Hello All,

Doing this to keep track of my plays as well as to gain insight from those of you whom have been doing this a lot longer than I. I started the account with $15k. I got into this due to the buzz around the AMZN split. I spent the month of April reading up on how the market was functioning and learning some of the basic jargon. I decided to get into options because it appeared to the be the way to make profit without having huge amounts of capital. My first purchase was AMZN 2600 calls for 6/10. Apparently, I went full Degenerate and allocated 80% of my portfolio to it. I had the opportunity to sell the calls prior to the split for 300% gain. I chose not to due to FOMO. Lesson learned. I ended up selling on split day for 220% gain, still a good gain, but definitely left money on the table. I continued my degenerative actions by allocating all of my gains into more call options for AMZN. I unfortunately bought at the top on Monday. By Tuesday morning i was in hole about $5k. When I tell you the feeling of defeat had set it, that doesn’t do it justice. I regrouped and made smaller plays to gain back my capital. By Wednesday i had made back around $2k. Thursday the information i was reading on the trading floor as well as news updated led me to believe the market was about to turn red. I went in on some Puts. I sold a few on Thursday to gain around $7k. Obviously with the market dumping after the CPI on 6/10 my puts printed.

I would like to thank Squishy for the DOCU DD.

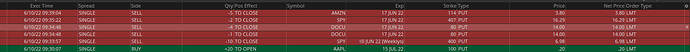

Here are my orders as of 10:00 am on 6/10. Account is up 16k or 106% on the first full week of trading! Hopefully i can keep that momentum going!

I added to my AAPL JUL15 100p. I’m up to 50 contracts. I don’t intend to keep these past June. They were relatively cheap given the upside potential.

I added 10 SPY Jun15 390P right before the Biden Speech when it spiked to 392. I going full degen and holding these over the weekend. I don’t expect much movement, just banking on SPY retesting 390 next week if it doesn’t blow through it during power hour today. I plan on letting these go on Monday.

Sold my 20 Jun 15 SPY 390P @ 11.65 for 291% gain!!! Let’s go!! I’m waiting for another test at 382 to make a decision on re-entering into SPY plays.

I doubled my AAPL position on JUL15 100P. There’s a lot of noise on AAPL dropping due to employees being required to sell their shares they leveraged against the purchase of a primary residence. I understand that this is a significant drop from its current price, I don’t expect to hold it until expiration.

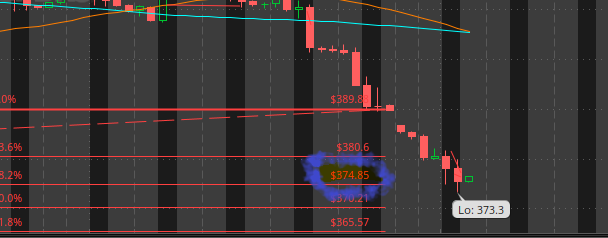

Amazing Day today! Account up 67.3% on the day!!! Let’s goo! My overnighters are what made the day! Once Spy hit my support around 374.85 I took a quick position on SPY 379C. The Action was faster than I expected and I sold for 7% gain. It ran up to 381 which would have been awesome, but the play was more about testing my TA than going for the homerun. It ran all the up to the next resistance I had marked at 380.6. I opted for 15 SPY JUN 22 370p’s here. Lesson learned here was to give it a few mins to let the IV cool off, because the 370s were still trading as though we were still in the 375 range. Once we dropped down to 378 I felt the right thing to do was avg down since the price had actually come down a bit, so i took another 15. Unfortunately the price ran back up to 380, at this point i was feeling like i should let it go and take the L, but after reading the general sentiment of Valhalla I felt like patience would prove to victorious, so i went full degen and grabbed 10 more. As it continued to drop the remainder of the day, i started selling off 5 at a time, ranging from 30-48% gains on each trade. I am currently holding 20 overnight like the degenerate i am. Post Market news is making me believe that it was the right decision to sell a few as well as hold some. All of the news is pointing to a drop again tomorrow, which could be interpreted as a small rally before FOMC.

Still holding my 100p AAPL for JUL 15. I believe there is still some downside still to go on AAPL. I won’t hold it to execution.

I got some insightful DD from @Droburt regarding RDBX. I took a 19c position. I’ll keep everyone posted!

Lets keep it going!

Lets fucking go brother.

Overall, down 2.8% today. Some would call this a bad day. I actually felt really good about it and learned a lesson from it. Here’s why.

