Okie Dokie. Tinfoil (Dunce cap) hat on. I’ve found the DD that best explains the multiple bull cycles we’ve seen since the Jan 2021 Gamma + short squeeze.

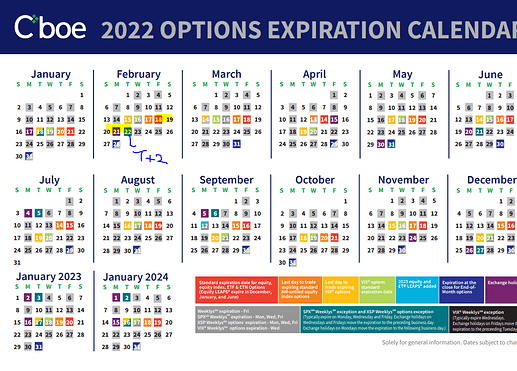

I’m bringing this up as the next run-up date is February 22nd. (Next Tuesday). …yea yea yea I know it’s another date.,…

The replies above simply attribute the current price action to the earnings run-ups. Not sure about this given next earnings is sometime in March (?). Not sure if run can be defined as an ER run-up given the time to. Also see the previous ER’s and respective run-ups (or lack thereof) below.

Disclaimer: I say best explains, but I just barely understand it lol. I’m a bit of a smooth brain myself and don’t have a position in this yet… The exact days predicted thus far have been pretty accurate. So if anything, just watch it and see how it plays out. Also note: Not sure how this will play out given current market conditions.

DD links (Web archive - 15th November)

$GME & Evidence of predictable cycles - GME Explained Part #1

$GME & Evidence of predictable cycles - GME Explained Part #2

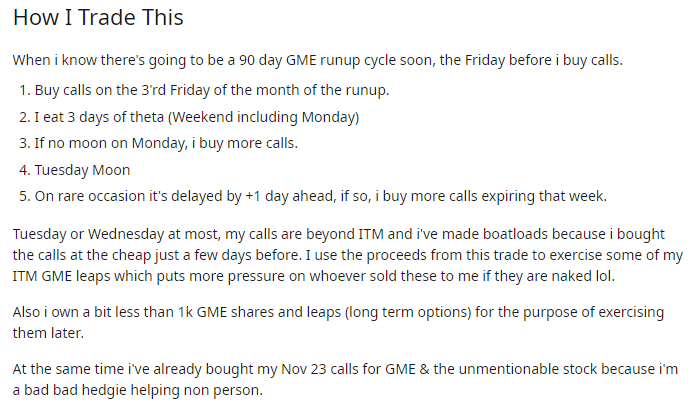

Extracts from the DD (Only presenting those relating to (1). Best to read it in full).

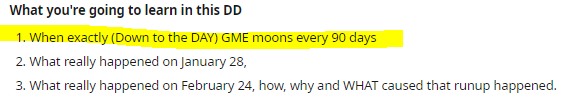

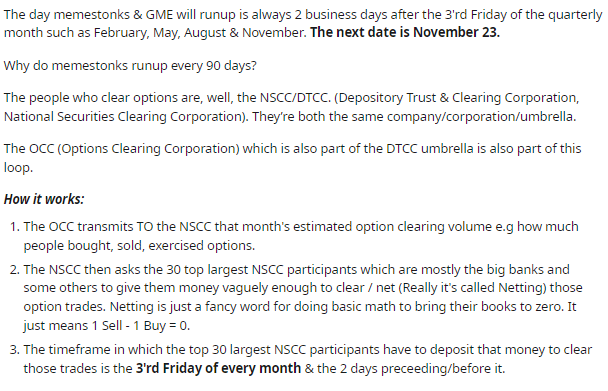

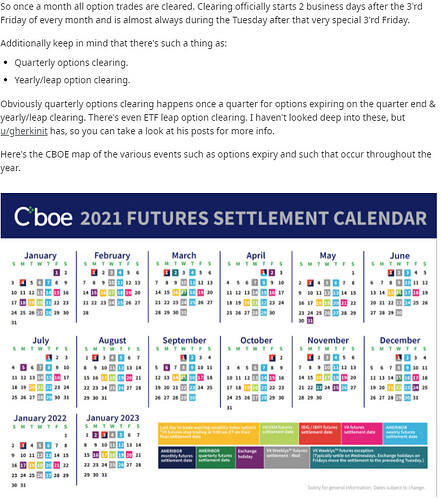

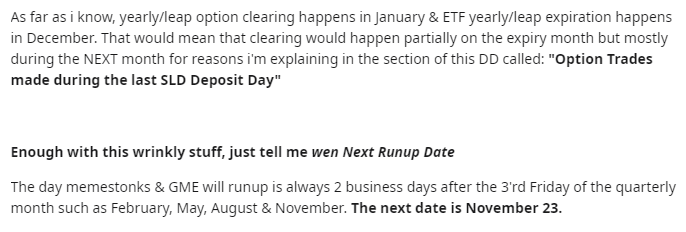

(1) Why do memestonks runup every 90 days?

