Relevant links from UPST on their previous no-action letters:

https://www.upstart.com/blog/upstart-receives-first-no-action-letter-issued-consumer-financial-protection-bureau

https://www.upstart.com/blog/an-update-from-cfpb-on-upstarts-no-action-letter

The basics of the no-action letter is to let UPST use it’s AI to increase fair-lending activities without worries of regulation.

In exchange, UPST would have to constantly report the following to the CFPB:

-

Notify the Bureau of significant changes to Upstart’s model prior to

implementation;

-

Provide the Bureau with model documentation on a periodic basis, including a

Technical Report (which describes certain aspects of each component of Upstart’s model) and Performance Monitoring Reports (which evaluate how Upstart’s customer population and model performance change over time);

-

Test Upstart’s model and/or variables or groups of variables on a periodic basis for adverse impact and predictive accuracy by group, with results provided to the Bureau;

-

Research approaches that may produce less discriminatory alternative models that meet legitimate business needs;

-

In addition to fair lending testing, conduct periodic access-to-credit testing to determine how Upstart’s model compares to other credit models in enabling credit access, with results provided to the Bureau; and

-

Provide the Bureau access to the software code that is used to implement the MRAP (Model Risk Assessment Plan).

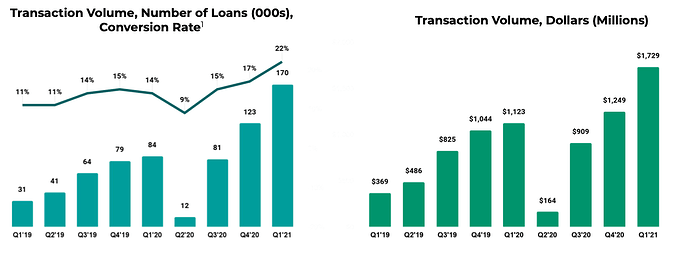

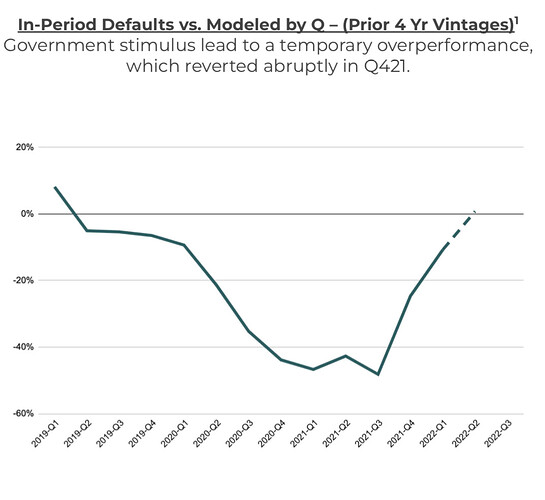

According to CFPB in 2019, UPST’s AI “increases access to credit across all tested race, ethnicity, and gender segments by 23-29% while also decreasing average rates by 15-17%.”

