Chainlink (ticker: LINK) an oracle protocol designed and built by offchain labs to bridge blockchain and the real world:

So this DD will be pretty big. I have spent a lot of time looking at blockchain and trying to figure out what role it has to play beyond a giant centralised casino. I am not a coder or developer however I’d like to think I have a grasp of the overall ecosystem enough to understand some potential applications.

I know a lot in the server don’t do crypto so I’m starting out with an outline of that and building towards my end thesis and where I believe LINK is going (to the moooon!).

A new world and a new paradigm or 3…:

So to start off blockchain is a cryptographically secured self updating ledger. AKA a computer accountant that is kept safe and secure by maths. The first blockchain was worked out on paper by Stuart Harber And W. Scott Stornetta who ere trying to find a way to have timestamped tamper proof documents. The first operating blockchain is actually 13 years older than bitcoin called surety created by the aforementioned researchers who then advertised it in the classified adds of the new York times. It basically is an incorruptible record of digital documents. Feel free to look more into this but I need to stop my self or I’ll drone on.

So there you have it Bitcoin is NOT the first blockchain and Satoshi Nakamoto is NOT its inventor. In fact Satoshi cites them in his paper 8 times here https://bitcoin.org/en/bitcoin-paper. No one knows who Satoshi is and that’s not a real name anyway. In 2009 bitcoin blockchain started and the first fully decentralised blockchain was started.

This is Paradigm 1 and 2. 1 = surety incorruptible unalterable digital records

2 = bitcoin first de-centralised ledger with exchangeable currency

Fast foward 2013 and Vitalik Buterin (still working on eth reluctant leader but main founder), Charles Hoskinson (Was CEO of Ethereum did more money and legal framework stuff then tried to raid Ethereum’s foundation funds, left in a bitch fit when he wasn’t allowed some of that sweet dolla dolla funded Ethereum classic with 4 devs for a year out of spite before scamming Japanese investors with IOHK and Cardano which still doesn’t have FULL smart contracts a code no one wants to use and no dapps outside ones that are just bridged from eth yay top 3 how?) Gavin wood (creator of ethereum yellow paper, solidity coding language for smart contracts no. 1 amongst devs created of polkadot eth compatible scalable sharding masterpiece of tech and its kusama test net) , Anthony Di iorio (Money and marketing man left after non profit route was chosen, now works outside of crypto), Amir Chertrit (worked on coloured coins a pre smart contract thing on bitcoin network, helped vitalik coding, now works outside of crypto), Jeffrey Wilcke (coder made master coin first initial coin offering then jumped to eth, now works outside of crypto), Mihai Alisie (did the legal stuff and set up banking for the etherum foundation now does other stuff) , Joeseph Lubin (another money man has since left and made Consensys that launches blockchain companies also helped bring in etherum partners like JP morgan, CME group, Bancor Santander, Intel, Microsoft and others and Link is here too more on that later) Also weird fact they all decided live in a cabin and lock the world out to build Ethereum as fast as possible then all got cross with each other and split funny that.