(2) Finding the Month of a GME cycle

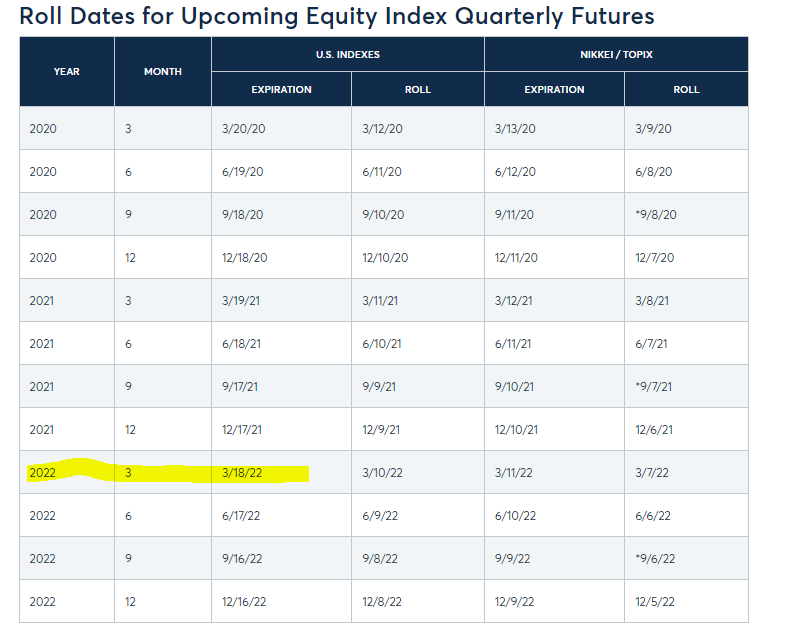

(1) https://www.cmegroup.com/trading/equity-index/rolldates.html

(3) Finding the EXACT Day of a GME runup Cycle

(4) Previous Run-ups

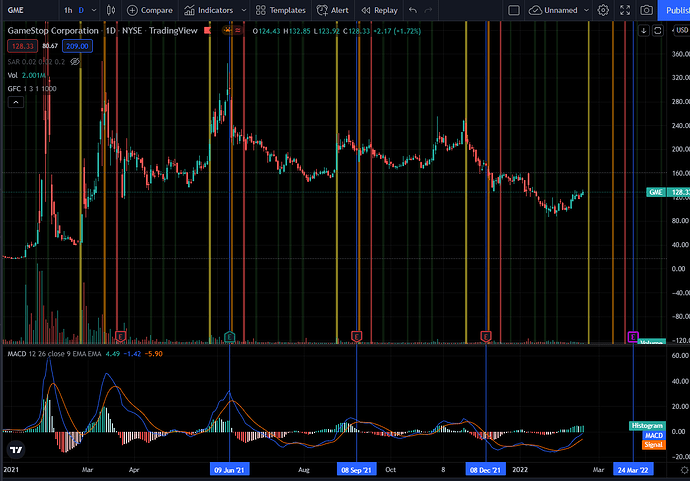

Gherkinit (superstonk contributer) along with others have also discovered this cycle and has a Tradingview community script for this. The yellow bars are the days predicted as per above.

Gherkinit’s DD is referenced in the DD linked above. Read into it to understand meaning behind the other bars. This is an alternative to the original DD linked.

I’m only interested in the main spike run-up days… Looks pretty interesting right?

The Reddit account has since been deleted.

Friday is upon us. I might grab one call. We’ll see.

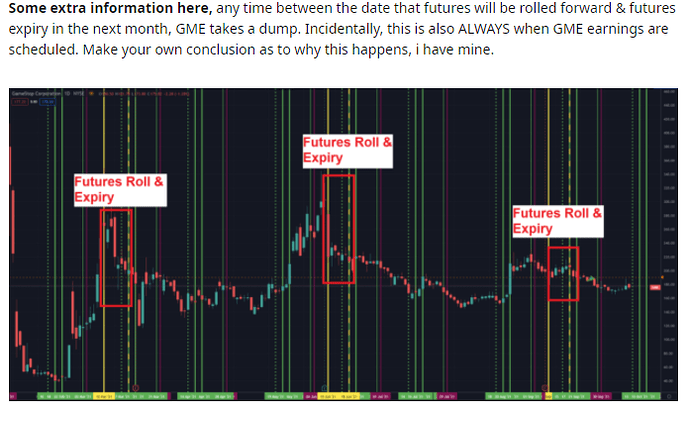

Price action after the main run-up day

Note: Chart from DD linked, not Gherkinit’s one.

I’d recommend reading the DD linked to better understand this.

Cheers,