This thread is for general discussion and analysis of the listed commodity.

If lithium companies aren’t reporting record profits this upcoming quarter then someone is getting royally screwed.

Elon tweeted Friday:

Price of lithium has gone to insane levels! Tesla might actually have to get into the mining & refining directly at scale, unless costs improve.

There is no shortage of the element itself, as lithium is almost everywhere on Earth, but pace of extraction/refinement is slow.

Lithium price ($/tonne):

2022: $78,032

2021: $17,000

2020: $6,800

2019: $11,310

2018: $14,660

2017: $12,070

2016: $8,840

2015: $5,110

2014: $4,680

2013: $4,750

2012: $4,450

SGML has earnings Monday PM, no options, but I’m thinking of grabbing some shares.

LIT is a global lithium ETF I’m looking at for May 75c because of overall sentiment around lithium and it seems to have had its pullback YTD.

As the markets are cooling off, a bunch of the more popular tickers are coming back down to earth.

The lithium ETF LIT and one of the more popular names LAC are two of them. Will potentially be looking to watch them bounce from support to initiate positions in commons.

LAC is now below that $24 line. There is talk of them splitting off the US entity to focus on Thacker Pass, which everyone’s eyes are on as one of the major sources of lithium in the US. There are some regulatory risks which are expected to be resolved in Q3. Right now everything is selling and this has created an opportunity to get into a stock that is riding the lithium wave but one that also has real potential. Once the market bottoms, this could be a very good swing for a few months.

Btw this is completely speculative, but TSLA has been aggressively staking out deals with miners. Given their US presence, I would not be surprised if he goes for some kind of close relationship with LAC. Also… Scamath has been known to be interested in Thacker Pass - I remember seeing his eyes light up in a different kind of way during an interview. If there is a spinoff, not impossible he or his type would be involved. Because the site is not under production yet, its highly undervalued in nominal terms (but risk adjusted), so much interest in it.

Time to buy would be when lithium is cool again, which it currently is not. More because the market is puking than anything else. LIT is a great ETF for the long haul, and unlike LAC which has idiosyncratic risk, is a buy at the bottom, hands down. Let’s keep an eye on this so we can catch the upswing.

Thank you as always sir! I Have held a few shares of PLL for sometime and they dropped like 20%. But adding this to my list as possible add. Thank you

Ah yes, cheers for noting PLL - they are an odd one. They had the original supply deal with TSLA but haven’t heard anything about that in a while. Just can’t seem to find why they fell 20% today though, other than market… but then the others didn’t fall as much. Would you know?

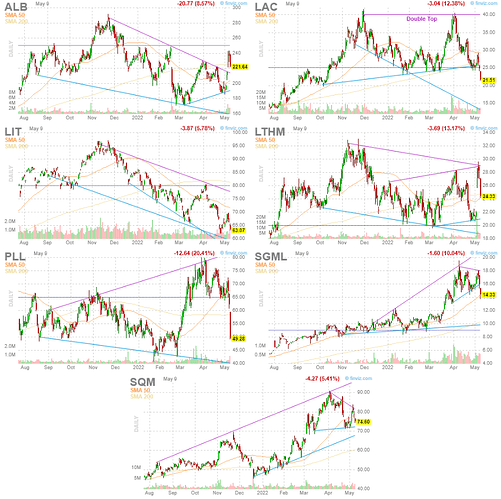

These are the seven tickers am tracking on Lithium btw - ALB, LAC, LTHM, PLL, SGML and SQM in stock, and the LIT ETF:

Thank you @The_Ni !

Other than the market well off I’m not coming up with much.

Ownership appears to be a 50/50 between retail, individual, and institutions from what I saw.

From what I have seen they do follow TSLA a bit, not sure if barchart below will attach and show as comparison.

Parking this here as I hold a good chunk of PLL shares which had a big drop Wednesday and Thursday. Will add more this weekend

PLL getting crushed the past few weeks.

Appears that due to delays of their mining based on article above, coupled with the materials market is causing PLL to continue to move down. That said seems most remain positive with a buy rating given PLL will have the ability to begin and increase production of lithium here in the US.

Here are two recent pieces not gospel as you know

I continue to grabs commons here as well as hold a few options for August at the 45 mark

Will add more over the weekend. Cheers

$PLL continues to fall over the past few weeks, however I’m still bullish on it and adding shares as well as averaging down on my August calls to the $35 and $40 strikes. Let go of a few and hedged by grabbing some $$30 puts for August

Hello.:.continuing to watch PLL as they have ER coming up on 8/1. Recent price movement likely tied to EVs

That said there was a recent article about an investigation into the top brass of PLL so that may cause some issues for 8/1 or beyond