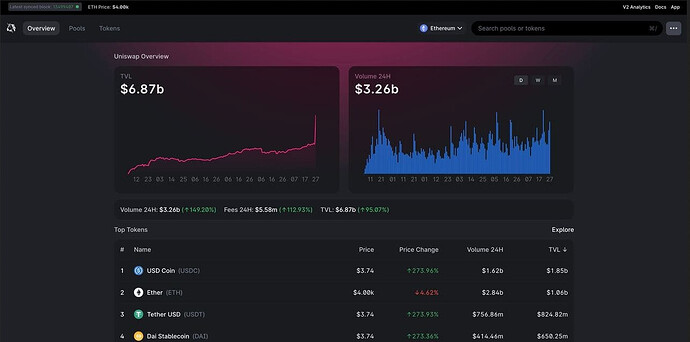

So Paradigm 3 we now have a programmable blockchain with a ledger and transferable funds that can have sub ledgers (alt coins) built on top of it using its security and creating a standard ERC20 token that’s interchangeable among different programmes. Also ERC721 NFT’s those Cough useful cough not shit jpegs people are trading. On top of that Dapps (decentralised apps) can be created permissionless (don’t need to ask) by anybody all in one interoperable language and layer. ERC721 is simply a non-fungible (non standard each one is not a duplicate of another think painting vs a nickel where the nickel is ERC20) this will be useful for storing documents, national insurance numbers passports, deeds of ownership to land etc (LINK will be part of this but more on that later) but its just very nice pictures definitely worth thousands of dollars for now. Its since had 100s of thousands of devs devoting millions of hours building an incredibly complex ecosystem which if you think that big corpos are going to the github and ctrl C cntrl V the code lets see how Richard Hearts Hex works out because that’s what he’s trying to do. In fact JP morgans Onynx blockchain (Onyx by J.P.Morgan) which 40 other financial and non financial entities have signed up to use (oh yes Link here too its everywhere) is using as a settlement layer. Yes that’s right the best the corpos can muster is a side chain. Added to the fact that devs working on de-centralised projects can do so at a higher level of income (thanks to you degen gamblers pumpng coin prices) and autonomy means that the big boys don’t get the pick of a the labour pool like they are used to in other sectors.

So I don’t prescribe to the “blockchains the real gem they will just build their own” philosophy. Also projects value is deeply tied to their partnerships, interoperability and how ingrained they can be in a larger ecosystem islands don’t win here continents do. As a given example we recently had layer 1 mania with each pump starting with which project got the bridge first Sol didn’t pump until it got Wormhole (link to eth) same for AVAX and many others. Oh yeah bridges are janky and suck I use them but don’t worry yes you guessed it LINK has a solution.

A place in the world:

So whats it all good for other than tracking what magic internet coins we all have, gambling, playing shit blockchain games, tracking who owns this JPEG which they have no IP or royalty right to. Its all bollocks and magic fairy dust right back by tethers hidden billions and binances dodgey reserves, bitfinexs leveraged hot air tether exchange. Well yes right now. But what this actually is, is fully automated, trustless, cryptographically secure, programmable, adaptable base layer for a financial system in the making. Its not done yet, theres energy use concerns, scalability, speed, usability, regulation, tax liability concerns its still early and in its infancy. But my entire premise for any long term position in crypto is that it is an eventual replacement for the antiquated software system that the current financial system sits on. It’s capable of more and more adaptable look at defi its madness but its impressive. We have Ivy league universities, nobel prize winners, Microsoft, google, JP Morgan, Swift, Swisscom, T mobile and many more working on this technology there’s got to be something more than gambling on shit coins here.

The Thesis: A safe bet, There is only 1 LINK

Welcome to the Layer cake son:

So before I expand on this Blockchain is talked about in layers. Layer 1 is ethereum it’s the most secure but slow and expensive (eth 2.0 will introduce something called state sharding to ease this) things like Matic and Xdai (maker dao home of dai stable coin and the first Decentralised finance aka defi project) are side chains they run along side Ethereum settle things on their own chain then relay back to Ethereum to use its security. Next are layer 2’s called rollups they are Optimitic roll ups like Arbitrum (offchain labs aka links project I told you EVERYWHERE) which assume the transactions are correct then later check them with Ethereum base layer and ZK rollups which sign the transactions off before processing not read too much into this but there isn’t one working yet I don’t think. So they sit on top if etherum and run all their transaction through it rather than just checking in every now and then. They are also fully decentralised whereas side chains can have their own centralised validators which is a weak point. Vitalik and many others have stated this is not a winner takes all scenario and he envisages a world where many blockchains co exist and interconnect.

Chainlink protocol is the product of offchain labs. Their end goal is to make chainlink fully decentralised and autonomous (but how will they profit?!). Chainlink will be THE standard which future tech will be built upon and already is in many cases in blockchain offchain labs will continue to sell and advise on solutions built upon the network they created. That’s right they will build the world then show people how to live in it as a rough analogy

