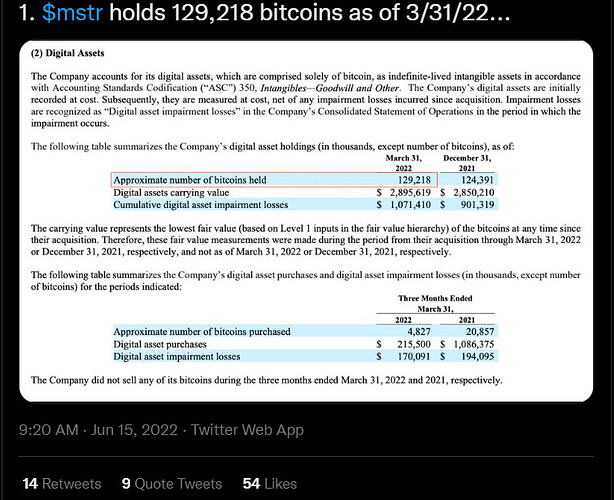

MSTR holds 114k BTC (around 7$B) and the cap is 7.6$B

the company only worth 600$ Millions?

The company is worth whatever the market cap is, and that’s what market participants think it’s worth. Their most recent balance sheet shows 2.6B in assets and 2.5B in liabilities. However you split it, it’s not clear what’s the value of the business excluding btc. Maybe you could comeback to the month before people realized that the company owns btc to get an idea of how much the market thought the business alone was worth.

When it comes to holding BTC and how it affects the price, there’s kind of an implicit agreement that MSTR is an unofficial Bitcoin etf, none cares about their actual business.

I mean if i take into account Saylor’s last tweet from September, the company without its bitcoin holding is evaluated as of now at around 600$ Millions disregarding its bitcoin holding.

Looks extremely cheap to me:

In January 2020 pre-Bitcoin the company was at 1.5B market cap, do you mean 600million is cheap compared to that, or compared to what?

I mean the company did not follow its bitcoin evaluation properly and is being valued lower than it actually suppose to, both in eps and revenue. Makes a good value investment for tonight (?) Q3 ER.

Or I am missing something?

Crypto chicken might be coming home to roost for MSTR.

For context:

https://twitter.com/saylor/status/1476539985562152960

They issued >$2B in unsecured convertible debt and equity to FOMO into BTC. Yield on some of this debt is reportedly > 7% already, so folks are getting nervous. Not distressed by far, but nervous.

Here’s the twist - this debt can be converted to equity if price is below $390 for 5 days trading days. MSTR was at $376 after a 17% drop on 1/21. (The drop seems to be partly because of the drop in BTC price, and partly because of the dissemination of an earlier SEC objection letter to MSTR’s attempt to use funky accounting.)

MSTR therefore faces the risk of bond holders converting to equity and cashing out. Typically, this wouldn’t make much sense unless the company was distressed - there’s much runway left on the bonds. Years of runway. And there’s a real software business underneath generating $500M a year.

But… BTC is at $35K, and getting close to that $30K average purchase price. Once it falls below $30K, they’ll have to take that markdown, which will eat its way into equity. And at some price point (I’ve seen estimates of $20-25K), equity goes poof.

What will nervous convertible bond holders do if they think there’s a decent chance of BTC hitting $20K, forcing insolvency? Convert to equity and liquidate, of course. That would just exacerbate the situation, crashing stock prices and making it difficult to raise addl capital.

So yeah - worth keeping a close eye on BTC prices - if it falls below $30K for a period of time, MSTR may be in deep, deep trouble.

Fwiw, this works both ways. If (when?) BTC make a comeback, MSTR can act as a ~2x leveraged ETF on BTC (because of the 2B debt) if it is still alive then, and stock prices can skyrocket.

