These are just some of my thoughts of the two big players in the semiconductor industry of Intel ($INTC) and AMD ($AMD) and how the next six to nine months could potentially shake out.

Note: This section is not required to read but just gives a glimpse into why I decided to look into this and leveraging some of the information I have gathered for the past few months and just overall pc tech information over the past many years

Personal Side Note: (My personal reasoning/motivation for looking into this)

I consider myself a semi-tech enthusiast who has been interested in the PC/tech industry for the past 15 years or so. I follow the mainstream consumer tech products from the three powerhouses of Intel, Amd, and Nvidia pretty closely as I also like to build my own computers and also game. Because I am avidly into building computers for myself, family, friends and I also used to do this as a side job, I am quite heavily invested into learning about parts, performance, prices and trends. On the PC desktop/laptop front, Team Blue (Intel) and Team Red (AMD) have always been fierce competitors.

Minor Background: (Also not necessary to read but giving this to provide some context as to why I hold such thoughts about AMD and Intel)

AMD pre-2008 has not put up much of a big fight against Intel in terms of consumer grade CPUs. From 2008 to about 2015, Intel was able to milk quad core performance without having to make any massive/significant strides in upgrades.

While in 2017 with the launch of Kaby Lake Intel finally pushed up the typical core counts from 4 to 6, there still was not much of a massive breakthrough in terms of technology or processes. Amd simply did not pose enough of a challenge with enough generational improvements/ipc changes to force Intel to really innovate. This led to probably one of Intel’s big notable flops in Rocket Lake aka 11th Gen where even the new products were barely able to outperform the previous gen and in some cases its performance was worse.

Now 2017 was the beginning period of when AMD slowly started to turn things around with their launch of Ryzen “Zen” architecture. While Intel continued to really rest of its previous laurels and would launch new product in the typical 2 year cycle with a few % pt bump in performance just so it could continue to market itself as the best performing products in the market, AMD continued to make massive strides in their lineups with big double digit IPC uplifts.

This finally leads to 2021 when Intel finally realizing that AMD’s improvements were now nearly on par with them released their 12th gen (Alder Lake) that provided great generational uplift vs its previous 11th gen (aka Rocket Lake). Intel could no longer get by releasing products with minor bumps in performance and successfully compete with AMD not only in terms of performance but also in terms of value.

Thus, now we have come to 2023 where Intel is now on 14th gen Raptor Lake “Refresh” vs AMD’s Ryzen Zen 4.

