This thread is for general discussion and analysis of the listed commodity.

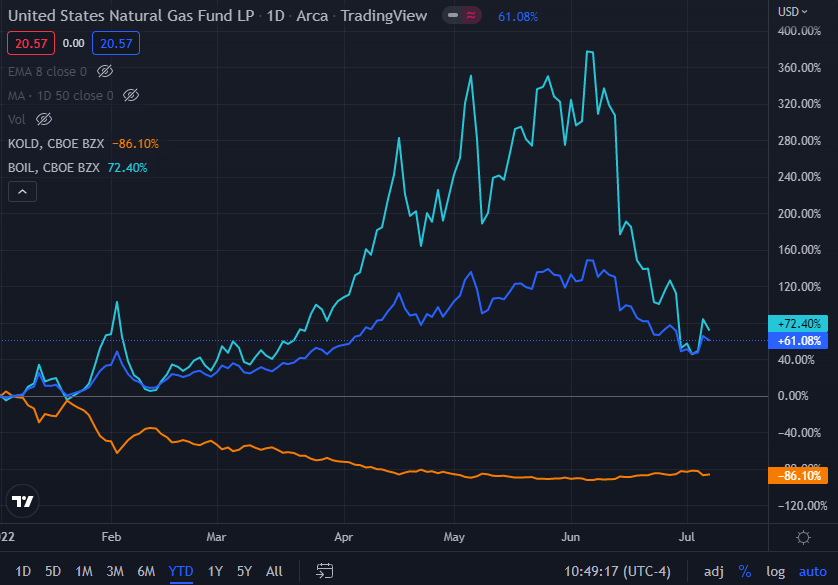

Some major natural gas related ETFs:

- UNG - tracks natural gas futures

- BOIL - leveraged; 2x daily return index

- KOLD - inverse, leveraged; -2x daily return index

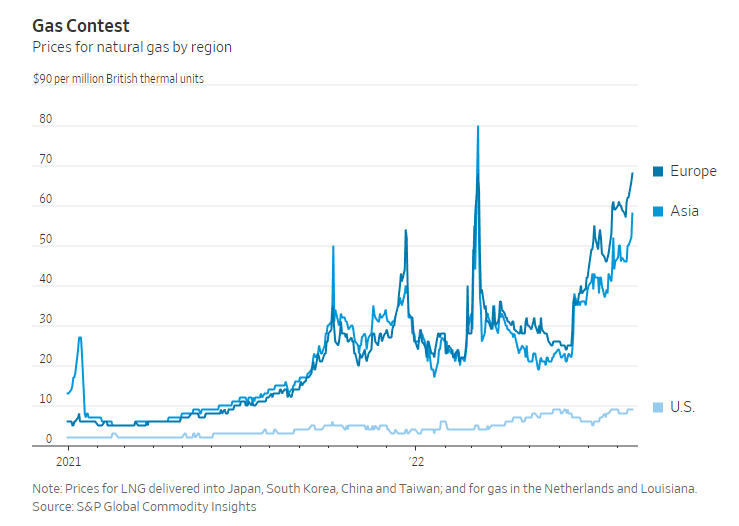

The runup was mostly due to the Russia-Ukraine war. The recent cooling off is related to a large extent to the fire at the Freeport LNG facility.

Another great session by MacroAlf, this time on oil and gas.

The clip above should start at the key points Papic makes:

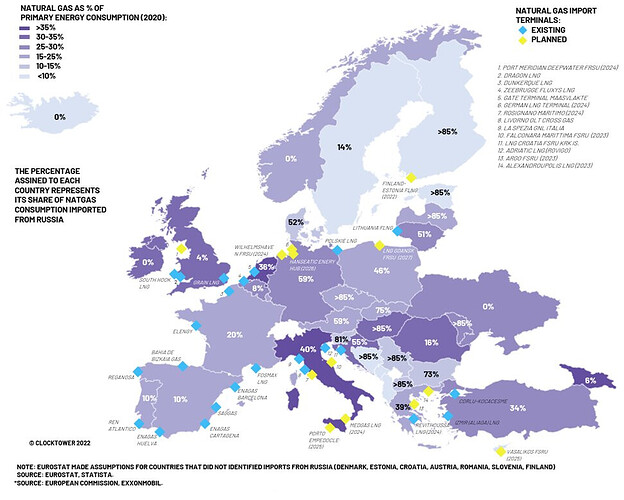

- Europe imports 39% of its natural gas from Russia, and uses natural gas for 25% of its energy needs. So 10% of Europe’s energy needs is satisfied by Russia. 10% is nothing to sneeze at, of course.

- But! Europe represents 74% of final demand for Russian oil.

- Thus, Russia might have almost monopolistic powers because it is the marginal supplier at the moment, but it too is quite vulnerable in the longer term.

- If Europe survives this winter ok, they can be sure that they will lose a good chunk of their their biggest customers. All this gas is piped to Europe, and there are no pipes to China or India. And as we know, moving nat gas on tankers is a whole different ballgame compared to oil.

Map on this (note the current and planned LNG terminals):

Papic goes on to call shorts on both oil and gas. While he may be right in the long run, Russians probably have a few tricks left, and politically fragmented Europe might still pull a few fits.

The Nordstream 1 is shut down for maintenance, and is supposed to turn back on on July 21. European gas storages seem to be 64% full. I don’t know how significant this is, given that we are in July, but the question that comes to mind is, how long can Russia keep the taps turned off and freak Europe out for concessions on Ukraine, before they kill their golden goose?

In terms of a play, would be great to get more direct exposure to European gas prices. Barring that, looks like UNG is up already, from 20 to 24:

Difficult to see how prices don’t keep adjusting upward in anticipation of bad news on July 21, so may look at initiating some bullish positions. Anyone have any suggestions other than UNG though, to play this? OI not really liquid, and spreads are rather bad with UNG options.

Maybe some Norwegian gas producers could be a play? They are supplying 20% of Europe’s natural gas according to this article, and are willing to send more.

https://www.reuters.com/business/energy/eu-norway-agree-increase-gas-deliveries-russian-cuts-deepen-2022-06-23/

Maybe Equinor? $EQNR - they have an options chain with some decent OI on some of the strikes, although it is sporadic (Also WeBull is showing some weird strike prices in October and beyond). I took some shares last week to play it long.

From their website: Equinor is the largest gas producer on the Norwegian continental shelf, and the second-largest gas supplier in Europe. The combined gas volumes from Equinor and SDFI (the Norwegian state’s gas volumes) constitute more than 20 per cent of the gas market in Europe.

https://www.equinor.com/energy/natural-gas

The downside could be that they also are in the oil game (if oil prices are in danger of plummeting), but I believe I read that natural gas was their bigger business segment in Q1.

Earnings are 7/27 too - maybe the Aug 40c monthlies could be a play. 4k OI on those according to WeBull.

Footnote: the company is 67% owned by the Norway govt. It was partially privatized in 2001 and trades as a public limited company. I think the political risk of full renationalization is miniscule, but they are basically commies.

https://www.equinor.com/about-us/the-norwegian-state-as-shareholder

Last time the pipeline went down for maintenance natural gas prices spiked… Could be another catalyst right here…

- The unscheduled maintenance works on the Nord Stream 1 pipeline, which runs from Russia to Germany via the Baltic Sea, deepens a gas dispute between Russia and the European Union.

- Gas flows via the Nord Stream 1 pipeline will be suspended for the three-day period from Aug. 31 to Sept. 2.

WSJ article talking about LNG tankers are in high demand right now.

