Continuing the discussion from AMC & GME Analysis:

01/20

01/21

01/22

01/25

01/26

01/27

01/28

01/29

I know it’s a little early, but besides the shorts being under water, if this momentum continues and we get a good close tomorrow, this has a chance to trigger a gamma squeeze, yea?

It’s definitely something to consider.

I don’t think it’d be a gamma squeeze as in something like what we saw in Jan 2021, but gamma from all the sudden calls becoming ITM as well as new FD buyers should contribute to the upward move similar to when NVDA had its 10% day.

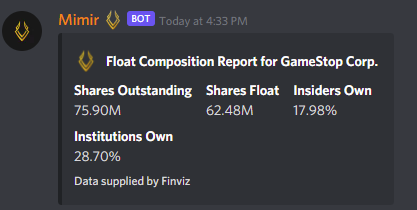

The float is 62.48M

Recent volume has been 10M to 16M per day.

If GME opens at $200 that adds 23,826 OI ITM, which is a hedging pressure of up to 2,382,600 shares assuming a max delta of 1.0. We also don’t know much of it was Sell To Open. Regardless, I think the new ITM call pressure, de-hedging of puts going from ITM to OTM, plus new call smashing should help an upward move.

Posting link.here for those interested about the “dividend” split, as there were questions in trading floor. Obviously we will learn and post more as this develops. Remember the server is riding sentiment and squeeze potential, not long term holding so do so at your own risk.

https://www.thestreet.com/.amp/investing/gamestop-plans-a-stock-split-shares-soar