Minor Background End

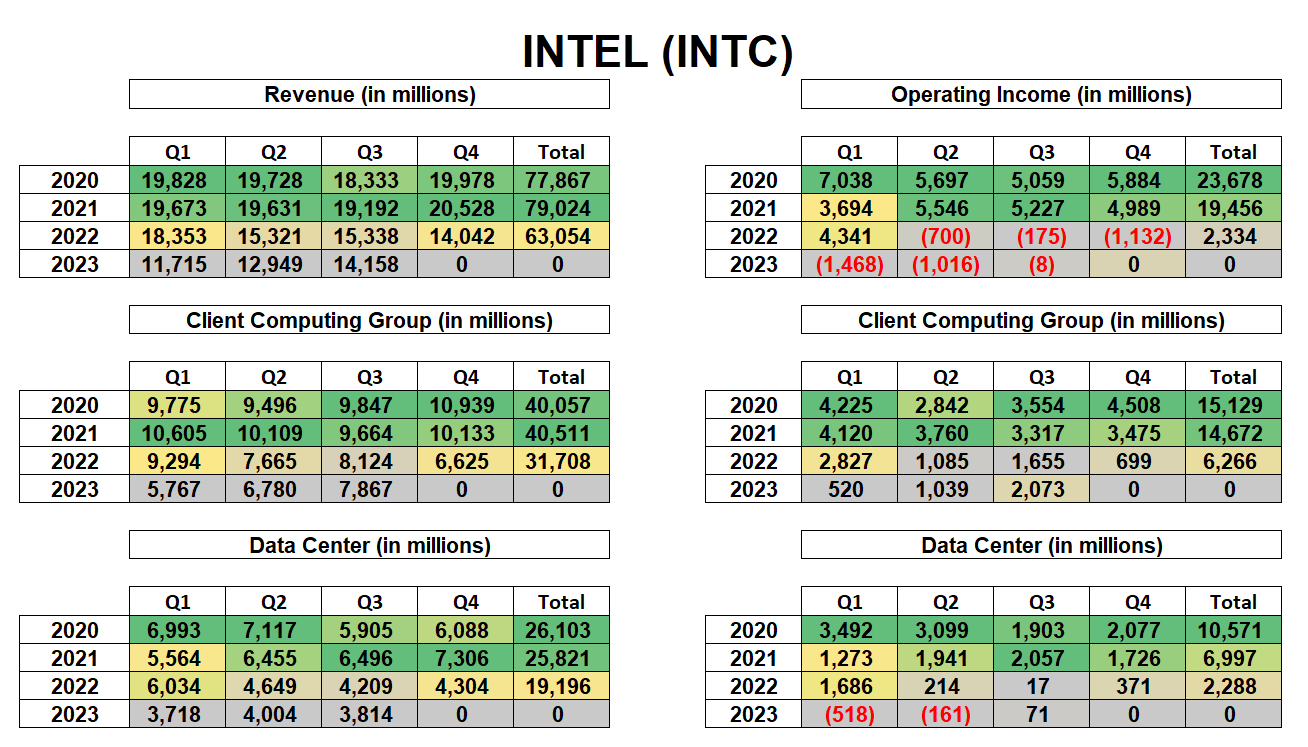

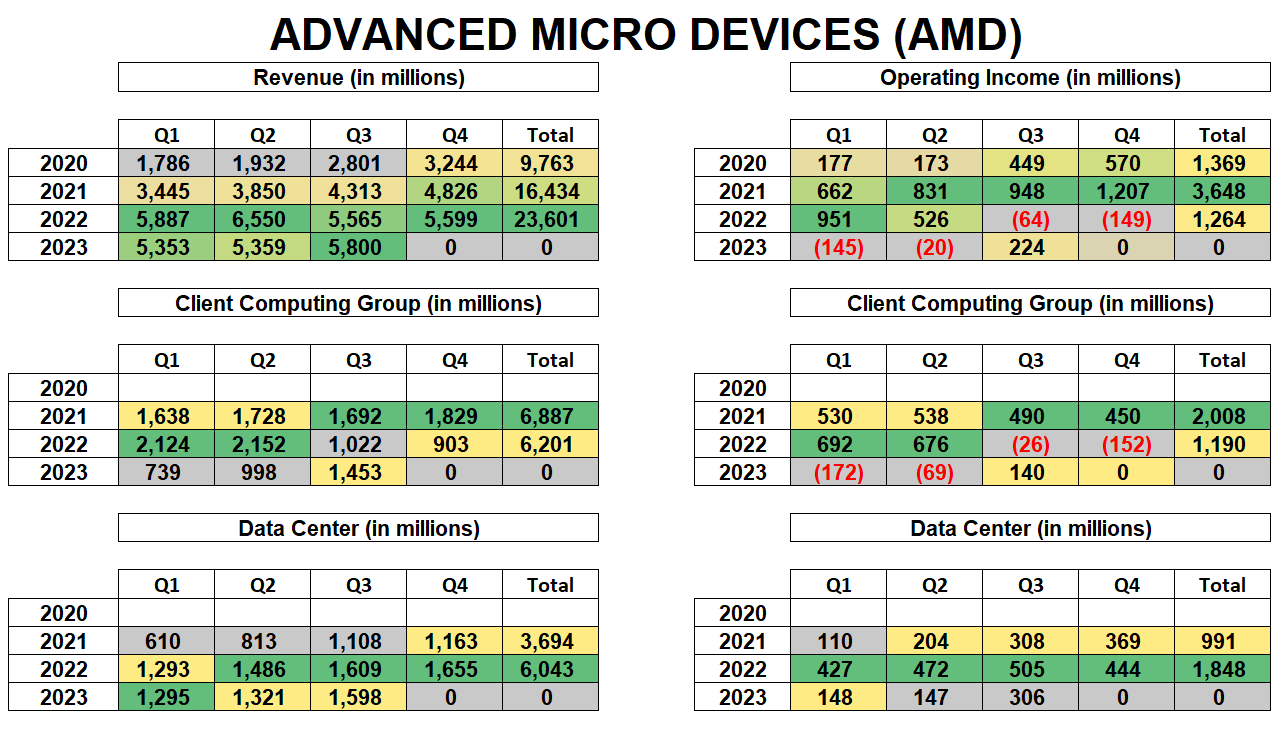

Now here are some figures to consider. I tried to pull numbers to try to compare as closely from an apples to apples comparison.

Intel (INTC)

AMD

In terms of size/revenue, obviously Intel is a behemoth when compared to AMD but the two things I want to really focus on are two main segments of CCG (Client Computing Group) aka Desktop/Laptops and Data Center.

