New breadcrumb new trillion 117 dollar marketplace

https://www.reddit.com/r/UniSwap/comments/qgxiz5/can_someone_explain_whats_going_on/

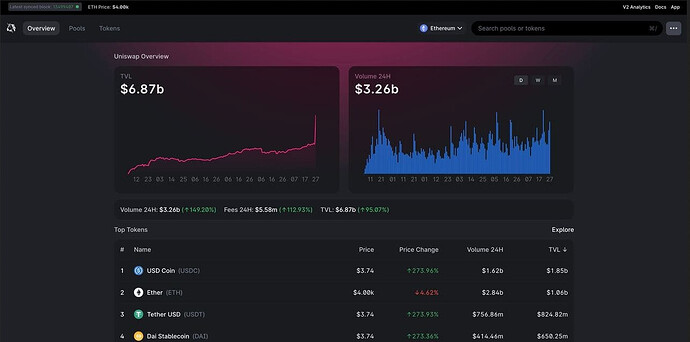

Uniswap Uses its own blockchain native oracles here’s an example of why that’s a bad idea.

Uniswap does not like chainlink because uniswap makes all its money from MEV attacks and chainlink is stopping that with FSS and arbitrum layer 2. Its millions of dollars of revenue they steal of people trading on their platform and LINK is a threat to it.It’s reporting $1 stable coins at $3.73

CCIP is up RIP any other bridges

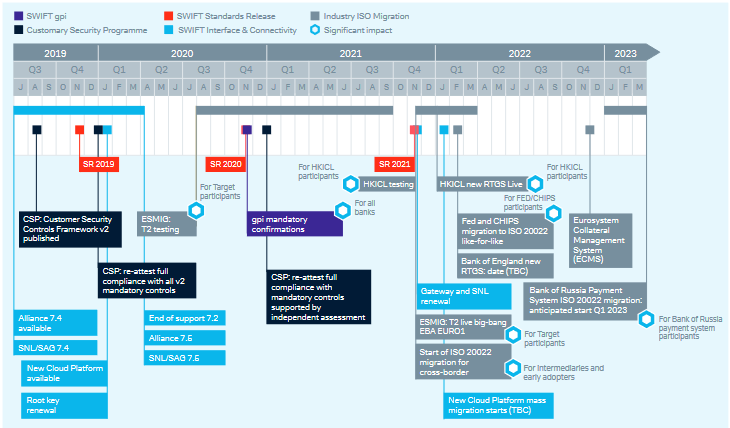

https://www.swift.com/news-events/events/smarter-securities-0/programme

More confirmation that Chain Link will be the standard for transacting value on a global scale

Quality 4chan post

Actual Chainlink Alpha Anonymous (ID: Ocw/9JBP) 11/25/21(Thu)01:45:43 No.[43731447](javascript:quote(‘43731447’)![]()

![]()

>>43731514 >>43731562 >>43731658 >>43732823 >>43733126 >>43733179 >>43733856 >>43734258 >>43735740 >>43735896 >>43736146 >>43737038 >>43737308 >>43739866 >>43740132

The endless torrent of paid fud is getting annoying and there are no good link threads anymore so here’s some uncut hopium:

Sergey’s latest tweet confirms that a revenue source for nodes is offchain compute (arbitrum). Arbitrum currently is throttled with ~$3 simple contract interactions and ~$10 for more complex stuff. Unthrottled with the current arbitrum gas prints this drops by over 20x and costs decrease as batches get larger (to a point).

This is important with CCIP launching. Long term, the L1 battle is a race to the bottom and chainlink knows this. CCIP makes L1s liquid with each other and allows a lot of what is on L1 ETH to be transferred off to arbitrum. A few examples:

If you’re a crv user you can not only receive your crv on arbitrum, but you can (via CCIP) restake it for vecrv without ever touching L1. The amount of money this saves in L1 gas costs is profound, especially for these defi protocols. So much so that any networks not doing this will lose liquidity as their users don’t want to pay hundreds for contract interactions.

(cont’d)

>>43731447 (OP)

This also opens up huge doors for protocols like crv/aave. A key design principle for arbitrum is that transactions sizes in terms of gas are uncapped. This opens the door to an even more advanced level of defi offerings: imagine if you had 50k in BTC or USDC and you wanted to LP across 5 chains with exposure to 25% BTC, 30% ETH, 40% Link and 5% USDC. That doesn’t exist right now, but you could easily do that with a CCIP/arbitrum enabled frontend which would autobalance your participation in various pools to achieve this. For retail this is appealing, for professional money managers this is the holy grail.

>>43731562

It gets even better if you look at what eds team did with their next iteration of arbitrum: previously they were focusing on other iterative improvements over what is out now that would basically result in larger more efficient batches but they’ve pivoted to a fully integrated L1/L2 stack with an embedded eth client which gives even more significant scaling improvement that is easier to achieve. This also finally makes chainlink truly chain agnostic in that if L1 eth decides to do something truly malicious to protect MEV or imposed vitalik’s social views on users the nodes validating for arbitrum become a de facto fork.