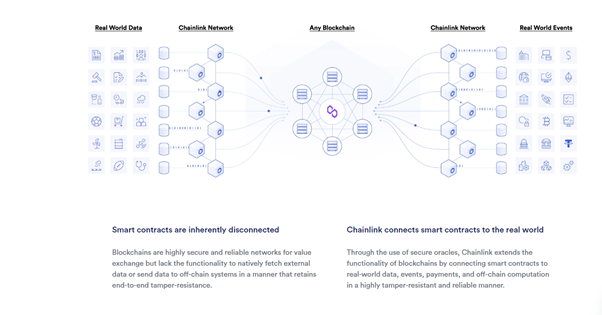

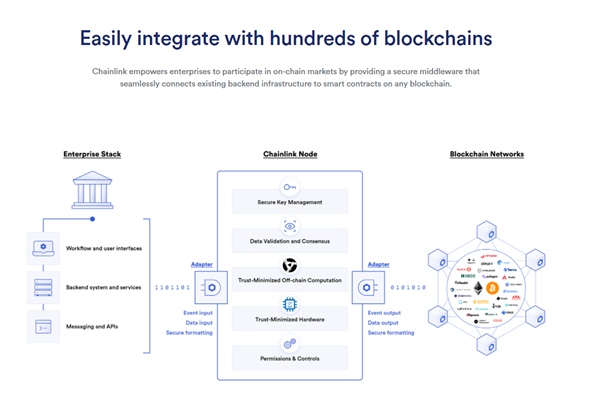

The other Major layer is the oracle layer and this is a whole other ball game or should I say squid game as only one winner will survive and I see no other alternative to Chainlink winning this. Oracles verify data from anywhere it can be weather reports, price feeds, population changes anything that people care to submit the oracles job is to verify the data and feed it to the correct source chainlink also attaches an economic value to this data and creates a trustless market place for data streams. But that’s not all it does. Oh yeah its also block chain agnostic so you don’t need to care which chain wins are takes more market share it doesn’t matter it’s THE oracle network for all chains and its competition won’t ever catch up.

So chainlink is not yet fully de-centralised but it get less and less centralised as time goes on. This is important as centralisation gives a weak point of attack and prevents it being fully trustless. All networks in blockchain are ran by either “miners” solving cryptographic puzzles to be the block validator the work done on the puzzles provides the security. The other route which chainlink is taking (as well as ethereum 2.0 and many others) is proof of stake this is where the validators commit economic value which risks getting slashed aka taken off them as punishment for providing false data. Heres some chainlink validators.

And the users

Roll the dice with chainlink VRF verifyable randomness:

This is used way more than you think the off chain version is tamper proof vs on chain options hence its wide use. https://www.leewayhertz.com/what-is-chainlink-vrf/ https://chain.link/solutions/chainlink-vrf

Heres some use cases

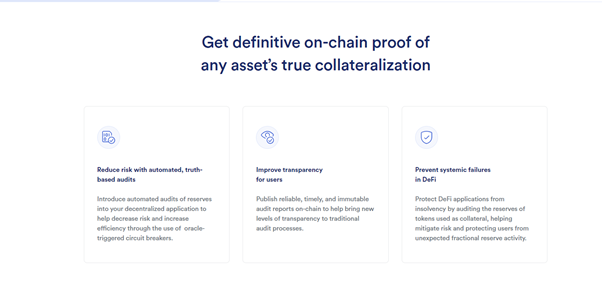

Proof of reserves look in the vault:

Wonder how they keep track of the various reserves and make sure whats they say is there is indeed there well here it is.

Here the users:

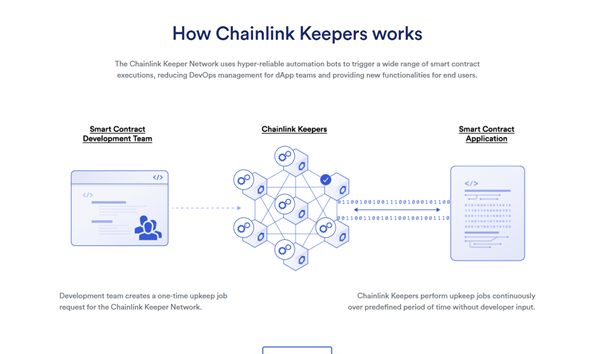

Keeper of truth: offchain computations with chainlink Keepers

So one of the biggest issues with crypto and blockchain tech is scalability and computational power required to do it on chain. So what if you could do the grunt work off chain then verification only on chain. Great idea so yea chainlink did it with keepers.

some users

![]()

No troll toll Bridge:

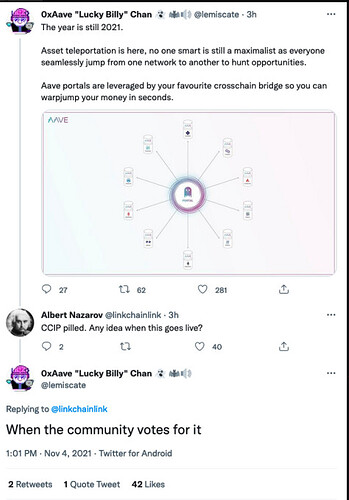

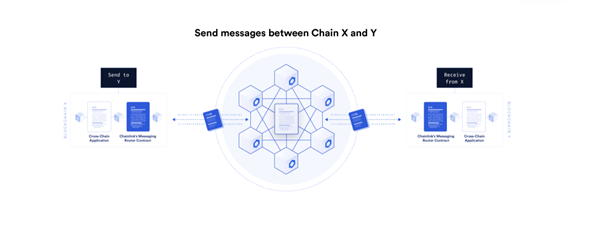

The next product the Chainlink network has is CCIP or the cross chain interoperability protocol you can read more on chainlinks website but it basically means those slow wierdy bridges that all work differently like binance matic wormhole etc can all be standardised and be faster better etc. So if you want to take some Dai form ethereum over to Solana it would be an identical process as eth to ADA or ADA to BNB etc. This is still in development you’ll know when its done because all the other bridges will be replaced with it.

Enterprise solutions: https://chain.link/solutions/enterprise

Other stuff:

· Mixicles for large companies that want data on chain but still auditable I could write a ton about this alone but heres some infohttps://medium.com/coinmonks/how-chainlink-mixicles-work-75d68f3094b6

· Town crier, don’t the fudders trick you it is being used but unibright (ticker: UBT) base ledger a system to allow JP morgans ONYX network to use ethereum as a settlement layer to other institutional blockchains while obscuring commercially sensitive data while still allowing smart contracts to execute fucking jaw dropping shit as always from chainlink.

· DECO basically the same as above however rather than going through centralised white listed node operators this will go through the decentralised chainlink network increased security at the cost of decreased speed of exection to verify data or documents.

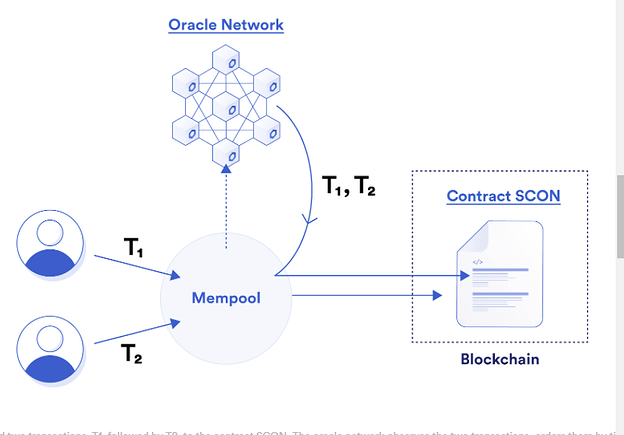

Fair sequencing services: The primary use case here to combat something called MEV thats miner extractable value. As ethereum scales it suffers higher transaction costs and longer mining times (computing the transaction) this leaves the transactions stuck in something called a mempool like a trainstation for transactions waiting to be delivered. BOT and algos programmed by savvy traders are able to look inside the mempool and do something called a sandwich attack. When you trade on a dex (decentralised exchange) you allow for slippage on the trade (the difference between the price shown and potential price paid) its necessary to execute the as the price will never be completely static. What they do is purchase before your buy and sell after to a degree that maximises the slippage tolerance and stealing your money, This is worth around $1.4 billion annual and its growing rapidly. The first system originally proposed by flashboys 2.0 paper (which ari Jules co wrote0 and its another Cornell paper. Its also concerning that this could be the very tip of the iceberg as most trading occurs on CEX’s (centralised exchanges) where the host could much more easily front run trades. The problem with MEV is the centralisation of control given to the minutes which allows them to execute these sandwich attacks by choosing the order the transactions are executed. Without this MEV goes away. To solve this problem you need to both resolve the high gas costs and the transaction sequencing. Yes LINK has solved this. FSS or fair sequencing services (used by layer 2 arbitrum FYI) achieves this with no alteration to the layer 1 it operates on again blockchain agnostic. This is done by sending the orders to an oracle network to fairly sequence them and sending them in order to be processed by the miner or node. This is opposed to the other proposed solutions which use MEV auctions essentially saying to the miners you can take MEV but cheapet wins chainlink says you will have no MEV and you will be happy.

