Looks to me like he converted some RSUs into common stock and then sold all the shares.

As far as I know, CEO selling is usually bearish. I don’t particularly see that in this case. Only 1/3 of his $6.96 per share option vested. 2/3 of the shares, for which he has already met the conditions preceding his purchase option, still arent vested until 2023 and 2024 respectively, so if he loses his position or if the share value plummets, he loses money.

Just my college try.

Edit for clarity.

All lightning reservation holders were informed today that if they have not received invite to order they are not getting one. This is way early in model year to cease production. Have heard of several cancellations already

Is Ford more exposed than other manufacturers? This seems to be an industry wide problem. More so for EVs. I’m mainly looking at this a swing trade right now for the production and delivery announcements. I do like Ford long term and whatever teething problems they encounter short term will hopefully be worked out while everyone else is just coming to market in this segment.

I don’t think they are necessarily more exposed I think they were less prepared. Fact of the matter is F production manufacturing issues started in 08 GM and Chrysler filed bankruptcy and were able to eliminate an amount of their dealers F did not. So now to this day you still have F dealers in every little tiny corner town. They can’t keep up with production to keep cars on underperforming dealer lots. I do wholly think at some point when the supply chain catches up F future business model is going to dominate the industry. As in enough cars for people to look at test drive but not over production and need for huge incentives and advertising. As a whole if I had to pick one of the big 3 for leaps F is the one. However I think we are a year out from major changes and bullish moves. Currently I think Ford is valued as close to it has been in last 6 months. I still think there is some over valuation in short term. But they are setting themselves up to crush

Thanks for all the inputs, everyone! This helps plan the trade much better <3

Watching some parts of the Spring Auto Conference this week.

Ford was on yesterday and said they’re not directly affected by the RU-UE war.

I’m of the opinion that Ford will just trade sideways (to low), until a Big Buy Cignal comes in from CEO and/or CFO.

I think it stays pretty flat til some good news. NADA (North American Dealers Association) convention starts tomorrow in Vegas could get some positive news from it. This is a big deal in the auto industry with 4 days worth of manufacturer meetings and vendors courting dealers. Would be a good time for F to drop some EV news or bullish supply chain news.

I think the CFO bought (big bulk) and sold some shares again.

Can someone verify that please?

Highlights.pdf (435.2 KB)

adding in some highlights from a recent internal meeting. primarly rehasing all the positives that have been going on globally for the company if you all are interested in looking at it.

So there is one play I will state here is On the first week of each Month ( I believe first Wednesday) they publish their previous months car sales. In addition to this they also release some kind of news/update on their strategies. If you look at their chart it coincides with the release of the company split division strategy (March), Earnings(Feb) , Increased capital allocation to EV expansion (Jan) , etc (Cant recall the other news and Im not sure how to google news in previous months. Im speculating that this coming publication they will publish their plans on internal restructuring details of their company division. Ford seems to like to be visible with publications of their decisions that has been acting like price action catalysts so far this year. So I am going to look to scalp/swing some ford calls and use that profit for gambling on this coming sales publication. Also the good caveat that we are in supply chain shortage is there is no good expectation of car sales on the past month(At least not that im aware of since the last numbers were bad but the company division caused it to run up). One thing I also noticed is that when compared to something like earnings we dont have an IV spike so weeklies wont become overly expensive. Im researching as im typing so im not sure if they will release sales number / info since earnings is April 27 for Q1.

Adding on information as I look over notes from meetings I attended this week, a basic search on Google does not come back with anything related to this, but it seems that Lincoln is going to be teasing or talking about their new EV vehicle to the press on April 20th at their Centennial Event in LA.

Possible to see a runup based on how the media reacts to the announcement whatever EV news they announce at this event.

On a side note, production has been steadily increasing this quarter as Ford has dropped the ball on production in the last couple of months.

Food for thought

Legacy Automakers have bad q1 sales and this includes Ford. https://www.investors.com/news/auto-sales-q1-2022-ford-f150-lightning-ev-launch-nears/

Ford will release their March car sales tomorrow. I thought it would be Wednesday. Hopefully my theory is right that they will have some kind of press release tomorrow to go along car sales to keep their investors happy . If Ford goes back down to 16.3 I might look to get some calls.

March is typically one of the top 2 to 3 strongest months in retail automotive. However I would not expect huge numbers from F. Typically it’s a largely used car driven month. And they tend to be lagging behind inventory and supply from the other legacy manufacturers and even imports. Hopefully this changes soon.

Thanks for the input, yall!

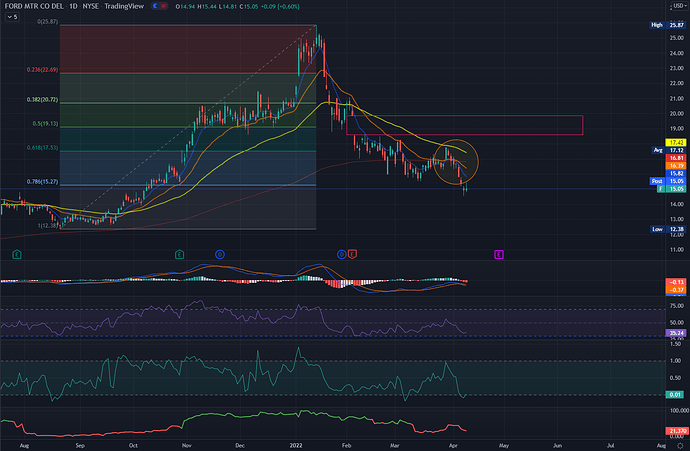

I was going to start my leaps this week, but Ford broke below the 0.75% Fib Retracement level…

21 day Average also looks weak here, and the 55 (yellow) day Average isn’t too far away.

Personally, I’m looking at 12-13 now for my ideal start.

Just received an email this morning, Ford is going to tease Lincoln’s EV today on social media, at 11. be on the lookout from that EV news is typically bullish

I knew I missed something today! Thanks for the heads up, bud. I read the same email too.

Hopefully we’ll get more details in the coming days.

The full rollout is on 4.20 right?

not full rollout, but will be showing it off at an event in Cali. not sure what they are showing, the marketing says its a concept car.

Expect to see an official BEV car from Lincoln in Oct. Ford will probably follow suit with another BEV car as well.

Launch date for lightning has been set

usually these things give a price pump