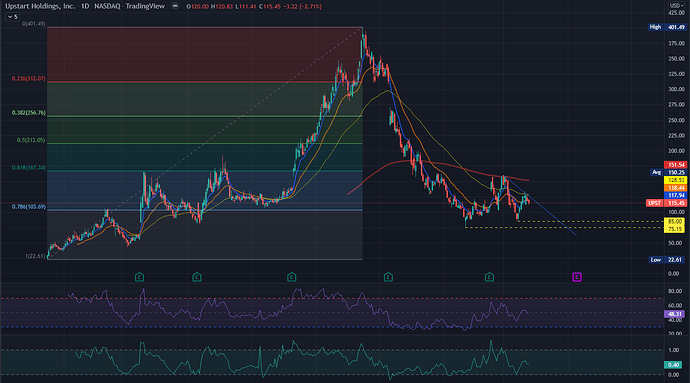

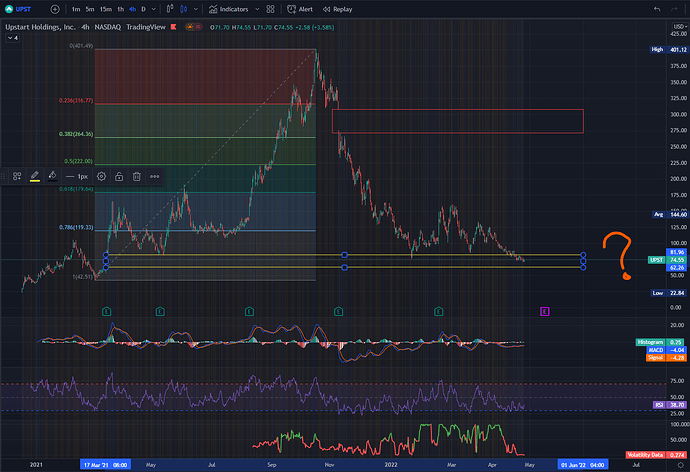

This has led to an increase in personal loan issuance:

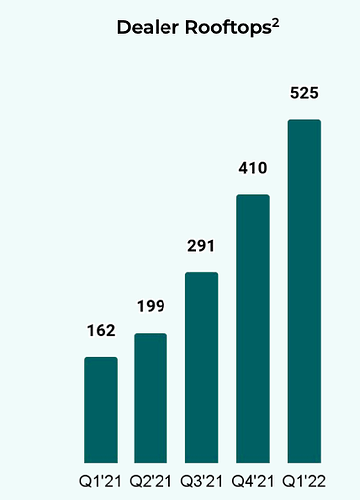

And are also expanding into the auto loan industry:

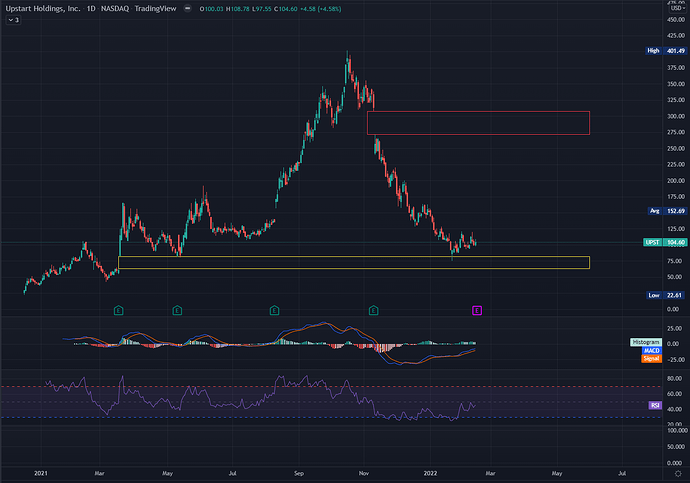

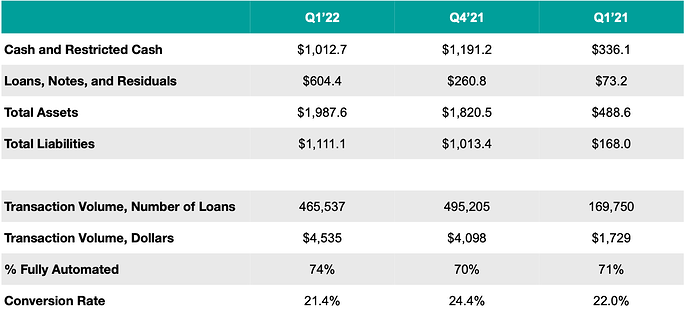

“Bank partners originated 465,537 loans, totaling $4.5 billion, across our platform in the first quarter, up 174% from the same quarter of the prior year. Conversion on rate requests was 21% in the first quarter of 2022, down from 22% in the same quarter of the prior year.”

“Bank partners originated 1.3 million loans, totaling $11.8 billion , across our platform in 2021, up 338% from the prior year. Conversion on rate requests was 24% 2021, up from 15% in the prior year.”

