Polestar

There are many EV companies out there today and as we all know, these manufacturers are usually highly overvalued (Tesla). Polestar if anything is undervalued and here is why.

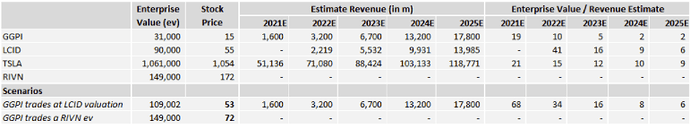

Lucid right now has a market cap of 72 billion and delivered its first car last month and has 13,000 orders.

Rivian will IPO tomorrow and will have a market cap of about 65 billion with 42 deliveries and 150,000 orders.

Polestar plans to have a 20 billion market cap and while this might make you skittish comparing it to others you should know they have made and delivered 10,000 cars in 2020 and are on track to deliver 29,000 cars this year. Polestar expects to deliver at least 290,000 cars a year by 2025 and already has started to outsell Tesla with Polestar 2s in Sweden and Norway. Polestar is backed by Geely and Volvo and this means it already has the infrastructure to ramp up production which is exactly what it will do when it starts to produce the Polestar 3 (an SUV) in a South Carolina Volvo factory. Polestar had revenue of over 600 million in 2020 and plans to reach 1.5 billion revenue next year. Polestar is in 14 countries right now and plans to be in 30 by 2023.

Polestar’s lineup consists of the Polestar 1 which is a sports car, the Polestar 2 a sedan, and the Polestar 3 an SUV. The 2 is the cheapest starting at 44,000 and is the one that is starting to surpass Tesla in northern Europe. The 2 is built in a factory in China where it has already made thousands of units.

We all know the stupidity of Nikola rolling semis down a hill, Elon tanking his stock with a tweet, and Lucid having a higher market cap than FedEx. Polestar isn’t like that, it doesn’t have dreams it has foundations. Polestar is putting itself in a position to dominate in Europe and spread into America and has years of making and delivering EVs. It is not the classic hyped EV company it’s real value. Polestar has already had a 600 million investment from Volvo, an investment of unknown size from Leonardo Decaprio (he can be the Elon of Polestar), and 1.05 billion from the merger.

The Polestar 2

GGPI - The SPAC

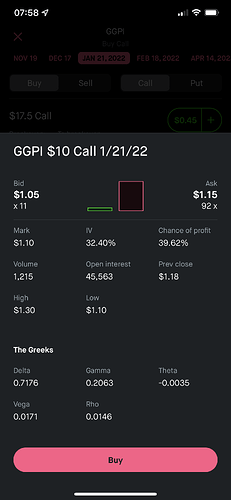

I would not be writing all this if we didn’t have a chance of making money off Polestar but thanks to GGPI the odds increase. Polestar on its own website says they plan to merge with GGPI in the first half of 2022 and that does mean this could be a long wait but looking at the setup I think it will be worth it.

Right now GGPI has a free float of 78.92 million and a short interest of only 3% of free float which is a 24 million dollar position that’s currently down 9.41%. What has drawn my attention to GGPI more than anything else is this.

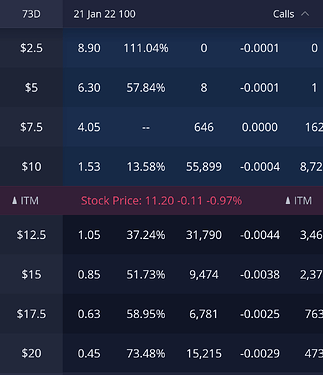

OI in the third row

GGPI already has over a hundred thousand OI on the January chain and almost half of that is itm already. Nov 19 has about 60,000 OI of which 29,000 is itm, Dec 17th has 40,000 OI of which 16,000 is itm, and April 14th has 16,000 OI of which 7,000 is itm. This merger has no confirmed date other than being in early 2022 so we do not know if there will ever be a chance for this all to be set off but over the last few days the OI has been increasing and is getting to be massive.

If lockups are high and keep the float low and the OI stays this stock could be a gamma squeeze one day, it may not be ready just yet but the fundamental value of polestar and the investments fueling the laid out and realistic plans of growth could make this one of the best EV stocks on the market and interesting deSPAC play.

This could take weeks to months to play out, news about the merger can drop at any time as was seen with AGC today. The timeline is unclear but the reality of Polestar is that it is in my opinion a great investment.