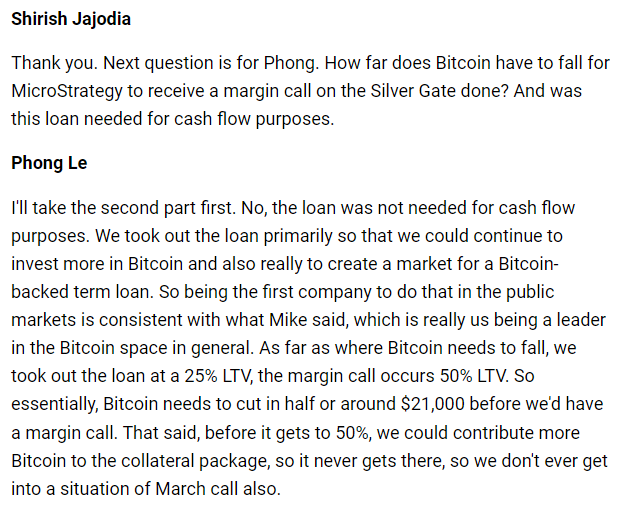

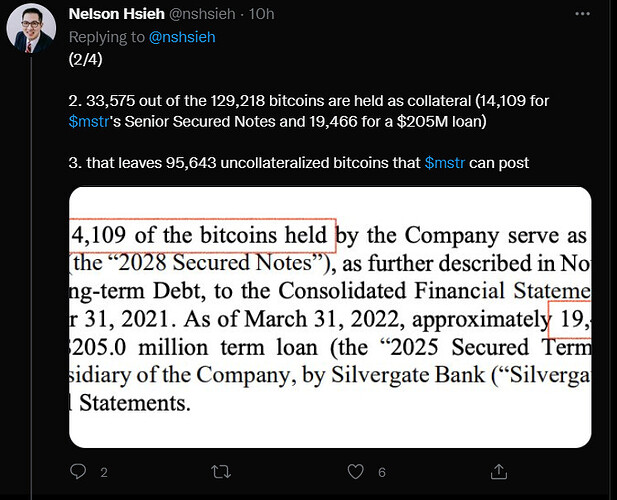

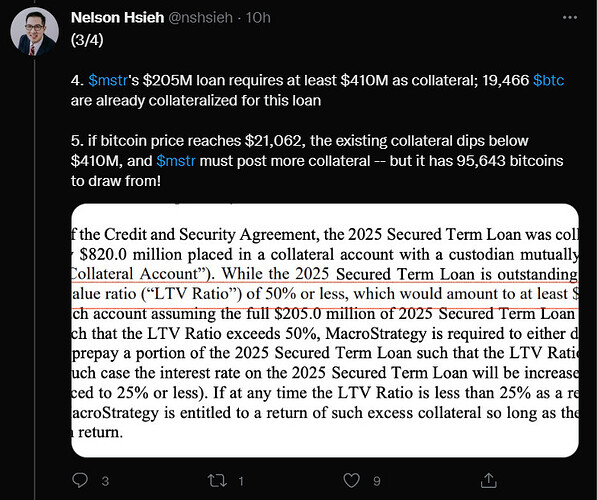

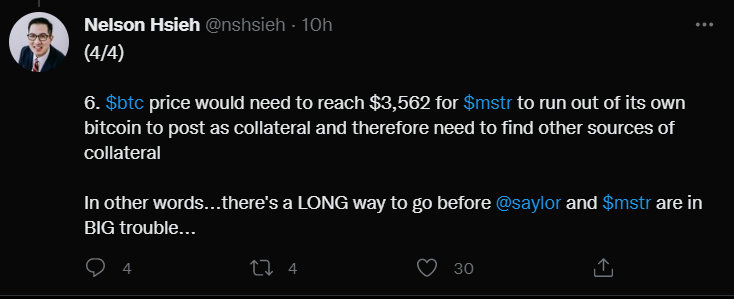

Interesting little tidbit from their earnings call, around the “MSTR will get margin called if BTC falls below $21,000” datapoint making its rounds:

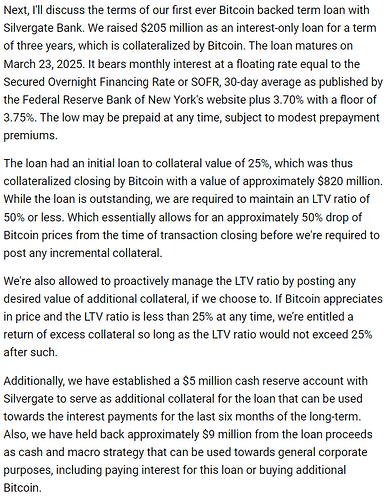

Details of the loan:

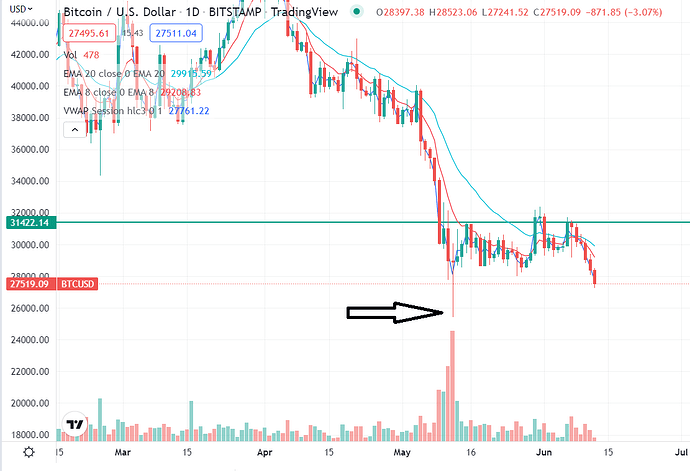

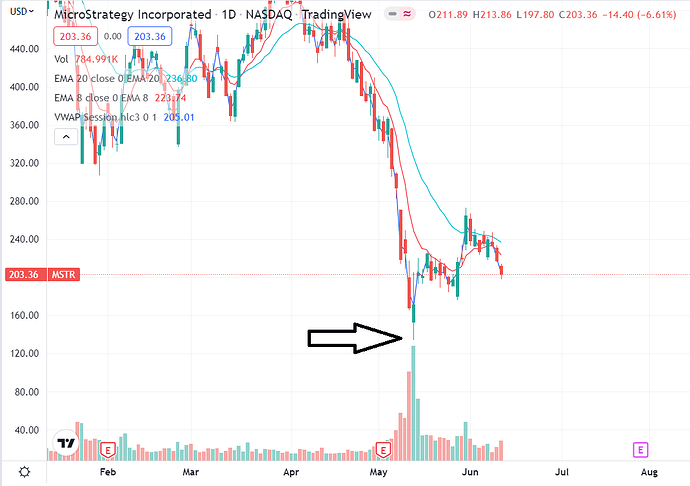

Life comes at Saylor fast. In the last 5 days, MSTR has fallen 40%.

2x leveraged BTC ETF doing what it is supposed to, I suppose. If they survive, they will be such a great leveraged bet on BTC’s recovery.

Does anyone know the avg purchase price of MSTR’s bitcoin?

They issued 1.7 billion in bonds due in 2025 and 2027 to finance the purchase of the bulk of their BTC.

If BTC crashes for real (like, back to 5K), MSTR is legitimately facing bankruptcy as early as 2025. Granted, companies have ways to stay afloat, but if this ends up being a 100MM valued software company with 2B of debt because of a shitty BTC bet, it’s unlikely anyone will want to loan them money.

The Terra-Luna fiasco was kinda nuts, but it being comfortably at ~$0 doesn’t mean the rout is over.