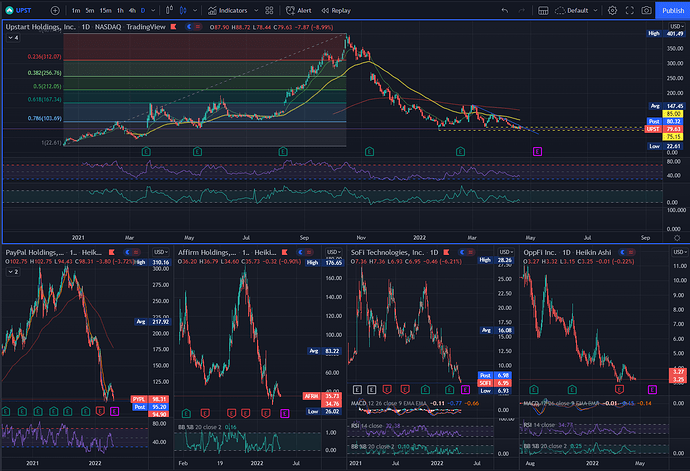

Today, CFPB announced UPST requested a termination of a no-action letter due to UPST wanting to “make time-sensitive model changes that are not possible if the CFPB were to conduct the appropriate level of monitoring and review.”

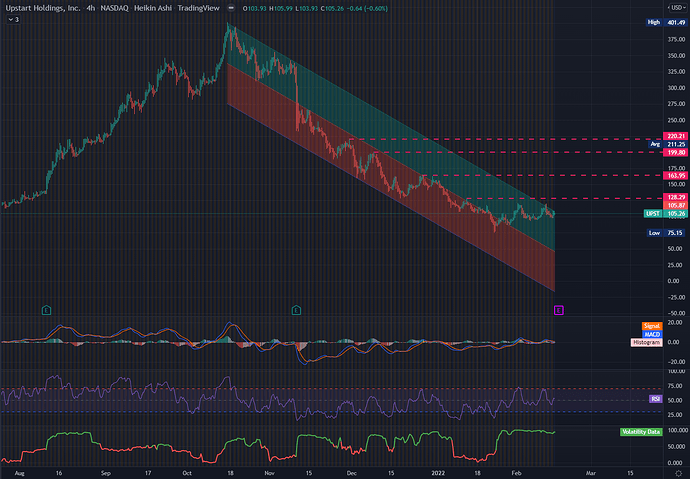

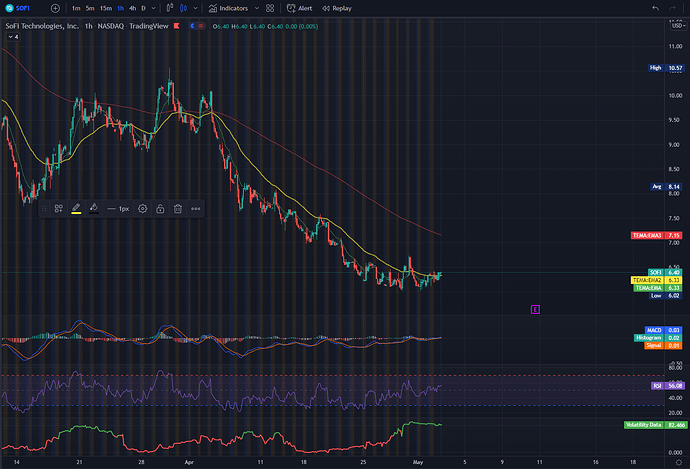

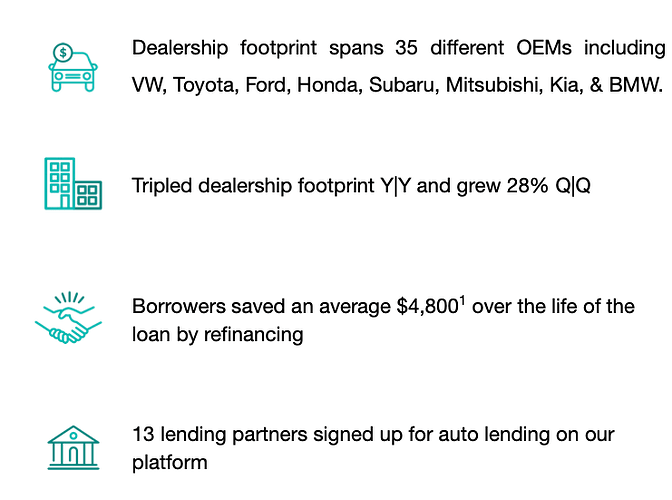

I’ve already had concerns about UPST, including a trend of increasing defaults. UPST CFO said in their Q1 2022 earnings call ”the macro environment has become an increasing headwind to growth this past quarter with both rising interest rates and rising consumer delinquencies putting downward pressure on conversion.” About the trend: “ The delinquencies… renormalized to pre-pandemic levels fairly abruptly starting in October and November. I think that pattern stabilized in sort of roughly February. To us, March and April were very stable months. ”

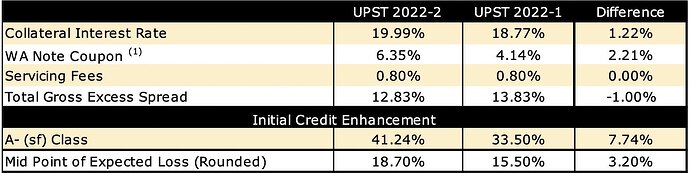

This is also affecting UPST’s securitization of their debt. The Kroll Bond Rating Agency (KBRA) came out recently saying their 2022-2 ABS securitization would have a bigger midpoint of expected losses than previous securitizations due to weakening delinquency/loss trends.

This has resulted in some downgrades in the past, one analyst saying UPST’s AI system had not been “battle-tested” and that their biggest risk was “its dependence on third-party financing, and this risk tends to worsen during recessions.”

