So I need to do a better job of posting on the forum. I’ve created this space to chat my thoughts on macroeconomics, market trends and things of that nature.

This was a good week, I’ve ended at +101% on my port by being in and out of QQQ / FB / AMD. I’ve been making regular calls in the TF all week, but I was somewhat revenge trading and I will be posting here more often.

The bull thesis was for this week was simple: Its priced in. Looking at macroeconomic events we had the geopolitical conflict which has essentially devolved into Russia shelling Ukrainian cities while the economy of Russia continues to collapse. The big question factor was China stepping into the fray, but I dont think they will - mainly because they stand to lose more than to gain at this stage with Russia.

In addition to that we had rate hikes. They were expected. They came in as expected and they’re healthy for the economy. There’s not much to this.

When looking at opportunities, it was easy to see that tech had taken an absolute beating. QQQ is an ETF that offers broad exposure to the tech sector, so I bought calls. Its abundantly clear that Im not the biggest fan of TA, but when looking at opportunities I found that bull flags and ascending triangles were good indications of “legs up” as QQQ did a steady climb upwards.

So, looking forward, what’s next? The short answer is Im not too sure - but im leaning bullish. Looking to the horizon, it seems like the bearish catalysts will be the new COVID development in Europe / China (not likely to manifest in any material way). The interest rate hike happened, so dont think that we will have much of a selloff associated with that any time soon. I see inflation levels reducing themselves as a byproduct of society coming back to normal, COVID being shaken off and the worse of the economic ramifications of the war passing.

There is one word im terrified of and its nukes. The threat of, talk about or discussion of nukes will bring the market down like a house of cards.

Thems my thoughts. Final closing thoughts - success this week was brought about by averaging into positions. Taking small positions. Having day trades ready to go. Cutting anything down 30%. Cutting anything above 70%. Make sure you have rules. Secure your cost basis.

Have a good weekend!

5 Likes

Picked up a JD 3/25 70c. China looking strong.

If I had day trades I would buy a QQQ call here but I don’t so I’m not.

Just get a cash account bozo

1 Like

Want to prove you can do this without one.

Out of day trades? I am sorry! Since you don’t have any left, care if I tell you about a cash account? Well my friend, WeBull happens to offer a cash or margin account as well as your own PERSONAL IRA. WeBull is the best fucking broker and if u join off my invite code then you and I both get 6 stocks valued up to 3,300$. Yes that’s right. 6 stocks up to 3,300$. WHO DOESNT LOVE FREE MONEY??

2 Likes

I’ve been overlooking tech’s beat down and wish I had caught on to your callouts earlier in the week. Thanks for taking the time to post in the forums and share your thoughts.

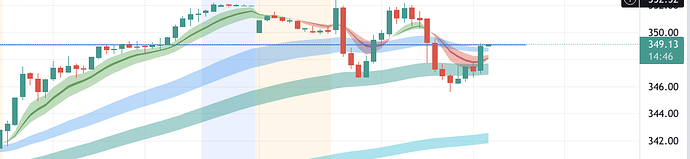

watching this 349 level as resistance on QQQ. If we break and hold on the 15 as vix continues to fall I might wonder into some calls. For now, no position.

Outside of that I averaged down on FB. Slow day. Pull back after rally was anticipated, powell comments didnt spook the market as much as I thought it would.

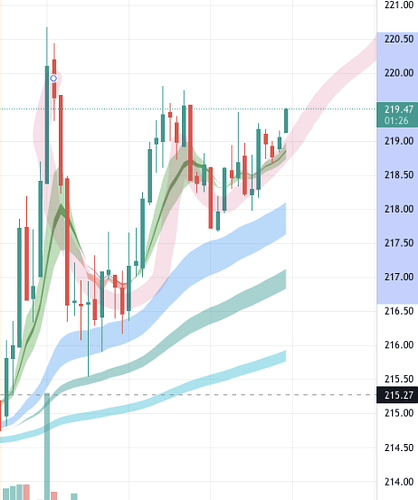

Averaging down at the lows of FB yesterday paid quite well off the FB spikes to 213 this morning. Scaled out of most my positions for profit, left 2 calls as runners.

Overall not a great trade, only up slightly but a good lesson on how averaging down can help save a precarious position.

No other positions at the moment.

In a near 180 from what I said a few mins ago im picking up fb calls here in addition the runners I left from my original position.

With profits secured, im comfortable re entering.

QQQ is strong and SPY is clearly having a bullish day. I’ve been playing FB last 2 weeks so it’s what I know at the moment.

FB going crazy - riding market momentum. I said this last week - lots of opportunity to identify the most beat down stocks and ride the market trend back to a nominal level.

Stg if someone calls this a 5 rivers play im gonna lose my shit

1 Like

Scaled out of FB at 218. Great trade today, only need the one good one. Have been nursing this particular 220 position since last week.

I’ve been at the gym all morning so I havnt been able to look at many market trends, just watched QQQ and FB. Will take a look at everything later today.

Currently 0 positions.

3 Likes

In other news, I was very dumb this morning. Riding the high of a very successful 2 weeks, I gave into old trading habits and APE’d into GME calls on the way up at market open. I panic sold half them when I saw the fat red candle - taking a 25% loss on my port (after a 60% gain, I forgot how fast memes move. These are the terrible trading habits we’re trying to get rid of, so I’ve removed my trading competency roles as I dont feel I deserve them at time being. We’ll see how the rest of the week pans out.

Transparency is key.

2 Likes

Considering making this a dream journal.

I shed alll my GME this morning at open. Not a fun time! I tried to average down yesteday and got BEE TTEEE FF OODD.

But that’s ok. I scalped FB this morning for 20%, might not trade for rest of week.

1 Like

You’ll be aight. :pepe hug:

I’ll be fine! It’s just a wash, memes get you exited for potential and force you to ignore the reality of the situation. I know better, and I’m just frustrated with myself for falling into old habits.

2 Likes

Why do I always have heart burn

Anyways. Picked up a 4/1 FB 235c for .70. Logic: IV has cooled off from the spike this morning to 220, and a pop on QQQ (Or SPy, basically “the market”) will push it back to its HOD and potential beyond.

Still playing fb as my primary stock.

1 Like

Fb calls up 25% so CUT EM IF YA WANNA.

I picked up a single GME FD for less than 50 bucks bc I’m a dirty slut who’s a glutton for punishment

1 Like

i buy 4/1 225 here per chart I posted in tee efffff

1 Like