Update:

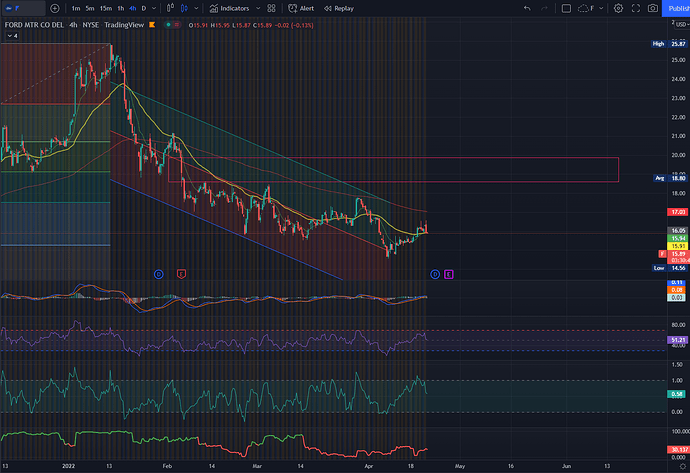

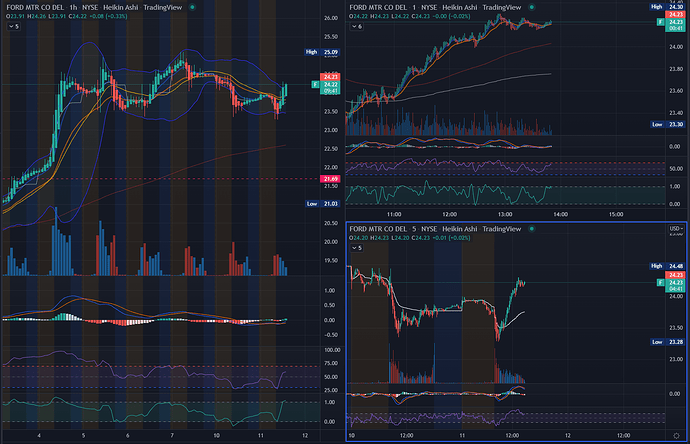

Ford is showing some bullish strength on the 4hour candles…

IF it drops and bounces again over $15, I’ll finally start my leaps.

I simply want the 13 and 48 (or 21 and 55) EMA lines to cross upwards, for my long call positions.

Update:

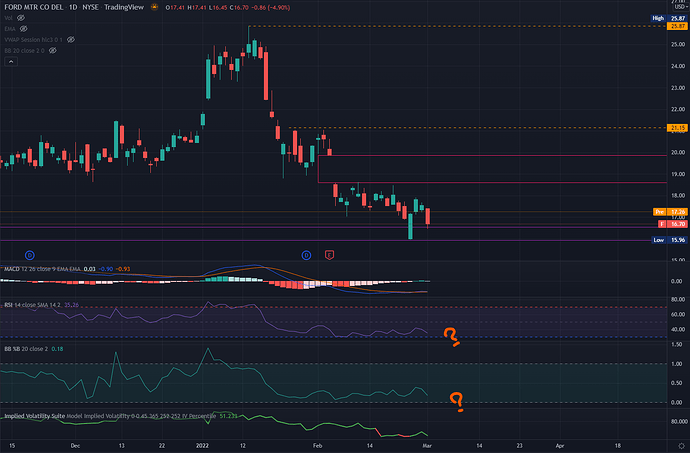

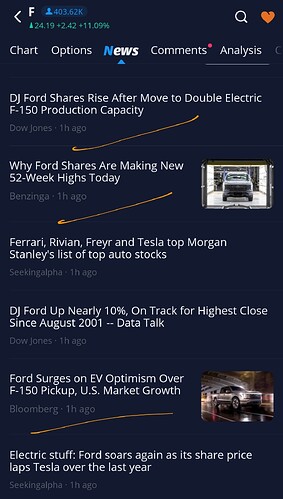

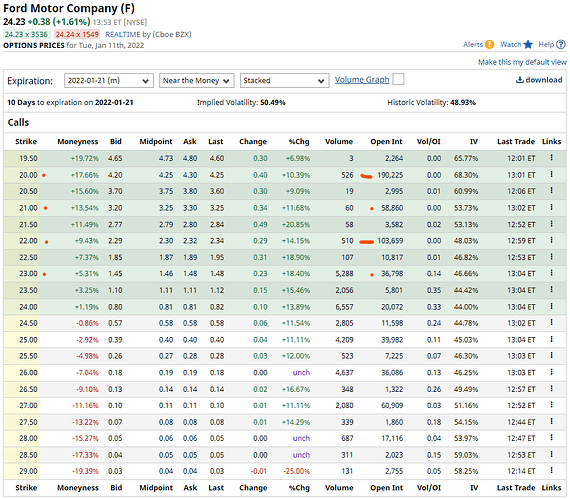

With Ford getting a direct mention last night from POTUS, a short bullish rally is expected…

