Welcome to another Navi DD I hope this leaves more of you less confused this time around, and I had to finish this so Conq could suck a fat tiddy. ![]()

This time we’re talking about Home Depot!

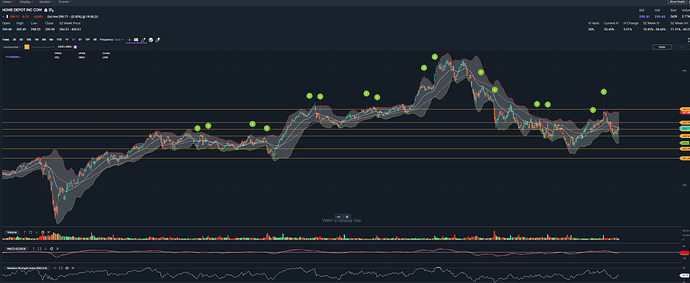

I’ve gone ahead and just marked some basic structure lines on the chart and wanted to expand on a few interesting points I’ve found.

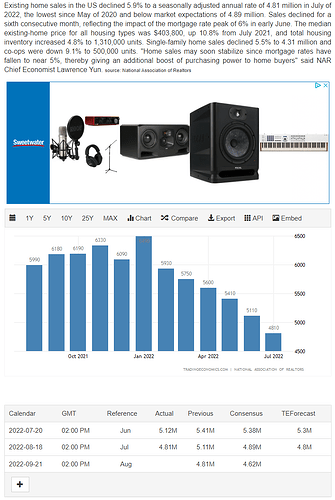

First off this is the data that came out today (Sep 14, 2022)

So 30 year mortgage rate is back at the same rate it was at… in 2008 (By the way its fine and dandy to do a bunch of legwork on DD. But usually someone has done it for you.)

https://finance.yahoo.com/m/6ae28670-0bb8-3c36-85b4-47fccf948ed8/mortgage-rates-top-6%25%2C.html?.tsrc=fin-srch

"The Mortgage Bankers Association said 30-year fixed rates for conforming loan balances of less than $647,200 rose 7 basis point to 6.01% for the week ending on September 9, a move that takes that headline rate to the highest level since the nation’s housing bubble burst in November of 2008.

The MBA’s seasonally-adjusted Purchase Index, which tracks mortgage applications for the purchase of a single-family home, rose just 0.2% as buyers backed away from new transactions amid the surge in borrowing costs, while new applications were down 1.2%.

The MBA said its refinancing index slumped 4.2% ahead of next week’s expected 75 basis point increase from the Federal Reserve, with bets on a 100 basis point hike now accelerating quickly.

“Higher mortgage rates have pushed refinance activity down more than 80 percent from last year and have contributed to more homebuyers staying on the sidelines,” said Joel Kan, the MBA’s associate vice president of economic and industry forecasting."

Also,

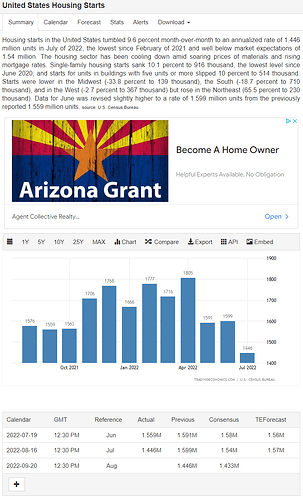

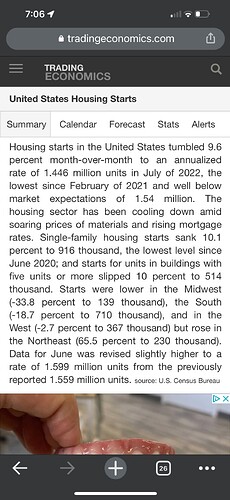

"A lack of new supply is adding to the pressures, as well, with U.S. housing starts hitting a one-and-a-half year low in July, thanks in part to surging mortgage rates and elevated construction costs.

The July slump included a 9.6% decline in the seasonally-adjusted annual rate, which was pegged at 1.446 million units, and a 10.1% plunge in single-family home starts, the largest component of the domestic housing market."

