This thread is being created within the “Asgard” category (formerly known as UpperCrust) so that the Asgardians (Legends & Champions) can provide analysis on these movements without additional clutter.

So offering my two cents heading into power hour; these movements are pretty standard for “squeezes”. Not I’m not talking about #itshappening type stuff here, I’m talking about this is how it looks when retail is actively pushing a stock and sentiment is building.

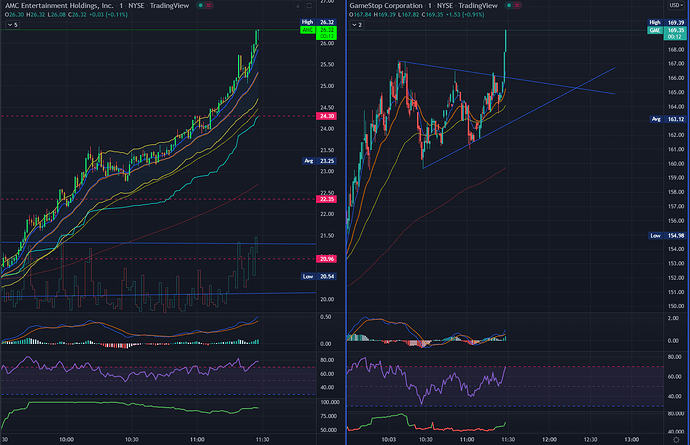

GME

GME is currently trading very similarly to how it did in early January of last year. You have to realize that these movements aren’t indicative of anything quite yet. The sentiment needs to hold and the buying pressure needs to keep coming. GME as predicted is trading slightly less bullish than AMC given the differences in pricing. AMC has been the constant pick for me in these runs and this one will be no different. If GME runs, AMC will probably run too so why not pick the one that retail can move with greater ease.

AMC

AMC is trading somewhat unusually. It’s keeping both its SPY correlation and correlation to GME to the bullish end. This is great when one or the other are actively going up because AMC seems to at least hold, however, in the event they’re both going down, AMC would likely fall pretty rapidly.

Of the two, GME is currently the better squeeze. Shorts are not underwater enough yet, but should they become so, you’d trigger a squeeze. The SI is enough and the DTC is high enough. However, GME options are super expensive and you’re probably going to get kinda the same thing with AMC. AMC shorts aren’t underwater at all yet, however, if this bullish correlation keeps up, they will be pretty fast. So while GME is running out of steam, AMC very likely would keep going.

This is all super hypothetical but I’m calling it as I see it. While I’m not overjoyed that these are making a return, it’d be a disservice to not offer analysis on what we’re seeing considering we’re probably some of the most experienced individuals when it comes to things that there are.

I’m currently holding my one call overnight, I plan to probably add one more before close. GME has potential for a slight post market jog and AMC would probably follow same as yesterday. A “squeeze” here would be somewhat of a surprise.

I’m holding only two three options overnight tonight. The reason for this is two-fold. First off, the overnight holds weren’t really that important during my 6.7K to 1.1M run on AMC. Only one of them was crazy profitable and it was the very last one. Secondly I’d rather hold light overnight and have plenty of ammo to average in or trade something else tomorrow should this be over and knife than to hold heavy and be caught off-guard.

So while the overnights seem appealing, its not really a necessity. A dump into close isn’t unprecedented for one of these runs so I wouldn’t be too worried if we got one, but I’m happier having gotten my full position near support rather than regretting now having taken it later on if it runs.

We saw both AMC & GME come down in AH last night and that bearish momentum continued into open. GME looks to have at least temporarily found a bottom and AMC is currently tracking SPY pretty closely. Nothing major to report on either front. Holding the calls I currently have but not really interested in adding to the position at this juncture.

Dropped my AMC position. Its lost pretty important strikes and GME is incredibly weak at the moment. AMC could do AMC things here but I’d just collect another position when it turned bullish again.

Watching GME pretty closely now and into next week, it’s fast approaching squeeze territory.

