50 brings it to 81% (up from 75%), and the whole chain is up to 142% (up from 137%).

Still seeing accumulation across the board, expecting tomorrow to continue this trend probably to a greater extent.

is there any reason why MMs can’t hedge in smaller, spread-out, buy orders throughout the day? i’m just thinking back to the run-up…even with 10x of the float in ITM OI (don’t remember the exact number), volume was 22M at peak day which easily dwarfs 3.3M. i guess i’m asking why we were sure hedging hadn’t been happening during the run-up

With the amount of volume we saw that Tuesday, I am sure hedging was part of the run-up. And even though it is low float, the float can be traded many times over with retail consistently exchanging (buying/selling) shares.

I’m guessing some of the run-up on the price prior from low 10’s to the teen’s before the Tuesday where we saw big movement was hedging just on a smaller and more gradual scale.