There has also been concerns about whether or not UPST’s model, which has taken the majority of its time learning during lax monetary policy environments and low interest rates, can withstand restrictive monetary policy:

One analyst has said “Although Upstart’s business model has shown strong growth in a benign credit environment, yield demands from credit investors have risen rapidly as interest rates and default rates have risen, suggesting problems ahead. The negative view is that at some point soon credit investors will likely force Upstart to charge consumers a rate so high that they will balk, decimating loan originations… we fear the economic uncertainty could limit upside potential.”

Others have cited similar concerns saying that the AI’s predictive capacities will deteriorate as “the company’s artificial intelligence appears to take 'time to adjust to deteriorating macro” conditions’".

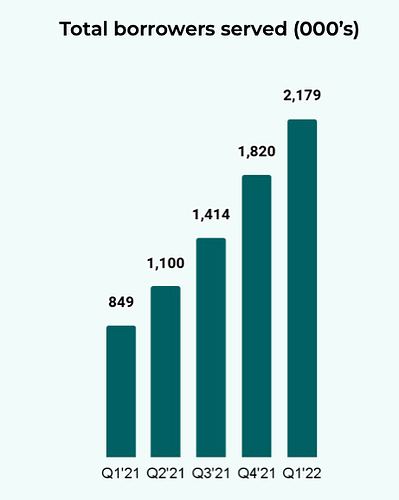

There is no doubt that UPST has achieved great growth with their AI lending program:

However, in my opinion, I would wait until the Q2 conference call in order to gauge:

-

How have higher rates impacted the AI model?

-

Are default rates coming back to trend as expected? (By the way, I recommend you read TheHouse’s great DD on AutoNation. He touches on his concerns on auto loans there).

-

Is there any concern from creditors about their securitizations/is its dependence on third-party financing coming back to bite them?

-

Are they adapting fast enough to the environment and taking appropriate risk-management measures while doing so?