(cont’d)

>>43731669

For enterprise volumes the inputs and outputs (oracle layer) dictates the contract executions flow. It’s hard to overstate how dangeous this is to ETH’s value proposition long term. Not only could Chainlink just decide not to update to whatever ETH decides to do but also the nodes could simply give away L2 executions (while maintaining their CCIP/VRF/Data/API/DECO revenue streams), putting insane pressure on other L1/L2 only projects to cut costs as much as possible for end users. Remember the big misconception for ETH 2.0 is that it will increase L1 throughput; it won’t. It’s being done only for the environmentalism angle as POW is now viewed in woke circles as bad. The really scary part of this for ETH is that they want higher L1 volumes after this, but if arbitrum nitro is live by then there is no reason for anything other than L1 Eth2.0 and as many purpose built nitro rollups as are needed to get to over 100k tps including as complex of contract interactions as are needed for the most advanced smart contracts.

(con’t)

>>43731877

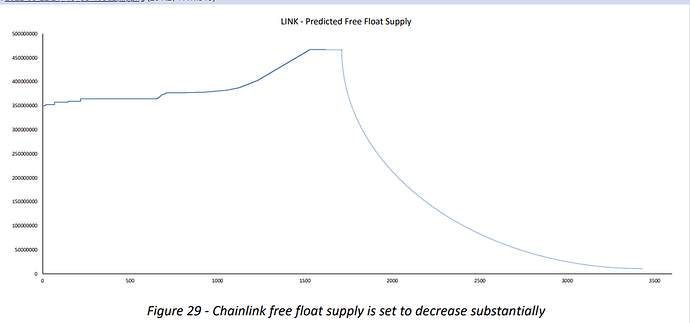

Note the change in tone with respect to staking in the middle of all of this: it used to be “we’ll make link nodes stake link in order to secure high value contracts”

Now it’s “we have supralinear staking to allow for any value contract to be secured and staking of the link token allows you access to the revenue streams of all of our space critical functions”

This may seem like nothing, but this is basically a wink and a nod to traditional startup methodology where early companies use their runways to dominate a space before monetizing it. That’s what chainlink is doing now. What you usually see with these kinds of projects is what you saw with amazon or tesla: a few years of subsidized production and smarter big money investors realizing that the space can be made into a cash cow whenever the team flips the switch.

>>43732384

AAVE and CCIP are currently top priority

Arbitrum nitro likely 6 months down the line as network usage for current arbitrum is not saturated and bandwidth can be increased simply by loosing the throttle

The team has likely had technology ready for a while now. The ADD autistic hive mind here has missed the forest for the trees: the link team does the same thing for every feature/iteration that they release.

- Develop the theory through peer reviewed research on the backs of nearly free academic postdoc labor

- Code the implementation and run on testnet

- Get as many external audits as are available and spend whatever it takes to get them

- Don’t launch anything until every audit finding has been addressed

- Launch with a limited number of launch partners who know and trust the team to ensure no initial failures

- Slowly open up features to the wider public as the feature develops a long track record

Only the data feeds portion of the network has gone through all of this. Every other feature is still being rolled out.

>>43733213

If you look at link’s past performance the average annual price has 3-5x’d every year like clockwork.

If that sounds good to you, buy link.

Based anon. Us real linkchads are still around. The future will be glorious.

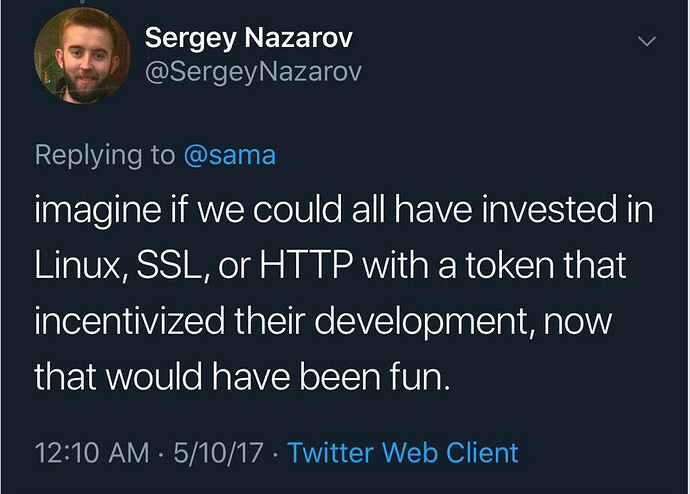

We spent 4 years picking apart at every detail about link.

Link was chosen by a congregation of the largest gathering of autistic nerd wizards with possible good acting insiders.

Besides BTC link is the most important and profound crypto in the entire genre.

Link price has not oerformed well this year yet its still constantly talked about and fudded nonstop. Nobody even bothers to talk shit or fud actual shitcoins because everyone knows its shit and doesnt need to waste any energy attacking it.

What’s funny is my girlfriend owns more link then all these spammer shills

In the future the linkers who capitulated will seethe for the rest of their lives.

They will feel so foolish just like the Apple co founder who sold his stake for 600$ which now would be worth billions

dydx

chainlink are basically working with all of layer two

This is the crypto I bought on the dip so I appreciate all this info!