My RDBX play I picked up at the end of the day yesterday, became essentially worthless during off AH & PM. This put me in the hole 20% from where I closed the account the previous day. I have yet to sell them, frankly because I’m already down 98% on the play, now I’m just holding in the off chance RDBX goes back up. Lesson on this = Stop Loss is mandatory on extreme plays like this one. My only issue is, most of the volatility occurred during off hours and my stop loss wouldn’t have executed. Moving forward I won’t allocate as large of a percentage of my capital towards an uncomfortable play.

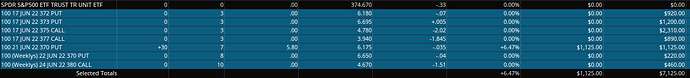

I spent the majority of the day trading in and out of 370p, 372P, 373P, 375c and 377c. I felt like my general reads were correct on the plays. Below are the results of those plays today. These plays brought me back from -20% to -2.8%, which is why I felt good about the day.

I picked up FedEx 200p for Jul 1. I’ll do some DD on this play and make a separate post.

Currently Holding 30 SPY 370P. I will let these go at open, i think the results at 8:30 will have a negative impact on the market and we will see dip PM and then a small rally/profit taking until the big news at 2pm. Just my opinion.

What a day!

My Degen 370p’s i held overnight printed! ![]() I traded a few plays today through the ups and downs on Spy overall all plays that I am out of were solid wins.

I traded a few plays today through the ups and downs on Spy overall all plays that I am out of were solid wins.

Had issues trying to get rid of the RDBX 19cs I have. Looks like I will bag hold tomorrow unfortunately. ![]()

My AAPL 100P are gone for a solid 31% gain! (Thanks to the advice of TnP ![]() as well as the other individuals that encouraged me to take the win.) If we have a rally tomorrow I will more than likely get back in this play for a cheaper cost, as I believe AAPL will still drop to 100.

as well as the other individuals that encouraged me to take the win.) If we have a rally tomorrow I will more than likely get back in this play for a cheaper cost, as I believe AAPL will still drop to 100.

My FedEx 200P are gone as well for a 20.5% gain!! (Thanks to the advice of TnP ![]() as well as the other individuals that encouraged me to take the win.) Same scenario here, if we rally tomorrow I will get back in this play as I truly believe the 30 point jump we saw is overhyped.

as well as the other individuals that encouraged me to take the win.) Same scenario here, if we rally tomorrow I will get back in this play as I truly believe the 30 point jump we saw is overhyped.

I grabbed some SPY 372c for Jun 21 and SPY 380c for Jun 24. I grabbed small positions on these for fun going into my first witching event. Looking forward to the volatility!!! Make sure you check out all the DD regarding witching before you make any moves. Don’t do anything based on my plays, I am not a financial advisor nor am i an experience trader.

Thank you all for the continued guidance.

DD on Witching is here: SPY & The Quad Witching (June 17th) - #24 by The_Ni

What a week!

I want to start off with thanking all of the folks that took the time to directly answer my questions regarding the volatility of this week. The list is long, but just know if that thank you applies to you, I mean it.

My account is up 208% from where it closed last Friday. 208 freaking percent…mind blowing. This is largely in part to the community here at Valhalla.

For those of you whom may be struggling, take a step back and think about what is going wrong. Ask questions, make notes, read some of the free information on the forums. The amount of good information available here is fantastic. I am new trader and if I can do it, so can you. I promise I’m not the brightest crayon in the box.

Closing out the week, my calls i held overnight were a struggle. I took around a 2k loss on the 372cs, and oddly enough the 380cs brought home a 450 gain.

After doing some late-night reading and video watching last night, I got into plays immediately at bell based on Vix, MACD, and RSI data points. We shot down right before bell, so as soon as the bell rang, I waited a few seconds for IV to kick in and I took a hefty position at 366 calls. And boy did this play pay out!!! it shot up to 369.5 and I took a solid 185% win. I couldn’t have been move excited that I took what was available here in the forums and applied it. I traded in and out the rest of the day with moderate puts and calls based on VIX movement, and other technical readings, plus call outs that were mentioned on the TF. Thank you Mayor, for the Degen play at the end of the day.

I still feel like my 100p AAPL and 200p FedEx plays are solid moves. I will look to take a position on Tuesday if we have a small rally before JPOW on Wednesday.

I have some Degen news… I took a big stance on SPY 370c JUN 24 at the very end of the day when we dropped down to 366. I know this is a terrible idea, and honestly, I almost immediately hated myself for doing it. Hopefully I can get out of this play remotely to cost on Tuesday.

At the end of the day, I can’t complain too much, my account is green which is the goal of all traders.

Cheers,

Oak

FedEx DD is here: FedEx Reversal - Research & Analysis / Earnings - Valhalla (ascendedtrading.com)