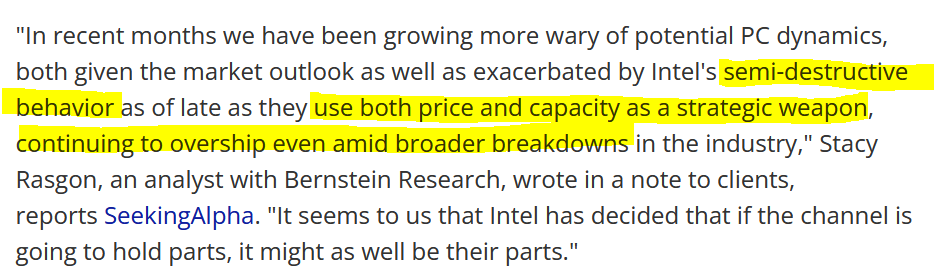

Also I would like to point this out. If you read through some of the minor background a quick TLDR (too long didn’t read) is that Intel has been resting on its laurels for quite some time. Instead of being innovative, they merely tried to milk the cash cow with barely any improvements. However, this has finally started to catch up on them and because of their lack of innovation and delays, they are now behind the eight ball. As a result, they are now forced to play their size/pricing as a way to compete and push down competition from AMD. So instead of making better products to directly compete, they are just going to sell alot more products aka massive supply forcing prices to go down even though products are inferior and thus at certain product stack segments where price sensitivity is high Intel will maintain market share.

Shorter TLDR: Push tons of supply leading to major drop in prices. While competitor product is better, due to higher price, the inferior product is sold more.

This sort of behavior started end of 2021 and into 2022. Which is why at electronics retailers you could see massive discounts not only on 11th gen but also 12th gen products.

So if you see this situation on a larger scale, you see Intel starting to fall behind in innovation/technology in their product stack to AMD in the consumer grade and even server grade products. To remain competitive they are over-shipping products and slashing prices to remain competitive. Because Intel is so much more massive compared to AMD, they are able to do so. However, that is to their detriment of revenue/profits/margins, etc…

This problem now continues to go on in 2023 going into 2024. As mentioned previously, Intel’s new generation of chips the 14th Gen is nothing innovative vs the 13th Gen. It is merely a ctrl c ctrl v with minor software tweaks with the hot word “ai”.

Also in Intel’s 12 > 13 > 14 gen changes, their improvements in performance came at a massive detriment to their efficiency. While not as majorly impactful in the consumer side, it is a major issue in the server side.

With the lack of innovation in their 14th Gen, their sales are poor and because they are marketing 14th gen as new thing to buy and the 13th gen now gets a price cut even though performance wise they are essentially identical.

So Dec 14th 2023 is when Intel launched their 14th Gen lineup. Intel’s 15th Gen is expected to launch late 2024 if not H125.

Intel’s 14th Gen lineup for the most part is behind AMD’s own Zen4. With Zen5 coming in H124 and early leaks/rumors showing that Arrow Lake still might not really compete with Zen5 even with Intel trying hard to pull up its release date, the struggles at Intel I think will only continue.

Laptop OEMs such as Dell, HP, Lenovo, Asus, Acer, etc… have hinted that they may really start a significant shift with using far more AMD products in their lineups vs Intel due to not only performance but also efficiency issues.

CCG revenue is a 50%+ impact for Intel which is major part of their revenue.

Similar situation applies to the server side situation with Intel Xeon Sapphire Rapids vs AMD’s Bergamo lineup. Intel’s next gen of Sierra Rapids won’t be out for at least a full year. And unlike for the consumer grade deskptop/laptop chips, Intel can’t brute force their way with added performance by cranking up more power.

The biggest issue is really execution on AMD’s part. Amd is a much smaller company in terms of the amount of chips that it ships and Intel can continue to leverage their economies of scale/production capacity to smother Amd. However, I think that after nearly 2 years of doing so and looking at Intel’s financials, Intel will be hard pressed by its shareholders to continue this path.

Now there are a few areas that I did not cover in this analysis due to partly some lack of time, lack of information/knowledge.

For example what was not covered is Intel and their foundry services. While Intel continues to build our their foundries, that could serve as a major positive point to bottom line revenue. IFS has been making notable improvements quarter after quarter.

Also missing from AMD’s analysis is their GPU lineup. While it would not be much of a comparison to do Intel vs AMD for the GPUs, AMD’s Gaming division which houses their GPU revenues is also nearly a quarter of their revenue. Nvidia’s dominance in this sector and continued dominance could pose a threat.

There are a few more things I still haven’t added but hope to add by next weekend but these are just some of my thoughts for Intel and AMD.

Now the reason for bringing this information up is a specific catalyst that I am potentially eyeing at.

CES 2024 is from Jan 9 - 12. Leaks have already come out from board partners for AMD about AMD 8000 APUs being added with a scheduled Jan release. Meaning that CES 2024 would be the perfect time for AMD to come out with news of their upcoming release. This could move the needle furthermore in terms of notebook/mobile unit sales with AMD’s rising dominance in performance and efficiency vs its Intel counterpart.