Making digital currencies interoperable through universal payment channels | Visa Navigate fast forward to 1:37 CCIP for Visa lmao

Hope this is a helpful/bullish article.

It is but chainlink gets multiple Integrations per week bear in mind.

This is the one holding from last year that’s still green in my portfolio

I havnt sold only bought more this will play out over years if im correct.

This essentially yet again is something chainlink labs talked about creating coming into use in the real world by reputable institutions insurance for businesses in unstable parts of the world is one of the main advantages LINK can offer of traditional financial contracts. we take for granted that when we take out insurance in the developed world when things go wrong it gets paid out. In developing nations having trustworthy 3rd parties that are also affordable is

unheard of. The link network can provide said insurance that can be trusted to automatically trigger when terms of the contract are met. As the most common business in these areas is agriculture this is phase 1. offering insurance against adverse weather such as drought. Hence the importance Accuweather setting up oracle nodes. Still early days but they continue to make strides to creating something useful, profitable and real that can help stabilise existing markets and create new ones that don’t yet exist.

I am by no means posting all the updates and developments with LINK but I’m still in and continue to add to my position. LINK during this bear market sell off has increased the number of API calls on the network not even ethereum can claim this (that’s why gas prices went down less people fighting for block space).

I think crypto is still 95% hype and marketing looking at what moves the market and whats ranked where but on a fundamental level LINK is still the strongest performer in terms of having achieved and growing long term revenue for node operators without subsidies. AKA they can make a profit without new investors continuing to subsidize them an anathema to crypto at the moment.

The third largest reinsurer in the world is now in a DAO with Avalanche, Chainlink, DAOstack, Etherisc, Pula, and Tomorrow.io. The DAO is named the Lemonade Foundation or L3C.

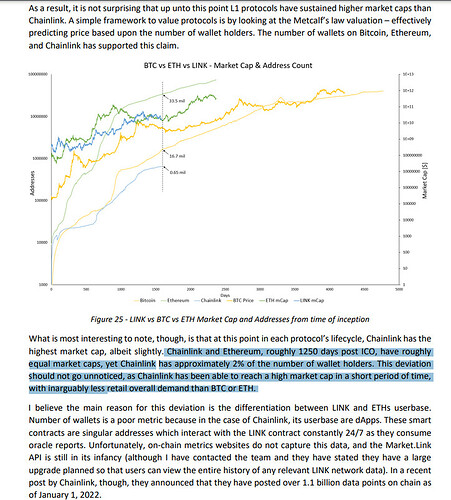

If you’ve ever wondered why layer 1s dominate the top 20

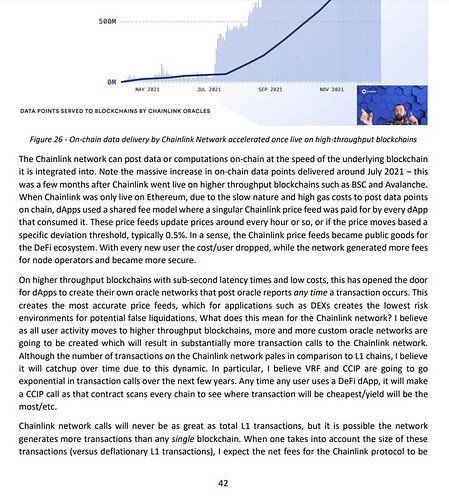

Ethereum merge will be a really big deal. Chainlink could see a spike in data points served to L1/L2 like we did in July '21

With respect to bridge operation, Chainlink already has the infrastructure in place. The network has 337 distinct, high-performance node operators. These node operators have a long history of on-chain performance and can begin providing CCIP services at launch. The second CCIP goes live, Chainlink will have the capability to create the most decentralized bridge, with the strongest trust assumptions. The Chainlink staking mechanism can also be utilized to further increase the security of said bridges.

Been a long time since ive done anything with this server and forum and will be a while before im active again. A lot going on with restructuring my company and starting a family time is limited. I do keep peeking in and its developed a lot amazing what conq and the team are doing with the server and forum.

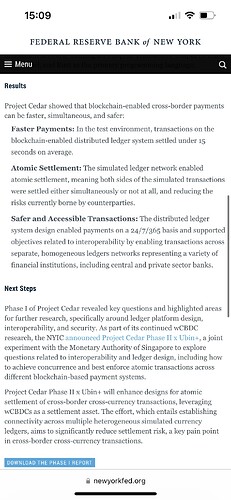

I did stumble accross a few interesting articles that indicate the world banking system is moving towards CBDCs again. We have previously established chainlink labs is working with swift to make cross chain inter operability possible along with other techinical aspects confrimed by swift officially. The next stage is specifics in what form that will take and if it transpires to use of the chainlink network and increased api calls leading to increased token value. These articles discuss how the first stages may be implemented in CBDCs stating the swift network is key. As theres no direct mention of chainlink here the assumption is the way swift does it is by utilising thier partners chainlink labs.

Heres the stuff below. Look forward to having some time set aside to trade again.