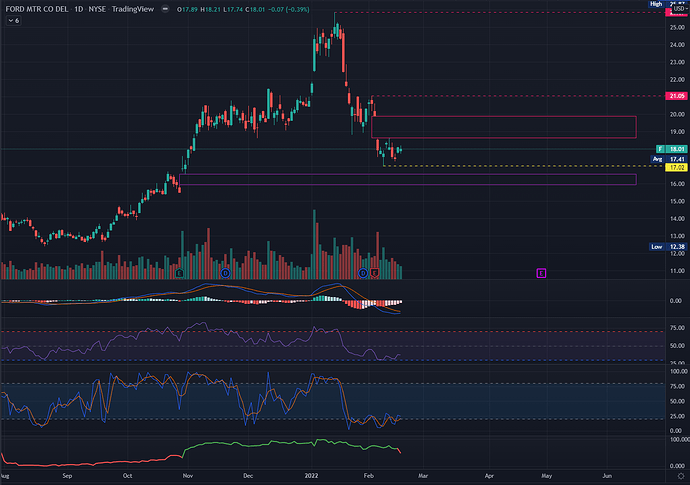

And as you can see on the Daily candles chart, that lower gap to 15.92 got filled.

Looking at both the RSI and the BB%b indicators, though, make me want to wait a bit longer before adding a lot to my position.

I’d like for both to go full under and then recover.

Nonetheless, this isn’t a bad place to start looking for entries.

What this is: Short DD on Ford long positions.

Who is this for: Long term investors looking for solid stocks to sit some capital on.

TLDR:

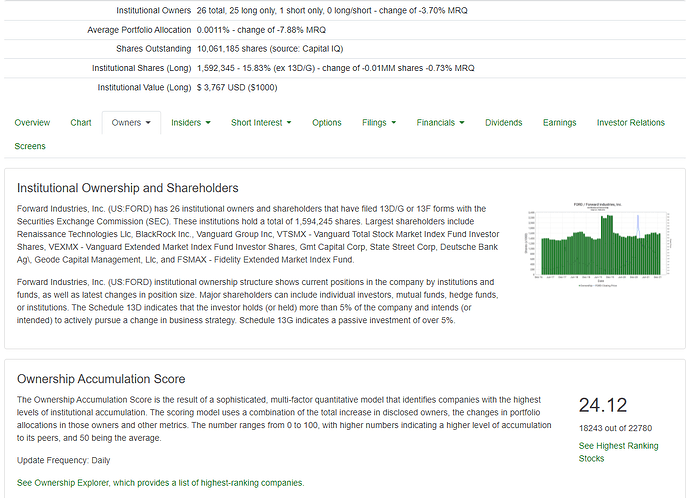

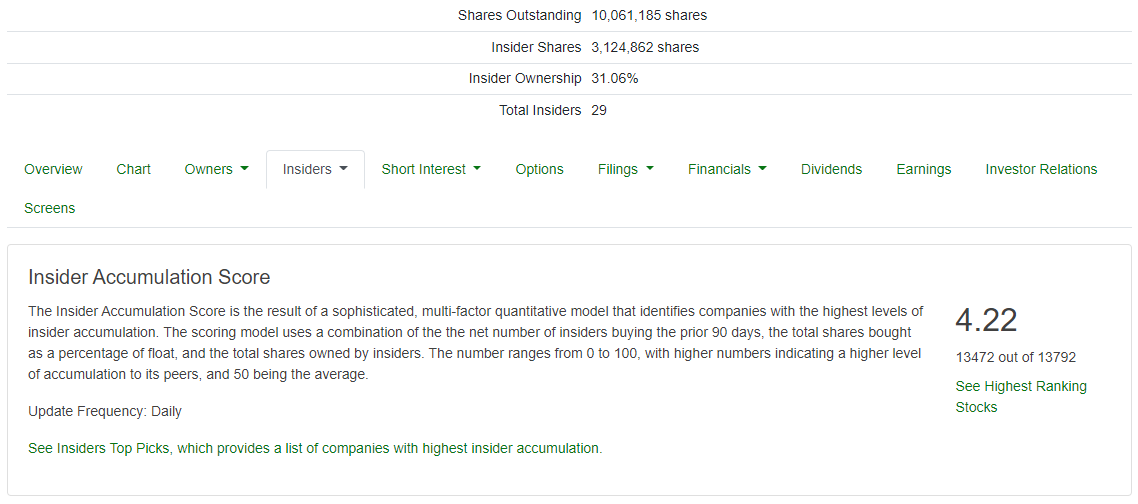

Shares Float - 3.917B

Dividend Yield - 1.93%

Price to Earnings Ratio (time of writing) - 28.66

My Price Target - $30-33 for 2023 leaps, based on TA.