(Fair Sequencing Services: Enabling a Provably Fair DeFi Ecosystem)Follow the breadcrumbs:

Ok so this is where we start tip toeing into cult like madness however A LOT of these breadcrumbs have already been confirmed. So lets start with those shall we.

Microsoft (confirmed): So Microsoft there were breadcrumbs saying chainlink acquired Kaleido which was going to make oracle services for business cloud. Coindesk then made an article saying Koleido was working on Microsoft Azure and Amazon AWS. The initiative for crypto currencies and contracts also listed the following donors chainlink and Microsoft among others around this time. Sergey Nazarov the founder of offchain labs was also photographed with Yorke Rhodes co-founder of blockchain at Microsoft. It’s since been confirmed since we had smart con 2.0 (chainlink conference) where Microsoft spoke there.

Deutsche Telecom/T-Systems (confirmed) 101billion eur in revenue in 2020: In February 2nd 2021 they were one of the main data providers to chainlink this did not mean partnership as that is something they can make money on however in July it was confirmed they are a node operator which currently requires a partnership with offchain labs.

Swisscom 11.1 billion CHF revenue 2020: Cointelegraph have published an article confirming they are a node operator they also spoke at smart con 2.0 there was prior speculation with their hold on telecom and broadband in Switzerland.

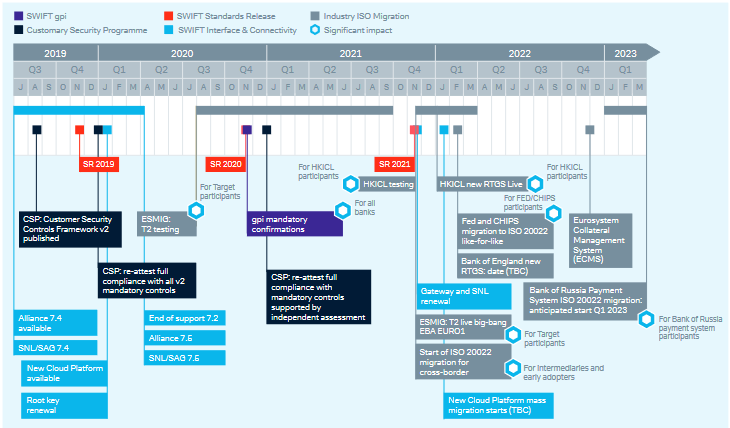

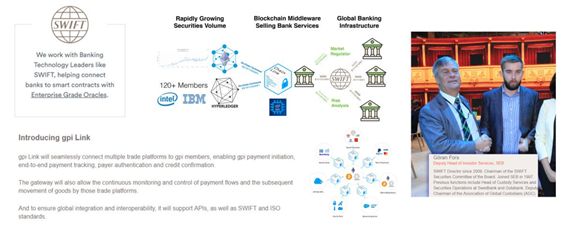

Swift transacts $1.25 quadrillion/year: Swift started proof of concept in jan 2019 with r3 for gpi payments to DLT and blockchain based platforms gpi is used to transact 300 billion per day. They called this gpi LINK not subtle I know. To work it was confirmed it needed to be put through an oracle and chainlink also stated they were making a purpose built oracle for a system to transfer billions of dollars across 11,000 banks. Anyway swift were at smart con 2.0 and heres the director shaking Sergey Nazarovs hand he isn’t bending the knee and kissing his feet but he will learn the correct greeting with time (what I said I joined the cult don’t look at me like that).

Docusign (confirmed but dormant): Docusign made a statement saying they were looking to integrate smart contracts through chainlink and also gave chainlink $5.5 million however de to the cost prohibitive nature of transactions on blockchain currently this has not yet progressed further. But stress not chainlink has a solution as always.