So to end my initial thoughts, the quick and short is this.

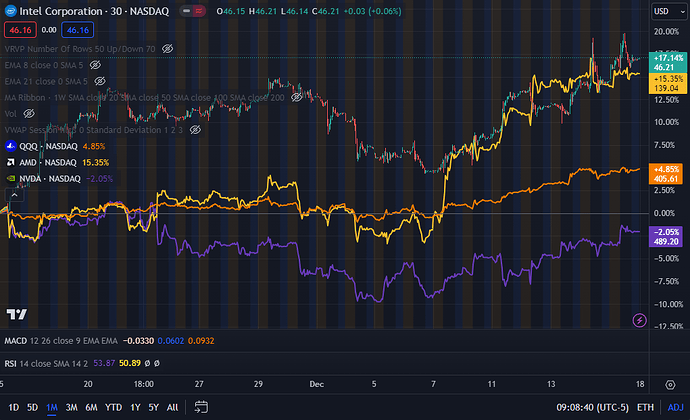

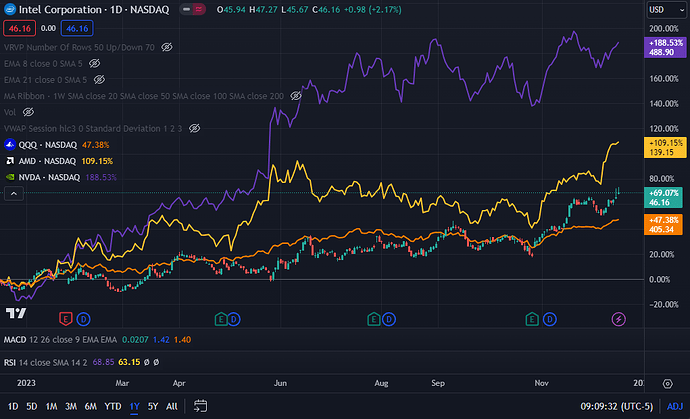

I am bearish on Intel going into first half of 2024. I think that their CCG sales are going to continue to decline and Data center revenue will also continue to decline as Intel loses market share more and more to AMD. Intel will be either forced to continue their attrition tactics of over shipping parts in order to remain competitive via price but at expensive of profit margins which have been greatly shrinking.

With expensive R&D costs for their future innovations and CapEx, I don’t think Intel can really afford to take that path, thus I see AMD rising up from Intel’s fall.

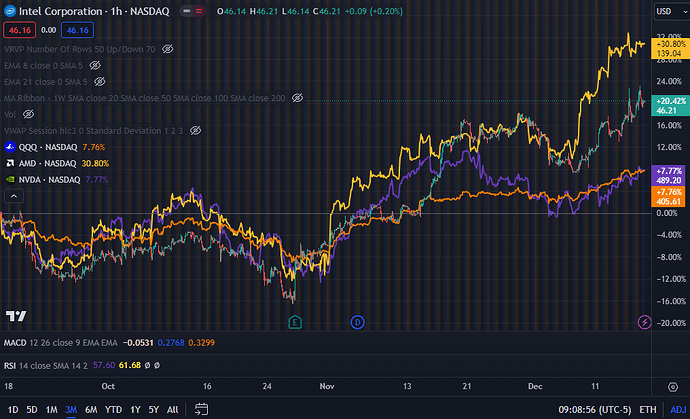

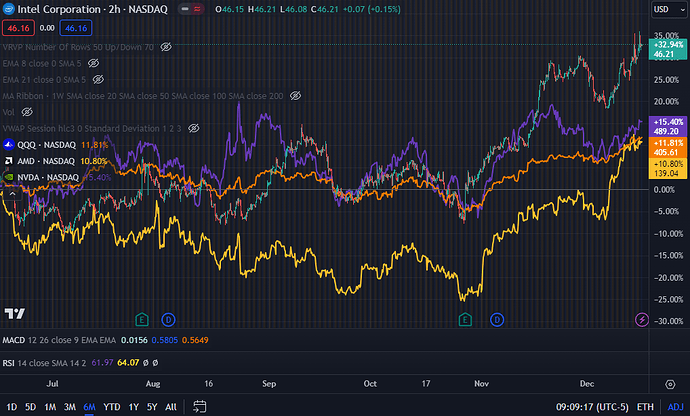

I will be looking at charts to look at shorting Intel stock at key levels and look at semi short dated AMD call options to play for the CES news announcement.

As mentioned before, I will have more updates to follow and more new clips and some added video/podcasts to link for my sources.

Posting this now so that perhaps we can get some traction and get some other opinions and thoughts to see if my thoughts of CES event could indeed be a playable catalyst.