Should AMC hold over 19, it might just keep tracking with GME’s bullish momentum…

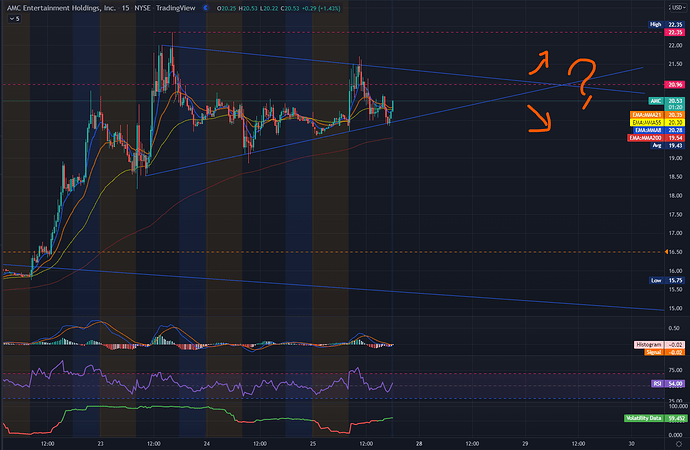

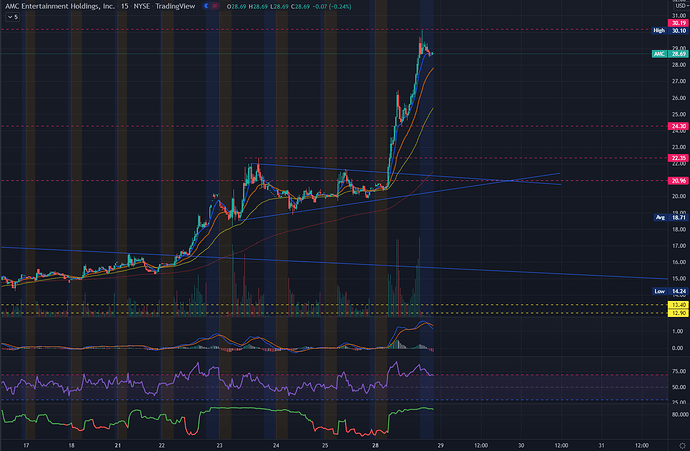

Breaking that 22.35 resistance will be a sweet deal.

AMC & GME are currently exhibiting 1:1 SPY correlation.

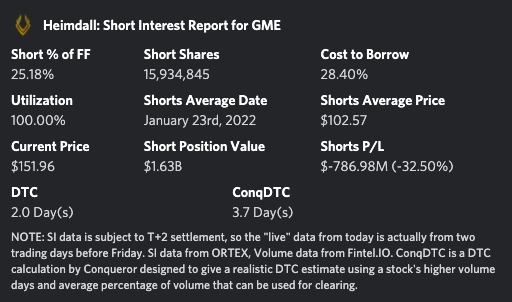

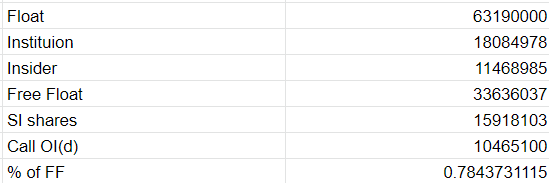

Here’s the situation with GME:

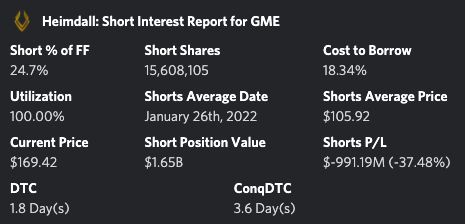

You’ve got 25% SI which from memory is the highest it’s been since being cleared in January of last year, they’re currently down 32% on this investment on average and past performance indicates that around 40% down you’ll trigger substantial clearing. Looking at traditional DTC you’ve got 2.0 which means it would take over 2 days to clear the position if they had to, however, looking at my DTC calc, it would actually take about 4 days using the volumes and the average % that can be used for clearing.