Google (confirmed): nice and simple here’s google bending the knee eerm I mean working with chainlink https://cloud.google.com/blog/products/data-analytics/building-hybrid-blockchain-cloud-applications-with-ethereum-and-google-cloud

World Economic forum (confirmed): Professor You will eat ze bugs Klaus schwab wrote a book called the forth industrial revolution talking about blockchain is a new paradigm also giving reference to swift, and Cornell (chainlink has strong ties here I know EVERYWHERE) smart contracts.com is chainlink. https://www.weforum.org/agenda/2020/12/the-missing-link-between-blockchain-and-existing-systems/ I mean they even use LINK’s infographics come on.

Oracle (confirmed): Its been in the news and Ian Keane head of solution engineering for UK and Ireland at oracle slapped chainlink all over his linked in back in may 2020

Mastercard (confirmed): A risk intelligence company called Ciphertrace started up a link node then shortly after mastercard bought them. https://twitter.com/mastercardnews/status/1435966760549715978?lang=en

Intel (confirmed): https://software.intel.com/content/www/us/en/develop/articles/new-confidential-computing-solutions-emerge-on-the-hyperledger-avalon-trusted-compute.html

American News agency Associated press (confirmed): Now running a node “help bring economic, sports and race call data onto blockchains, the decentralized computer networks for recording information in an unalterable way.” American News Agency Associated Press Is Partnering With Chainlink ($LINK) | Cryptoglobe

SXSW conference (coinfrimed): https://www.sxsw.com/news/2021/alexis-mcgill-johnson-sarah-bond-vicki-dobbs-beck-more-join-sxsw-2022/ “At the 2022 SXSW Conference, we will focus on building a future that is equitable and sustainable across society, culture, technology, and policy,”

Ernst & Young (confirmed): Sposer of the chainlink Hackathon event https://twitter.com/chainlink/status/1451232408800530433

Facebook: Evan Cheng facebooks director of engineering joined chainlink as a technical advisor 08/09/2017 as well as running facebooks blockchain department AKA libra chain.

That’s mixicles we looked at earlier being used on libra I mean come on.

China: They have something called the Blockchain services network and its integrated chainlink oracles.

Amazon: Kaleido is building on AWS to make smart contracts easy to set up through AWS and they are using chainlink to do it it is assumed AWS are partnered in some way as they will benefit from the increased capabilities of AWS.

Nasdaq: 02/06/2020 ( I’m a brit so day/month/year) interwork alliance IWA launched to try and make a standard for token enabled systems aka creating THE standard (Like LINK) and be able to BRIDGE (CCIP anyone?) anywhere and BLOCKCHAIN AGNOSTIC (like LINK) members include Nasdaq and chainlink.

Sataoshi Nakamoto: there a theory Sergey is Satoshi feel free to dig into this buts its something that will never be confirmed

JP Morgan and Onyx: so Ari Jules chief science officer of offchain labs and creator of zero knowledge proofs formally of Cornell University co wrote a paper on sybil resistance with Christine Moy the head of Onyx blockchain, they’re also quite good friends in real life. JP morgan also spoke at smart con 1 so yeah. Onyx is also this from their website

Yeah I know boss just add an extra I they will never know its really just all chainlink.

The Citibank report: Link will eclipse bitcoin https://ir.citi.com/_tpHpW8MfaZ1QXwGmP1JGMGXXI95qXm3IMJzUJScLMb6XIjtOls6EbDehXMR3B_o9Opi7mdc5tQ%3D

LINK to $81,000.00:

Chainlink: Positive & Bullish Thoughts - Album on Imgur A link to many good quality posts over the years.

Chainlink and layer 1:

Growth potential:

This has been taken from a 4chan post with other information from other sources: Sales force bought Mulesoft for $6.5 billion in 2019 and visa payed $5.3 billion for plaid (API Economy: Is It The Next Big Thing?) companys that makes APIs externally available: This at the time (a still may be) the most expensive Acquisition the salesforce ever made. This is a bet of confidence in the importance of the new rise in the API economy in relation to the also rapid growing smart contract economy. API’s will be a whole new revenue stream for fintechs and financial services. The API economy is already very large valued at $2.2 trillion in 2018. There are 24,000 API’s in existence today. In 2016 netflix alone received 5 BILLION API requests Per day!