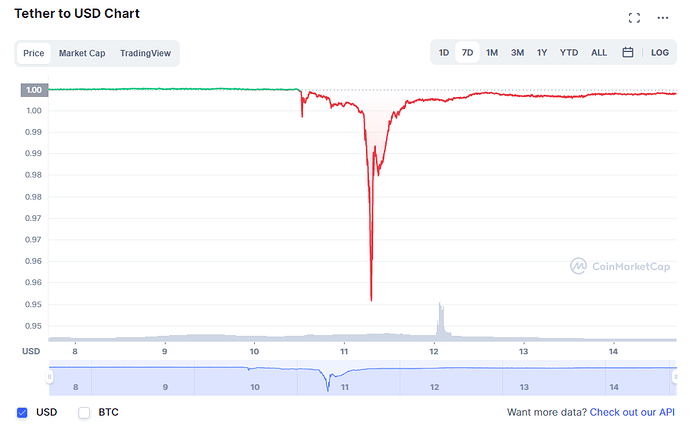

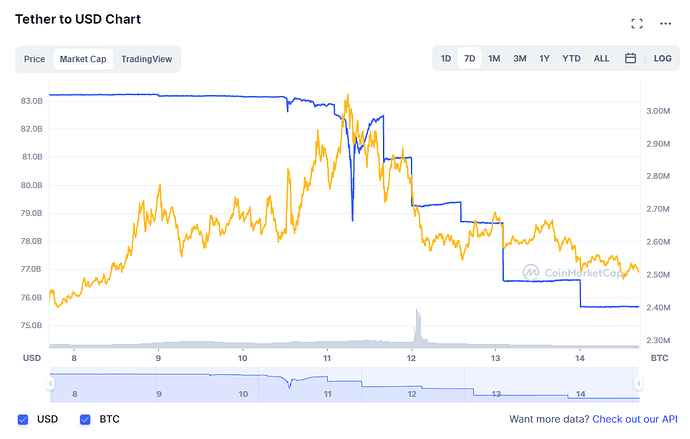

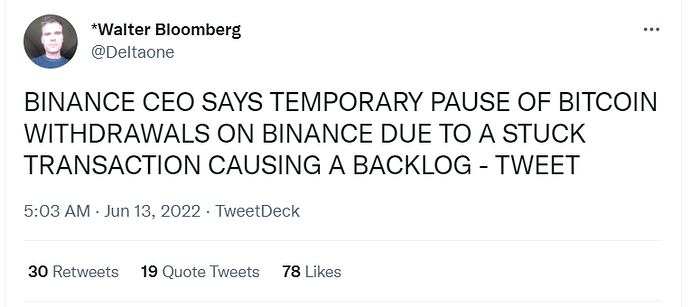

Tether, which is an order of magnitude larger and effectively holds up the price of BTC and other crypto is wobbling. It survived an initial run:

But over the last few days, has seen steady redemption in both USD and BTC terms.

Tether puts up a facade of transparency that actually hides what it actually holds as collateral. It was only in October 2021 that they paid a $41M file when the CFTC called bullshit on their claims that they were fully backed by U.S. dollars:

As found in the order, Tether held sufficient fiat reserves in its accounts to back USDT tether tokens in circulation for only 27.6% of the days in a 26-month sample time period from 2016 through 2018. The order also finds that, instead of holding all USDT token reserves in U.S. dollars as represented, Tether relied upon unregulated entities and certain third-parties to hold funds comprising the reserves; comingled reserve funds with Bitfinex’s operational and customer funds; and held reserves in non-fiat financial products. The order further finds that Tether and Bitfinex’s combined assets included funds held by third-parties, including at least 29 arrangements that were not documented through any agreement or contract, and that Tether transferred Tether reserve funds to Bitfinex, including when Bitfinex needed help responding to a “liquidity crisis.”

Just a few days ago, it refused to disclose details to the Financial Times on its $40 billion hoard of US government bonds for fear of revealing its “secret sauce.” Precisely the wrong thing to do if one needs to restore confidence in “the bank” but also precisely the thing to do if there is still a lot of cow manure under the hood that is being relabeled as investment grade.

Which brings us to the 9% redemptions we have seen over the last few days along, which not everyone can do either.

The distribution of their reserves currently shows that about half of it is in cash or US govt bonds. Given their evasive response to the FT on these, and the general haircut that commercial paper has taken recently, it is likely they will start feeling the heat soon if redemptions continue at the current clip. Some say if Tether gets depegged it will have a similar kind of effect the Mt Gox fiasco did almost a decade ago.

From the perspective of someone who is still learning about this, it seems this is a good case to short BTC in some form, as the Tether risk transfers rather well to BTC.

What do our crypto folks think?

IMO everybody who holds tether should sell/redeem immediately. The people who redeem first will be made whole, if it turns out their reserves are insufficient, it’s the later redeemers who will be left with the bag.

Why anyone is stupid enough to hold something that has potential downside but no actual upside is beyond me. USDT is trading at .9988 right now. So basically if you’re a holder of USDT, you’re risking 50-100% downside for 0.12% upside. That’s a pretty shitty trade if you ask me. Are there not other stable coins that actually have properly audited books?

Also, LUNA/UST is pretty much dead at this point. My guess is Do Kwon will be focused on keeping himself out of jail for the 50B fraud he committed – which is on par with the size of Madoff’s fraud. I would not expect any kind of recovery there. The only thing that’s slightly bullish for BTC from that debacle is supposedly LFG dumped their entire BTC reserve to try to repeg UST, and a sale of that magnitude didn’t push BTC even lower than it went.

If USDT turns out to be an even bigger fraud than UST though, that could easily slam the entire crypto market down another 50% or more.

With BTC breaking support at 28.5k and quad witching week coming up with a heavily bearish option chain. Could definitely be worth taking some puts here, although they’re expensive. Options prices are absolutely jacked and will probably be even more at open, be careful if you’re playing OTM weeklies as the theta on them is absolutely brutal.

The cheaper play would be BKKT as people mentioned in TF, dropped all the way down to $2.00 when BTC last knifed.

Last time BTC dropped below it dumped all the way to 25.5k. Which dropped MSTR all the way to 135.

MSTR will also be margin called if BTC hits 21k.

@JoshBrewsDIPAs and I were just talking about this. Interested to see how the first hour looks like. Might get something around the $130 strike range on the out side just to let it ride.