In short this is the closest that this stock has been to a short squeeze since January of 2021.

If you’re allergic to these, don’t play it, it’s a gamble, it could fall of the face of the earth here… but if it doesn’t… it could run.

This is what we have on the 15min candles…

AMC either breaks down or rockets upward along with GME on Tuesday (if GME does break further up).

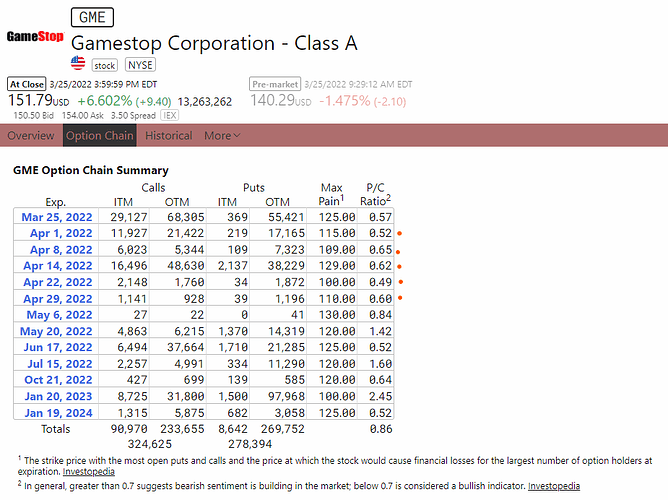

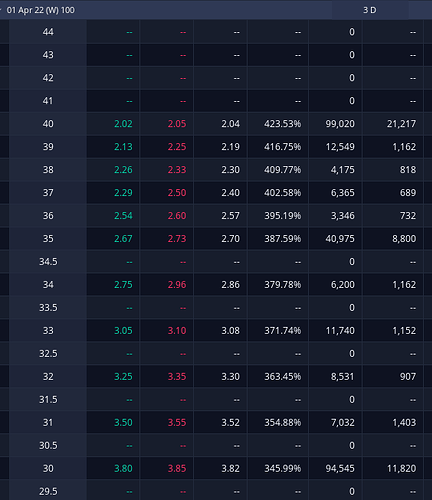

GME’s chain for next week remains bullish…

I’d take caution though, since this data from chartexchange is probably 1-2 days late.

AMC’s chain is even more bullish at the 22April opex and beyond…

Unless there’s really crazy news this weekend that’s not been accounted for, I think there’s a good chance for a run to the 24-25 channel.

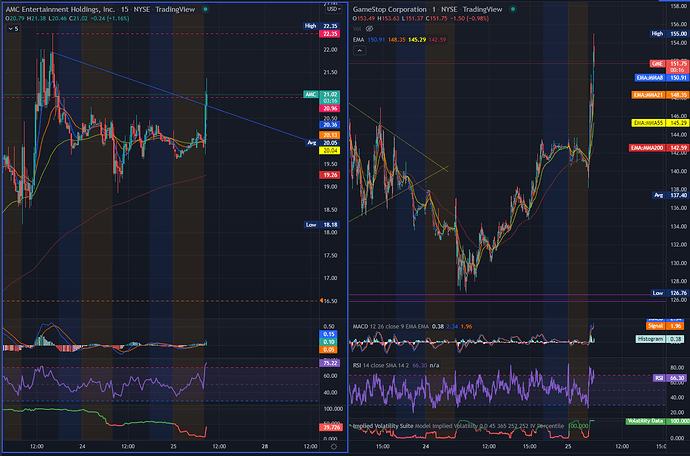

Here’s the broader picture on both tickers…

AMC is the orange line, of course.

At some point, GME will rocket further and out of this link.

AMC will have its own run after that.

*Note that recent gap on GME–it will come back to cover it later.

*This is probably my final contribution for this momentum, all we can do now is watch and exit wisely.

OI(d) is approximate since it is based on the numbers at open. Also put side OI is not included here.