Homepage - https://www.ford.com/

Investors site - https://shareholder.ford.com/investors/overview/default.aspx?gnav=footer-aboutford

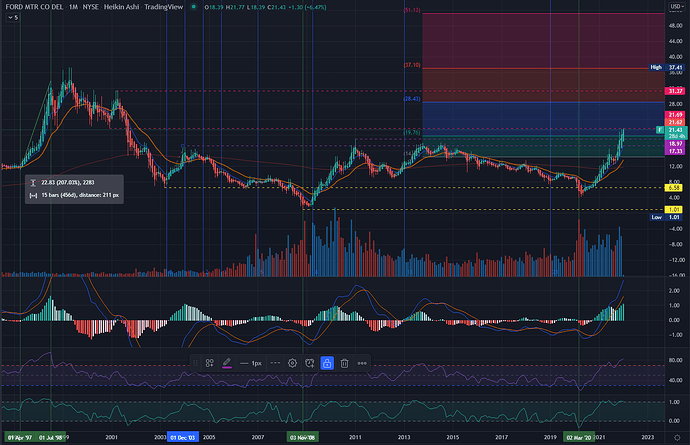

This is Ford’s Monthly chart…

From the high of April 1999, it has fallen all the way down to $1.01, on Nov 2008.

Since then, Ford has traded in the range of 4-20.

I believe Ford is almost done accumulating here, and is primed to blow past its ATH of 37.41 in the next year or so.

With such a high cap of almost 4B shares, it takes a lot to moves the stock price.

Regardless, things are looking bright for this institutional American car brand.

While typing this work, Ford tested the price of 21.77, working to break the old support-now-resistance line of 21.69–marked in Pink.

I’m looking for it to continue vibrating in this range of 18-23, and then it should lift off–assuming all goes well.

2nd support line is 17.33, so if your looking to get ITM options, I’d consider that and 18.97–both marked in Purple.

Related News…

-

From the F-150 Lightning to Rivian, here are the 11 hottest electric vehicles coming out in 2022

-

Ford Wants To Compete With Tesla, But Its Dealers Are Getting In The Way

-

Ford (F) Valuation Tops General Motors After 5 Years, Stock Up - December 29, 2021 - Zacks.com

Externals sources for data…

Fintel…

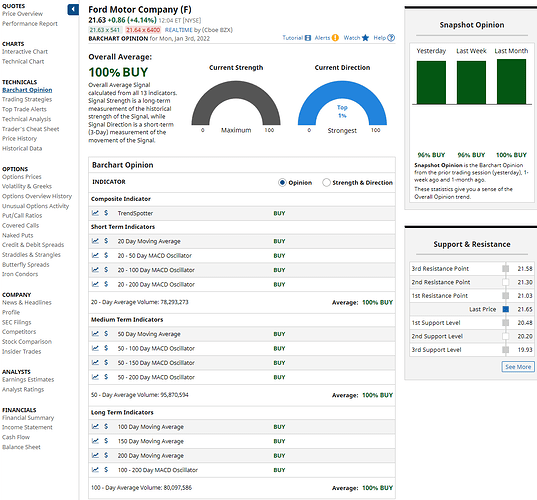

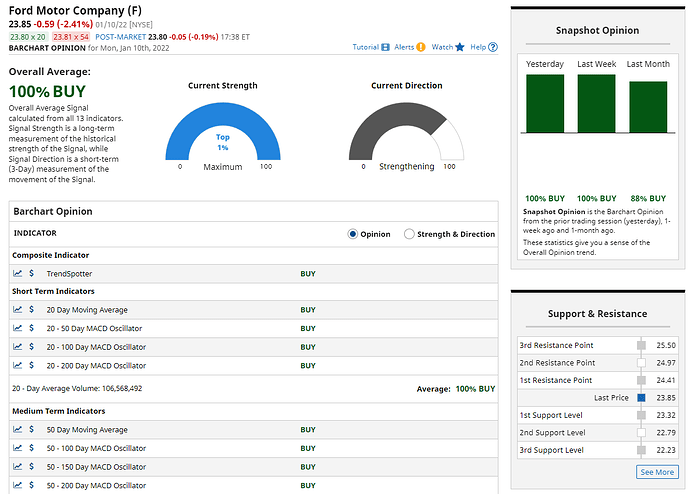

Barchart Opinion (Ai)…

Options Calculators…