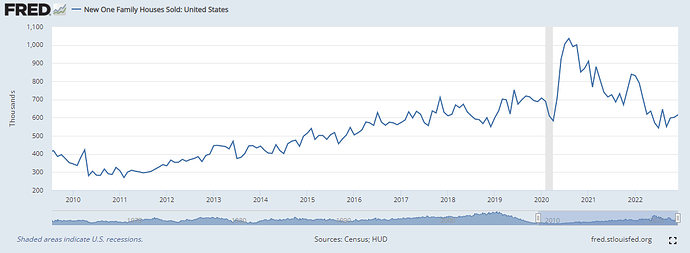

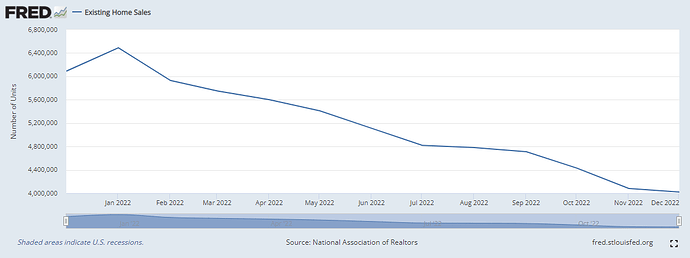

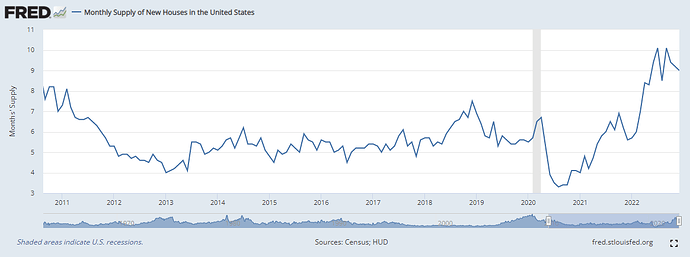

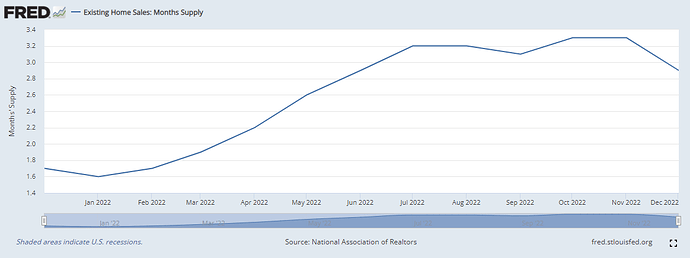

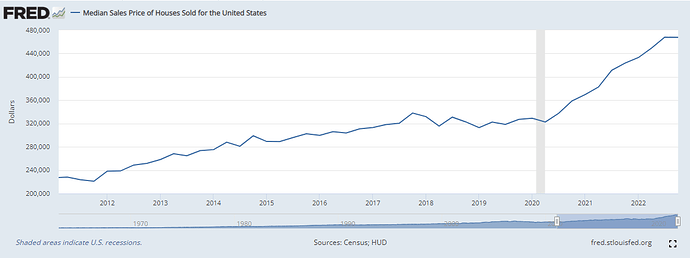

^^ This is from 7 months ago. Yet, looks like we’ve pretty much stuck to the same script. Median home prices have only gone higher, while sales of both new and existing homes are down and supply of both are up (though there does seem to be a slight downtick in Dec).

This is quite surprising, no? What is the missing link that explains apparent contradiction? Where supply seems to be abundant, while prices still go up and homebuilders are doing quite ok?

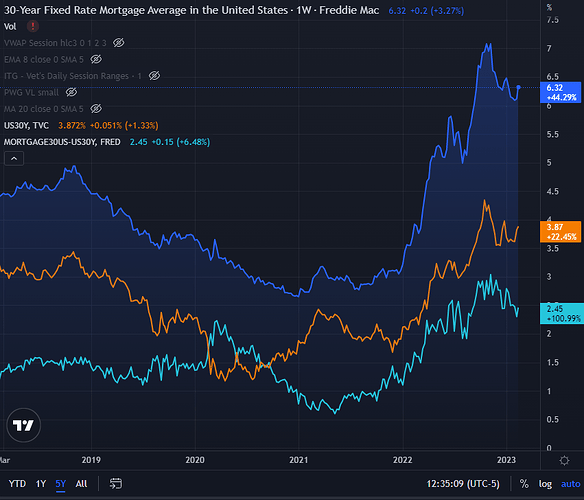

XHB, the homebuilder ETF, went up 33% in the last 3 months. There was a bit of a reprieve as 30Y mortgage rates fell from 7% to 6.3%, but with yields going up, this could go the other way again. And the spread is historically high, suggesting originators are pricing in additional risk.