An API request is a job that and oracle would do. If chainlink could capture 3% of this market place of $2.2 trillion it would lead to a market cap $66 billion. We know that the CEO of offchain labs Sergey Nazarov is reported to have 19,000 interested parties wanting to establish chainlink nodes. That was stated back in 2019 its probably grown so that’s 50% of the market already give or take.

So what does this look like in terms of revenue for a node operator why is chainlink such a premium choice. Well apart from being the best technological platform with 0 exploits (people claim there’s been 2 that is wrong which we will cover later) it is also the largest well known liquid on chain API market. Ok lets imagine that the on chain API economy reaches the same scale as the regular API economy now. If we look at the average “hobbyist” running a non blockchain node on nordicapis.com as the equivalent of someone running a LINK node from home that 688,991 calls per month or 8,267,892 per year. At $0.01 per API call or Job which is the minimum Oraclize charge that’s $82,678.92 per year. IBM Watson charges $0.0025 per call which would be $20,669.73 per year. Docusign says their API “you may not exceed 1000 API requests per account per hour. So that’s 24,000 a day and at 1 cent a job is $87,600.00 per year per node operator. For all the node operators that were stated had interest (in 2019) in setting up a chainlink node that’s 19,000 serving 1,000 API request per hour that’s $1,664,400,000 revenue per year. That’s only 0.08% of the estimated $2.2 trillion API economy.

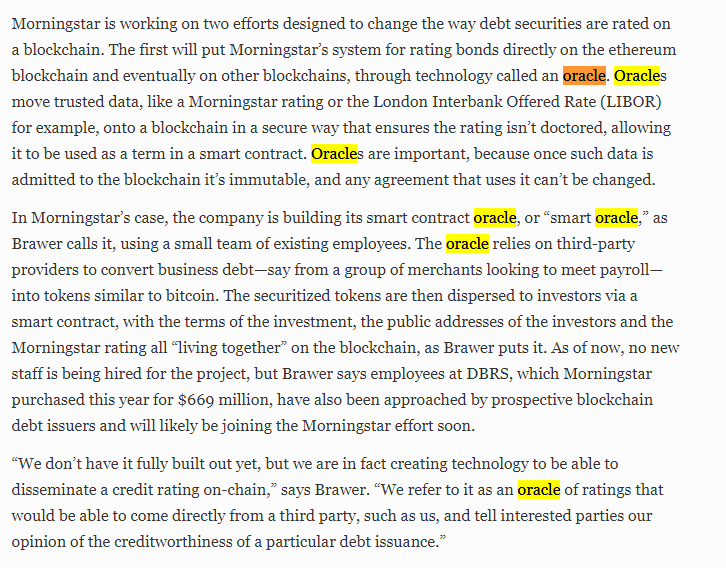

Transacting bonds:

So there’s already bonds being issued on the blockchain network from legacy finance systems the world bank being one of them raising $110 million in 2018 (Briefing: Bonds on the blockchain | Features | IPE) . the world bond market today sits at $128.3 trillion. If LINK were to capture 1% of this value ($1,283,000,000,000) that would equate to a per coin value of $1,283.00/coin. We know that as Link is a proof if stake system that uses economic penalties through slashing the stake of the node operators to keep them honest the value of the collateral must exceed the value of the asset. We also know that asset transaction is not LINKs only potential market place (see API calls) and this is only a small section of a bond market already open to the use of blockchain. This also links to chainlinks potential role in CBDC’s and ISO2022 which if realised will make them the platform of choice for securing these assets.

SIBOS (Swift International Banking operations seminar) https://www.sibos.com/: Surprise Guest 2021 Sergey Nazarov Chainlink CEO https://www.youtube.com/watch?v=c3OlqSEon38

Partners include but not limited to (all listening to offchain labs CEO Sergey Nazarov): Swift obviously, Amazon AWS (connected previously), Bank of America, Barclays, Citibank (remember that report), Deutsche bank, financial times, google (connected previously), HSBC, ING, JP Morgan (connected previously), KPMG, Lloyds bank, Microsoft (connected previously), Mastercard (connected previously), Oracle (connected previously), R3 (connected previously), VISA, Wells Fargo. I cherry picked here but heres the full list https://www.sibos.com/conference/partners