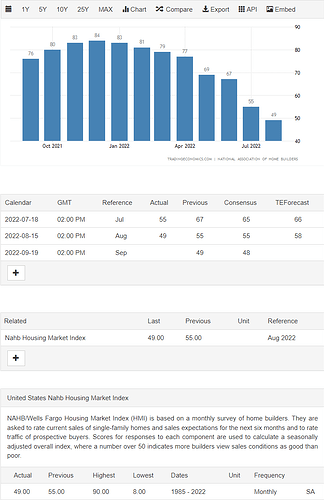

A big market Data point to look for next week (outside jobless claims this week) is the

NAHB Housing Market Index on Monday (Sep. 19th)

In case you skipped the text here it is again:

NAHB/Wells Fargo Housing Market Index (HMI) is based on a monthly survey of home builders. They are asked to rate current sales of single-family homes and sales expectations for the next six months and to rate traffic of prospective buyers. Scores for responses to each component are used to calculate a seasonally adjusted overall index, where a number over 50 indicates more builders view sales conditions as good than poor.

In August we dropped below that critical 50 level where home builders are starting to see sales conditions as poor. Wonder if there are any builders that are slowing down or halting building?

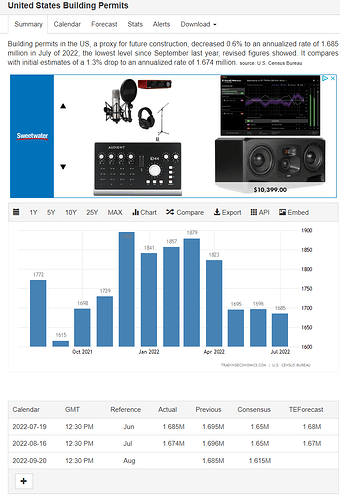

Well fuck I’m glad you asked cause the following day (Sep 20th) we get our building and housing permit reports! God damn you’re fucking lucky I like you.

Mainly housing came in under the consensus (and not just a little bit the unit here is MILLIONS, so we were under 100k housing starts when the market already doesn’t have enough supply). One of you idiots is gonna say something about Cali having plenty and yeah thats cause no one wants to live there.

Building permits is somewhat similar but not as telling of the markets reaction to rising rate hikes

Well what about the existing home sales Navi?

Its the very next day you lucky duck you (alongside FOMC) which will ultimately be the big mover since the rate hike decision will undoubtedly heavily affect Home Depot’s main driver of business (Being the Pro customers).

For a strong economy you’d expect to see some more home purchasing right? Well inflation is sneaky my fairweather friends.

After the rate decision being Sep 21st I think you could probably allow about a few days for the market to mull it over and figure out where exactly the market wants to put its money.

This is why some of you may heard Beak and I talking about taking a position today (Which ended red

No price targets in this DD unfortunately. I just think this is a good playbook for looking at how to play the upcoming week and following week after FOMC and the rate decision.

If you don’t give a fuck about ER calls don’t worry about this next part:

So I listened to their Q2 call and heres the gist:

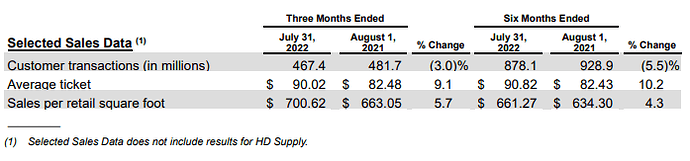

They reaffirmed that the sales from July were weak due to seasonal reasons (pretty interesting to say when you look here, which doesn’t include pro, or HD Supply as they call it).

So I mean lets be real about the conditions that high interest rates come with that could effect Home Depot’s big customer base (their “DIY” customers, people like me and you who don’t do manly shit like build or remodel your entire house yourself… Not everyone can be my father ![]() ). With higher interest rates all those numbers that lead up to the interest rate hike will more than likely get worse (not better no matter the rate hike decisions). But the effects of the past couple rate hikes probably are just starting to truly be felt in the mortgage market, housing permits, and all of the fun real estate things. The biggest spenders with Home Depot are undoubtedly going to be new home owners. They’ve gotta buy all the incidentals and random shit you need (appliances, door mats, a fly swatter to kill those pesky SwoleFlys). Existing home owners add to that demographic when they sell their home and move and with rising interest rates I’m heavily doubting a lot of people are looking to get into a home anytime soon. This isn’t a DD for their upcoming ER but it may be a possibility when these numbers come out.

). With higher interest rates all those numbers that lead up to the interest rate hike will more than likely get worse (not better no matter the rate hike decisions). But the effects of the past couple rate hikes probably are just starting to truly be felt in the mortgage market, housing permits, and all of the fun real estate things. The biggest spenders with Home Depot are undoubtedly going to be new home owners. They’ve gotta buy all the incidentals and random shit you need (appliances, door mats, a fly swatter to kill those pesky SwoleFlys). Existing home owners add to that demographic when they sell their home and move and with rising interest rates I’m heavily doubting a lot of people are looking to get into a home anytime soon. This isn’t a DD for their upcoming ER but it may be a possibility when these numbers come out.