Shipping tickers I know of that do natural gas: $FLNG, $LPG, $TNP

Gas prices in Europe jumped a further 19% Monday after Russia said it would temporarily close a major pipeline for unexpected maintenance later this month. The rise in Europe dragged the U.S. natural-gas market up 5.6% to its highest level since 2008. Traders expect gas prices and tanker rates to zoom even higher if China, where demand has been curtailed by Covid-19 lockdowns, steps back into the market before winter.

https://www.wsj.com/articles/europes-natural-gas-crunch-sparks-global-battle-for-tankers-11661150781

Interesting thread providing some counterpoints. This guy called the top of the oil bull market, and seems to know what he’s talking about.

Last time news came out for work on the pipeline UNG didn’t move too much until the actual shutdown occurred. I’m thinking it might be worth taking a cheap little gamble call near end of day tomorrow to see if it spikes again when news drops of the actual shutdown happening on Wednesday.

Gas flows via the Nord Stream 1 pipeline will be suspended for the three-day period from Aug. 31 to Sept. 2.

Looks like late night news saying now Nord Stream 2 pipeline is also out of service. Should be a bump for natgas today. $UNG $CTRA

NS2 never came online. NS1 hasn’t been pumping since that unplanned “emergency” maintenance.

They probably keep a certain amount of pressure in the line when idle for the exact reason of detecting leaks.

You can look at the flow history (realtime) via:

Could be Russia sending a warning. Denmark to Poland line is ramping up capacity early, and Poland just inked a big time natural gas deal with Norway (Equinor). There are quite a few pipes on the bottom of the Baltic Sea. If they can sabotage two, they can sabotage more. Norway supplies 25% of all natural gas to Europe. UK, Germany, everyone could be in trouble this winter if there is more sabotage down there.

This is a decent thread with the tinfoil hat scenario: https://twitter.com/AndreasSteno/status/1574790406998474765?s=20&t=NVXUl2qsaIF82qrPpOIRGg

Another great video by Wall Street Millennial here: The Highly Suspicious Nord Stream Explosions - YouTube

WSM goes over the background info and speculative theories on who blew up the Nord Stream pipelines and why.

It’s difficult to tl;dr the video with so much important information and layers, but I will try to summarize what I got out of it.

Russia

Russia doesn’t gain from blowing up the pipelines. On the contrary, Russia seems to lose for two reasons:

-

Gazprom is owned by the Russian government and is a majority owner of both pipelines.

-

Russia already “indefinitely suspended” the pipelines’ operation and flow to Europe. There is no need to blow up the pipelines. By suspending flows, Russia has negotiating leverage to ask for loosening/ending of sanctions in exchange of resuming gas flows. Blowing up the pipelines takes this negotiating leverage away.

Norway

Norway’s economy is essentially a large gas station. They stand to gain from a prolonged war and destroyed pipelines.

Norway also owns 6 submarines and is geographically close to the Nord Stream pipelines.

However, Norway hasn’t been significantly involved with any war since WWII, making their military most likely too inexperienced for such a sophisticated and risky naval operation.

United States

This is pure informed speculation but what I got out of the video the most was the United States seems to be the most likely culprit for blowing up the pipelines for the following reasons:

-

The US has the highest capability and experience for pulling off the destruction of the pipelines.

-

10:39: US Secretary of Defence, Lloyd Austin, publicly stated that one of the strategic aims of arming Ukraine is to weaken the Russian military. By taking away the Nord Stream pipelines, it greatly reduces the odds of a political negotiation for ending the war. (See Russia section, note #2 above). Essentially, blowing up the pipelines should prolong the war which would be good for US military interests.

-

Most curious is at 11:14 where Biden literally said in February 2022 (before the invasion) that if Russia invaded Ukraine, he would “end Nord Stream 2”.

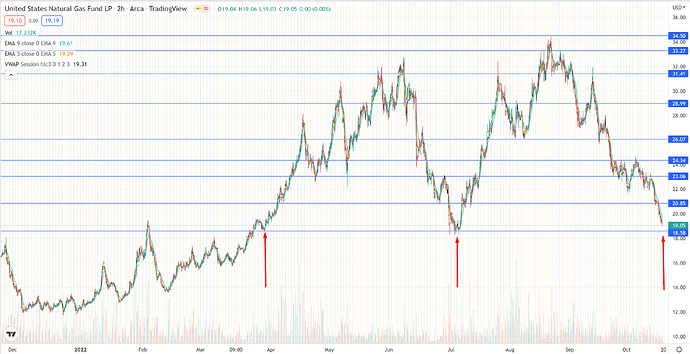

UNG seems to be coming down to its trendline.