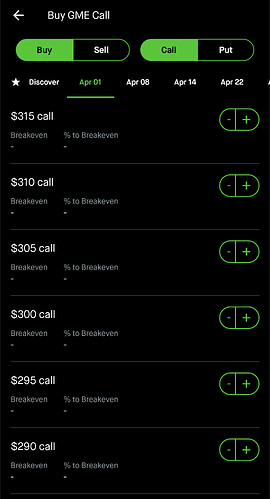

Could be old news, but it looks like Robinhood at least has the chain extended out to 315 on the weeklies for most expirations.

Not seeing the same in Webull currently. Not sure if other brokers can check their end.

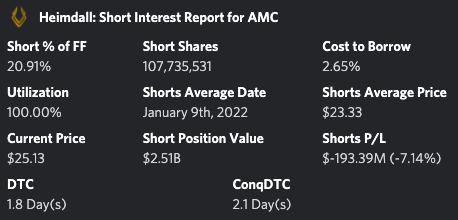

Everything is moving as we’d expect for one of these sentiment runs. AMC is currently taking the lead which isn’t too surprising given price points, however, GME is steadily putting more and more shorts in the red. A margin call on at least some of them is probably not too far off should the trend continue. Margin calls would be issued after hours.

Explaining my positioning on AMC, I’m currently working into a position of $40 strikes. IF AMC were to run, retail would FOMO into the $40 strikes and make them the most profitable option to be holding. Now, this is a LOTTO, they’ll also run to worthless a lot faster than anything else. So the position I’m taking will be small and collected over time to make sure my cost basis isn’t too far off from the active trading price.

It’s still generally advised that if you’re playing AMC alongside the challenge, you take as close to ITM as you can reasonably afford.

Late day update, all is well. Both stocks are exhibiting what we used to call “squeeze trends”, which I’m now pretty confident were just morning FOMO rolling into SPY correlation in the later day. GME shorts on average are currently at -37% and DTC is sitting at 3.6 Days. It’s ripe for a short squeeze. This doesn’t mean you’ll get it, it just means that all the criteria have been “technically” been met at this point. The price needs to hold and the uptrend has to maintain:

AMC shorts have crossed into the negative threshold as well with a DTC of 2.1 days and an average loss of 7%:

In the best case, fairy tale scenario, GME squeeze related upward pressure causes AMC sympathy movements that trigger an AMC squeeze. This is a dream, could it technically happen? Yes. Will it? There’s no way of knowing.

I’ll probably be holding my positions here and will continue to watch closely for any deviations from what we’d expect.

It is currently my opinion that they’ll run. That can change and I’ve been wrong before. Before you YOLO based on that think back to your ESSC losses and so on and so forth. Everyone is watching me meticulously acquire a position in this, you should be doing the same if you choose to play it. Pay attention to the position sizing and pay even more attention to the profit taking and cuts.

Will update if anything changes ![]()

Here is one lesson that some people learned during AMC #1 in June. We were trading FDs and guessing when the squeeze would happen, we had several people completely run out of money just before it launched the following week because their options expired worthless. FD’s are for nothing more than scalping the intraday movements. If you’re holding this waiting for a squeeze, you are a moron if you’re eating that decay on the FD.

I’ve got 4/8’s and later. There is a reason for that.

Interesting day, to say the least…

This worked out real well…

Everyone who was following this thread since it was started should have exited with great profits todays.

Best re-entry window for overnight call positions was from 12:15pm to 1:15pm.

There should be profit-taking again tomorrow so you can play both sides once more intraday.

Should AMC break the 3 resistances of 30.19, 32.23, and 33.92, there should be plenty of fireworks ahead.

Keep following Conq’s callouts for good guidance here.

Extend me, daddy…

As you can see here, the chain has been extended and expanded in between.

Expect profit-taking right out of the gate.

AMC can go as low as 22 but then still bounce hard.

Play this smart, secure your gains.

AMC & GME are both currently following SPY