Some Lessons I Learned Before Starting Journal

- Setting reasonable stop losses can make a trade. I’ve only started trading a few months ago and one bad habit I’ve had was not setting stop losses. I always thought yeah I can just sell if it doesn’t go my way, but that doesn’t always work out. It’s sometimes best to just set a stop loss that your risk tolerance allows for.

- Using a profit-taker order and setting it to a reasonable amount can also make sure you are green. I learned this the hard way after being more than 20-30% up multiple times and not taking profit, only to have a quick reversal and lose it all, and end up red on the trade because of it.

- Conqueror does in fact love Canadians.

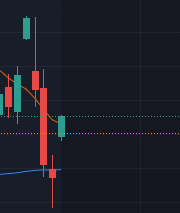

- I’ve learned to just attach a bracket order to my buy order when buying options and adjust that as needed. I generally set it up with a little more room for upward movement. I’ve found it’s easier to adjust the bracket as the option price moves than it is to keep adjusting the sell levels in my mind and to enter the sell order manually. If I do see an upward movement big enough I then move the whole bracket upwards alongside the price movement, this way even my stop loss is at a profit and I don’t feel too bad for being stopped out of the trade.

- I’ve learned some technical analysis through just listening to VC and trying to call out patterns where I see them before or around the same time they’re called out in VC. Also Kryptek’s post on patterns is phenomenal and needs to be read by everyone.

Trades

This post will probably be different than ones that follow because It’s the first entry and I wanted to include my last couple of days of trading in it as a starting point.

2022-02-02T05:00:00Z

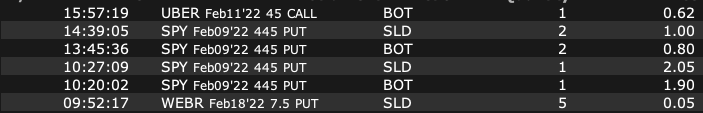

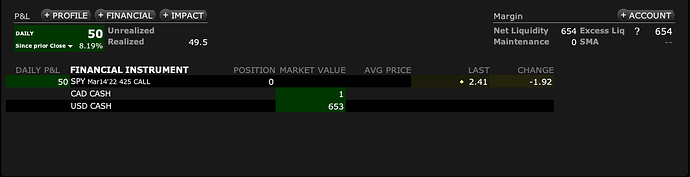

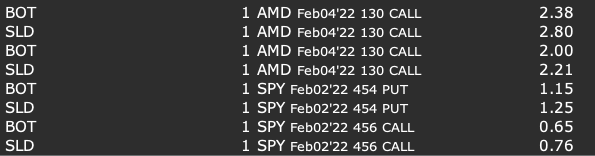

This was generally a good day for me. Made a few good scalps, some called by TF, some on my own. Overall, made about 10% of my account value in profit.

2022-02-03T05:00:00Z

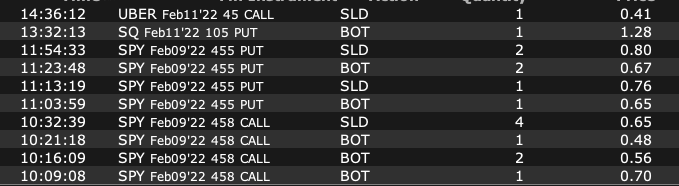

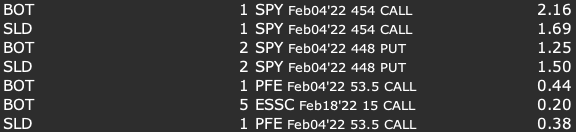

Overall I lost (I think) about 1-2% of my account value. I made a bad entry on my SPY call in the morning and even though I was up about $10 on it, I got greedy for more, ended up losing $50. I then saw the struggle SPY was having breaking 453 and thought it would retest 450, but didn’t trust myself and so I cut at $25 per 448 put to recover my loss from earlier. I then entered ESSC 15 calls thinking I clicked 12.5, I was so happy to get a 0.2 fill for them but hey, ADHD doing its thing. I restart my meds for the first time in 3 years next week so that’ll hopefully prevent shit like this. I then made a small trade on PFE and lost out a little to end the day.

I’ll be updating this daily and I will be taking part in the 1K-1M challenge. Cheers.