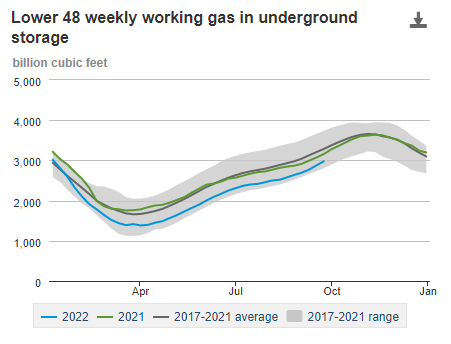

Storage levels are also lower than recent historic averages:

Natgas swings wildly, but we do have winter coming up when prices may - may - spike depending on the temperature. Freeport should also be coming back online sometime in Nov. So we may have catalysts pushing this higher in a few weeks.

Worth keeping an eye on.

I couldn’t make sense of it. I would’ve thought that the Nord Stream explosion news would be pushing natgas quickly higher, and that UNG should be higher.

For natgas I am long CTRA (thx Maverick of Wall Street).

Contrary to UNG, CTRA is up 4.75% today versus UNG’s down 4%. Not sure why that is.

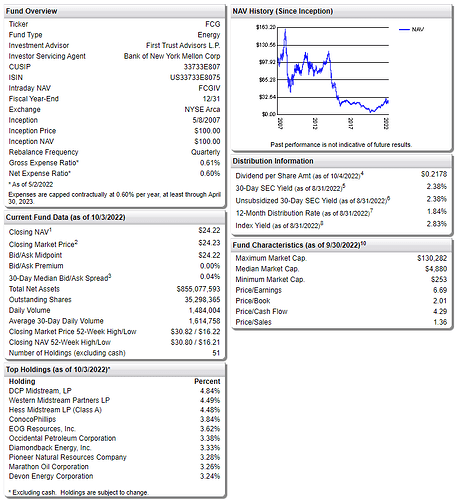

Picked up UNG commons @ $23.525 and FCG commons @ $25.14. No options.

Additional reason to be bullish on natgas - WH rules out ban on natural gas exports this winter.

FCG is “comprised of exchange-listed companies that derive a substantial portion of their revenues from the exploration and production of natural gas.”

FCG has trailed UNG/Natgas YTD, but is showing signs of catching up. Both should go up, but FCG could perform relatively better for the time being. It should also be a smoother ride than UNG which tends to flail around a lot.

UNG is almost at that 18.58-19.00 July bottom range.

I have an order in for Jan 2023 25c at 2.00.

The Starks are always right eventually. Winter is coming.

My UNG Jan 2023 25c filled for 2.00 this morning.

Mental stop loss is if UNG clean breaks below 18.58 and holds below it. Otherwise I’m playing a double bottom.

Adding some news to the swing play thesis.

The Energy Department projects heating bills will jump 28 per cent this winter for those who rely on natural gas, used by nearly half of U.S. households for heat. Heating oil is projected to be 27 per cent higher and electricity 10 per cent higher, the agency said.

That comes against inflation rates that accelerated last month with consumer prices growing 6.6 per cent, the fastest such pace in four decades.

The pain will be especially acute in New England, which is heavily reliant on heating oil to keep homes warm. It’s projected to cost more than $2,300 to heat a typical home with heating oil this winter, the energy department said.

High risk

Limit buys filled on UNG 10/28 19c at 0.90

I am in on this, got some fills on the Jan 2023 $25c at 1.55. Watching today to possibly add commons.

Kevin, did you cut, hold, or average down?